Singapore $1,080 Payment for Senior Citizens: When it comes to taking care of older citizens, Singapore isn’t playing around. The government knows that retirement can be tough—especially for those who didn’t earn big bucks during their working years. That’s why, in October 2025, Singapore is rolling out a $1,080 cash payment for eligible senior citizens under the Silver Support Scheme. This quarterly payout isn’t just another welfare check—it’s a targeted effort to ensure that no elderly Singaporean falls through the cracks. And honestly, it’s something the rest of the world, including the U.S., could learn a thing or two from.

Table of Contents

Singapore $1,080 Payment for Senior Citizens

The Singapore $1,080 payment for seniors in October 2025 represents more than just financial assistance—it’s a reflection of the nation’s values. It rewards hard work, supports independence, and ensures that no senior is left behind. While the U.S. has its own systems like Social Security, Singapore’s Silver Support Scheme showcases how data-driven governance and compassionate policy can work hand in hand. As the global population ages, countries will face similar challenges. But Singapore’s approach offers a roadmap: use data, act early, and focus on dignity, not dependency.

| Category | Details |

|---|---|

| Program Name | Silver Support Scheme (Singapore Government) |

| Payment Amount | Up to S$1,080 per quarter (≈ USD $800) |

| Next Payment Date | September 30, 2025 (for Oct–Dec 2025 quarter) |

| Eligibility Age | 65 years and above |

| Income Criteria | Lifetime CPF contributions ≤ S$140,000 |

| Housing Criteria | Lives in 1–5-room HDB flat; no private property ownership |

| Household Income Limit | ≤ S$2,300 per person |

| Payment Frequency | Quarterly (4 times a year) |

| Official Source | CPF Silver Support Scheme |

| Comparable U.S. Program | Social Security / SSI |

| Main Objective | To support low-income seniors and reduce financial hardship |

Understanding the Silver Support Scheme

The Silver Support Scheme (SSS) is part of Singapore’s broader retirement safety net. It was introduced in 2016 to provide direct cash supplements to seniors who earned lower wages during their working years and have less savings today.

Unlike many aid programs, the Silver Support Scheme is not based on application. The government automatically assesses eligibility using official data such as CPF savings, housing ownership, and household income. This means there’s no paperwork, no queues, and no red tape—just efficient, data-driven support.

In 2025, the scheme underwent an enhancement that raised the top-tier payment from S$900 to S$1,080 per quarter, reflecting inflation and rising living costs. This makes the program more meaningful in real terms.

Why the Singapore $1,080 Payment for Senior Citizens Matters?

For a senior living on limited income, S$1,080 (roughly USD $800) can go a long way. It can cover essential bills, groceries, or healthcare expenses. It may not sound like much to a young professional, but for a retiree managing on modest CPF withdrawals, that’s a significant quality-of-life difference.

This initiative also signals how Singapore values dignity in aging. Instead of labeling support as “charity,” it’s framed as part of a responsible, fair system—where the nation gives back to those who helped build it.

It’s also a testament to smart policy design. Rather than universal payouts (which can waste taxpayer dollars), Singapore’s model targets those most in need, making every dollar count.

Eligibility Criteria (Explained Simply)

To qualify for the Silver Support payout, seniors must meet all the following requirements:

1. Age and Citizenship

- Must be a Singapore citizen.

- Must be 65 years or older.

2. Lifetime CPF Savings

- Total CPF contributions (Ordinary and Special Accounts combined) by age 55 must not exceed S$140,000.

3. Self-Employed Workers

- If self-employed, the average annual net trade income between ages 45 and 54 must not exceed S$27,600.

4. Housing Type

- The senior (and spouse) must live in a 1–5-room HDB flat.

- They must not own private property or multiple homes.

5. Household Income

- Household monthly income per person must be S$2,300 or less.

If you’re reading from the U.S., think of this as the Singapore equivalent of Supplemental Security Income (SSI)—but smarter, faster, and far more data-driven.

