The Philippine Social Security System (SSS) has introduced a significant ₱1,000 increase in monthly pensions for senior citizens starting in 2025. This adjustment aims to provide better financial support to the country’s elderly, with the reforms affecting retirement, disability, and survivor pensioners. Understanding the eligibility criteria and payment process is essential for those who will benefit from this landmark change.

Table of Contents

Senior Citizen Pension 2025

| Key Fact | Detail/Statistic |

|---|---|

| Pension Increase | ₱1,000 increase in monthly pension for eligible senior citizens starting January 2025. |

| Eligible Beneficiaries | Includes retirement, disability, and survivor pensioners meeting contribution requirements. |

| Payment Method | Payments will be credited automatically through existing channels like banks or remittance centers. |

| Impact on Pensioners | Aimed to assist over 3.8 million pensioners across the country. |

| Timeline for Annual Increases | Structured annual increases to begin in September 2025 with a 10% increase for retirement and disability pensioners. |

| Official Website | SSS Website |

The SSS ₱1,000 pension increase marks a significant milestone in the Philippine government’s efforts to provide better financial security to its senior citizens. As this reform unfolds, pensioners can look forward to further increases in the coming years, ensuring a more stable retirement. With these changes, the government aims to provide greater support to one of the most vulnerable segments of society.

As the population of senior citizens continues to grow, the SSS reform represents a crucial step in ensuring the long-term stability of the social security system, helping Filipino retirees navigate the financial challenges that come with aging.

Understanding the ₱1,000 Senior Citizen Pension Increase

In a move to better support elderly Filipinos, the Philippine Social Security System (SSS) has announced a significant pension increase set to take effect in 2025. This initiative, which is part of a broader pension reform program, promises to deliver more financial stability to the country’s senior citizens, particularly those relying on monthly SSS pensions.

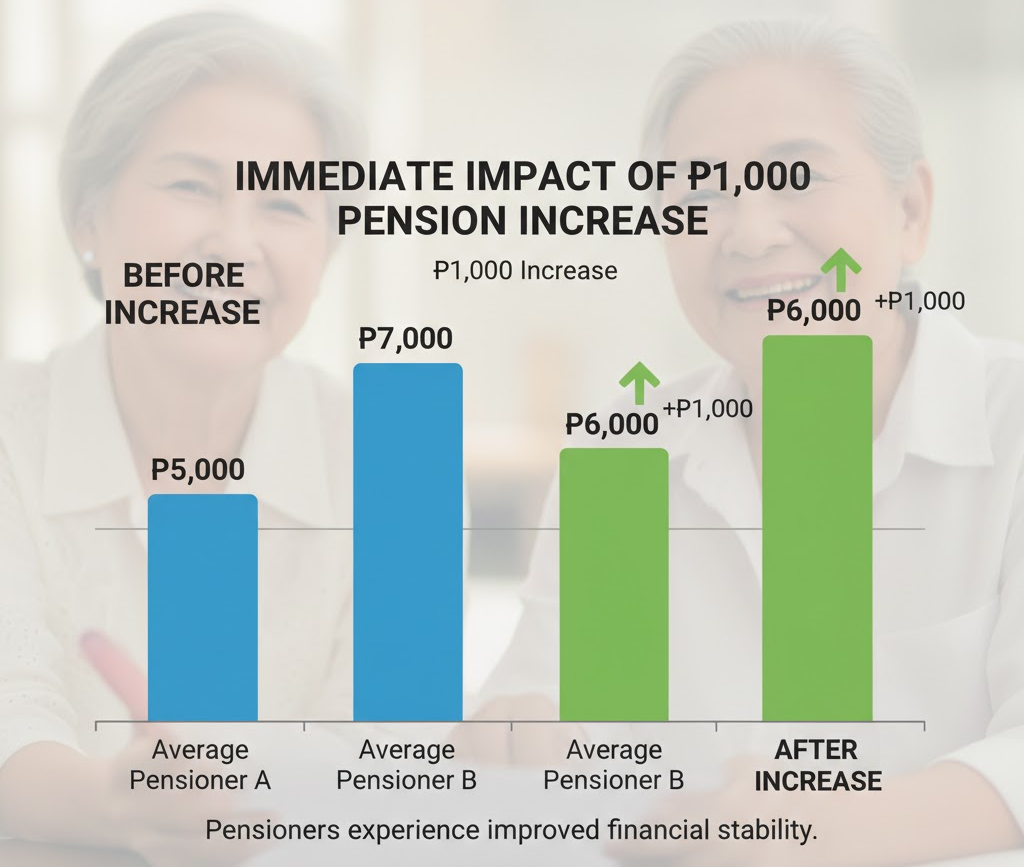

Starting January 2025, eligible retirees, disabled individuals, and survivors of deceased members will receive an additional ₱1,000 in their monthly pension payments. This increase marks the first step in a three-year pension adjustment plan designed to provide greater financial relief to the growing population of elderly Filipinos.

