Wells Fargo $5,000 Settlement: If you’ve banked with Wells Fargo or run a business connected to them over the past decade, here’s an important update you gotta hear. Wells Fargo recently announced a $5,000 settlement payout aimed at customers and businesses who were impacted by unauthorized recorded phone calls and other complaints stretching from 2011 through 2023. This payout comes after years of public backlash and legal fights, focusing particularly on your privacy rights and fairness. Whether you’re a regular Joe wanting to understand what’s up or a finance pro looking for the fine print, this article breaks down exactly what the Wells Fargo settlement is all about — who’s eligible, how to claim your cash, how much you can get, and why all this matters — explained in plain, easy-to-get terms.

Table of Contents

Wells Fargo $5,000 Settlement

The Wells Fargo $5,000 settlement is a powerful step toward justice for Californians and businesses harmed by privacy violations and unauthorized recordings. It reflects the bank’s acknowledgment of wrongdoing amid a long history of misconduct. If you submitted a claim on time, your payout should arrive soon—keep checking the official site and avoid scams. This settlement isn’t just about money—it’s about setting standards for privacy, trust, and corporate responsibility in banking.

| Feature | Details |

|---|---|

| Settlement Amount | Up to $5,000 per claimant (California privacy claims pool at $19.5 million) |

| Eligible Period | Phone calls and account activity from 2011 to 2023 (phone calls recorded Oct 2014–Nov 2023) |

| Claim Deadline | Claim submissions closed on April 11, 2025 |

| Payment Timeline | Checks and direct deposits issued from October 2025 through January 2026 |

| Governing Law | California Invasion of Privacy Act (CIPA) |

| Official Website | Wells Fargo Settlement Portal |

| Related Settlements | Separate class actions for unauthorized accounts, improper fees, and unauthorized insurance |

