Senator Reveals Trump’s Secret Plan to Slash Tariffs: Big news is making the rounds in Washington: Senator Bernie Moreno has revealed that Donald Trump is working on a secret plan to slash tariffs for U.S. vehicle production. If this plan moves forward, it could transform the car industry, give automakers some much-needed relief, and maybe—just maybe—bring down the high prices we’re all paying for cars. Here’s the short version: Trump wants to reward companies that build and assemble cars in the United States by cutting the tariffs they pay on imported parts. Translation? If automakers keep their plants and workers here, Uncle Sam will cut them a break on the extra taxes they face when sourcing engines, transmissions, or chips from abroad.

Table of Contents

Senator Reveals Trump’s Secret Plan to Slash Tariffs

Trump’s secret plan to slash tariffs for U.S. vehicle production is more than a campaign slogan—it could reshape the auto industry, create jobs, and influence the price of every car sold in America. While still just a proposal, the stakes are sky-high: automakers see billions in potential savings, workers see more job opportunities, and consumers may finally get some relief at the dealership. But this road comes with bumps: global trade disputes, political opposition, and uncertainty about whether those savings actually reach everyday buyers. One thing’s for sure—the U.S. auto industry is gearing up for big changes.

| Topic | Details |

|---|---|

| Plan | Extend 3.75% tariff credit for U.S.-assembled vehicles up to five years; expand it to include U.S. engine production. |

| Impact | Up to 15% credit of vehicle value to offset imported part costs. |

| Who Benefits | U.S. automakers (GM, Ford, Stellantis), foreign automakers with U.S. plants like Toyota and Honda. |

| Jobs | U.S. auto manufacturing already supports 4.5 million jobs; plan could create thousands more. |

| Market Reaction | Automaker stocks rose after the announcement. |

| Challenge | Not finalized; subject to political pushback and trade disputes. |

| Official Reference | U.S. Department of Commerce |

Why Tariffs Hit Home for Every American?

Tariffs might sound like an abstract policy debate, but here’s why they matter: they directly affect the cost of your next car. When automakers pay extra fees on imported steel, semiconductors, or transmissions, they simply roll those costs into the sticker price. That’s a big reason why the average new vehicle in the U.S. hit $48,000 in 2024.

By slashing tariffs for companies that keep production in the U.S., Trump’s plan aims to:

- Lower costs for domestic automakers.

- Encourage global automakers to build more factories in the U.S.

- Create jobs while potentially easing car prices for everyday buyers.

How Tariffs Work: An Easy Breakdown

Think of tariffs like a toll booth. Here’s how it works:

- Ford builds a pickup truck in Michigan.

- The transmission is imported from Mexico.

- The U.S. government charges Ford a tariff (a tax) on that imported part.

- Ford passes the extra cost onto you, the customer.

- Under Trump’s plan, Ford could cancel out that tax with a tariff credit for building the truck in the U.S.

It’s not complicated—but the ripple effects are massive.

What Exactly Is in Trump’s Secret Plan to Slash Tariffs?

Extending the 3.75% Credit

Automakers currently get a 3.75% tariff offset if they build vehicles in the U.S. Trump wants to extend that benefit for five years.

Expanding to Engines

Engines are the heart of a car and often imported. The proposal adds relief for U.S.-based engine production, giving automakers more reason to keep high-value manufacturing stateside.

Offering Up to 15% in Relief

One version of the plan proposes a tariff credit worth 15% of a vehicle’s value. For a $40,000 SUV, that’s as much as $6,000 in tariff savings for the manufacturer.

Ending Double Taxation

Currently, cars can get hit with overlapping tariffs under different trade laws. The plan seeks to streamline this so U.S.-assembled cars don’t get taxed twice.

