UK Families Could Save £9,700 in Mortgage Interest: That headline has been making waves — and for good reason. For many UK families, even the hint of falling mortgage rates feels like a lifeline after years of financial pressure. But what does it really mean? Are banks truly slashing rates? And is that £9,700 figure realistic — or just marketing hype? In this article, we’ll break it all down in plain English. Whether you’re a first-time buyer, a financial pro, or someone who just wants to keep your budget under control, this guide gives you the full picture: the facts, the strategy, and the smart moves to make right now.

Table of Contents

UK Families Could Save £9,700 in Mortgage Interest

That bold headline — “Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone” — sounds dramatic, but the truth is both simpler and more empowering. Yes, rate cuts are happening. Yes, families can save thousands — not overnight, but through smart decisions, timely remortgaging, and consistent overpayments. The real takeaway? You don’t have to wait for luck. By being informed, proactive, and strategic, you can capture a real share of those savings. Financial peace doesn’t come from headlines; it comes from knowing your numbers and acting wisely.

| Topic | What’s Happening / Estimate |

|---|---|

| Bank Rate (as of Nov 2025) | 4.00 % |

| New mortgage rate average | ~4.28 % |

| Typical fixed deals (2 yr / 5 yr) | 4.98 % / 5.02 % |

| Mortgage lending growth forecast (2025) | +3.1 % |

| Who benefits most | Tracker, variable, or soon-to-expire fixed deals |

| Potential lifetime saving | £8,000 – £10,000 |

| Official rate tracker | Bank of England – Current Rate |

Why UK Families Could Save £9,700 in Mortgage Interest Figure Is Trending?

Let’s start with context. That “£9,700 saving” doesn’t mean banks are suddenly handing out free cash. In most cases, it refers to long-term savings on total interest — what a typical family could save over the life of a mortgage by switching to a cheaper deal, remortgaging, or overpaying.

Here’s what’s driving the buzz:

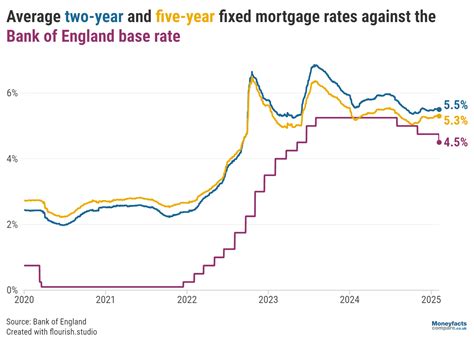

- The Bank of England cut its base rate from 4.25 % to 4.00 % in August 2025, giving lenders room to adjust.

- Some banks, like Barclays and Nationwide, responded by lowering rates on select fixed and tracker products.

- But not everyone benefits equally — more than 85 % of UK mortgages are fixed-rate deals, meaning those borrowers won’t see savings until their fixed term ends.

The £9,700 figure likely assumes a scenario where a homeowner with a sizable loan switches from an older, high-interest deal (around 5.5 %) to a newer one closer to 4.5 %, over a 20- to 25-year term. That’s realistic — but it takes action.