The Long, Bumpy Road: Wells Fargo’s Legal Troubles in Context

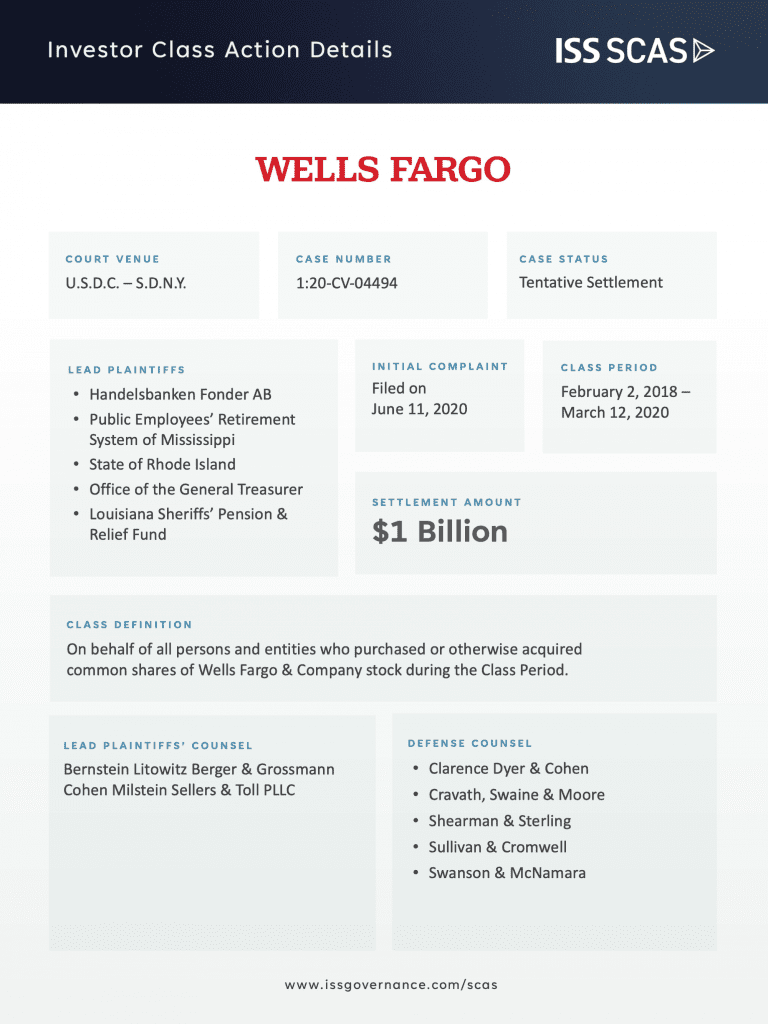

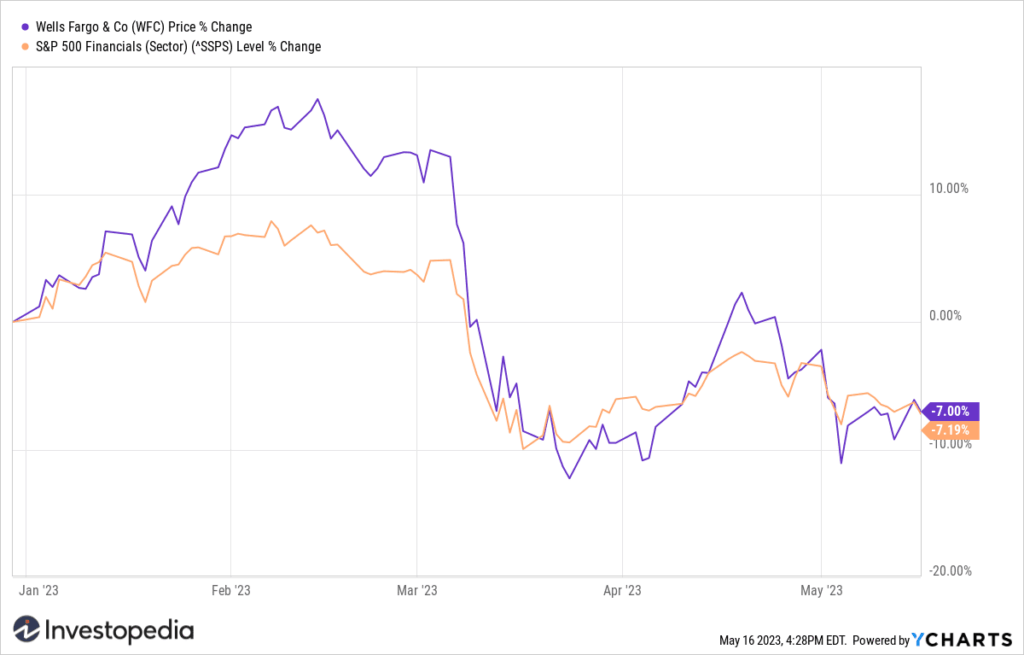

Understanding this settlement means stepping back and looking at Wells Fargo’s history over the past decade—a history that got pretty messy. Back in 2016, the bank hit headlines with the fake accounts scandal, where millions of unauthorized bank and credit card accounts were secretly created for customers without their knowledge or permission.

These fake accounts were a result of intense internal pressure on employees to meet sky-high sales targets. To hit their quotas, employees took drastic measures—including creating fake accounts, signing people up for products they didn’t want, and charging unauthorized fees. Some accounts were even created by enrolling homeless individuals, showing just how far some staff went to meet unrealistic goals.

The scandal was so huge and damaging that it led to:

- Wells Fargo being fined hundreds of millions by regulators like the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency (OCC).

- The forced resignation of CEO John Stumpf.

- The firing of over 5,000 employees involved in the scheme.

- Multiple lawsuits and billions of dollars paid in penalties and settlements.

Beyond fake accounts, Wells Fargo was also involved in other controversies, including:

- Charging customers for unneeded auto insurance.

- Wrongful foreclosure and mortgage fee abuses.

- Discriminatory lending practices.

- Unauthorized insurance policies pushed on customers.

The Federal Reserve even imposed a cap on Wells Fargo’s growth in 2018 until it could prove real reform. Multiple audits and investigations uncovered widespread misuse and poor oversight.

