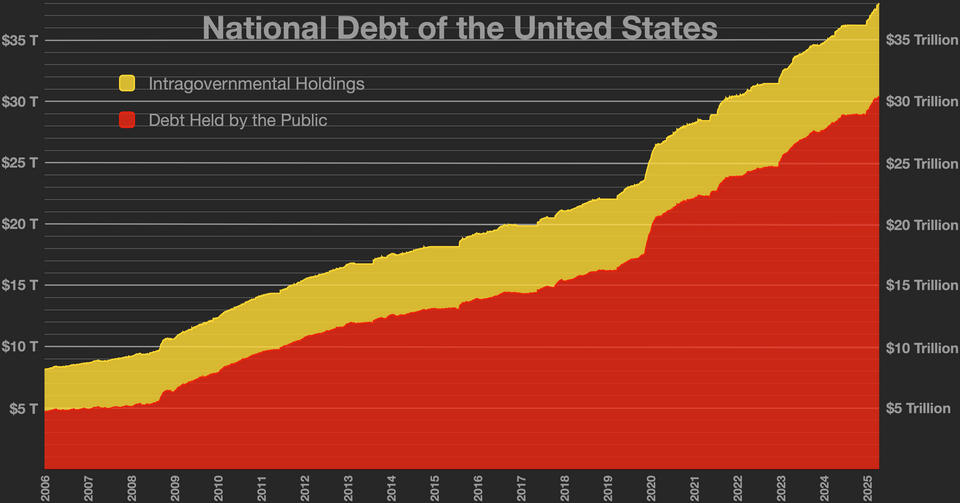

The U.S. national debt crossed $38 trillion this month, according to Treasury Department data released on October 23, 2025. This milestone, reached just weeks after hitting $37 trillion, represents the fastest $1 trillion increase in federal borrowing since the height of the COVID-19 pandemic. Economists warn the surge reflects both structural budget challenges and the growing cost of servicing the debt in a high interest rate environment.

Table of Contents

U.S. Debt Hits $38 Trillion

| Key Fact | Detail / Statistic |

|---|---|

| Total U.S. national debt | $38.02 trillion |

| Time to increase by $1 trillion | Approximately 2 months |

| Annual interest payments | $1.2 trillion (projected FY 2025) |

| Debt-to-GDP ratio | 123% |

| Major cost drivers | Interest, Social Security, Medicare, discretionary spending |

| Official Website | U.S. Treasury |

Lawmakers face a narrowing window to stabilize the fiscal outlook before rising interest costs and political divisions make action even harder. As one senior Treasury official said, “The longer we wait, the fewer options we have.”

A Historic Milestone for Federal Borrowing

The federal debt reached $38.02 trillion on Thursday, an unprecedented level in U.S. fiscal history. The increase of $1 trillion in roughly eight weeks is the fastest peacetime debt accumulation since modern records began, according to the U.S. Treasury Department.

“This level of borrowing is not sustainable over the long term,” said Dr. Anya Sharma, senior fellow at the Brookings Institution. “We’re now at a point where interest payments alone are larger than the entire defense budget.”

The surge coincides with a partial government shutdown and ongoing negotiations in Congress over appropriations for the 2026 fiscal year.

Historical Context: How the Debt Reached This Point

The U.S. has carried debt since its founding, but modern borrowing accelerated in the late 20th and early 21st centuries.

- Post-WWII: Debt peaked at 119% of GDP in 1946, then declined during decades of rapid economic growth.

- 1980s: Tax cuts and defense buildup increased debt levels significantly.

- 2008 Financial Crisis: Federal borrowing surged to stabilize markets and fund stimulus programs.

- 2020 Pandemic: Debt rose by over $5 trillion in less than two years.

Today, the debt-to-GDP ratio has surpassed its postwar high, underscoring structural imbalances that have accumulated over decades.

Rising Interest Rates Amplify the Fiscal Burden

The rapid growth in the national debt has been compounded by elevated interest rates. The Federal Reserve has kept benchmark rates above 5 percent for most of 2025 to curb inflation. As a result, the cost of borrowing for the federal government has risen sharply.

