UK Two-Child Benefit Cap Changes: The UK Two-Child Benefit Cap has been one of the most controversial welfare policies in recent years. If you live in the UK, receive Universal Credit, or simply want to understand how government benefit limits affect families, this article breaks down everything you need to know — what’s changing, how it impacts you, and what experts and policymakers are saying about the future of this policy. Whether you’re a working parent trying to stretch your budget or a professional following the latest government reforms, this is your go-to guide. We’ll keep it conversational and straight to the point while explaining the numbers, exceptions, and political talk surrounding the Two-Child Benefit Cap.

Table of Contents

UK Two-Child Benefit Cap Changes

The UK Two-Child Benefit Cap has defined welfare policy for nearly a decade. Originally introduced to reduce spending, it now stands as a symbol of inequality for many families across the nation. As living costs continue to rise and evidence mounts of its negative impact, political momentum for scrapping the rule is growing stronger by the day. If Labour follows through on its promise to end the cap, millions of children could benefit, and the UK might take a major step toward reducing child poverty. For families struggling under its weight, that change couldn’t come soon enough. Understanding your rights and entitlements is the best way to prepare for the changes ahead.

| Topic | Details |

|---|---|

| Policy Name | Two-Child Benefit Cap (Two-Child Limit) |

| Introduced | April 2017 |

| Applies To | Universal Credit & Child Tax Credit (for children born after April 6, 2017) |

| Main Rule | Limits benefit payments to the first two children per household |

| Exceptions | Multiple births, adoption, non-parental care, non-consensual conception |

| Average Loss per Family | Around £3,455 per year |

| Households Affected (2025) | 469,780 |

| Children Affected | 1.66 million |

| Possible Change | Labour Government considering scrapping the cap in 2025 |

| Official Source | UK Government – Two-Child Limit Policy |

Understanding the UK Two-Child Benefit Cap

The Two-Child Benefit Cap, sometimes called the two-child limit, was introduced by the Conservative government in April 2017. It restricts families from receiving the child element of Universal Credit or Child Tax Credit for more than two children — unless they qualify for specific exceptions.

In simple terms, this means if you have three or more children and your third child was born after April 6, 2017, you cannot receive extra support for that child through these benefits.

The cap does not apply to the separate Child Benefit payment that all parents receive, but it does significantly reduce income support for larger families. The policy was designed to encourage “responsible family planning,” but over time, it has drawn criticism from charities, economists, and religious leaders who say it pushes children into poverty and unfairly targets working families.

Why the Policy Was Introduced?

When the policy came into effect, the government was under pressure to reduce public spending following years of austerity. Ministers argued that it was unfair for families on benefits to receive more in support than working families earned.

The idea was that limiting benefit payments would “align” welfare with the financial choices working families make. However, as the years passed, the UK’s economic situation changed — inflation surged, food and housing costs rose sharply, and wages failed to keep up. As a result, the policy began to affect not just unemployed families but millions of working households who depend on Universal Credit to make ends meet.

How the UK Two-Child Benefit Cap Works in Practice?

To understand the rule clearly, here’s how it operates step by step.

- When you apply for Universal Credit, you report the number of children you care for.

- If you have more than two children and any of them were born after April 6, 2017, you’ll only receive the child element for the first two.

- The cap reduces your Universal Credit by roughly £288 per month (or £3,455 per year) for each additional child beyond the second.

- Certain exceptions allow families to still receive payments for more than two children.

These exceptions include:

- Multiple births (for example, twins or triplets)

- Adoption from local authority care

- Non-parental care situations, such as kinship or foster care

- Children conceived through non-consensual sex or coercive control

Each case must be verified through documentation and is reviewed by the Department for Work and Pensions (DWP).

Who Is Affected?

According to official government data published in April 2025, about 469,780 Universal Credit households are affected by the cap. That includes around 1.66 million children living in capped households.

Even more striking is that 59% of those households are in work. This shows that the policy doesn’t just affect unemployed families; it affects working-class parents juggling low wages and high costs.