Eligibility for the ₱1,000 Pension Increase

To qualify for the ₱1,000 increase, pensioners must meet certain eligibility criteria established by the SSS. These criteria include:

- Retirement Pensioners: Individuals who have reached the age of 60 or 65 and have at least 120 monthly contributions to the SSS.

- Disability Pensioners: Those receiving benefits due to a disability recognized by the SSS.

- Survivor Pensioners: Legal spouses and dependent children of deceased members.

It is important to note that active SSS members who are not yet pensioners will not be affected by this adjustment. Pensioners who do not meet these criteria will continue to receive their existing benefits.

How the Payment Process Will Work

The increase in pension payments will be processed automatically by SSS, meaning that eligible pensioners will not need to take any action to receive the ₱1,000 increase. The funds will be credited through the same payment channels used for regular pensions, such as banks, remittance centers, or the Unified Multi-Purpose ID (UMID)-linked cards. This means a seamless transition for pensioners who are already accustomed to receiving their benefits through these channels.

The goal is to ensure that the distribution of this increase is as efficient and straightforward as possible, reducing the administrative burden on pensioners and eliminating any potential delays in payment.

Scheduled Annual Increases for Future Years

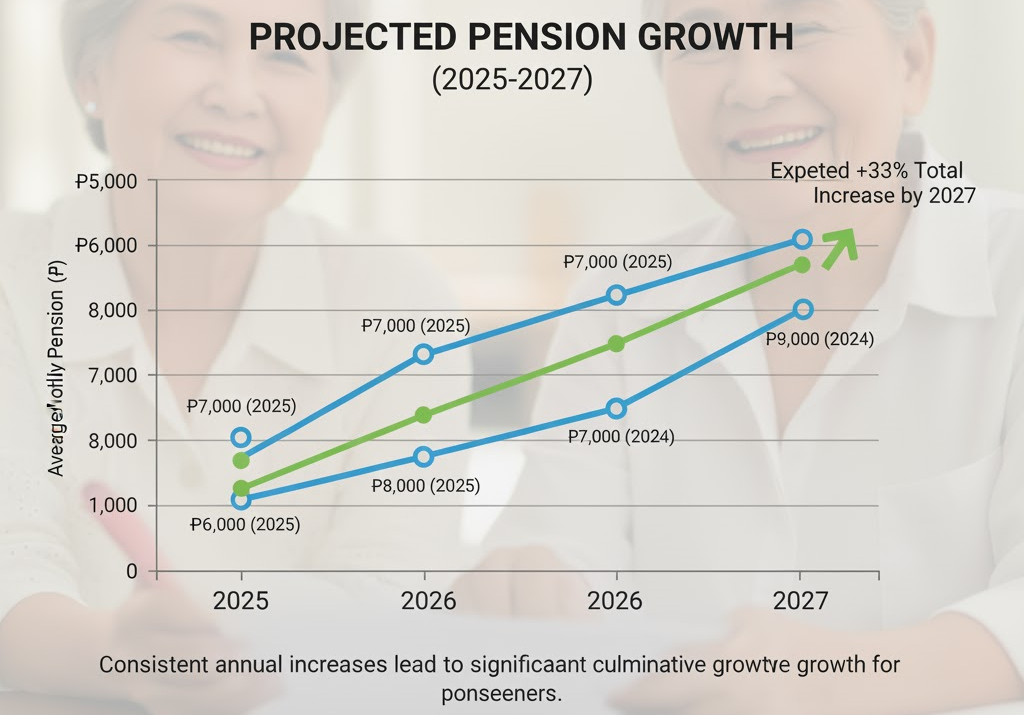

The ₱1,000 increase in 2025 is only the first part of a larger pension reform plan. Starting in September 2025, additional increases will be introduced on an annual basis. These increases will vary depending on the type of pension received:

- Retirement and Disability Pensioners: A 10% increase will be applied to these pensions starting September 2025.