Payment Schedule for 2025

The Silver Support payout happens four times a year, once every quarter. Here’s the 2025 calendar:

| Quarter | Payment Date | Covers Months |

|---|---|---|

| Q1 | December 31, 2024 | Jan–Mar 2025 |

| Q2 | March 31, 2025 | Apr–Jun 2025 |

| Q3 | June 30, 2025 | Jul–Sep 2025 |

| Q4 | September 30, 2025 | Oct–Dec 2025 |

So, the October 2025 payout will actually hit bank accounts by September 30, 2025. It’s timed this way to help seniors prepare for upcoming expenses before the quarter begins.

How Much Each Senior Can Receive?

Not every senior gets the same payout. The government adjusts payments based on the flat type (which signals wealth) and household income.

Here’s a breakdown of quarterly payment tiers:

| Flat Type | Monthly Household Income ≤ S$1,500 | Monthly Household Income $1,501–$2,300 |

|---|---|---|

| 1–2 room | S$1,080 | S$540 |

| 3-room | S$860 | S$430 |

| 4-room | S$650 | S$325 |

| 5-room | S$430 | S$215 |

Seniors receiving ComCare Long-Term Assistance get a flat S$430 each quarter.

This scaling system keeps things fair—those in smaller flats with tighter budgets receive the most help.

