The State Pension Overhaul scheduled to begin in 2026 will bring some of the most significant changes to the UK’s pension system in decades, according to the Department for Work and Pensions (DWP). The reforms will affect millions of retirees and future pensioners, reshaping how and when people in the UK retire.

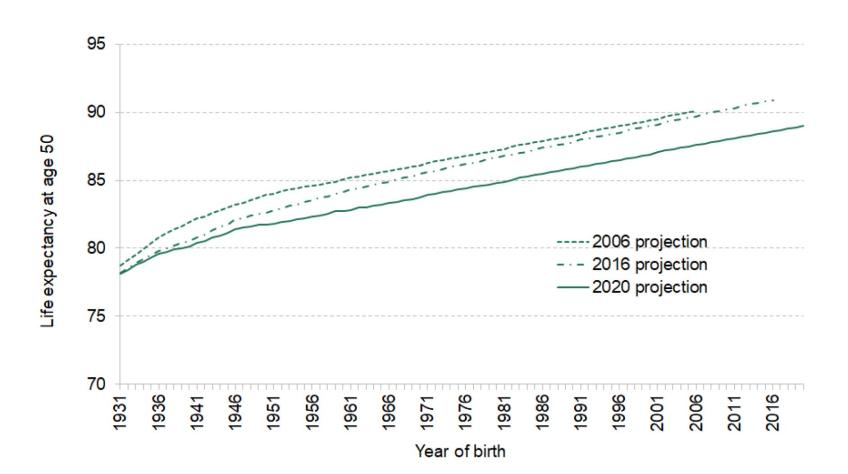

The government says the changes are necessary to reflect longer life expectancy and mounting fiscal pressures. Critics, however, warn they may increase inequality and force lower-income workers to remain in the labour force for longer.

Table of Contents

State Pension Overhaul Coming in 2026

| Key Fact | Detail |

|---|---|

| State Pension Age increase | Rising from 66 to 67 between April 2026 and March 2028 |

| Triple lock commitment | Pension will rise by the highest of CPI, earnings growth, or 2.5% |

| Full new state pension | £230.25 per week for 2025–26 |

| National Insurance requirement | 35 qualifying years for full pension remains |

| Policy review | Third statutory review underway |

A Gradual Increase in Retirement Age

The centrepiece of the State Pension Overhaul is the increase in the state pension age from 66 to 67, starting in April 2026. The transition will be phased over two years and completed by March 2028.

“It is essential that the system remains fair, sustainable, and reflective of demographic realities,” said Mel Stride, Secretary of State for Work and Pensions. The government argues that as people live longer, working lives must also extend to keep the pension system viable.

Demographers project that by 2030, one in four UK residents will be aged over 60. This demographic shift underpins the government’s push to raise the retirement age and review benefit structures.

How the Triple Lock Will Apply

Under the triple lock guarantee, the State Pension will continue to rise each year by the highest of inflation, average earnings growth, or 2.5%. For the 2025–26 financial year, the full weekly new state pension is set at £230.25.

Economists warn the triple lock, while popular, is expensive. “Pension uprating at this pace creates fiscal risks if wage growth stagnates,” said Dr. Alice McLean, senior economist at the Institute for Fiscal Studies (IFS). “But scrapping it would carry significant political costs.”

Eligibility and National Insurance Rules

The 35-year National Insurance (NI) contribution requirement for the full state pension remains unchanged. Those with fewer years receive a reduced amount.

However, the DWP is reviewing NI credits for carers, those with disabilities, and individuals with interrupted work histories. Advocacy groups are urging the government not to tighten eligibility. “NI credits are a lifeline for many who step away from the workforce to care for others,” said Caroline Abrahams, Charity Director at Age UK.

A Brief History of Pension Reform in the UK

The UK state pension was introduced in 1948, offering £1.30 a week. Since then, the system has undergone multiple reforms:

- 1978: State Earnings-Related Pension Scheme (SERPS) introduced.

- 2010: Retirement age for women began rising to equalise with men.

- 2016: “New State Pension” replaced the old basic and SERPS systems.

- 2026: Planned increase in state pension age to 67.

This trajectory reflects broader demographic and economic pressures. Many developed countries are following similar paths.