- Death and Survivor Pensioners: A smaller 5% increase will be introduced for these pensioners during the same period.

This structured increase will continue over the next few years, ensuring that pensioners receive more significant financial support as time progresses. By 2027, the total increase for retirement and disability pensioners will reach 33%, while death and survivor pensioners will see a cumulative 16% increase.

Long-Term Impact on the Philippine Economy

The introduction of this pension reform program is expected to have a significant impact on the Philippine economy. According to estimates from the SSS, the adjustments will inject an estimated ₱92.8 billion into the economy over the next three years. This economic boost will benefit not only pensioners but also their families and the businesses they interact with.

Additionally, as the population of elderly Filipinos grows, it is essential to ensure their financial security. This increase will help mitigate the impact of inflation on fixed-income groups, which is crucial for maintaining the quality of life for pensioners. Experts argue that these pension reforms are timely, as the aging population puts increased pressure on social welfare systems worldwide.

Furthermore, the SSS assures the public that the pension fund remains financially sustainable despite these increases. Actuarial studies have shown that the fund will continue to be able to cover the increased benefits without jeopardizing the long-term health of the program.

No Increase in Contributions Required

Unlike past adjustments, this pension increase will not require an increase in member contributions. This means that the burden of funding these increases will not fall on active workers, ensuring that the system remains equitable for both pensioners and contributors. This decision was made after careful consideration of the economic impact and long-term viability of the SSS fund.

Many pensioners had expressed concern about the possibility of higher contributions, as seen in previous reforms. However, the government has reassured the public that the adjustments will be funded through existing resources, ensuring that workers and employers are not overburdened with additional payments.

Comparing the ₱1,000 Increase with Past Pension Reforms

Historically, the Philippines has experienced several pension reforms aimed at addressing the financial needs of its aging population. The most notable of these was the ₱1,000 increase in 2017, which aimed to provide immediate relief to pensioners struggling with rising living costs. However, that increase did not come with structured annual adjustments and was seen as a temporary fix.

In contrast, the current ₱1,000 increase is part of a more sustainable long-term strategy, with annual increases planned through 2027. The current reform addresses the growing demands of an aging population and seeks to ensure the future solvency of the SSS fund.

While the previous increase was appreciated by many pensioners, some criticized it for not being enough to keep up with inflation and the rising costs of healthcare and other essential services. The new reform plan, which includes both the ₱1,000 increase and subsequent annual adjustments, is expected to be more effective in mitigating the challenges faced by pensioners in the long term.

The Role of SSS in Supporting Senior Citizens

The SSS plays a critical role in providing social security to Filipino workers and retirees, offering retirement, disability, and survivor pensions to millions of Filipinos. As the country’s population continues to age, the SSS’s role in ensuring the financial security of senior citizens becomes even more important.

According to SSS President and CEO Michael Regino, the ₱1,000 increase is a response to the growing needs of the elderly population, who face challenges such as high healthcare costs and limited income. “This increase is part of our commitment to ensuring that Filipino retirees can live with dignity and security,” Regino said in a statement.

In addition to pensions, SSS also provides other forms of social protection, such as healthcare benefits for retired members. These services are crucial for helping retirees maintain their health and well-being during their later years.

Global Context: Pension Reforms in Other Countries

The Philippines is not alone in grappling with the challenges of an aging population. Many countries around the world are implementing pension reforms to ensure that their elderly citizens are adequately supported.

For example, Japan has introduced various pension reforms to address the needs of its rapidly aging population. Similarly, many European countries, such as Germany and the United Kingdom, have made adjustments to their pension systems to ensure sustainability and adequacy for retirees.

These global trends highlight the importance of pension reform, not just in the Philippines but across the world. As populations age and life expectancy increases, governments must adapt their social security systems to provide adequate support for retirees.

FAQ

Q: How will the ₱1,000 pension increase be distributed?

A: The ₱1,000 increase will be credited automatically through the pensioner’s existing payment channels, such as bank accounts or remittance centers.

Q: Will the pension increase affect all senior citizens?

A: No, the increase applies only to eligible retirement, disability, and survivor pensioners who meet the necessary contribution requirements.

Q: What are the planned future increases in pension amounts?

A: Starting in September 2025, pensioners will receive an annual increase, with 10% for retirement and disability pensioners and 5% for death and survivor pensioners.