Singaporeans eligible for the Singapore $1300 Support Payout 2025 will receive their benefits in several phases throughout the year, with major disbursements scheduled for February, August and December. The payout combines multiple government support programmes—including the GST Voucher, the Assurance Package and the Seniors’ Bonus—aimed at cushioning households from inflation and the impact of the recent Goods and Services Tax (GST) increase.

Table of Contents

Singapore $1300 Support Payout 2025

| Key Fact | Detail |

|---|---|

| Total Potential Payout | Up to S$1,300 (depending on eligibility) |

| Main Disbursement Months | February, August, December 2025 |

| Key Programmes | GST Voucher 2025, Assurance Package 2025, Seniors’ Bonus 2025 |

| Eligibility | Based on income, property ownership, age |

| Official Website | Ministry of Finance |

What the Singapore $1300 Support Payout 2025 Covers

The Singapore $1300 Support Payout 2025 is a composite payout rather than a single cash transfer. It includes the GST Voucher (GSTV), the Assurance Package (AP), and the Seniors’ Bonus—all targeted at lower- and middle-income citizens.

The Ministry of Finance (MOF) said the programme aims to “maintain fairness and fiscal responsibility while ensuring those who need support most receive it first.” The package reflects Singapore’s targeted welfare model, which prioritises efficient distribution over universal subsidies.

“We are ensuring that every Singaporean receives meaningful support amid cost-of-living pressures,” said Deputy Prime Minister and Minister for Finance Lawrence Wong in an official statement. “This is part of our commitment to an inclusive society.”

Payment Timeline — When Singaporeans Will Receive Their 2025 Payouts

February 2025 — Seniors’ Bonus

The payout season starts in February with the Seniors’ Bonus, benefiting around 850,000 seniors aged 55 and above. Eligible recipients will receive between S$100 and S$300, depending on income and property ownership.

Criteria include Singapore citizenship, age above 55, and property AV limits. Payments will be credited via PayNow-NRIC or directly to bank accounts.

August 2025 — GST Voucher 2025

The GST Voucher will be distributed in August. This is one of the country’s largest cash disbursement programmes, reaching about 1.5 million Singaporeans. Eligible individuals aged 21 and above can receive up to S$850, depending on income and property ownership.

The GSTV was first introduced in 2012 to offset GST for lower-income households. Its value has increased steadily in response to rising costs.

Registration closes on 20 June 2025 for those not yet on PayNow. According to MOF, 93% of payouts in 2024 were made digitally.

December 2025 — Assurance Package Cash Payout

The final Assurance Package (AP) Cash payout will be made in December 2025. Adults aged 21 and above who meet income and property AV criteria can receive between S$200 and S$800.

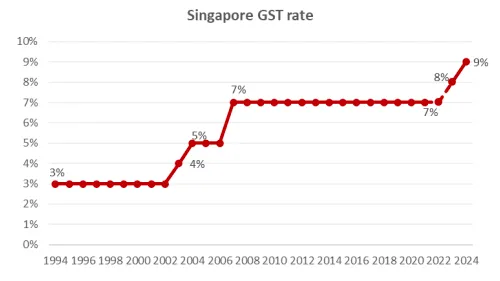

Launched in 2022, the AP is a five-year programme designed to soften the impact of Singapore’s GST hike. Total government spending on the AP is projected to reach S$10 billion over its lifespan.

Historical Context — How Singapore’s Support Schemes Evolved

Singapore’s targeted fiscal support model has deep roots. The GST Voucher scheme was introduced in 2012 to provide direct assistance as GST rose from 5% to 7%. The Assurance Package followed a decade later as part of Budget 2022, preparing households for the 2023–2024 GST hike to 9%.

Between 2020 and 2022, Singapore also rolled out extensive COVID-19 support measures, which paved the way for more digital and automatic payment systems. More than 90% of recipients now receive payouts directly through PayNow, streamlining distribution.

Economist Dr. Tan Wei Ming from the National University of Singapore (NUS) described the evolution as “a clear shift towards automatic stabilisers in fiscal policy. Instead of ad-hoc one-time payments, Singapore is embedding structured, predictable support tied to cost-of-living metrics.”

