The 2026 COLA Increase, set at 2.8%, will boost monthly Social Security benefits for approximately 71 million Americans beginning in January. But rising Medicare premiums, inflation pressures, and structural rules affecting some retirees mean many will not see the full increase in their bank accounts. Analysts warn that for many households, the modest cost-of-living adjustment may only partially keep pace with real-world expenses.

Table of Contents

2026 COLA Increase

| Key Fact | Detail |

|---|---|

| 2026 COLA increase | 2.8% |

| Affected population | 71 million beneficiaries |

| Projected Medicare Part B premium hike | $20–$25/month |

| FERS COLA cap | 2.0% if COLA > 2% |

| CPI index used | CPI-W |

| Trust fund solvency outlook | Depletion projected early 2030s |

What the 2026 COLA Increase Means for Beneficiaries

The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment (COLA) beginning January 2026, reflecting annual changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This figure, determined by the U.S. Bureau of Labor Statistics, is intended to protect retirees’ purchasing power against inflation.

For a typical retiree receiving $2,000 a month, the increase represents an extra $56 per month. “This adjustment is critical for millions who depend on Social Security as their main income,” said Nancy Altman, president of Social Security Works.

While the headline figure appears positive, the net benefit for many retirees will be lower due to rising Medicare Part B premiums and other out-of-pocket costs.

A Look Back: How COLA Came to Be

The cost-of-living adjustment was first introduced in 1975, during a period of high inflation, to ensure that Social Security benefits would rise automatically with consumer prices. Before that, benefit increases required congressional action.

