U.S. Minimum Wage Increase 2025: The talk of 2025 is money — more precisely, how much of it Americans are taking home. With grocery costs still climbing and housing prices stubbornly high, the question on everyone’s mind is: Did the U.S. minimum wage finally go up? The short answer? Not nationally. There’s no new federal minimum wage increase taking effect after October 5, 2025. But before you roll your eyes — hold up. Dozens of states and cities have quietly raised their rates, giving millions of workers a real boost. So, while Washington D.C. may be slow to act, Main Street isn’t waiting around. This article breaks it all down — where wages are going up, why it matters, and how both workers and business owners can prepare.

Table of Contents

U.S. Minimum Wage Increase 2025

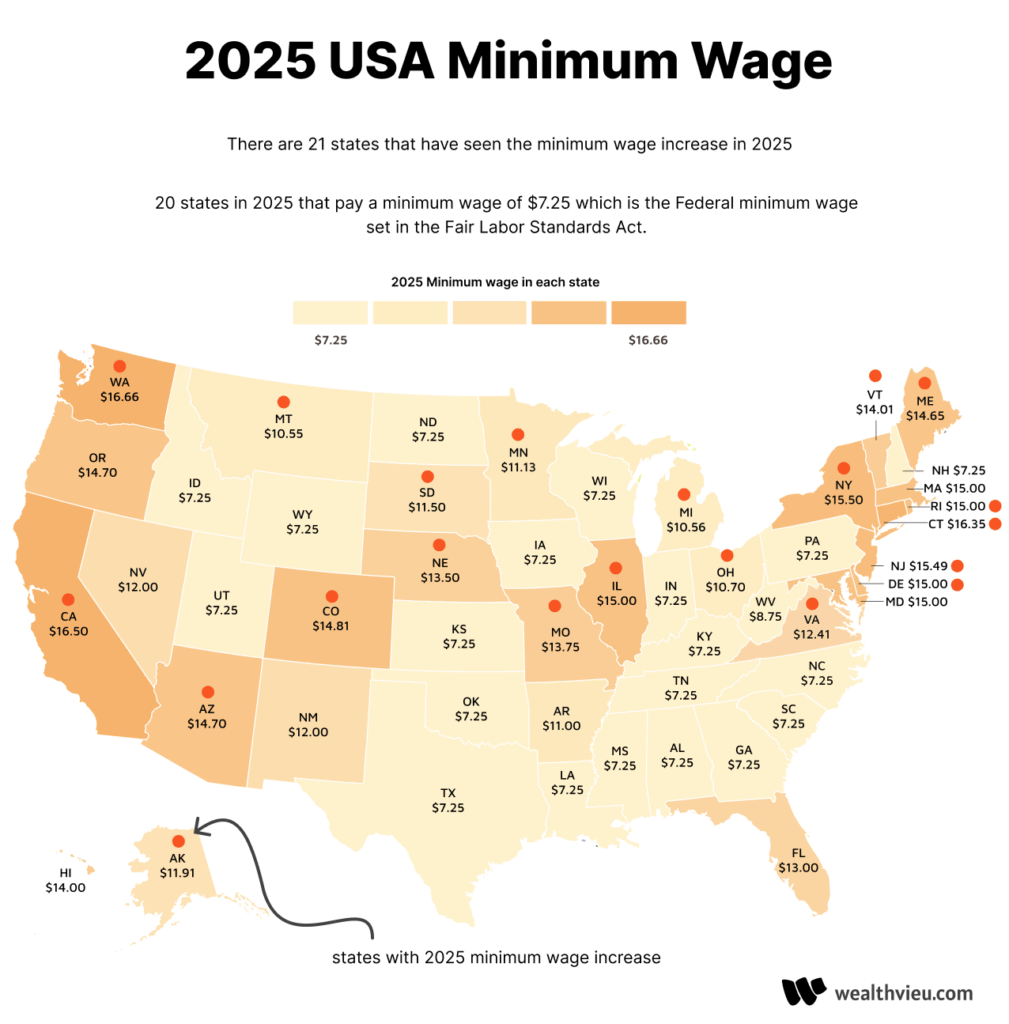

There’s no nationwide minimum wage hike after October 5, 2025, but that doesn’t mean paychecks are standing still. Dozens of states — from California to Florida — have already implemented increases, with more scheduled before 2026. The federal minimum remains $7.25/hr, but economic pressure, inflation, and worker demand are rewriting the rules. Whether you’re a barista, a factory worker, or a small-business owner, the smartest move is to stay informed, plan ahead, and use the data to your advantage. The bottom line? Wages are moving — maybe not from Washington, but from the ground up. And in today’s America, knowledge of your rights and local laws is the most valuable currency you can have.