The Bigger Context: Singapore’s Aging Population

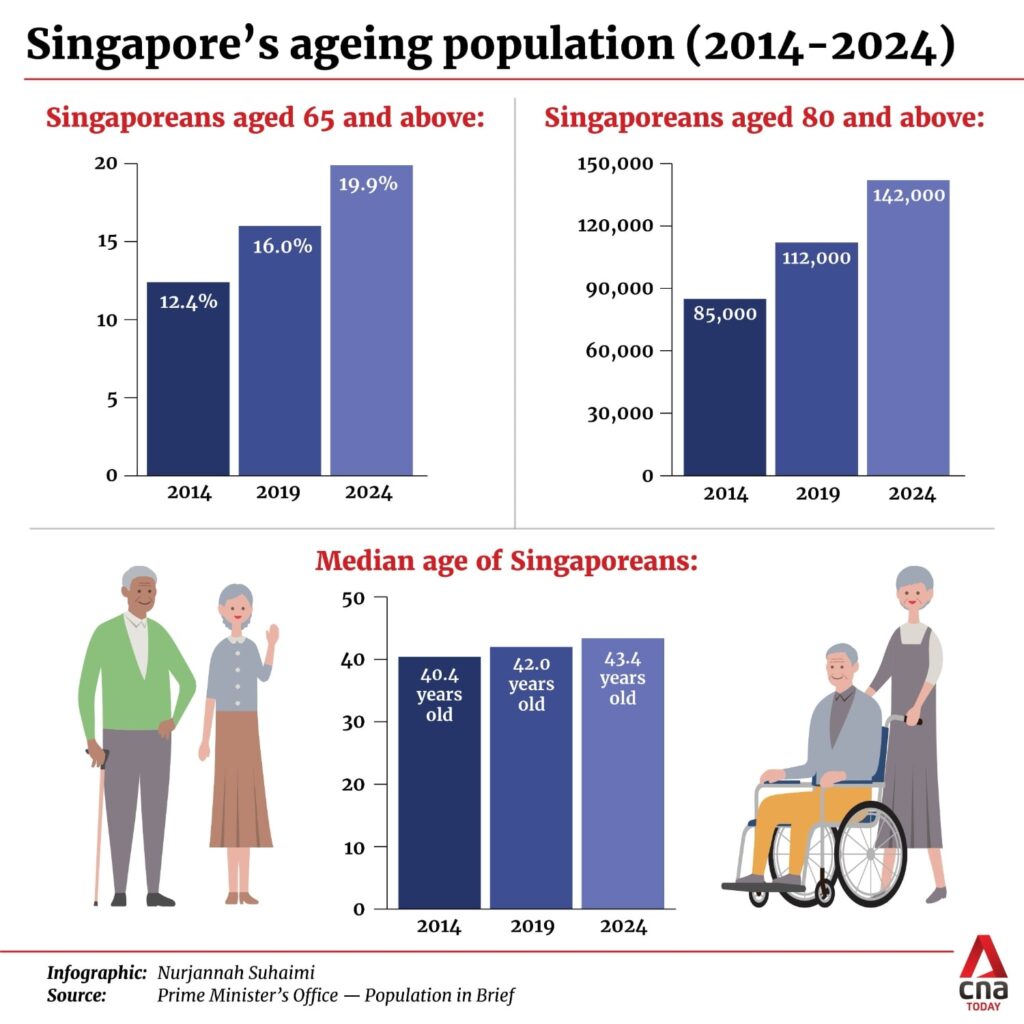

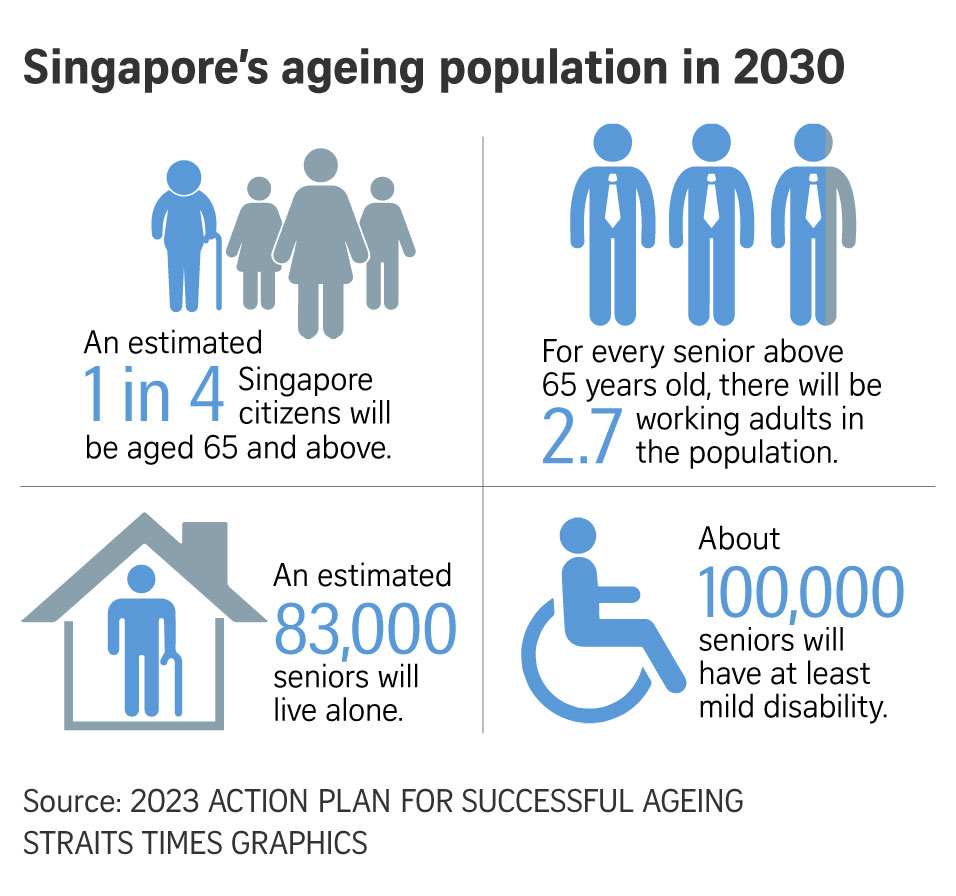

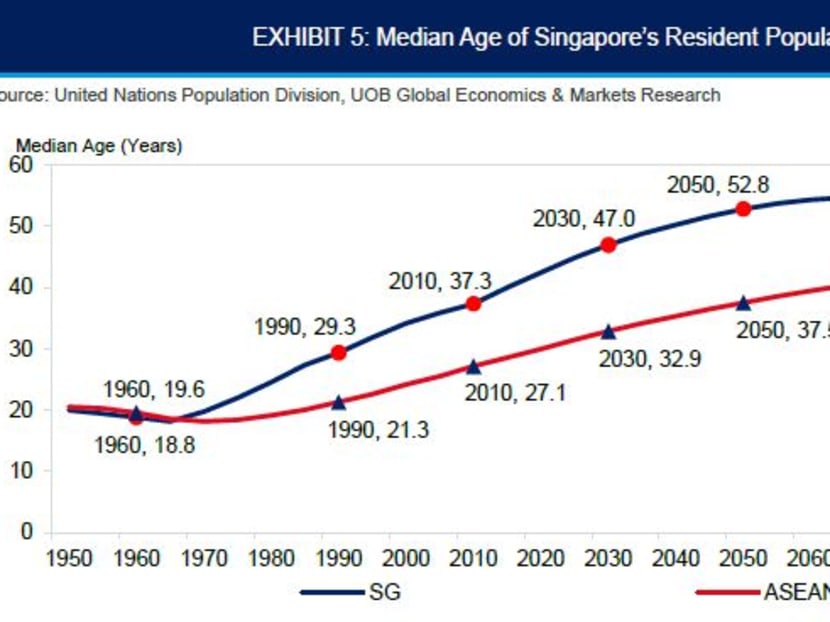

Here’s a reality check: Singapore is one of the fastest-aging countries in Asia. According to the Singapore Department of Statistics, by 2030, about 1 in 4 citizens will be aged 65 or above. That’s a massive shift from the early 2000s when the ratio was only 1 in 11.

This demographic change creates pressure on healthcare, social services, and pension systems. The Silver Support Scheme helps ease that burden, acting as both a financial and emotional safety net.

At the same time, Singapore is promoting active aging—encouraging seniors to stay employed longer, volunteer, and remain socially connected. So, Silver Support isn’t about dependency—it’s about supplementing independence.

How Singapore’s Program Compares to U.S. Social Security

For American readers, the Silver Support Scheme has some striking similarities to Social Security and Supplemental Security Income (SSI) but with a few key differences:

| Feature | Singapore (Silver Support) | U.S. (SSI / Social Security) |

|---|---|---|

| Funding Source | National budget, not payroll tax | Funded by payroll taxes |

| Eligibility Basis | Lifetime income, housing, household means test | Work credits and earnings history |

| Payout Frequency | Quarterly | Monthly |

| Average Amount | ~USD $800/quarter (max) | ~$1,900/month (Social Security) |

| Application Needed | No (automatic) | Yes |

| Objective | Targeted support for low-income seniors | Broad retirement income program |

The takeaway? Singapore’s approach emphasizes targeted fairness—only those who truly need it receive benefits—while the U.S. model ensures broad coverage across all retirees.

Why Automatic Payouts Matter?

