Social Security beneficiaries are eagerly awaiting the 2026 Cost-of-Living Adjustment (COLA) announcement, which is expected to bring a 2.7% increase in benefits. This adjustment is crucial for retirees, disabled individuals, and survivors who rely on Social Security payments to keep up with inflation. The official COLA figure will be confirmed by the U.S. Social Security Administration (SSA) on October 24, 2025.

Table of Contents

Social Security 2026 COLA

| Key Fact | Detail |

|---|---|

| COLA Estimate for 2026 | 2.7% increase in benefits |

| Projected Benefit Increase | Average $54 per month for retired workers |

| Medicare Premium Increase for 2026 | 11.6% rise in Part B premiums |

The 2.7% COLA increase for 2026 offers much-needed relief for Social Security beneficiaries but may not fully offset the rising costs of healthcare and housing. While the COLA adjustment helps keep benefits aligned with inflation, experts argue that reforming the system to better reflect seniors’ unique financial challenges is critical. As inflation continues to impact the cost of living, Social Security recipients should remain informed and prepared for future adjustments.

The 2026 Social Security COLA Increase: What Beneficiaries Can Expect

Projected COLA Increase for 2026

The Social Security Administration (SSA) is expected to announce a 2.7% Cost-of-Living Adjustment (COLA) for 2026. This increase is aimed at helping beneficiaries, especially retirees and those with disabilities, keep up with inflation. For the average retired worker, the adjustment would raise monthly benefits by approximately $54, from $2,008 to $2,062.

The Influence of Inflation on COLA Adjustments

Social Security COLA adjustments are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the price changes of common goods and services. The increase in COLA directly reflects inflation, and higher costs in everyday living expenses can push this adjustment higher.

In 2026, inflation continues to be a primary concern. Although recent years have seen fluctuating inflation rates, the expected 2.7% increase is a sign that inflation pressures remain, albeit at a lower level compared to the double-digit increases observed in 2022.

“The COLA increase is necessary to ensure Social Security recipients can maintain their purchasing power,” said Dr. Henry Huber, an economist at the National Academy of Social Insurance. “However, it may not fully keep up with the steepest increases in essential sectors like healthcare and housing.”

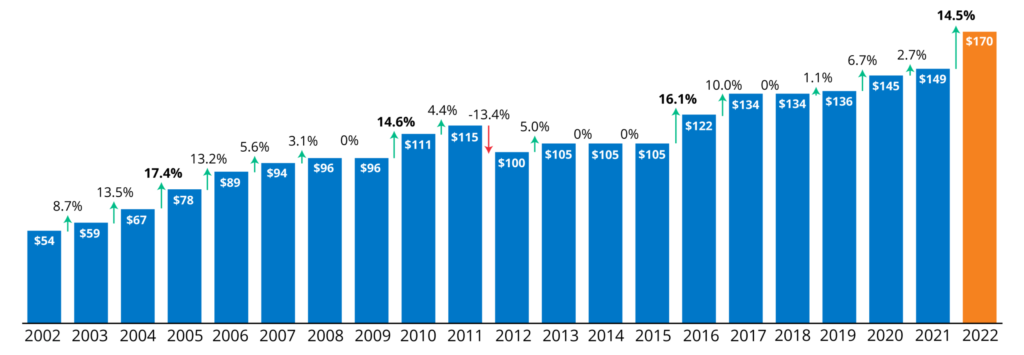

Historical Context: Evolution of COLA Adjustments

The Social Security COLA system was implemented in 1975 to protect beneficiaries from inflation. Before that, Social Security benefits remained fixed, regardless of economic changes. The system has adjusted over the years in response to economic conditions, with increases varying greatly. Some years saw drastic hikes, particularly in the 1980s, while in recent decades, COLA increases have been more modest, typically ranging from 0.3% to 3%.

The 2026 COLA increase of 2.7% is in line with the historical averages seen in recent years, continuing the trend of moderate increases, although the 5.9% increase in 2022 highlighted the impact of the COVID-19 pandemic on inflation.