| Topic | Why It Matters | Key Data / Notes |

|---|---|---|

| Federal baseline | Sets the floor for all covered workers | $7.25/hr — unchanged since 2009 |

| State-level increases in 2025 | Many states now far above federal level | California → $16.50, Arizona → $14.70, Missouri → $13.75 |

| Florida’s special bump | Scheduled raise under 2020 amendment | $13.00 → $14.00 on Sept. 30, 2025 |

| Cost-of-living comparison | Shows wage value differences | $15/hr in Mississippi ≈ $8/hr in California in real terms |

| Inflation factor | Prices up ~18% since 2020 | Drives state indexing formulas and new wage laws |

| Official resource | Track changes directly | U.S. Department of Labor Minimum Wage Page |

Quick History: How We Got Here

The federal minimum wage first came to life in 1938, part of Franklin D. Roosevelt’s Fair Labor Standards Act (FLSA) — a bold move during the Great Depression. It started at $0.25/hour.

Over the decades, the wage climbed steadily to keep up with inflation and economic growth. But here’s the kicker: the last federal increase was in July 2009, when it rose to $7.25/hour.

That’s sixteen years ago. Since then, inflation has eaten away roughly 35% of its value, according to the Bureau of Labor Statistics. In simple terms, $7.25 in 2009 has the same buying power as about $5 today.

This long freeze is why states and cities have taken the lead, pushing local minimum wages higher — some even linking them to inflation automatically.

The 2025 Landscape: Which States Raised Their Wages

Every year, several states revise their minimum wage laws. As of 2025, more than 30 states and territories now exceed the federal floor.

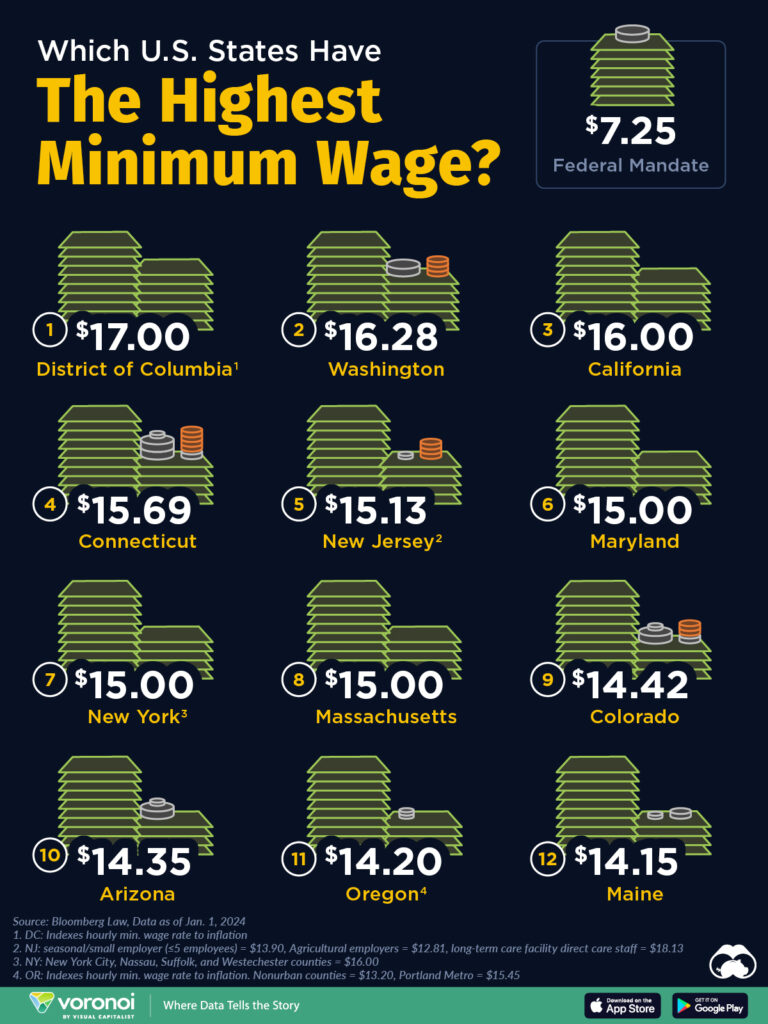

States Leading the Pack

- California: $16.50/hr statewide, up from $16.00 in 2024. Some cities like San Francisco and Mountain View exceed $18/hr.

- Washington: $16.28/hr, one of the highest in the nation.

- New York: $16.00/hr in NYC, $15.50/hr in other regions.

- Arizona: $14.70/hr, tied to the state’s inflation index.

- Colorado: $14.42/hr, automatically adjusted each January.

- Connecticut: $16.35/hr.