One of the most underrated features of the Silver Support Scheme is that eligible seniors don’t need to apply. The system automatically identifies them based on CPF data and housing records.

This eliminates administrative friction and reduces stigma. Many older adults hesitate to “apply” for aid because they feel embarrassed or don’t want to deal with bureaucracy. Automatic inclusion solves that problem beautifully.

It also helps the government avoid fraud, since all data is verified through official records.

Practical Advice for Seniors and Caregivers

If you’re helping a parent or relative in Singapore, here’s what you can do:

- Verify eligibility by checking their CPF savings and housing type.

- Keep contact details updated with the CPF Board to avoid missing notifications.

- Watch for letters or SMS alerts before each quarter’s payout.

- Encourage financial planning—combine Silver Support with other benefits like GST Vouchers, MediSave top-ups, and the Pioneer Generation Package.

- If unsure, call CPF directly or visit www.cpf.gov.sg for personalized guidance.

For context, Singapore’s benefits ecosystem also includes healthcare subsidies (CHAS), MediSave contributions, and other targeted top-ups. Silver Support fits right into this ecosystem as the “cash buffer.”

The Economics Behind the Program

Now, let’s look at the bigger picture. Each quarterly Silver Support payout costs the Singapore government hundreds of millions of dollars. But it’s not just spending—it’s an investment in social cohesion.

When older citizens feel financially secure, they’re less dependent on family, less stressed, and more likely to stay healthy and active. That translates into lower healthcare costs and a happier society.

Economists often call this a “virtuous cycle of social spending.” By giving seniors modest but regular support, the government keeps poverty rates among the elderly low (Singapore’s elderly poverty rate is around 10%, significantly below regional averages).