The Impact of Rising Healthcare Costs on Seniors

One of the most significant concerns for Social Security recipients is the rising cost of healthcare. Medicare Part B premiums, which cover outpatient services like doctor visits, are expected to rise by 11.6% in 2026. This increase in premiums will erode the real value of the COLA adjustment for many beneficiaries.

“For many seniors, the rise in healthcare costs is a more pressing issue than the COLA itself,” said Dr. Anne Carter, a senior policy advisor at AARP. “While the 2.7% COLA will offer some relief, higher medical costs will absorb much of that increase.”

In addition to rising premiums, the cost of prescription drugs, dental care, and long-term care services has been steadily increasing, contributing to the financial strain on seniors. These rising healthcare costs further highlight the need for reform in how COLA is calculated, especially considering the healthcare-specific inflation seniors face.

Policy Debate: Should COLA Adjustments Be More Generous?

There is ongoing debate over whether the current COLA system adequately addresses the specific needs of seniors. Some experts argue that the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the metric used to calculate COLA, does not accurately reflect the spending habits of older adults, particularly in areas such as healthcare and housing.

A proposal to use the Consumer Price Index for the Elderly (CPI-E) instead of the CPI-W has been discussed. The CPI-E better reflects the expenses of seniors, who spend a larger portion of their income on healthcare and housing. Advocates believe that using the CPI-E would lead to more accurate COLA adjustments for Social Security recipients.

“The current COLA formula does not fully capture the inflation that seniors face, especially in healthcare,” said Dr. Michael Roberts, a policy expert at the Brookings Institution. “The CPI-E would be a more appropriate metric and would provide a more accurate increase in benefits for older Americans.”

The Government Shutdown’s Effect on Social Security COLA

The federal government shutdown in late 2025 delayed the release of the inflation data needed to calculate the 2026 COLA. This delay caused uncertainty for many Social Security recipients, who rely on timely announcements to plan their finances. Despite this setback, the SSA has assured that payments will continue as scheduled, and the COLA will be applied retroactively once the data is made available.

“The timing of the COLA announcement is critical for beneficiaries, especially those living on fixed incomes,” said Michael B. Shapiro, spokesperson for the SSA. “While the delay is unfortunate, we are committed to ensuring that beneficiaries receive the adjustments they need on time.”

The Future of Social Security: Long-Term Challenges

The future of the Social Security system faces significant challenges. As the baby boomer generation ages, the number of beneficiaries is increasing, which will put pressure on the Social Security Trust Fund. Experts predict that the Trust Fund may be depleted by the mid-2030s unless Congress takes action to address funding shortfalls.

There are several proposals to address this issue, including raising the payroll tax rate, increasing the income cap on taxable wages, and potentially adjusting COLA formulas. Without reform, beneficiaries may face reduced benefits in the coming decades.

“The Social Security system needs comprehensive reform to ensure it remains solvent and effective for future generations,” said Dr. Henry Huber. “COLA adjustments are just one part of a much larger issue.”

U.S. Expands Visa Waiver Program in October 2025; Find Out If Your Country Made the List!

Social Security 2026 COLA Update Pushed Back Due to US Shutdown – What You Should Know

USA Retirement Age Increase From October 2025 – Check New Retirement Age & Revised Eligibility

FAQs

What is the Social Security COLA?

It’s an annual increase in Social Security benefits to keep up with inflation.

How much is the 2026 COLA expected to be?

The 2026 COLA is projected at 2.7%, adding about $54 to the average monthly benefit.

How does the COLA affect Medicare premiums?

Medicare premiums are expected to rise by 11.6%, which may reduce the COLA’s effectiveness.

Why is the 2026 COLA announcement delayed?

The announcement was delayed due to the 2025 federal government shutdown.

Will the COLA be enough to cover rising costs?

The 2.7% COLA may not fully offset rising costs, especially in healthcare.