Millions of Americans who rely on Social Security payments to cover essential living costs are facing unexpected delays this week. The Social Security Administration (SSA) confirmed that a combination of calendar disruptions, bank processing slowdowns, and administrative backlogs has pushed several scheduled deposits to later dates. Officials emphasize that all payments will be completed, but warn that processing may take up to 72 hours.

Table of Contents

Social Security Payments Delayed

| Key Fact | Detail |

|---|---|

| Number of recipients affected | Estimated 2.3 million beneficiaries experiencing delays |

| Primary cause | Calendar shift, banking errors, and processing backlog |

| Expected resolution timeline | Most payments expected within 3 business days |

| Official Website | SSA |

Why Social Security Payments Are Delayed

Social Security payments, which are typically issued on a precise schedule each month, were delayed for millions of retirees, disabled Americans, and survivors this week. The Social Security Administration (SSA) confirmed on Friday that “technical processing issues combined with calendar shifts” caused the interruption.

“This is not a systemwide failure, but a limited delay affecting specific payment batches,” said Jeff Nesbit, an SSA spokesperson. “We expect most of the delayed deposits to clear in the next 72 hours.”

The delay coincided with a federal holiday and weekend overlap that pushed scheduled deposits into the next business week. SSA officials say the majority of payments are already in processing and will appear in recipients’ accounts shortly.

Calendar Quirks and Bank Processing Slowdowns

Payment Dates Affected

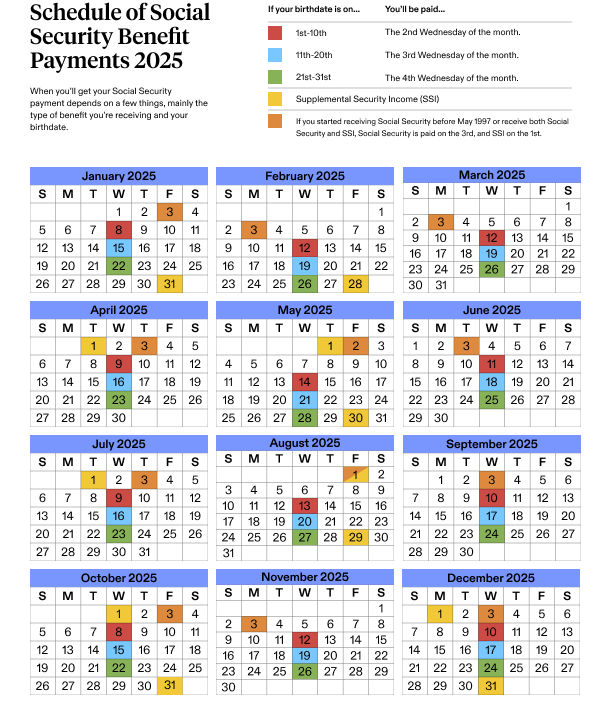

SSA distributes payments based on recipients’ birth dates:

- Birth dates 1–10: second Wednesday of the month.

- Birth dates 11–20: third Wednesday of the month.

- Birth dates 21–31: fourth Wednesday of the month.

This month, one of those payment dates landed on a federal holiday weekend, forcing a delay in bank processing schedules. Even though the SSA initiated payments on time, many financial institutions processed deposits later than expected.

Timeline of Key Events Leading to the Delay

- October 15, 2025: SSA initiated the first wave of direct deposits as scheduled.

- October 17, 2025: A federal holiday and weekend began, halting bank processing.

- October 20–21, 2025: Payments started appearing in some accounts, but others remained pending.

- October 23, 2025: SSA confirmed a backlog affecting around 2.3 million recipients.

- October 24, 2025: Treasury and SSA issued a joint statement confirming resolution within 72 hours.

Administrative Backlogs Add Pressure

The SSA also cited increased processing times linked to banking information changes, address updates, and a seasonal surge in new claims. Robert Peterson, a retired SSA field officer, said the backlog is “not uncommon but more visible this year because of higher claim volumes.”

According to the agency, more than 71 million Americans currently receive Social Security benefits. Even a delay affecting 3 percent of payments translates to more than 2 million households.

Financial institutions also play a role. When direct deposit information changes or accounts are closed, payments are automatically held for manual verification. This step, while protective against fraud, slows distribution.

Historical Context: A Recurring Challenge

This is not the first time Social Security payments have been delayed. According to SSA records, similar disruptions occurred in 2018, 2020, and 2022, often linked to holiday processing or temporary system slowdowns.

