State Pension Set to Rise Again: If you’re keepin’ an eye on your retirement plans, then the State Pension rise in 2026 is news you absolutely need to catch. Starting April 2026, millions of pensioners across the UK will get a much-needed bump to their income – thanks to the government’s “triple lock” policy. This article breaks it all down—from what it means, how much you’ll get, to practical tips on maximizing your State Pension, plus the latest eligibility info and changes affecting your retirement plans. The State Pension is set to jump by a solid 4.8% come April 2026, pushing the full new State Pension weekly payment from £230.25 up to £241.30. That adds up to £12,547.60 per year—an increase of nearly £575 annually, or roughly £11 extra per week. For folks on the basic (old) State Pension, payments will rise by about £440 a year, reaching around £9,615 annually. This rise means more cash to help pensioners keep pace with living costs and enjoy the golden years a bit more comfortably.

Table of Contents

State Pension Set to Rise Again

The 2026 State Pension rise offers a much-needed financial boost of nearly £575 a year for the full new pension, guaranteed by the triple lock. While this helps pensioners keep up with living costs, watch out for the rising pension age and possible tax impacts due to frozen allowances. By checking your National Insurance record, planning the timing of your claim, and supplementing with private savings, you can maximize your income and enjoy a more secure retirement. Stay informed and proactive—your future self will thank you.

| Feature | Details |

|---|---|

| State Pension Increase | 4.8% from April 2026 |

| New State Pension Weekly Amount | £241.30 (up from £230.25) |

| New State Pension Annual Amount | £12,547.60 (up from £11,973) |

| Basic State Pension Weekly Amount | £184.92 (up from £176.45) |

| Basic State Pension Annual Amount | £9,615.84 (up from £9,175.40) |

| State Pension Age Increase | From 66 to 67 between 2026 and 2028 |

| Official Resources | Gov.uk |

What Is the State Pension and Why Should You Care?

Think of the State Pension as your government-backed safety net—a regular income you receive once hitting retirement age, based on contributions you made during your working life through National Insurance (NI). It’s a foundation many depend on to cover essential expenses after work stops.

There are two main types:

- New State Pension: For those who reached State Pension age on or after April 6, 2016.

- Basic (Old) State Pension: For those who reached pension age before that date.

Your eligibility and the amount you get depend on your NI contributions and when you qualify to claim it.

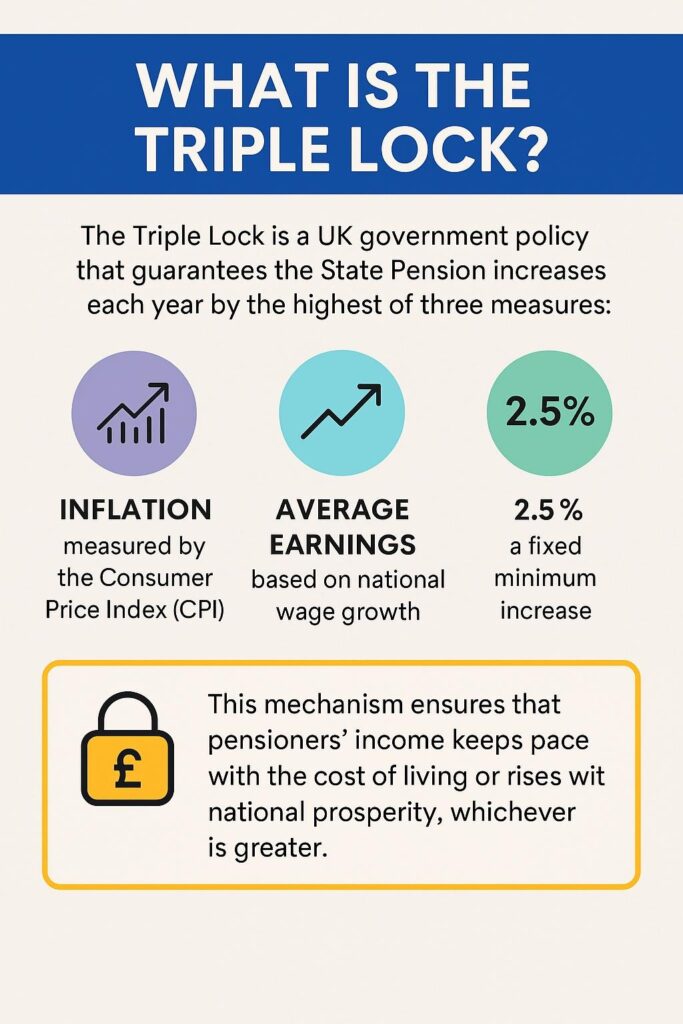

How Does the Triple Lock Work?