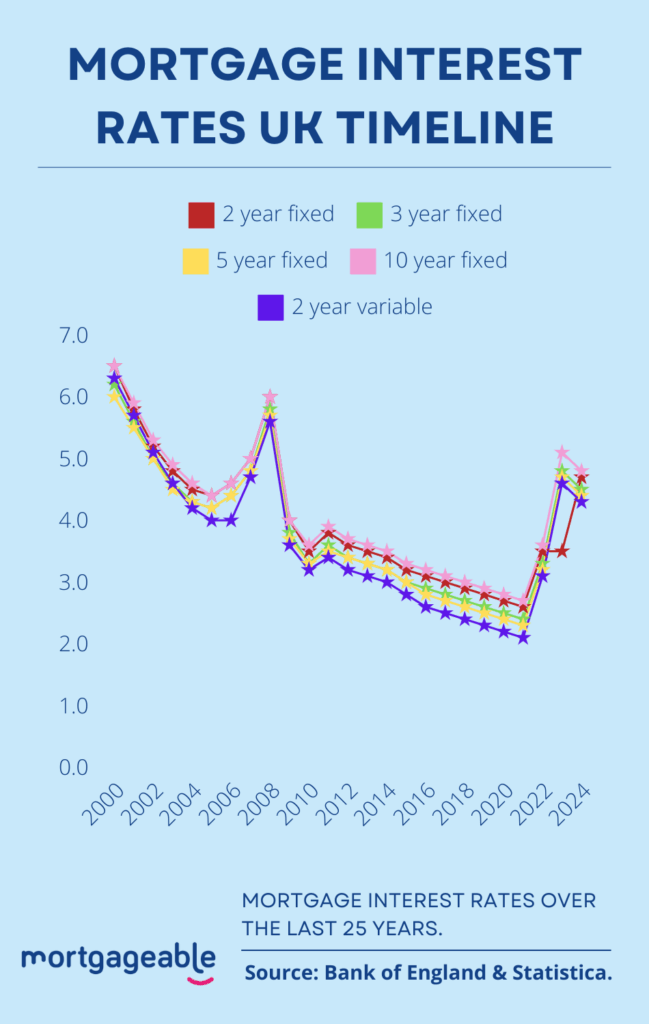

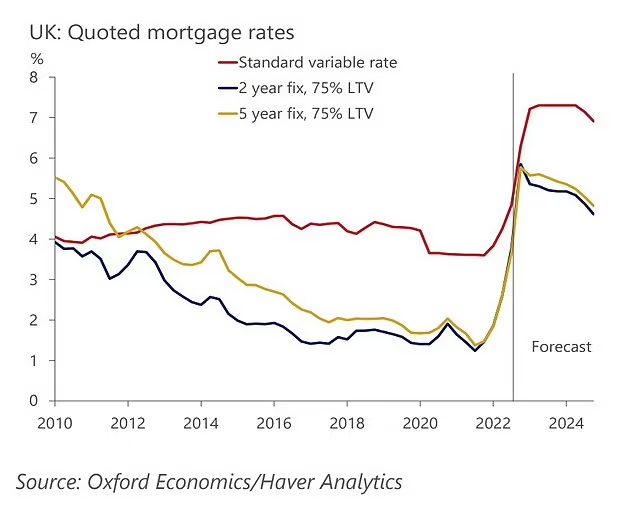

The Mortgage Landscape in 2025

The UK mortgage market in 2025 has been a rollercoaster. Just two years ago, average fixed rates soared above 6 % amid inflation fears and global economic turbulence. Today, the picture looks calmer, but still uncertain.

The numbers at a glance:

- Base rate: 4.00 % — lower than 2024’s highs, but still above pre-pandemic averages.

- Effective mortgage rate: 4.28 % on new lending.

- Average fixed rates: Between 4.5 % and 5 % for most borrowers, depending on credit and loan-to-value ratio.

- Tracker / variable mortgages: More directly tied to the Bank Rate — these borrowers already see small savings.

- Mortgage approvals: Up slightly compared to late 2024, suggesting renewed buyer confidence.

Even small changes in rates make a big difference. For a £300,000 mortgage, every 1 % reduction could save around £170 per month — or over £2,000 per year.

Why Banks Are Cutting Rates?

Banks respond to multiple pressures — not just the Bank of England.

- Falling swap rates: The cost of funding long-term fixed deals has dropped, letting lenders offer better rates.

- Competition: Big lenders like Santander, NatWest, and HSBC are under pressure to attract customers as demand for mortgages cools.

- Market stabilization: With inflation easing and economic growth slowing, banks feel safer lowering rates.

- Policy influence: Government schemes (like green mortgage incentives or Help to Buy-style replacements) also encourage lending.

But lenders remain cautious. The average drop in mortgage rates has been slower than the fall in the base rate, meaning households aren’t yet seeing the full benefits.

How UK Families Could Save £9,700 in Mortgage Interest?

Let’s break it down with real-world math.

Say you have:

- Loan: £300,000

- Term: 25 years

- Current rate: 5.5 % (monthly payment: ~£1,847)

- New rate: 4.5 % (monthly payment: ~£1,667)

That’s a difference of £180 per month, or £2,160 per year. Over 25 years, the cumulative saving in interest could reach around £9,700–£10,000 — assuming consistent payments.