Historically, these delays have been short-lived, lasting between one and three business days. The agency’s data shows no permanent loss of payments in such cases. However, for millions of recipients living paycheck to paycheck, even a short delay can create cascading financial challenges.

Real-World Impact: Voices from the Ground

For many recipients, Social Security is their primary or only source of income.

“I’ve been on Social Security for 12 years and rely on that money to pay rent and medication,” said Mary H., a 74-year-old retiree from Ohio. “Even a two-day delay makes a difference because everything is timed around that deposit.”

A similar sentiment came from David R., a disabled veteran in Texas, who said the delay forced him to postpone a utility payment. “I know it’ll come, but it’s stressful,” he said. “It’s not just numbers — it’s our lives.”

Advocacy groups argue that while the payments will eventually arrive, the lack of clear early communication adds unnecessary anxiety for vulnerable groups.

Broader Economic Context

Experts say disruptions like this, while temporary, can have lasting ripple effects. Dr. Anya Sharma, a senior fellow at the Brookings Institution, said: “For many retirees, Social Security isn’t supplemental income — it’s their only income. Even a short delay can create hardship for those living on fixed budgets.”

The U.S. Treasury Department, which handles the actual disbursement, reported no security breaches or cyber incidents tied to the delay. Treasury officials emphasized that the issue is “administrative and calendar-related.”

The SSA noted that a rise in direct deposit enrollments has reduced mailing issues, but it also places more pressure on automated banking systems. Minor disruptions can quickly multiply when millions of transactions are processed simultaneously.

Digital Security and Fraud Prevention

SSA officials also confirmed that no fraudulent activities have been detected in connection with the delay. However, they urged beneficiaries to remain vigilant against phishing and scam attempts that often spike during such disruptions.

“Scammers exploit uncertainty,” said Nesbit. “We will never call, text, or email asking for personal or banking information. If someone does, it’s a scam.”

The agency encourages recipients to report suspicious contacts through its official fraud reporting channels and to check their payment status only through my Social Security.

What Beneficiaries Can Do

Immediate Steps for Recipients

The SSA advises recipients to:

- Check their bank accounts for pending deposits.

- Wait three business days after their scheduled payment date before filing a missing payment report.

- Confirm their personal and banking information on my Social Security.

- Avoid sharing sensitive information with unofficial sources.

- Sign up for email or text alerts from SSA to receive official updates.

If payment still hasn’t arrived after three business days, beneficiaries can contact SSA at 1-800-772-1213.

Policy and Legislative Response

The payment delays have renewed calls from lawmakers and advocacy organizations for a modernization of SSA’s payment infrastructure. A bipartisan group of senators has proposed legislation to upgrade outdated payment systems, expand real-time communication tools, and build safeguards against future delays.

“The Social Security system is one of the most critical lifelines for millions of Americans,” said Senator Laura Morales (D-CA). “We need 21st-century technology to match its importance.”

The SSA has already begun pilot programs to automate more verification processes and strengthen its coordination with financial institutions.

How the U.S. Compares Globally

Delays in benefit payments are not unique to the United States. Countries like Canada, the United Kingdom, and Germany also experience occasional disruptions due to calendar or system issues. However, many have adopted real-time payment verification systems, which reduce delays to a matter of hours rather than days.

Experts say adopting similar technology in the U.S. could reduce the impact of future delays and improve transparency.

Looking Ahead: Preventing Future Delays

The SSA says it is updating its payment infrastructure to better anticipate holiday and weekend overlaps and to improve coordination with financial institutions. “We recognize how critical these payments are,” Nesbit said. “We’re committed to ensuring this doesn’t happen again.”

Advocacy groups such as the National Committee to Preserve Social Security and Medicare are urging the agency to offer clearer communication to recipients ahead of schedule disruptions. They also recommend the agency invest more in predictive modeling to forecast potential delays.

Millions of Californians Could Lose CalFresh Benefits as Major Rule Changes Loom: Check Details

$5108 Stimulus Payment for Seniors: Full Schedule and Details for October 2025

FAQ About Social Security Payments Delayed

Why didn’t I get my Social Security payment today?

Your payment may be delayed due to a calendar shift, a bank processing issue, or an SSA administrative backlog. Most delays are expected to clear within 72 hours.

Will I lose my payment?

No. The SSA has confirmed that all scheduled payments will be delivered. There is no loss of benefits.

Should I call SSA immediately?

Only after three business days without a deposit. Most issues resolve automatically.

Can I track my payment?

Yes. You can log in to your my Social Security account to check the status of your payment.

Is this kind of delay common?

It happens occasionally, especially around federal holidays or during system maintenance periods, but it usually resolves quickly.