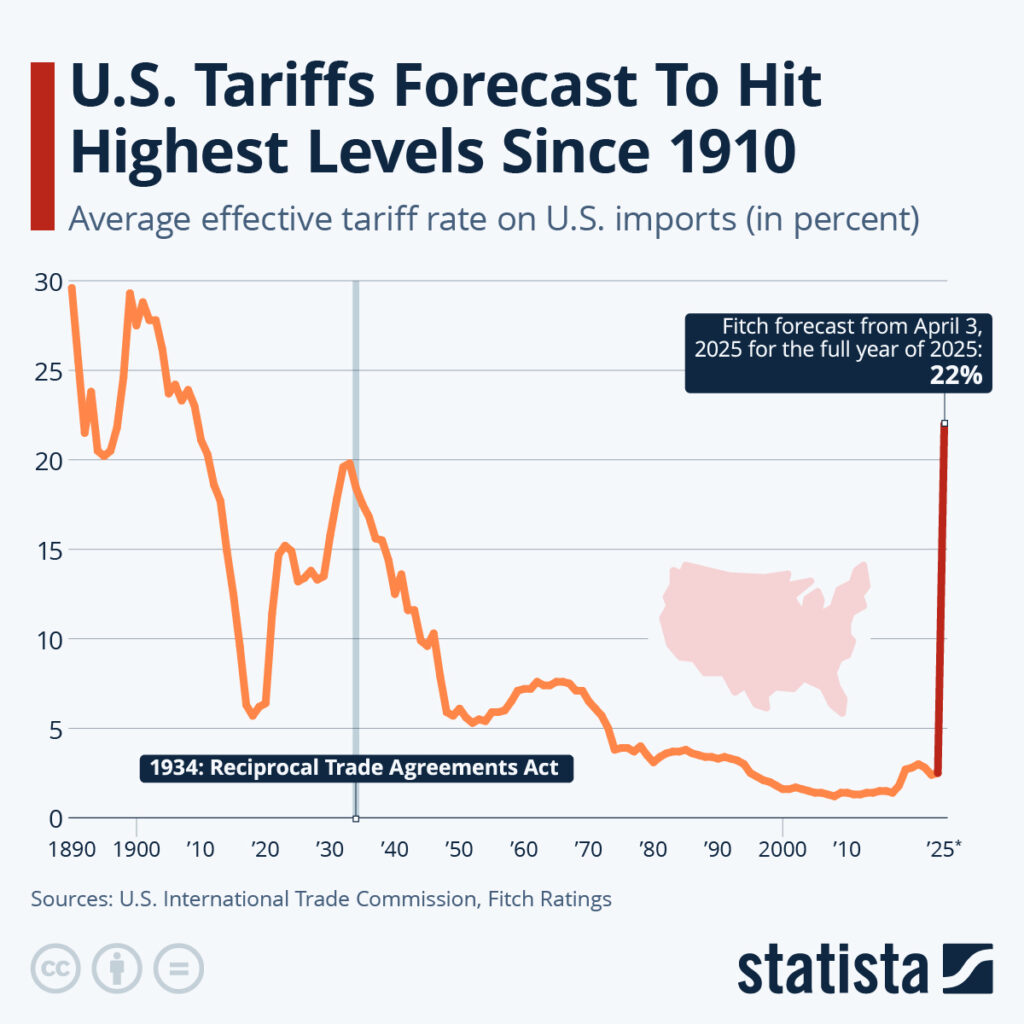

Historical Context: America’s Love-Hate with Tariffs

This isn’t new territory. Tariffs have shaped the U.S. auto industry for decades.

- In 1964, the U.S. imposed the “Chicken Tax,” a 25% tariff on imported trucks. That’s why most foreign automakers build trucks and vans in the U.S. instead of shipping them in.

- During Trump’s first term, steel and aluminum tariffs were imposed in the name of national security, sparking mixed reviews from economists.

History shows tariffs can make or break entire industries.

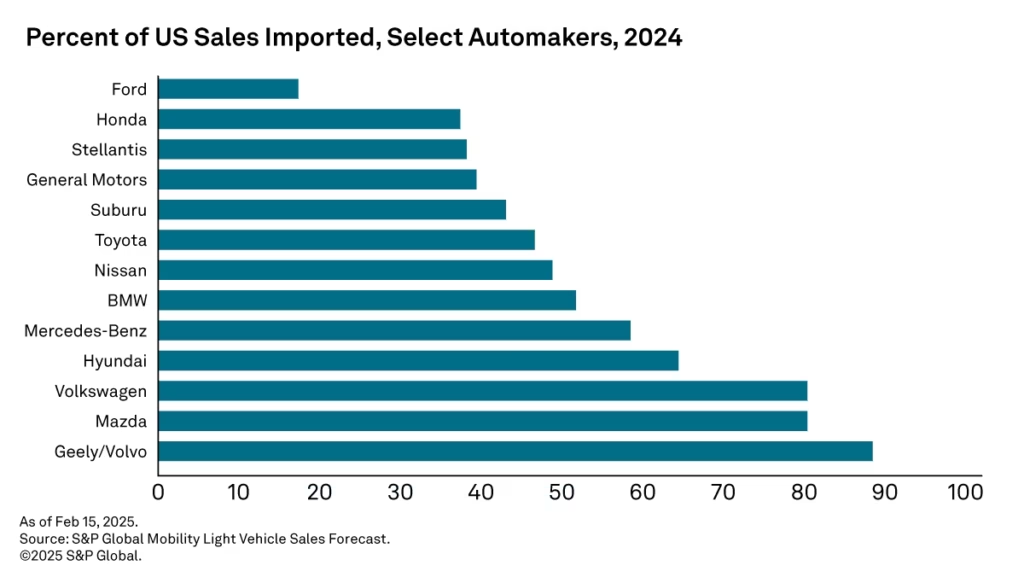

Winners and Losers

Winners

- Ford, GM, Stellantis: Already invested heavily in U.S. plants.