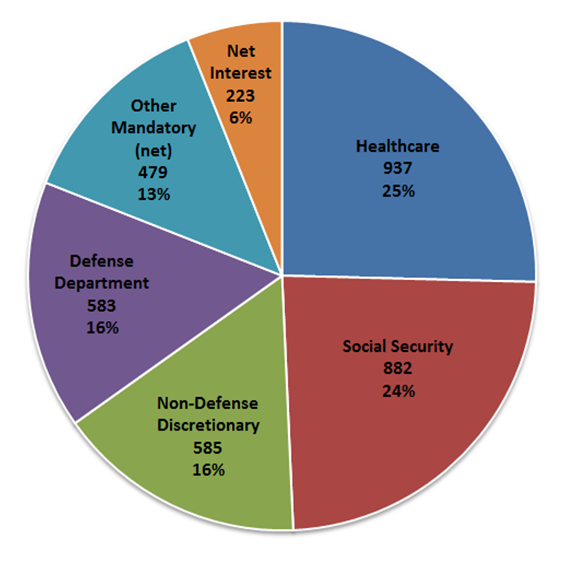

According to the Congressional Budget Office (CBO), annual interest payments are projected to exceed $1.2 trillion by the end of the fiscal year. This figure is more than the federal government spends on Medicaid and nearly matches the Defense Department’s entire budget.

“This is not just about how much we owe,” explained Mark Willis, a former deputy assistant secretary at the Treasury. “It’s about how expensive that debt has become to maintain.”

Structural Drivers Behind the Surge

Economists attribute the debt spike to several long-term structural issues:

- Entitlement spending: Programs such as Social Security and Medicare are expanding as the population ages.

- Defense and discretionary spending: Outlays have remained high despite attempts at budget restraint.

- Revenue shortfalls: Tax revenues have not kept pace with spending growth, leaving persistent deficits.

The Peter G. Peterson Foundation, a nonpartisan fiscal watchdog, reported that nearly two-thirds of all federal spending now goes to mandatory programs and interest payments, leaving little room for discretionary spending cuts.

Global Comparisons and Reserve Currency Advantage

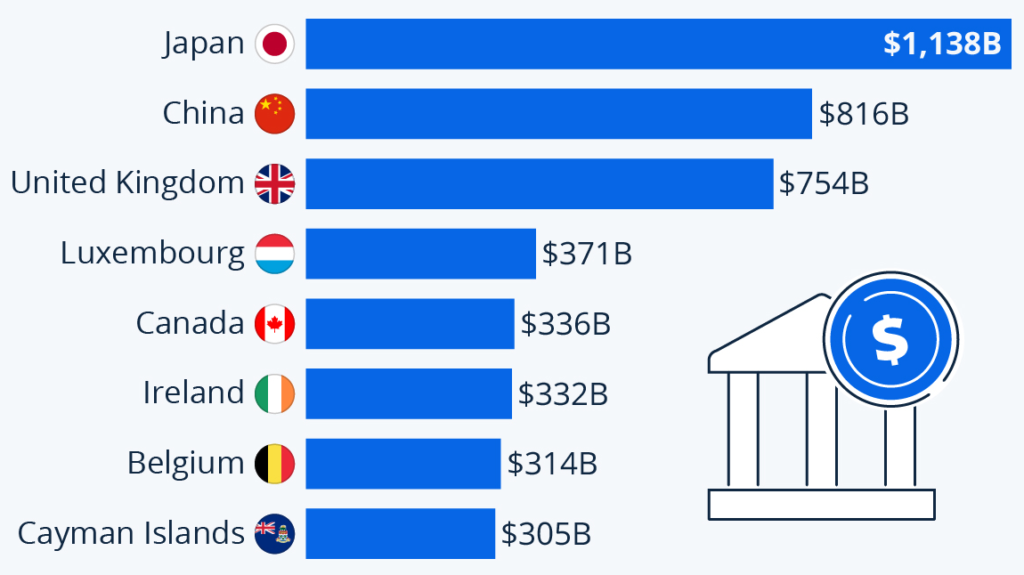

The United States is not alone in carrying high public debt. Japan’s debt-to-GDP ratio exceeds 250%, while Italy’s is above 140%. However, unlike most countries, the U.S. benefits from issuing debt in the world’s dominant reserve currency — the U.S. dollar.