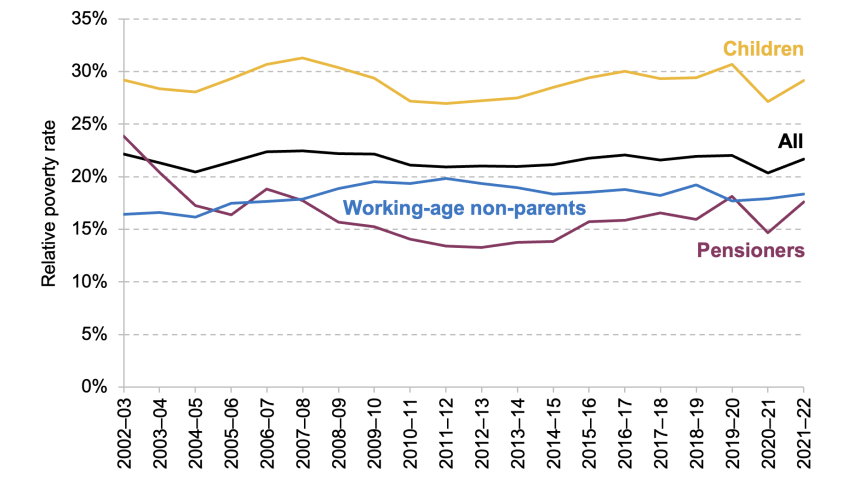

The Institute for Fiscal Studies (IFS) found that removing the cap could lift over 300,000 children out of poverty. Currently, one in ten UK children lives in a household impacted by the two-child rule.

The Human Side: Real-Life Example

Take the case of Anna and David, parents of three living in Leeds. Anna works part-time as a teaching assistant, and David is a delivery driver. Their third child, born in 2019, doesn’t qualify for the child element under Universal Credit. They lose about £290 a month because of the cap.

“It’s not like we planned for hardship,” Anna says. “We both work, we pay taxes, and we still can’t cover everything. That extra money could mean keeping up with rent or buying winter clothes.”

Stories like Anna’s are becoming more common. Many working families now depend on food banks and local councils for emergency help, showing just how deeply the cap affects everyday life.

Why the Cap Is So Controversial?

The Joseph Rowntree Foundation calls the policy “one of the biggest drivers of child poverty in the UK.” According to their research, the cap disproportionately impacts larger families, single parents, and ethnic minority households — especially those in urban areas with higher living costs.

Critics argue that it punishes children for circumstances beyond their control. Religious leaders, including the Archbishop of Canterbury, have publicly opposed it, calling the rule “morally indefensible.”

Meanwhile, supporters claim the policy encourages fairness between families who rely on benefits and those who do not. They argue that lifting the cap entirely could increase public spending by billions annually. The truth likely lies somewhere in between: the cap did save money, but at a human cost that is now under serious review.

The Labour Government’s Plan to Scrap the Cap

In September 2025, reports from Reuters and The Guardian revealed that the Labour Government, led by Chancellor Rachel Reeves, is preparing to abolish the Two-Child Benefit Cap in the November 2025 Budget.

If approved, the change would:

- Restore full Universal Credit payments for all eligible children

- Benefit nearly 2 million children nationwide

- Cost the Treasury around £3.5 billion per year

The Scottish Government has already pledged to eliminate the effects of the cap by March 2026, using devolved welfare powers. This adds further pressure on Westminster to act quickly to ensure consistency across the UK.

What Would Change for Families?

If the Two-Child Cap is abolished, here’s what families can expect:

- Automatic recalculations

The DWP will update payments for families currently limited by the rule. There’s no need to reapply. - No back payments

It’s unlikely families will receive retroactive compensation for past years when they lost benefits. - Increased monthly income

Families could see payments rise by around £288 per month for each additional eligible child. - Better long-term stability

Removing the cap could improve financial resilience for millions of households and reduce reliance on food banks.

Expert Commentary and Economic Outlook

Economists at the Resolution Foundation and the Institute for Fiscal Studies argue that ending the cap would not only reduce poverty but also stimulate local economies. Families with higher disposable income tend to spend that money locally — on food, clothing, and services — boosting small businesses and community growth.