This recent $5,000 settlement for unauthorized recorded calls is part of this broader accountability effort, aiming to compensate victims and force a stronger culture of compliance.

What Exactly Does the Wells Fargo $5,000 Settlement Cover?

This settlement centers on calls made by Wells Fargo or its agents that were recorded without the other party’s consent in violation of the California Invasion of Privacy Act (CIPA). This act mandates that all parties on a call must agree to being recorded—the bank missed the mark between October 22, 2014 and November 17, 2023.

The settlement compensates affected California residents and businesses for this invasion of privacy. It also connects with other Wells Fargo consumer complaints about unauthorized fees, accounts, and insurance—though those issues are typically settled under separate lawsuits.

If you received such recorded calls during the time frame and filed a valid claim by the deadline, you qualify to receive a payout.

How Do You Know If You’re Eligible?

The eligibility requirements are clear:

- You had to be a California resident or a business operating there.

- You received one or more calls recorded without your consent from Wells Fargo or its representatives between Oct 22, 2014, and Nov 17, 2023.

- You submitted a claim through the official channel before April 11, 2025.

Households, individuals, and businesses all could qualify. Companies can have multiple claims if they received numerous recorded calls.

Claims for other wrongful Wells Fargo practices (like fake accounts or wrongful fees) are handled through different litigation channels.

How Much Money Will You Get?

You’re probably wondering about the payout size. Here’s the breakdown:

- Each qualifying recorded call pays roughly $86.

- Total payouts are capped at $5,000 per claimant.

- So if you had 10 calls recorded, you’d get about $860.

- If you had 60 or more, you’d max out at the $5,000 cap.

Payments have been rolling out since October 2025 via check or direct deposit and will continue through January 2026.

How to Submit a Wells Fargo $5,000 Settlement Claim and Track Your Payment?

Here’s a step-by-step rundown on claiming your settlement and keeping track:

- Check Your Records: Review your phone and bank records for calls from Wells Fargo made during the qualifying period.

- Gather Proof: Collect call logs, account numbers, or any communication that backs your claim.

- Submit a Claim: Claims had to be filed on the official website wellsfargosettlement.com before April 11, 2025.

- Confirm Claim Acceptance: You should’ve received confirmation via email or mail.

- Watch Your Payment: Payouts are issued October 2025 through January 2026 by mail or direct deposit.

Since the claims deadline has passed, no new claims are being accepted.

What If You Missed the Claim Deadline?

If you missed the April 11, 2025 cutoff, unfortunately, there’s no way to submit a new claim under this settlement now. It’s important to:

- Verify with the settlement administrator if you think you have special circumstances.

- Stay alert to future related lawsuits or settlements, as big banks like Wells Fargo often settle multiple claims over time.

Are the Settlement Payments Taxable?

Good news: payments from privacy violation settlements like this usually aren’t taxable income. However:

- Keep records of your claim and payout documentation.

- It’s wise to consult with a tax professional for advice tailored to your specific situation.

- State tax rules might vary, but federal tax exemption is common for these types of damages.

Beware Scammers and Fraud

Big money settlements always attract scammers. Some tips to protect yourself:

- Wells Fargo will never ask you for an up-front fee to get your payout.

- Always confirm any info on the official website: https://www.wellsfargosettlement.com.

- Don’t give personal or bank info to callers or emails claiming to be settlement agents unless you initiated contact.

- Report scam attempts to FTC.gov and your state attorney general’s office.

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility

$5,000 Wells Fargo Settlement 2025: How to Claim Your Share Today

Capital One Settlement in October 2025: Who’s Getting Paid & How to Claim Your Share

Why This Settlement Matters Beyond the Money?

This case is more than just a cash payout: it’s about protecting your privacy and holding financial giants accountable. It sends a message that banks must get explicit consent before recording calls—and that violating customers’ rights carries serious consequences.

The settlement underscores the need for transparency, fairness, and respect in banking practices, rebuilding trust after years of scandals. For consumers and businesses, it’s a win for privacy protections and a reminder to stay informed about your rights.