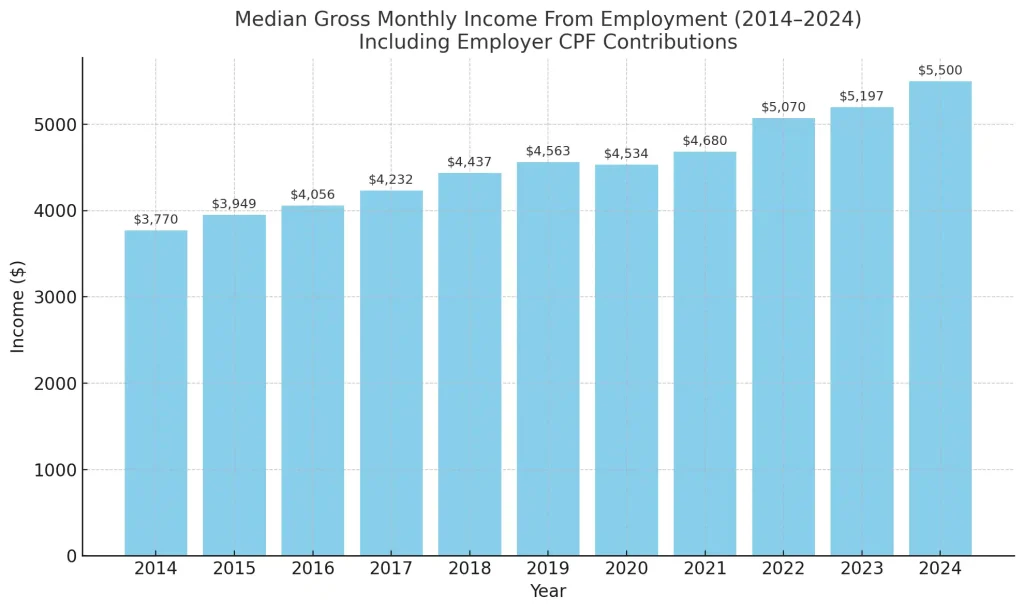

Economic Context — Why the Government Is Offering Support

Singapore’s inflation rate peaked at 6.1% in 2022 before easing to 3.5% in 2024. With the GST hike in 2024, food, transport, and utilities costs continue to pressure households, particularly lower-income groups.

A report by the Monetary Authority of Singapore (MAS) noted that households in the bottom 20% income bracket spend around 30% of their monthly income on essential goods. For these households, the payout represents a significant boost.

“This is not a stimulus package,” said Dr. Tan, “but a targeted cost-offset strategy. It’s about cushioning the impact of inflation without overheating the economy.”

How This Year’s Payout Compares to Previous Years

| Year | Maximum Total Payout | Key Components | GST Rate | Key Notes |

|---|---|---|---|---|

| 2023 | S$850 | GSTV, AP | 8% | Initial implementation of AP |

| 2024 | S$1,000 | GSTV, AP, Seniors’ Bonus | 9% | Expanded seniors support |

| 2025 | S$1,300 | GSTV, AP, Seniors’ Bonus, Silver Support | 9% | Highest total to date |

How Singapore’s Approach Compares Globally

While many advanced economies used broad cash stimulus during the pandemic, Singapore has stuck to its targeted welfare strategy. For example:

- United States: Sent out universal stimulus cheques during COVID-19.

- Australia: Used one-off welfare top-ups.

- Singapore: Focused on means-tested payouts through GSTV and AP.

This approach has allowed Singapore to maintain one of the lowest fiscal deficits in the region. OECD analysts have cited Singapore as an example of “efficient welfare targeting without administrative complexity.”

Eligibility Requirements — Who Qualifies

Broadly, to qualify for one or more components of the Singapore $1300 Support Payout 2025, recipients must:

- Be a Singapore citizen residing locally

- Be aged 21 and above (for adults), or 55+ (Seniors’ Bonus), or 65+ (Silver Support)

- Have an annual assessable income of S$34,000 or less

- Own no more than one property with a capped annual value between S$21,000 and S$31,000

- Be registered with PayNow-NRIC or have a valid bank account.

Those who do not automatically qualify can check their eligibility and register through govbenefits.gov.sg.

Voices from the Ground

Madam Lee Siew Lan, 67, a retired factory worker, said the payout will help with daily necessities. “Prices of everything have gone up. This extra money means I don’t have to worry so much about groceries.”

Mr. Ariffin Abdul, 35, a bus driver, added, “It’s not a huge amount, but it helps to pay for my children’s school expenses. The GST increase is noticeable.”

Experts say such human impact stories underline why targeted payouts remain politically and socially significant in Singapore.

How to Receive and Maximise the Payout

- Check your eligibility early: Use the official SupportGoWhere portal.

- Link your NRIC to PayNow: This ensures the fastest, most secure payout method.

- Register bank account if not on PayNow: Non-registered individuals must sign up by 20 June 2025 for GSTV.

- Beware of scams: The government will never ask for personal details or passwords via calls or SMS.

- Track your payment: Notifications will be sent via Singpass and SMS.

Expert Perspectives on the Policy’s Impact

Economists and social policy experts have welcomed the scale and precision of the 2025 payout. However, some have urged broader structural measures to tackle rising costs.

“Targeted payouts ease the pain but do not address the underlying affordability issues,” said Associate Professor Rachel Ong, a public policy specialist at Singapore Management University (SMU). “More holistic measures on housing and healthcare are needed.”

Others see the policy as a balancing act between short-term relief and long-term fiscal prudence. “Singapore’s fiscal space is limited compared to resource-rich nations,” said Dr. Alvin Ng, senior research fellow at the Institute of Policy Studies. “This approach reflects a careful calibration.”

Future Outlook — What Happens After 2025

The Assurance Package is expected to continue through 2026, though amounts may be revised depending on inflation and budget priorities. MOF has indicated that new measures could be introduced in Budget 2026 to “strengthen the social compact.”

Analysts suggest that future support may become more dynamic, linked to inflation indicators or household expenditure patterns. Some policymakers have hinted at more digital automation in disbursement, further streamlining the process.

“The goal is to ensure that every Singaporean feels supported without jeopardising fiscal sustainability,” said Lawrence Wong.

Singapore 60+ Residents to Get $1080 in October 2025 – Apply Before October 24 to Get Yours!

$1080 Singapore Silver Support Scheme 2025: Check Eligibility & Payment Date

FAQ

Q: Is the S$1,300 payout guaranteed to everyone?

A: No. The figure reflects the maximum combined amount across multiple support schemes for eligible individuals.

Q: Do I need to apply?

A: Most payments are automatic if you have PayNow linked to your NRIC. Others must register online.

Q: What is the deadline to register for GSTV 2025?

A: 20 June 2025.

Q: Will support continue beyond 2025?

A: Yes. The Assurance Package runs through 2026, and future support measures may be introduced in subsequent Budgets.

Q: How can I avoid scams?

A: Always check official websites (gov.sg) and ignore unsolicited messages requesting personal information.