However, fiscal conservatives warn about the long-term cost. They argue that without a matching rise in tax revenue, removing the cap could widen the government’s deficit.

According to IFS researcher Tom Waters, “It’s a matter of balancing compassion with sustainability. But given the UK’s current cost-of-living crisis, the argument for removal is stronger than ever.”

International Comparison: How the U.S. Does It

For readers familiar with American welfare policy, the contrast is clear. In the United States, the Child Tax Credit (CTC) provides up to $2,000 per child, and during 2021, temporary COVID-era expansions boosted it to $3,600 per child — without any limit on the number of children.

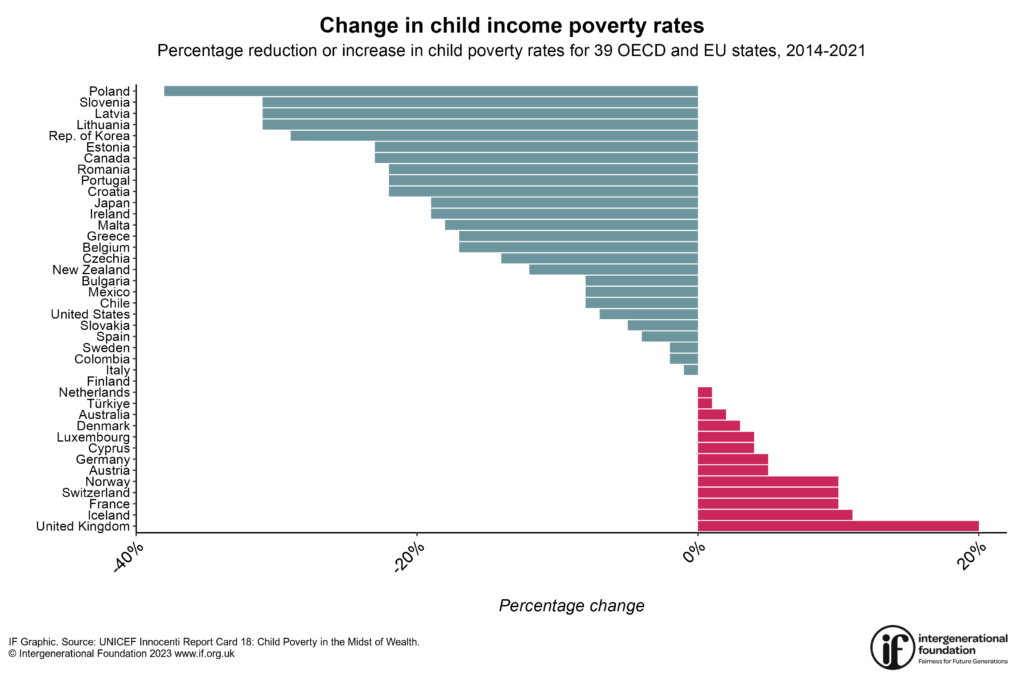

That version of the credit cut U.S. child poverty by nearly half, according to data from the U.S. Census Bureau, before Congress let it expire. The UK’s approach, by contrast, caps support after the second child, regardless of income or need. This difference highlights how policy design can shape national poverty outcomes.

Practical Steps: How to Check Your Eligibility

If you currently receive Universal Credit, here’s what you should do:

- Log into your Universal Credit account

Visit www.gov.uk/sign-in-universal-credit and review which children are included in your benefits. - Check for exceptions

If you had a multiple birth, adopted a child, or have a child under non-parental care, file the documentation to claim an exception immediately. - Stay informed

Follow updates through GOV.UK News and reliable sources. - Get advice

Contact Citizens Advice or the Child Poverty Action Group (CPAG) for free guidance and help with appeals.

New DWP Rule Triggers £416 Monthly Cut – UK Families Urged to Check Payments Immediately

Government Confirms £200 Cost of Living Support for October 2025 – Check Payment Date! Eligibility

Extra £90 Cost of Living Help for UK Families – How & When You’ll Get It!