“The U.S. enjoys a unique privilege because investors see Treasurys as the safest asset globally,” said Dr. Yuki Tanaka, senior economist at the International Monetary Fund (IMF). “But even that privilege has limits.”

Other advanced economies such as Germany and Canada maintain lower debt levels, which can give them more fiscal flexibility during downturns.

Impact on Ordinary Americans

Rising federal debt can indirectly affect household finances. Higher government borrowing often pushes up long-term interest rates, which can raise the cost of mortgages, car loans, and business credit.

“Debt of this scale eventually filters down to families,” said Laura Price, chief economist at the Economic Policy Institute. “When interest costs grow, the government has less fiscal space for investments in infrastructure, education, or climate resilience.”

In addition, larger deficits can contribute to inflationary pressures, reducing real purchasing power for American households.

Investor and Market Reactions

The surge in U.S. debt has prompted close scrutiny from investors and credit rating agencies. Yields on 10-year Treasury notes recently touched 5 percent, their highest level since 2007.

Fitch Ratings downgraded the U.S. credit rating in 2023, citing “fiscal deterioration” and political brinkmanship. Moody’s has warned of a possible downgrade if no credible fiscal plan emerges in 2026.

China and Japan, the largest foreign holders of U.S. Treasurys, have both slightly reduced their holdings in recent quarters, though analysts emphasize that U.S. bonds remain central to global markets.

Political Landscape and Fiscal Gridlock

The debt surge has reignited partisan debate in Washington. Republican leaders are pushing for deep spending cuts, particularly to entitlement programs and discretionary spending. Democrats argue for targeted tax increases on high earners and corporations, combined with preserving safety-net programs.

Treasury Secretary Janet Yellen warned that “failure to address the debt ceiling in a timely manner risks undermining global confidence in U.S. financial stability.”

The debt ceiling deadline is expected to return to the legislative agenda in early 2026, potentially setting up another high-stakes standoff.

Policy Paths and Economic Scenarios

Analysts are examining several scenarios for the debt’s future path:

- Status Quo: If current policies remain unchanged, CBO projects debt could exceed $50 trillion by 2033.

- Moderate Reform: A mix of revenue increases and targeted spending reductions could stabilize the debt-to-GDP ratio.

- Aggressive Action: Structural reforms in healthcare and tax policy could lower the ratio to under 100% over two decades.

“Every year of delay makes the math harder,” said Dr. Omar Velasquez, budget policy director at the Bipartisan Policy Center. “But the earlier Congress acts, the less painful the solutions can be.”

Debate Among Economists: Debt Risks vs. Economic Growth

Not all economists view rising debt as an immediate crisis. Some, including proponents of Modern Monetary Theory (MMT), argue that as long as inflation is under control and borrowing is in U.S. dollars, the government has flexibility.

However, mainstream economists caution against complacency. “Debt doesn’t explode overnight,” said Dr. Eleanor Grant of Princeton University. “It erodes fiscal space over time, leaving fewer options when the next recession or emergency hits.”

Forward Look: What to Watch

Key developments in the coming months could shape the next phase of the U.S. debt story:

- Debt Ceiling Deadline: Congress is expected to debate the borrowing limit early in 2026.

- Federal Reserve Meetings: Future interest rate decisions will affect borrowing costs.

- Treasury Auctions: Market demand for U.S. bonds could reveal investor sentiment.

- 2026 Elections: Fiscal policy is likely to be a central campaign issue for both parties.

“The fiscal trajectory of the U.S. is not set in stone,” said Dr. Lina Ortega of Harvard University. “It depends on political choices made in the next few years.”

$5108 Stimulus Payment for Seniors: Full Schedule and Details for October 2025

Millions of Californians Can Now Get Up to $1,789 in CalFresh; Here’s What Changed Overnight

FAQ About U.S. Debt Hits $38 Trillion

Q: What is the national debt?

A: It is the total amount of money the U.S. federal government owes to creditors, including individuals, corporations, and foreign governments.

Q: Why does it grow so quickly?

A: Because spending consistently exceeds revenue, and interest costs compound existing debt.

Q: Who holds most of the debt?

A: About 75% is held by the public, including foreign investors. The remainder is held by U.S. government accounts.

Q: How does it affect ordinary people?

A: Higher debt can lead to higher interest rates, reduced public investment, and inflationary pressures over time.