USA Retirement Age Increase: The USA Retirement Age Increase From October 2025 has become a hot topic among workers, retirees, and financial advisors alike. You might have seen headlines about “rising retirement ages” or “Social Security changes” and wondered: What’s really happening? Here’s the truth — starting in October 2025, the full retirement age (FRA) for Social Security will rise to 66 years and 10 months for people born in 1959. For everyone born 1960 or later, the full retirement age will officially be 67.

This change isn’t sudden or political; it’s part of a plan that started decades ago to keep Social Security sustainable as Americans live longer and work differently. Let’s unpack what this means, why it’s happening, and how you can plan smarter for your future.

Table of Contents

USA Retirement Age Increase

The USA Retirement Age Increase from October 2025 is a planned, gradual shift — not a sudden overhaul. It’s another small step in a decades-long adjustment designed to reflect longer lifespans and balance the Social Security system. For most Americans, it means planning smarter: knowing your exact full retirement age, weighing early vs. delayed claiming, and coordinating with your broader financial strategy. Whether you’re 30 years away from retirement or just a few months, the best time to start planning is now.

| Topic | Key Information | Source / Link |

|---|---|---|

| New FRA in 2025 | 66 years, 10 months (for those born in 1959) | |

| FRA for 1960+ | 67 years | SSA.gov – FRA Info |

| Earliest Claiming Age | 62 (with a permanent benefit reduction) | SSA.gov – Age Reduction |

| Maximum Benefit 2025 | $4,018/month at FRA; $5,108/month at age 70 | SSA.gov – 2025 COLA Fact Sheet |

| Earnings Test | $23,400 limit before benefit reduction | SSA.gov – Earnings Test |

| Policy Update | GPO and WEP repealed under Social Security Fairness Act (2025) |

Why did the USA Retirement Age Increase?

The idea of increasing the retirement age isn’t new. It actually began in 1983, when Congress amended the Social Security Act to gradually raise the full retirement age from 65 to 67.

Why? Back then, Americans were living much longer. In 1940, life expectancy was about 65 years — today, it’s closer to 79 years according to the CDC. That means people collect benefits for far longer than the system was originally designed for.

To prevent the Social Security Trust Fund from running dry, the government has been slowly phasing in higher full retirement ages. Each new birth cohort gets a slightly later FRA — a slow but steady adjustment rather than a sudden shift.

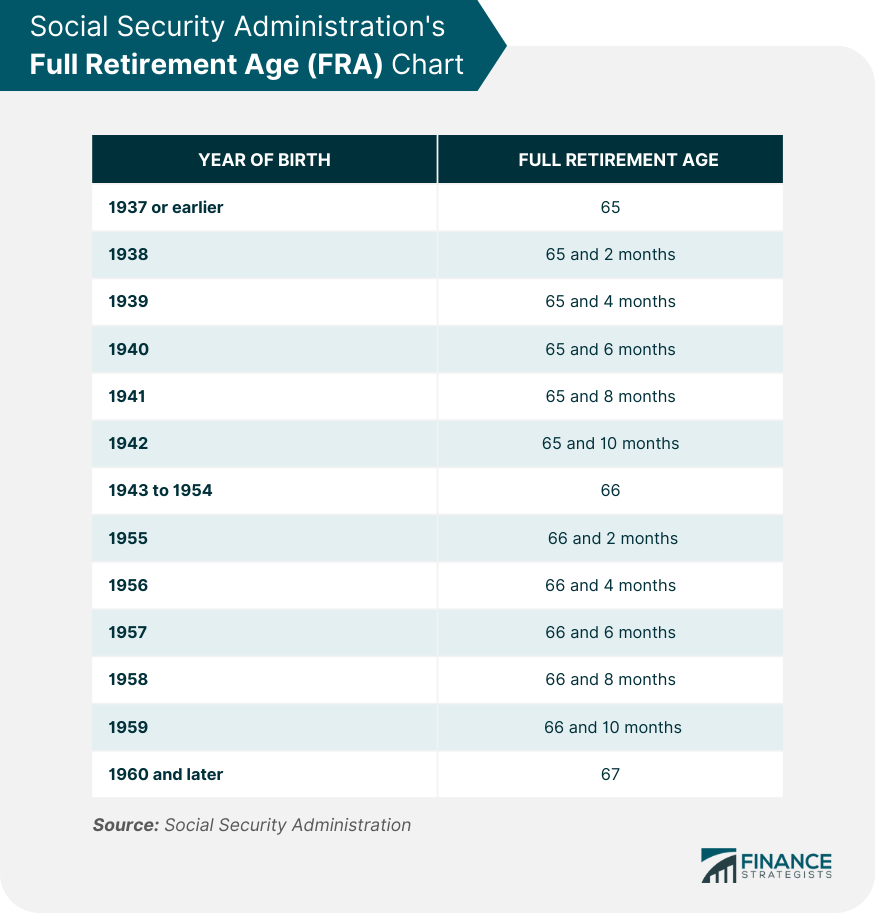

Understanding Full Retirement Age (FRA)

Your Full Retirement Age is when you’re eligible to receive 100% of your Social Security benefits. You can start claiming as early as age 62, but you’ll receive permanently reduced payments. Alternatively, you can delay benefits past FRA — up to age 70 — to earn delayed retirement credits of about 8% per year.

Here’s the chart showing how the FRA increases by birth year:

| Year of Birth | Full Retirement Age | Increase Over Age 65 |

|---|---|---|

| 1943–1954 | 66 | +1 year |

| 1955 | 66 years, 2 months | +1 year, 2 months |

| 1956 | 66 years, 4 months | +1 year, 4 months |

| 1957 | 66 years, 6 months | +1 year, 6 months |

| 1958 | 66 years, 8 months | +1 year, 8 months |

| 1959 | 66 years, 10 months | +1 year, 10 months |

| 1960 or later | 67 years | +2 years |

What’s Actually Changing in 2025?

