Tata Capital IPO Faces Final-Day Doubts: The Tata Capital IPO is the talk of the town — and for good reason. Backed by one of India’s most respected corporate houses, Tata Group, this offering has all the buzz, but also a fair bit of confusion and caution swirling around it. In this guide, I’ll walk you through everything — what’s going on with the IPO, why investors are showing mixed signals, what numbers you should really pay attention to, and whether this is worth your money. No corporate jargon here — we’ll break it down in plain English, the way you’d explain it to your smart 10-year-old nephew who’s curious about “how people buy companies.”

Table of Contents

Tata Capital IPO Faces Final-Day Doubts

| Topic | Key Data |

|---|---|

| Price Band | ₹310 – ₹326 per share |

| Total Issue Size | ₹15,511 crore (≈ $1.75 billion) |

| Anchor Funding | ₹4,642 crore from anchor investors, including LIC (Times of India) |

| Subscription (Day 3) | Fully subscribed: QIBs 1.18×, NIIs 1.10×, Retail ~0.84× |

| Promoter Sale | Tata Sons selling ~10.1% stake for ₹6,716 crore |

| Valuation Multiples | 3.4× Book Value; ~33× P/E (Moneycontrol) |

| Asset Quality | Gross NPA 0.5% standalone; TMFL NPA ~7.1% |

What is the Tata Capital IPO, and why now?

Tata Capital, one of India’s largest non-bank financial companies (NBFCs), finally hit the public market in 2025. The IPO — India’s biggest this year — opened on October 6, 2025, and closed on October 8, 2025. Shares are expected to list on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) by mid-October.

The offer includes both a fresh issue of shares (bringing new money into the company) and an offer for sale (OFS) from existing shareholders such as Tata Sons and International Finance Corporation (IFC).

The price band is ₹310–₹326 per share, giving Tata Capital a valuation near ₹1.25 trillion (≈ $15 billion) at the upper end. According to Reuters, this is India’s largest IPO in 2025, surpassing LIC’s earlier benchmark.

But while institutional investors lined up fast, retail investors — the average folks like you and me — have been a little hesitant.

Why this IPO is making waves?

1. A regulatory nudge

Tata Capital’s public listing wasn’t just strategic — it was mandatory. In 2022, India’s central bank (RBI) classified it as an Upper-Layer NBFC, which means it operates under stricter regulations, requiring higher transparency, governance, and, crucially, public listing within three years.

So, rather than waiting till the last minute, Tata Capital decided to make its debut in 2025. Smart move — it signals confidence and compliance.

2. The Tata trust factor

Let’s face it — when you hear “Tata,” you think reliability. The brand stands for ethics, long-term thinking, and solid fundamentals. That reputation alone attracts investors.

But even the Tata name doesn’t guarantee sky-high listing gains — and that’s where doubts creep in.

3. The merger wildcard

Earlier this year, Tata Capital absorbed Tata Motors Finance Ltd. (TMFL), a move meant to strengthen its auto finance business.

However, TMFL carried heavier non-performing assets (NPAs) — about 7.1%, compared to Tata Capital’s mere 0.5%. While the merger expands reach, it could also weigh down quality in the short term.

Tata Capital IPO Faces Final-Day Doubts: Why investors are hesitating

The IPO is fully subscribed, but the mood is cautious. Here’s what’s driving the last-day doubts.

Muted grey market premium (GMP)

Normally, when a big brand like Tata comes to market, the grey market premium — the unofficial price before listing — shoots up.

This time? Not so much. GMP hovers around ₹6–₹8 per share, about a 2–3% gain at best. That’s peanuts compared to other hyped IPOs in India, where premiums often hit 20–50%.

This signals that short-term traders don’t expect massive listing profits.

Retail apathy

Institutional investors — mutual funds, pension funds, big banks — have subscribed comfortably. But retail participation remains underwhelming at 0.84×.

This means everyday investors are on the fence, either finding the pricing too steep or the upside too limited.

Valuation concerns

At the upper price band, Tata Capital trades at a P/E of ~33× and a P/B of 3.4×, which some analysts call “fully priced.”

That’s higher than industry averages for similar NBFCs, suggesting the listing already prices in most of the good news.

Macro & interest-rate headwinds

With the Reserve Bank of India keeping rates elevated to curb inflation, borrowing costs for NBFCs have risen.

That squeezes net interest margins (NIMs) — the difference between what they earn on loans and what they pay on borrowings. If NIMs narrow, profit growth slows.

In short, this IPO isn’t arriving in the easiest environment.

A deeper look at the numbers

Tata Capital’s consolidated assets under management (AUM) stand at ₹1.72 trillion ($20.6 billion) as of March 2025. The loan book is spread across:

- Retail lending (consumer loans, home loans, personal loans)

- Corporate lending

- Infrastructure finance

- Auto financing (expanded post-merger with TMFL)

Its net profit for FY25 was ₹3,100 crore, up 32% year-over-year — impressive growth, though some of that came from improved cost efficiencies rather than purely credit expansion.