The government’s triple lock guarantee ensures your pension increases each year by the highest of these three:

- Average earnings growth (how wages rise),

- Inflation rate (measured by Consumer Price Index or CPI),

- Or a minimum of 2.5%.

For 2026, wage growth hit 4.8%, beating inflation (3.8%) and the 2.5% floor—triggering the full increase for pension payments.

Who Is Eligible for the State Pension Set to Rise Again?

Eligibility depends on several factors:

- Minimum qualifying years: You need at least 10 “qualifying years” of National Insurance contributions or credits to get any amount of the new State Pension.

- To get the full pension rate: You’ll need 35 qualifying years.

A qualifying year counts when you:

- Paid National Insurance contributions through employment or self-employment,

- Received NI credits while unemployed, ill, a parent, or a carer,

- Paid voluntary NI contributions.

If you started your National Insurance record after April 2016, these are the exact rules that apply. For those starting work before, there are special “foundation amounts” and some workers may have “protected payments” due to the old system. You might also qualify based on your spouse or civil partner’s NI record in some cases.

What’s New for Pensioners in 2026?

1. Increased Pension Payments

Starting April 6, 2026:

- The full new State Pension will increase to £241.30 per week (£12,547.60 annually).

- Basic (old) State Pension lifts to around £184.92 per week (£9,615.84 annually).

This bump helps pensioners cover rising living costs, keeping the pension relevant and meaningful even in tough financial times.

2. The Pension Age Is Rising

Pension age will rise from 66 to 67 gradually between 2026 and 2028. Those born between April 1960 and March 1961 will see their pension age increase incrementally from 66 years and 1 month up to 67 years. This change helps the system remain sustainable amid longer life expectancies.

3. Tax Implications

While pension increases sound great, there’s a catch. The personal tax allowance remains frozen at £12,570 until 2028, meaning more pensioners will have to pay income tax on their pensions as they cross this threshold. It’s essential to factor this in when budgeting your retirement income.

4. Pension Deferral Option

Did you know you can choose to defer your State Pension? If you delay claiming past your State Pension age, you can boost your weekly pension. For every 9 weeks you delay, your pension grows by 1%, which adds up to roughly 5.8% per full year deferred. This can be a smart move if you don’t immediately need the income.

But, deferring might affect eligibility for other benefits, so it’s wise to seek financial advice before deciding.

How To Make the Most of Your State Pension?

Step 1: Check Your National Insurance Record

Make sure you have enough qualifying years (typically 35) to secure the full new State Pension. Use the government’s online NI checker available on Gov.uk to spot any gaps in contributions. Missing years can sometimes be filled by paying voluntary contributions up to five years back – this can bump your pension by thousands of pounds over time.

Step 2: Plan When to Claim

Plan strategically when to start claiming your pension. Since pension age is going up, know your exact pension age using the State Pension Age Calculator. Claiming after your pension age adds extra cash (deferral bonus), while claiming earlier could reduce your weekly payout.

Step 3: Top-Up with Private or Workplace Pensions

State Pension alone won’t always cover all retirement needs. Consider maxing out contributions to personal or workplace pensions to build a bigger nest egg.

Step 4: Stay Updated

Keep an eye on government pension announcements to prepare for future changes in age, benefit amounts, or tax rules.

Other Important Pension Factors to Know

- Pension Credit: If your total income is low, you might be eligible for Pension Credit, which tops up your income to a guaranteed minimum.

- Inherited Pension Rights: It’s possible to inherit some State Pension benefits from your deceased spouse or civil partner.

- Living or Working Abroad: Time spent in countries with social security agreements (EEA, Switzerland, Gibraltar, and some others) can help fill your qualifying years for State Pension, which is handy for expats or those who worked overseas.

£300 Pension Blow for UK Retirees – HMRC’s October 9 Rule Change Sparks Outrage

State Pension Set to Hit £12,548 Annually in April – Triple Lock Means Bigger Payments

State Pension Soars to £12,548 a Year – What This Massive Boost Means for Your Retirement