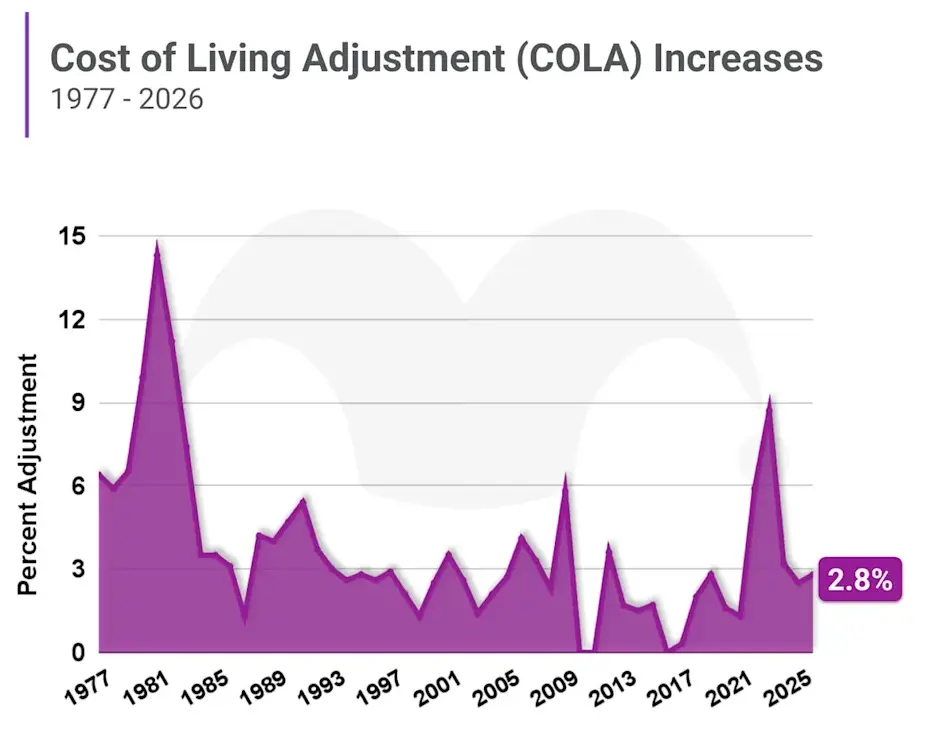

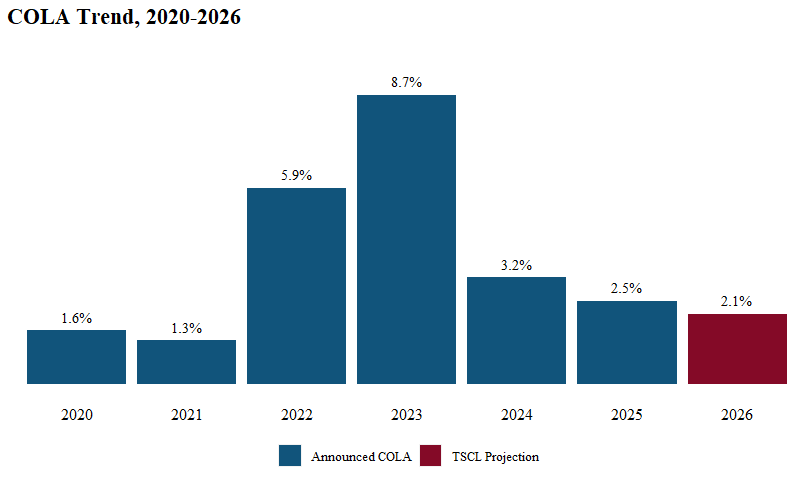

COLA has fluctuated widely over the years:

- 1980: Highest COLA ever recorded at 14.3%, during a surge in inflation.

- 2009–2010: No increase at all due to low inflation during the Great Recession.

- 2023: 8.7% increase — the largest in more than four decades.

- 2026: 2.8%, signaling cooling inflation but continuing cost pressures.

“These numbers reflect both inflation trends and the evolving economic landscape,” said Mark Zandi, chief economist at Moody’s Analytics. “A 2.8% COLA suggests we’re moving back toward moderate inflation, but seniors still face disproportionate cost burdens.”

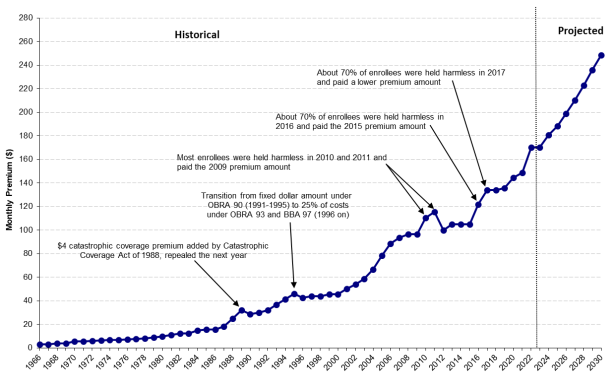

Rising Medicare Premiums Could Offset Gains

Most retirees have Medicare Part B premiums deducted directly from their Social Security payments. According to preliminary figures from the Centers for Medicare & Medicaid Services (CMS), the standard Part B premium is expected to rise by $20–$25 per month in 2026.

For many retirees, that could consume nearly half of their COLA increase.

“Even modest premium increases can erase much of the benefit of COLA,” said Mary Johnson, a policy analyst with The Senior Citizens League. “For individuals on fixed incomes, this is a real financial squeeze.”

FERS Retirees Will Receive Less

Not all beneficiaries receive the full COLA. Federal Employees Retirement System (FERS) retirees are subject to a COLA cap. When inflation exceeds 2%, their benefit increase is reduced to 2%, meaning they will receive less than Social Security recipients.

“This policy was designed to manage costs over time,” said James Sherk, senior fellow at the Heritage Foundation. “But for retirees, it often means they lose ground against inflation.”

Inflation Index Debate: CPI-W vs. CPI-E

The CPI-W measures price changes for working-age urban households, not retirees. Critics argue it does not accurately reflect the costs older Americans face, particularly in health care, housing, and prescription drugs.

The CPI-E (Consumer Price Index for the Elderly) was developed as an alternative. If used for COLA, many seniors would receive slightly higher adjustments. A 2025 GAO report found that CPI-E has grown about 0.2 percentage points faster annually than CPI-W over the past decade.

“Adopting CPI-E would better align benefits with actual costs faced by seniors,” said Richard Fiesta, executive director of the Alliance for Retired Americans. Opponents argue that switching would accelerate trust fund depletion.

Economic Backdrop: A Slower, Uneven Recovery

The 2026 COLA reflects broader economic dynamics. U.S. inflation has cooled from the 2022 peak but remains above the Federal Reserve’s 2% target. Core inflation in 2025 averaged 3.2%, according to the Bureau of Labor Statistics. Energy and housing remain key drivers of costs.

The Federal Reserve has signaled it will keep interest rates elevated longer to bring inflation under control. This means living costs may rise more slowly, but fixed-income households could still face challenges.

“The headline inflation number doesn’t tell the whole story,” said Diane Swonk, chief economist at KPMG. “Retirees are more exposed to health care and housing inflation, which tend to rise faster.”