The company’s capital adequacy ratio (CAR) stands around 20%, well above RBI’s regulatory requirement. That’s a good cushion for growth and risk management.

Tata Capital IPO Faces Final-Day Doubts: How to Evaluate This IPO

Step 1: Decode the structure

The IPO is divided into:

- Fresh Issue: ₹6,846 crore — this money strengthens the company’s balance sheet and fuels expansion.

- OFS (Offer for Sale): ₹8,666 crore — this goes to existing shareholders, not the company itself.

Knowing this helps you understand where your money goes.

Step 2: Compare valuations

Compare Tata Capital’s P/E and P/B with competitors:

| Company | P/E | P/B | Gross NPA | Remarks |

|---|---|---|---|---|

| Tata Capital (IPO) | ~33× | 3.4× | 0.5% | Freshly listed |

| Bajaj Finance | ~30× | 7.1× | 0.9% | Benchmark NBFC |

| HDB Financial (Unlisted) | ~25× (est.) | 3× | ~1.2% | HDFC-linked peer |

This tells you Tata Capital is priced at a premium to some peers despite being newer to the public market.

Step 3: Check growth levers

- Retail focus: Over 60% of AUM is retail.

- Digital lending: Tata is expanding its fintech platform “Tata Capital Digital” to automate underwriting and improve customer experience.

- Cross-sell power: Being part of the Tata ecosystem (cars, housing, consumer goods) helps it acquire customers at low cost.

Step 4: Assess risks

- Rising borrowing costs may pinch spreads.

- TMFL merger could add short-term asset-quality noise.

- Economic slowdown could increase defaults.

- Aggressive growth may stress capital adequacy if not balanced with prudent risk management.

Step 5: Define your goal

- Short-term investor? Expect modest listing gains, if any.

- Long-term investor? This could be a stable, compounding business with strong parentage.

The key is aligning your expectations with your time horizon.

Sector context: NBFCs in 2025

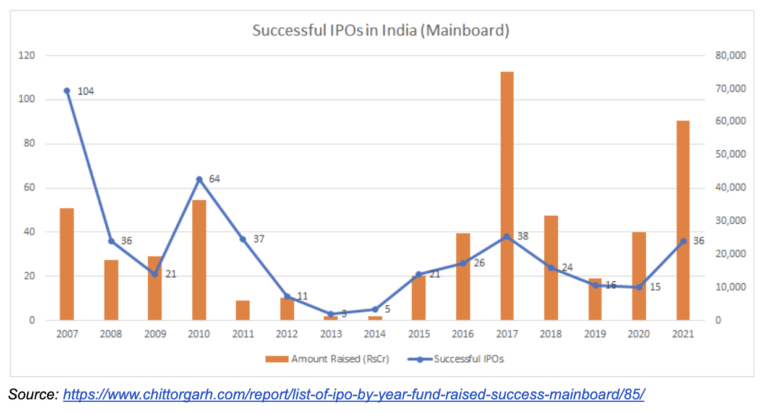

India’s NBFCs have grown at ~12% CAGR over the past five years, fueled by consumer credit, small business lending, and infrastructure funding.

But after a few blow-ups (IL&FS, DHFL), regulators tightened norms, requiring higher capital buffers and stricter audits.

Tata Capital, thanks to its size and brand, has emerged as a “safe haven NBFC” — a middle path between high-risk micro-lenders and slow-moving banks.

That’s a plus, but also means investors shouldn’t expect Bajaj-like explosive returns right away.

What to Watch Post-Listing?

- Listing Price: If it lists 5–10% above issue price, that’s a healthy start. Anything below could suggest sentiment remains lukewarm.

- Quarterly Results (Q3 FY25): The first set of post-listing earnings will reveal whether integration with TMFL is impacting profitability.

- Asset Quality: Keep an eye on NPAs — especially how TMFL’s legacy loans perform.

- Regulatory Developments: Any new RBI guidance for upper-tier NBFCs will directly affect Tata Capital’s capital and leverage ratios.

- Peer Performance: Watch Bajaj Finance and HDB Financial; their trends often influence sector valuation multiples.

Scenario Analysis

| Scenario | What Happens | Investor Impact |

|---|---|---|

| Bullish | Smooth TMFL integration, strong loan growth, listing pop of 20%+ | Healthy mid-term gains |

| Neutral | Modest growth, stable margins, limited listing pop (5–10%) | Steady compounding returns |

| Bearish | Higher defaults, margin compression, weak listing | Underperformance short-term |

These scenarios aren’t predictions — they’re planning tools to help you prepare for different outcomes.