If you were born in 1959, your full retirement age increases by two months in 2025 — from 66 years, 8 months (for 1958 births) to 66 years, 10 months.

Everyone born 1960 or later will see their FRA fixed at 67 years.

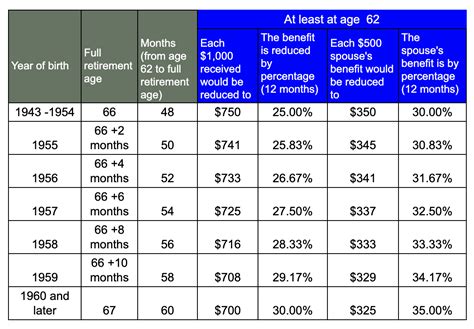

The earliest claiming age (62) remains the same. You can still apply for benefits early — but you’ll receive roughly 30% less every month for life compared to waiting until your full retirement age.

And if you delay claiming until age 70, your benefits can rise by up to 24% more than if you claimed at 67, thanks to delayed retirement credits.

The Real-World Impact of USA Retirement Age Increase

These shifts sound small on paper, but they can make a real difference.

Let’s say you’re eligible for a $2,000 monthly benefit at your full retirement age of 67:

- Claim at 62, and you’ll get about $1,400 (a 30% cut).

- Wait until 70, and you’ll receive about $2,480 — a 24% increase.

Over the span of a 25-year retirement, that could mean a difference of over $250,000 in total lifetime benefits.

So yes — those “few extra months” of waiting can pay off significantly if you expect to live a long life.

Working While Receiving Benefits

If you decide to claim benefits before reaching FRA but keep working, the earnings test applies. This rule temporarily withholds part of your benefit if you earn over a certain amount:

- In 2025, the limit is $23,400 if you’re under FRA the entire year. You’ll lose $1 in benefits for every $2 earned over that limit.

- In the year you reach FRA, the limit jumps to $62,160, and you lose $1 for every $3 earned over that amount.

- Once you hit your FRA, the limit disappears entirely — you can earn any amount without benefit reduction.

The key word here is temporary. The Social Security Administration recalculates your benefit once you hit FRA and credits back those withheld amounts in future payments.

Broader Economic and Demographic Context

This increase also reflects how America’s workforce and demographics have evolved.

- Longer lifespans: The average retiree today spends nearly 20 years receiving benefits — double the span from 1950.

- Changing work patterns: More Americans now work part-time or in flexible “encore careers” into their late 60s or 70s.

- System funding: The Social Security Trust Fund could face depletion by 2033, at which point payroll taxes would only cover about 77% of scheduled benefits, according to the SSA Trustees Report.

Raising the retirement age slightly helps slow the drain, but it’s not a permanent fix. Experts say deeper reforms may eventually be needed, such as lifting the payroll tax cap (currently $168,600 in 2024) or adjusting benefit formulas for high earners.

Who’s Affected Most?

- Blue-collar workers: Often hit hardest, since physically demanding jobs make working longer difficult.

- White-collar professionals: Usually benefit from the change, as many can continue working or delay retirement comfortably.

- Women: Tend to live longer than men, so delayed claiming can be especially beneficial.

- Public employees: In 2025, the repeal of the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) under the Social Security Fairness Act gives them a boost. Those penalties, which once reduced benefits for people with public pensions, are now gone.

Tips to Maximize Your Benefits

- Set up your “My Social Security” account at ssa.gov/myaccount. Review your earnings history yearly.

- Work at least 35 years. Your benefit is based on your top 35 earning years — missing years lower your average.

- Delay claiming if possible. Each year you wait past FRA adds ~8% to your benefit until age 70.

- Coordinate with your spouse. Couples can optimize when each partner claims to maximize combined income.

- Manage work income. Stay under the earnings threshold if claiming before FRA.

- Consider longevity. If your family tends to live into their 80s or 90s, delaying often pays off.

- Factor in taxes. Social Security may be taxed if your combined income exceeds $25,000 (single) or $32,000 (married).

- Plan Medicare timing. Medicare eligibility begins at 65 — separate from your FRA.

Example Scenarios

Example 1: Retiring Early at 62

John, born in 1960, plans to retire early. His FRA is 67, but if he claims at 62, he’ll receive only about 70% of his full benefit for life. It might make sense if he has health issues or other income sources — but it’s a tradeoff.

Example 2: Delaying to Age 70

Mary, born in 1959, works until 70. Her FRA benefit would have been $2,200, but delaying earns her a 24% increase — roughly $2,728 per month. Over two decades, that’s an extra $126,000.

Example 3: Working and Claiming

Bill, age 64, claims early and keeps working part-time earning $30,000. Since the 2025 earnings limit is $23,400, he’s $6,600 over — Social Security withholds $3,300 temporarily, then repays it later when he reaches FRA.

What’s Next: Future Policy Proposals

Congress and policy experts continue to debate the long-term future of Social Security. Proposals include:

- Gradually raising the full retirement age beyond 67 (for example, one month every two years).

- Increasing or removing the payroll tax cap, so higher earners contribute more.

- Adjusting cost-of-living formulas (COLA) to reflect modern inflation metrics.

- Offering incentives for delayed claiming or partial early retirement options.

So while 2025’s change is minor, it signals a broader conversation about the system’s future stability.

October SSDI and November SSI Payments Scheduled by Social Security for 2025: Check Payment Details!