Social Security Boost in 2026: If you’re one of the millions of Americans counting on Social Security, Supplemental Security Income (SSI), or Social Security Disability Insurance (SSDI), listen up — a boost is coming your way in 2026! The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment (COLA) effective January 2026 for most beneficiaries. This article breaks down what this means for you in plain English and offers expert advice, helping you understand how these changes can affect your monthly benefits. Whether you’re putting together your retirement budget or just curious about federal benefit hikes, this guide has got your back.

Table of Contents

Social Security Boost in 2026

The 2026 2.8% Social Security COLA increase means more money in pockets for millions who rely on Social Security and SSI for financial security. Though not a windfall, it helps offset inflation’s bite, especially with rising costs for essentials. By understanding how COLA works, earnings limits, and the program’s long-term finances, beneficiaries can better plan their financial futures in an increasingly complex economic landscape.

| Topic | 2025 Amount | 2026 Amount | Notes |

|---|---|---|---|

| Social Security COLA Increase | N/A | 2.8% increase | Applies to monthly Social Security and SSI benefits |

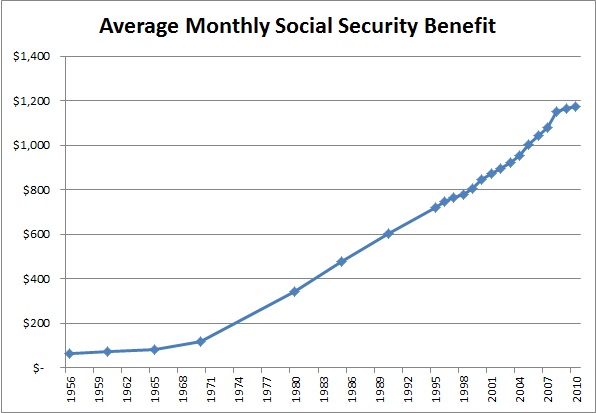

| Average Monthly Retiree Benefit | $2,015 | $2,071 | An average increase of $56 per month |

| Maximum Taxable Earnings | $176,100 | $184,500 | Income subject to Social Security tax increased |

| Earnings Limit (Under Full Retirement Age) | $23,400/yr. | $24,480/yr. | $1 deducted for every $2 earned above this limit |

| Earnings Limit (Year of Full Retirement Age) | $62,160/yr. | $65,160/yr. | $1 deducted for every $3 earned above this limit till retirement |

| SSI Payment (Individual) | $967/month | $994/month | Federal payment standard for Supplemental Security Income |

| SSI Payment (Couple) | $1,450/month | $1,491/month | Federal payment standard for couples receiving SSI |

| Maximum Social Security Benefit | $4,018/month | $4,152/month | For workers retiring at full retirement age |

What Exactly is the Social Security Boost in 2026?

Every year, in an effort to keep up with inflation and rising living costs, the SSA adjusts Social Security benefits through the Cost-Of-Living Adjustment (COLA). The COLA is designed to ensure that benefits maintain their purchasing power as prices rise, measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For 2026, the COLA is set at 2.8%, an increase determined by comparing the average CPI-W from July to September 2025 with the same period in 2024. The SSA calculates this number annually to reflect economic realities and keep Social Security recipients from losing ground as everyday prices climb.

But what does this mean for you? It means your monthly Social Security or SSI check will increase by 2.8% starting January 2026, helping keep pace with the cost of groceries, utilities, gas, and other essentials that tend to get pricier year after year. This COLA adjustment affects around 71 million Social Security beneficiaries, including retired workers, survivors, and disabled adults, along with about 7.5 million people receiving SSI payments due to disability, blindness, or old age.

What Does Social Security Boost in 2026 Mean for You?

While 2.8% might sound like a modest bump, it can significantly help millions of retirees and disabled Americans struggling with rising living costs. The average retired worker receiving Social Security will see their monthly benefit increase from about $2,015 in 2025 to $2,071 in 2026. Although an extra $56 may not cover everything, it can help offset increasing expenses in key areas such as food, gas, and prescription medication.