- Delaware: $15.00/hr, hitting a long-planned benchmark.

- Missouri: $13.75/hr, rising gradually under a 2018 ballot initiative.

- Florida: $13.00 now, climbing to $14.00 on September 30, 2025, under its 2020 constitutional amendment.

Middle-Tier States

- Illinois: $14.00/hr statewide.

- Ohio: $11.30/hr for non-tipped workers.

- Michigan: Complex schedule — $10.56 in January, moving to $12.48 by February 21, 2025.

Still at the Federal Minimum

Five states — Alabama, Louisiana, Mississippi, South Carolina, and Tennessee — have no state minimum wage law, so the federal $7.25/hr applies.

Why U.S. Minimum Wage Increase 2025 Matter?

It’s easy to treat the minimum wage as just a number, but for millions of working Americans, it’s the difference between scraping by and staying afloat.

For Workers

- Bigger paychecks: More income helps cover essentials — groceries, gas, rent.

- Greater job satisfaction: Employees feel respected when wages reflect effort and cost of living.

- Reduced turnover: Studies from the Economic Policy Institute show retention improves with fair pay, cutting training costs.

For Employers

- Higher labor costs: Payroll budgets grow, forcing strategic planning.

- Productivity gains: Happier, better-paid employees are often more efficient.

- Competitive advantage: Offering slightly above the new minimum helps attract and retain talent in tight labor markets.

For the Economy

- Boosts consumer spending: More disposable income circulates through local businesses.

- Moderate inflation risk: Price increases after wage hikes are typically under 0.5%, according to CNBC and BLS analyses.

- Community impact: Wage growth helps reduce reliance on public benefits programs, indirectly easing government spending.

Cost-of-Living Reality Check

A $15/hour wage sounds great — until you compare living expenses across the U.S.

According to MIT’s Living Wage Calculator:

- In San Francisco, a single adult with no kids needs about $25.60/hour to cover basic expenses.

- In Jackson, Mississippi, the living wage sits closer to $14.15/hour.

That’s why a $15 wage goes far in one state and barely keeps the lights on in another. This imbalance drives local governments to set regional wage laws, often tied to Consumer Price Index (CPI) data to ensure yearly adjustments.

Inflation, Indexing, and Real Wages

Here’s where economics meets real life.

The U.S. inflation rate between 2020 and 2024 averaged around 4.1% annually, according to BLS Consumer Price Index reports. When prices rise and wages don’t, real income drops — meaning your paycheck buys less.

To counteract this, states like Arizona, Colorado, Maine, and Minnesota now link their minimum wages to inflation automatically. When the CPI rises, wages follow suit the next January. This practice helps protect workers without requiring legislative battles every few years.

How Businesses Are Adapting?

Many small business owners feel the squeeze when wages rise, but smart planning can soften the blow.

Example: A coffee shop in Missouri with 10 employees saw payroll rise 7% in 2025. Instead of cutting hours, they introduced:

- Slight menu price adjustments (under 3%).

- Staff cross-training — baristas also handle inventory.

- Energy-saving upgrades to offset utility costs.

The result? Labor costs stabilized, and employee satisfaction went up.

Larger corporations — think Target, Costco, and Amazon — are already ahead of the curve, paying entry-level wages of $15 to $17/hour. These rates not only exceed most state laws but also set competitive pressure for smaller employers nearby.

What Workers Can Do Now?

You don’t need an economics degree to make smarter moves with your paycheck.

- Check your rights: Confirm your pay rate matches your state law.

- Track your hours: Keep records of work time and pay, especially if you’re paid weekly or in cash.

- Ask early: If your employer hasn’t adjusted pay since the law changed, speak up or contact your state labor board.

- Use raises wisely: Set aside part of any increase for savings or emergencies.

- Level up skills: Free training programs can move you into higher-pay brackets fast.

The Future Outlook: 2026 and Beyond

So what’s next?

By 2026, Florida’s path toward $15/hour will be complete. Other states like California, Washington, and New York are expected to cross that line soon after.

At the federal level, multiple proposals — including the Raise the Wage Act — have resurfaced in Congress. If passed, the plan would gradually increase the federal minimum to $17/hour by 2029, then index it to inflation.

Analysts at Forbes and CNBC predict that even if Congress stalls, the market itself will keep pushing pay higher. Companies competing for staff are already raising base wages voluntarily.

Automation, AI tools, and remote work flexibility will also reshape labor costs — meaning the “minimum wage” conversation may soon include guaranteed basic income or region-specific living wage laws.

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy

Here’s Why So Many Americans Wish They Waited to Claim Their $300 Social Security

$1,702 Stimulus Payment For Everyone in Oct 2025 – Will you get it? Check Eligibility