Now, if you add small overpayments (say £100/month extra), you’d shave years off your mortgage and double the lifetime saving. That’s how the headline becomes credible.

Regional and Economic Differences

Mortgage savings depend heavily on where you live and your property type.

- London & South East: Higher loan values mean greater absolute savings, but lenders are more selective.

- North of England & Scotland: Lower average property prices mean smaller total savings, but potentially easier remortgaging terms.

- Northern Ireland & Wales: Rates vary more widely due to local lender competition.

House price trends also influence rates. In 2025, property values are stabilizing after a mild correction in 2024, giving lenders more confidence.

Risk Factors to Keep in Mind

Before you jump to switch, there are a few caveats:

- Early repayment charges (ERCs): Many fixed deals impose 1–5 % penalties for switching early.

- Arrangement and legal fees: Remortgaging costs typically range between £1,000 and £2,000.

- Uncertain inflation: If inflation rebounds, rates could climb again.

- Short-term volatility: Some lenders offer temporary deals that might not last long.

- Credit score impact: Every application leaves a footprint; shop smart, not scattershot.

Pro tip: Always check your total cost of credit, not just the rate. A deal with a lower rate but higher fees might not save you anything long term.

Real-Life Example: Sarah and Jamal’s Story

Sarah and Jamal from Leeds had a £250,000 mortgage fixed at 5.5 %. When the Bank of England announced the rate cut, they contacted a broker.

- Old deal: 5.5 %, 22 years remaining.

- New deal: 4.4 %, £1,995 in switching costs.

- Monthly saving: ~£145.

- Annual saving: ~£1,740.

- Break-even point: 14 months.

By overpaying £100 each month on the new deal, they’ll finish their mortgage two years earlier and save roughly £10,300 in total interest.

That’s how real families reach the “£9,700” mark — not overnight, but through smart timing and discipline.

Step-by-Step Guide to Capturing Savings

Step 1: Know your mortgage inside out

Check your balance, remaining term, rate type, and whether early repayment penalties apply.

Step 2: Compare rates across lenders

Use trusted comparison platforms like MoneySuperMarket or Uswitch to benchmark deals.

Step 3: Calculate potential savings

Use an online mortgage calculator. Compare your current monthly payment with a lower-rate deal and factor in fees.

Step 4: Talk to a broker or advisor

A certified mortgage adviser can show you hidden options — including fee-free remortgages or green incentive deals.

Step 5: Check your credit score

A small bump in your credit score can unlock lower rates.

Step 6: Act strategically

If your fixed term ends soon, line up a remortgage early — lenders often allow applications up to six months before expiry.

Step 7: Overpay when possible

Even £50–£100 extra monthly can cut years off your loan and save thousands in interest.

Step 8: Reassess yearly

Rates, market conditions, and your income can change. Review your mortgage every 12–18 months.

Extra Insight: The Green Mortgage Trend

One underrated opportunity lies in energy-efficient mortgages. Some lenders offer better rates or cashback if your property has an EPC rating of A or B.

However, the market has cooled recently. As of late 2025, many banks have scaled back green incentives due to funding challenges.

Still, if you’re renovating or upgrading your home’s energy efficiency, check with lenders — a small rate discount could compound into thousands saved.

Historical Perspective: Are Rates Really Low?

Let’s put today’s rates in context.

- 1980s: Mortgage rates often exceeded 10 %.

- 2008 Financial Crisis: Fell to around 5 %.

- 2020 Pandemic period: Record lows below 2 %.

- 2023–2024 Inflation wave: Shot above 6 %.

- 2025: Settling in the 4–5 % range — moderate by long-term standards.

So yes, today’s rates aren’t “cheap,” but they’re significantly better than last year’s highs. If your current mortgage still carries a 5 %+ rate, switching now could make real sense.

Huge Mortgage Savings in November? UK Households Could Cut £9,700 in Interest—Don’t Miss Out

How to Save £9,700 on Your Mortgage in November; The Secret UK Lenders Don’t Want You to Know

UK Homeowners Could Save £9,700 This November; Here’s How to Slash Your Mortgage Interest Fast