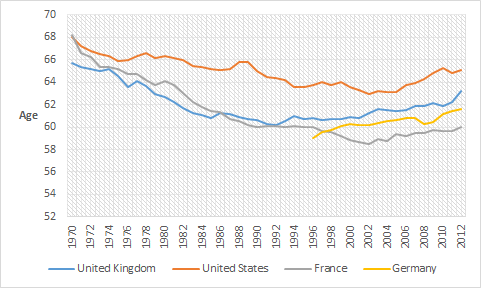

Global Comparisons: UK vs. Other Nations

| Country | Pension Age | Full Pension Weekly Equivalent (approx.) | Indexation Mechanism |

|---|---|---|---|

| UK | 66 → 67 | £230.25 | Triple lock |

| Germany | 66 → 67 | £240 | Wage-indexed |

| France | 64 | £220 | Inflation-indexed |

| United States | 67 | £285 | Wage and inflation-indexed |

Many countries are raising pension ages in response to ageing populations. The UK’s trajectory is broadly in line with Germany and the US.

Human Impact: Stories Behind the Numbers

Janet, 64, a hospital porter from Manchester, planned to retire at 66. The new rules mean she may need to work another year. “I’ve done shift work since I was 18,” she said. “Another year might not sound like much, but on my feet all day, it’s a big ask.”

David, 45, a teacher from Kent, said he understands why the pension age must rise. “I’ll be working longer anyway. But I want clarity. If they’re changing the rules, they need to be transparent about what that means for my generation.”

These stories reflect wider divides: physical workers may find it harder to extend their working lives, while professionals might adapt more easily.

Pension Age Review: What’s Next?

The third statutory review of the state pension age, launched in July 2025, will assess economic and demographic trends and recommend future policy. Experts say the next likely step could be raising the pension age to 68 in the mid-2030s.

The Office for Budget Responsibility (OBR) projects that state pension spending could rise from 5% to nearly 7% of GDP by 2050. Fiscal hawks argue that increasing the pension age is inevitable.

Tax Implications and Means-Testing Debate

The frozen personal tax allowance could mean some pensioners will soon pay income tax on their state pension for the first time. Analysts say this is a “stealth tax” effect, not a formal pension cut.

There is also debate over means-testing benefits such as the Winter Fuel Payment. “We must make sure benefits go to those who need them most,” said a Treasury spokesperson, though no formal changes have been announced.

Tools and Resources for Individuals

The DWP recommends individuals use the State Pension forecast tool to understand their personal entitlements and retirement age.

Workers who have gaps in their NI record can make voluntary contributions to boost their future pension. Independent advisers stress the importance of checking records early. “Many people only discover gaps at the last minute,” said Helen Parker, a pensions adviser with over 20 years of experience.

Expert Views: Balancing Fairness and Sustainability

“The UK faces a demographic challenge. This is not unique, but it’s acute,” said Professor Michael Green, a pension policy expert at the London School of Economics. “Raising the pension age is a lever governments can pull, but it cannot be the only one.”

Trade unions, meanwhile, are urging the government to consider occupation-specific retirement flexibility. “Not everyone can work longer,” said Paul Nowak, General Secretary of the Trades Union Congress. “It’s a blunt instrument.”

A System Under Long-Term Pressure

The UK’s state pension is funded on a pay-as-you-go basis, meaning today’s workers pay for today’s retirees. With fewer workers supporting more pensioners, the system faces growing strain.

“The pension system is a cornerstone of social protection,” said Dr. Anya Sharma, a senior researcher at the Resolution Foundation. “But it needs regular adjustment to remain viable.”

Looking Beyond 2028

Although the 2026 State Pension Overhaul focuses on raising the age to 67, future changes are already under discussion. The triple lock could be reformed or replaced with a less costly indexation formula. There are also proposals to align retirement age with life expectancy on a rolling basis.

Such changes are politically sensitive but may be required to secure the system’s future. A public consultation on long-term pension strategy is expected in early 2027.

Pensioners Hit with £300 Loss as HMRC Rule Change Kicks In October 15; Are You Affected?

Major Changes Hit Motability Scheme in 2025: What Every PIP and ADP Claimant Needs to Check Today

FAQ About State Pension Overhaul Coming in 2026

Q: When will the state pension age increase?

A: Between April 2026 and March 2028, from 66 to 67.

Q: Will the triple lock be scrapped?

A: No. It remains in place for now, though reviews continue.

Q: How many years of National Insurance are required for a full pension?

A: 35 qualifying years.

Q: Will pensioners pay more tax?

A: If pensions exceed tax-free allowances, some may enter the tax net.

Q: Where can I check my personal pension forecast?

A: Visit the UK government’s pension forecast tool.