A decades-old regulation, widely known as the 1997 pensions rule, is drawing growing public anger in the United Kingdom after it emerged that approximately 400,000 pensioners are receiving retirement income that is not protected against inflation. Unions, retirees, and campaign groups are urging the government to close what they describe as an “unfair loophole” that is steadily eroding living standards for older citizens.

Table of Contents

UK Pensioners Furious

| Key Fact | Detail / Statistic |

|---|---|

| Affected pensioners | Around 400,000 individuals |

| Rule introduction | April 1997 — indexation requirement applies only to post-1997 pension accrual |

| Inflation protection gap | Pre-1997 pension benefits are not legally required to rise with inflation |

| Estimated financial impact | Losses can reach tens of thousands over a retirement lifespan |

| Official Website | GOV.UK |

The government faces mounting pressure to address the 1997 pensions rule, but meaningful legislative change remains uncertain. Balancing pensioner protection, fiscal responsibility, and employer solvency will be a complex political and economic challenge.

For pensioners like Margaret Lewis, the outcome will determine whether they can keep pace with the cost of living—or face years of dwindling real income. With inflation stubbornly high and public debate intensifying, the issue is poised to be one of the defining pension debates of the coming year.

How the 1997 Rule Came to Be

The 1997 pensions rule was introduced following the Pensions Act 1995, a landmark reform intended to improve pension scheme security after a series of high-profile corporate failures in the early 1990s. The law required inflation protection for defined benefit pension schemes, but only for benefits earned after April 1997.

Lawmakers at the time argued that requiring inflation increases on earlier benefits would impose too heavy a burden on companies. Instead, pre-1997 benefits were left to the discretion of individual employers, creating what many experts now call an “inflation gap” in the system.

“The policy was designed for financial stability, not fairness,” said Dr. Michael Evans, a pension historian at the University of Oxford. “No one imagined back then that inflation would become such a pressing issue decades later.”

Who Is Affected — and How

The rule primarily affects retirees with defined benefit (DB) pensions — long-term contracts common in public utilities, transport, and manufacturing. These plans pay a guaranteed income for life, often based on years of service. For many workers, decades of service before 1997 mean a large portion of their pension is frozen in nominal terms.

Human Impact: “I Didn’t Expect to Fall Behind”

“When I retired in 2003, my pension felt secure,” said Margaret Lewis, a 74-year-old retired nurse from Manchester. “But more than half of it hasn’t increased since I left work. It’s like watching my money shrink each year.”

Margaret’s story is common. According to GB News, a pension of £10,000 in 1997 has the buying power of around £5,000 today when adjusted for inflation. For pensioners on fixed incomes, this decline translates into difficult choices over food, heating, and healthcare.

Another affected retiree, John Whitmore, 80, worked in the energy sector for nearly 40 years. “I gave everything to that company. But part of my pension has stood still while prices keep climbing,” he said.

Economic Impact of the Rule

The Office for National Statistics (ONS) reports that inflation averaged around 2.6% annually between 1997 and 2020, but recent years have seen spikes to over 5%. The result is a steep fall in the real purchasing power of frozen pension benefits.

According to the Institute for Fiscal Studies (IFS), a retiree with £8,000 in pre-1997 pension income in 1997 would need around £15,500 today to maintain the same standard of living. Without indexation, the gap has widened year after year.

Economists warn that the cumulative effect of these losses may also increase pressure on public services, as more older Britons turn to means-tested benefits or the NHS for support.

International Comparisons

The UK’s approach is unusual among developed nations. In countries like the Netherlands and Canada, most occupational pensions are automatically adjusted for inflation, or schemes receive incentives to provide partial indexation.

In Australia, compulsory superannuation contributions and state pensions are linked to both inflation and wage growth, reducing long-term erosion. Experts say the UK’s partial indexation framework leaves significant gaps for older pensioners.

“Britain’s system is increasingly out of step with other high-income countries,” said Dr. Anya Sharma, pensions researcher at the London School of Economics. “The lack of pre-1997 protection is one of the key structural weaknesses.”

Government and Industry Response

A spokesperson for the Department for Work and Pensions (DWP) told the BBC that ministers “recognise the concerns raised by pensioner groups” but currently have no plans to change the legislation. The department said any reform would have “significant cost implications” for employers and the public purse.