For SSI recipients, the 2026 increase raises the monthly benefit to $994 for individuals and $1,491 for couples, which can be critical for those relying on these payments as their primary financial support.

It’s important to remember that the COLA increase applies not just to retirement benefits but also to survivors and disabled worker benefits, ensuring a wide range of recipients can maintain a reasonable standard of living despite inflation.

But There’s More To Know: Earnings Limits and Taxes

If you’re still earning income while collecting Social Security before your full retirement age, the SSA imposes earnings limits that could affect your benefit payments.

- For 2026, if you’re under full retirement age, you can earn up to $24,480 annually without any reduction in benefits. If you earn more than this, SSA deducts $1 from your benefits for every $2 over the limit.

- In the calendar year you reach your full retirement age, the earnings limit rises to $65,160 annually, with SSA deducting $1 for every $3 above that threshold until the month you reach full retirement age.

- Once you reach full retirement age, there is no earnings limit, and you can earn any amount without reductions in benefits.

Additionally, the maximum amount of earnings subject to Social Security payroll tax will increase to $184,500 in 2026, up from $176,100 in 2025. This means higher earners will pay Social Security taxes on more income, which helps sustain the program’s finances.

Breaking Down These Numbers With Examples

Imagine you’re a 66-year-old retiree currently receiving $2,000 a month from Social Security. Here’s how the 2.8% COLA will affect your benefits:$2,000×1.028=$2,056\$2,000 \times 1.028 = \$2,056$2,000×1.028=$2,056

That’s an additional $56 each month, or about $672 more annually. Though it might not cover all inflation-related expenses like rent or medical bills, this increase can help reduce the pinch felt by rising everyday costs.

Suppose you’re 62 and work part-time, earning $30,000 in 2026. Your earnings exceed the limit by:$30,000−$24,480=$5,520\$30,000 – \$24,480 = \$5,520$30,000−$24,480=$5,520

For every $2 earned above $24,480, $1 is deducted from your Social Security benefits:5,5202=2,760\frac{5,520}{2} = 2,76025,520=2,760

So $2,760 will be withheld during that year—which is important to factor in when budgeting your income.

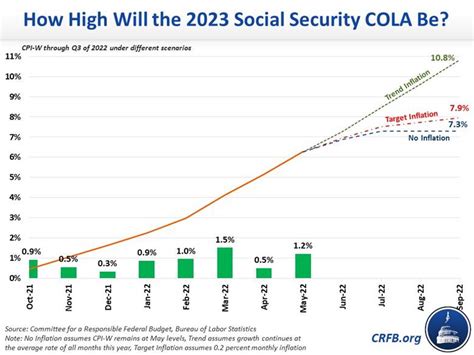

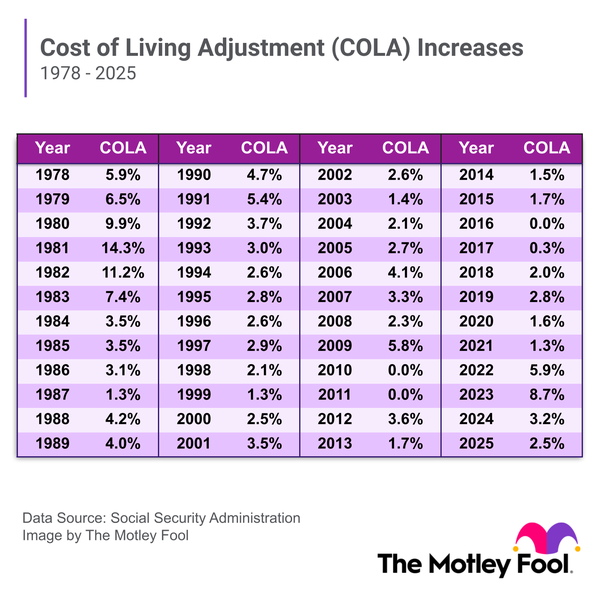

A Brief History of COLAs: Why It Matters

To truly grasp the significance of COLA, it helps to understand its history. Before 1975, Social Security benefits were raised sporadically by Congress. This meant that during times of rising inflation, retirees’ benefits often lagged far behind living costs, eroding their purchasing power.