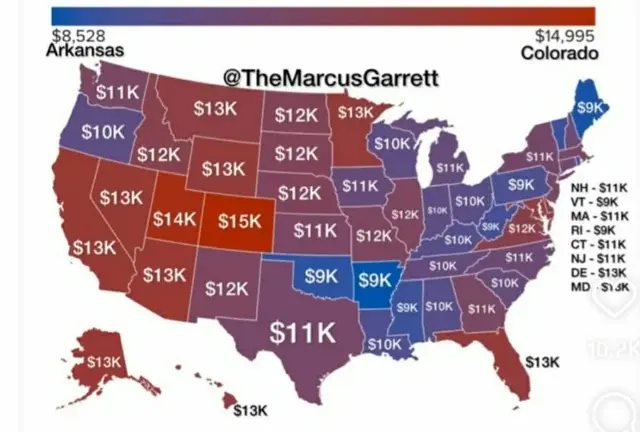

Regional and Demographic Differences

The impact of the 2026 COLA Increase is not uniform. Retirees in states with high housing and medical costs, such as California, Florida, and New York, may feel less relief than those in lower-cost areas.

Rural retirees often face higher transportation and medical access costs, while older women, who on average receive lower benefits due to career interruptions, may be more vulnerable to rising costs.

Case Study: How One Retiree Is Affected

For Ellen Sanders, 72, a retired nurse from Ohio, the 2026 COLA will increase her $1,800 monthly benefit by about $50. But her Medicare premium is expected to go up by $23, and she faces higher utility and grocery costs.

“By the time everything is deducted, it feels like there’s no real increase,” Sanders said. “It helps a little, but prices at the pharmacy and the grocery store keep climbing.”

This scenario is typical for many retirees who live on fixed incomes and have limited savings outside Social Security.

Trust Fund Solvency and Policy Debate

The Social Security trust fund faces long-term solvency issues, with the Congressional Budget Office projecting depletion in the early 2030s unless reforms are enacted. Lawmakers are debating several options:

- Switching from CPI-W to CPI-E to reflect senior expenses more accurately.

- Raising or eliminating the payroll tax cap to increase revenue.

- Gradually increasing the retirement age to account for longer life expectancy.

- Means testing for high-income beneficiaries.

“There is broad agreement that changes are necessary,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “But there’s no consensus yet on how to do it.”

Financial Planning Implications for Retirees

While COLA protects against inflation, experts warn it is not a raise. “COLA ensures your benefit keeps pace with inflation, but it doesn’t increase purchasing power,” said Johnson.

Financial planners recommend that retirees:

- Review annual Medicare and insurance costs.

- Reassess household budgets ahead of COLA changes.

- Explore supplemental income options if needed.

- Monitor policy developments that may affect benefits.

Political Reactions and Legislative Outlook

The COLA announcement has already drawn political responses in Washington. Lawmakers from both parties have renewed calls to protect Social Security benefits while addressing funding gaps.

- Democrats argue for expanding benefits and adopting CPI-E to better reflect seniors’ costs.

- Republicans emphasize long-term solvency, favoring gradual structural reforms.

“We must ensure Social Security keeps up with the cost of living, but we also have to secure it for future generations,” said Sen. John Barrasso (R-Wyo.) in a recent committee hearing. Sen. Sherrod Brown (D-Ohio) countered, “Seniors shouldn’t have to lose ground every year to rising costs.”

Looking Ahead

The 2026 COLA Increase will provide some relief to millions of retirees, but rising Medicare premiums, inflation, and systemic issues mean the net impact will be limited for many. Economists and advocates stress the need for structural reforms to ensure that Social Security continues to provide meaningful protection against inflation in the decades ahead.

“This is not about a bonus — it’s about survival,” said Altman. “The COLA is what keeps millions from falling into poverty.”

U.S. Debt Hits $38 Trillion: What You Need to Know About the Fastest $1 Trillion Increase

$500 Relief Checks Coming to One State: Check Eligibility Criteria and Payment Dates

Social Security Payments Delayed: Here’s Why You Won’t Get Yours Today

FAQ About 2026 COLA Increase

Who qualifies for the 2026 COLA increase?

Anyone receiving Social Security benefits — retirees, survivors, and disability beneficiaries — will automatically receive the adjustment in January 2026.

How does Medicare affect the COLA?

Medicare Part B premiums are deducted from most Social Security checks. If premiums rise, retirees may see less of the COLA increase in their net payments.

Why don’t FERS retirees get the full COLA?

FERS retirees face a cap when inflation exceeds 2%, resulting in a lower percentage increase than Social Security recipients.

Could the inflation index change in the future?

Congress is debating whether to adopt CPI-E to better reflect seniors’ expenses. No decision has been made yet.