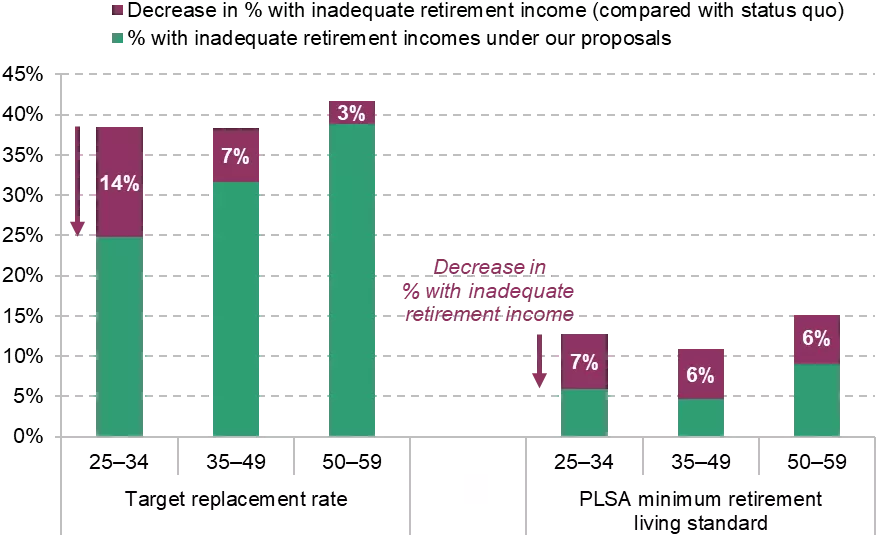

Industry groups, including the Pensions and Lifetime Savings Association (PLSA), caution that retrospective indexation could place billions of pounds in additional liabilities on already stretched schemes.

“Retrospective indexation would be enormously expensive and may destabilise schemes,” said Nigel Peaple, PLSA Policy Director. “Any reform must be balanced with financial sustainability.”

Political Pressure and Election Stakes

With the next UK general election approaching, the 1997 pensions rule has become a political flashpoint. Opposition MPs and several cross-party peers are pushing for legislative review, arguing that “decency in retirement” is a core social contract.

The All-Party Parliamentary Group on Pensions is preparing an inquiry that could shape future manifestos. Unite the Union and the National Pensioners Convention have vowed to make the issue visible on the campaign trail.

“This isn’t just about numbers. It’s about fairness for people who built this country,” said Sharon Graham, General Secretary of Unite.

Potential Reform Options

Policy experts and lawmakers are discussing several potential reforms, including:

- Extending statutory indexation to pre-1997 benefits.

- Targeted inflation top-ups for pensioners below a certain income threshold.

- Using Pension Protection Fund surpluses to support vulnerable retirees.

- Tax incentives for employers that voluntarily uprate older pension benefits.

“There’s no single easy fix,” said Sarah McLean, a senior policy analyst at the IFS. “But doing nothing will leave hundreds of thousands worse off in their final years.”

Practical Steps for Pensioners

Experts recommend that individuals who may be affected:

- Review their pension statements and identify how much of their benefit is pre-1997.

- Contact their scheme administrators to clarify indexation policies.

- Explore whether discretionary increases have been historically granted.

- Seek independent financial advice to mitigate inflation risks.

- Join or support pensioner advocacy groups pressing for reform.

“Awareness is the first line of defence,” said Helen Burrows, a pensions adviser at Age UK. “Many people don’t even realise part of their income is frozen.”

DWP confirmed £5,600 per year to State Pensioners born before 1959: Check Eligibility Conditions

DWP Confirms £416 Monthly Benefit Cut – Urgent Action Required for Thousands of UK Families

DVLA Confirms Major Licence Rule Change for Drivers Aged 57+ Across the UK – What You Must Know Now

FAQ

What is the 1997 pensions rule?

The rule refers to legislation that only mandates inflation increases on defined benefit pensions earned after April 1997. Pre-1997 benefits are not legally protected against inflation.

Who is affected?

Approximately 400,000 UK pensioners with pre-1997 defined benefit pensions, as well as some Pension Protection Fund beneficiaries.

Why does this matter now?

High inflation is accelerating the erosion of real pension values, reducing purchasing power for many retirees.

Is the government planning to change the law?

The Department for Work and Pensions says there are no immediate plans to legislate, but political and public pressure is mounting.