Inflation in the late 1960s and early 1970s soared, reaching more than 12% annually from 1969 to 1974. To remedy this, Congress passed the 1972 Social Security Amendments, establishing an automatic annual COLA starting in 1975 to help beneficiaries keep pace with inflation.

The very first COLA was 8% in 1975, followed by large jumps such as 14.3% in 1980 and 11.2% in 1981, reflecting the volatile inflation of that era. Over time, COLA averages stabilized around 2% annually, with occasional years of no increase during periods of low inflation like 2010, 2011, and 2016.

The early 2020s saw large COLAs again due to post-pandemic inflation surges: 5.9% in 2022 and a whopping 8.7% in 2023. The 2026 adjustment of 2.8% reflects somewhat cooled inflation but underscores the ongoing challenge of balancing benefit adequacy and program sustainability.

Financial educators emphasize that while COLAs are critical “lifelines” for retirees, these increases are meant to maintain purchasing power, not to significantly grow wealth. The persistent rise of essential costs like food, medicines, and housing means retirees must budget carefully even with COLA boosts.

How to Supplement Your Social Security Income>

Despite the 2026 COLA increase, many beneficiaries find their monthly payments fall short for all expenses. To bridge this gap, consider:

- Part-Time Work: If you’re healthy and able, working part-time can supplement income. Be mindful of earnings limits if before full retirement age.

- Savings and Investments: Consult a financial planner about retirement accounts such as IRAs, 401(k)s, or diversified low-risk portfolios to generate additional income.

- Government Assistance: Investigate programs like Supplemental Nutrition Assistance Program (SNAP), Low-Income Home Energy Assistance Program (LIHEAP), or Medicaid, which can reduce out-of-pocket costs.

- Community Resources: Local charities, senior centers, and nonprofits often provide aid or discounts on essentials for seniors and disabled adults.

What’s on the Horizon? Challenges and Policy Proposals

Social Security faces a financial crunch with its trust fund projected to be depleted in about seven years, leading to automatic benefit reductions if no action is taken. Proposed fixes include:

- COLA Caps: Some suggest limiting COLA increases for higher-income beneficiaries to preserve funds while protecting low-income populations.

- Chained CPI: Using the chained Consumer Price Index, which generally grows slower than CPI-W, to calculate COLA and lower benefit growth.

- Tax and Benefit Adjustments: Raising payroll taxes or tweaking benefit formulas to balance solvency and fairness.

Staying informed of these changes will allow recipients to adjust financial plans proactively.

Watch Out: Common Myths About Social Security COLA

- Myth #1: COLA completely offsets my cost increases. In reality, COLA targets general inflation but doesn’t always cover specific rising costs like medical care and housing, which can outpace inflation.

- Myth #2: If I work, I’ll lose all my benefits. Actually, many can earn below limits without benefit reduction, and partial deductions only apply above limits until full retirement age.

- Myth #3: Maximum Social Security benefits are the norm. Only workers with high lifetime earnings retiring at full age get the maximum benefit; most receive less.

$1,976 Social Security Payment Timeline for 62+ Recipients; Check Official Payout Dates

$14 Billion Restored: 3.1 Million Retirees Get Full Social Security Benefits Back

Social Security 2026 COLA Update Pushed Back Due to US Shutdown – What You Should Know

What Retirees Should Do Now?

- Plan Your Budget: Adjust for the anticipated benefit increase in January 2026.

- Check Your Earnings: Understand how income limits for working beneficiaries affect your benefits.

- Stay Informed: Watch for your COLA notice in November 2025 and review your Social Security statement via your my Social Security account.

- Avoid Scams: Be aware that SSA will never ask for payment or sensitive data unsolicited.

- Review Medicare: Stay updated on Medicare premium changes through Medicare.gov.