- Toyota, Honda, Hyundai: Build cars in southern states—these factories would benefit.

- U.S. Workers: More demand for assembly lines and engine production could create jobs.

Losers

- Luxury imports (BMW, Mercedes, Audi): Still dependent on foreign supply chains.

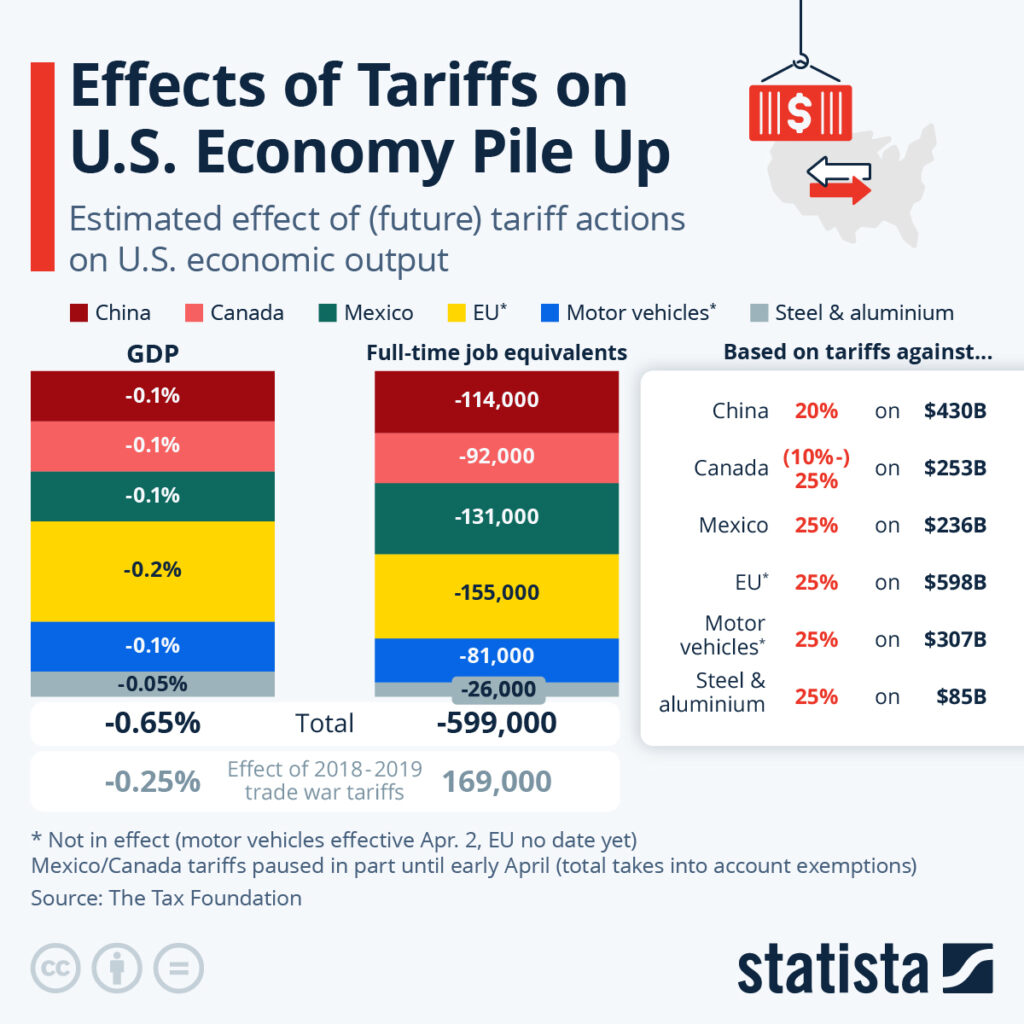

- Foreign governments: Canada, Mexico, and the EU may see less favorable terms.

- Small importers: Niche automakers relying on foreign parts may feel squeezed.

Expert Opinions On Senator Reveals Trump’s Secret Plan to Slash Tariffs

- Howard Lutnick, Cantor Fitzgerald CEO, said Trump’s move is clearly aimed at “reshoring production.”

- Brookings Institution economists suggest the plan could help consumers, but warn it could spark retaliation from U.S. trade partners.

- Auto unions like the UAW are cautiously optimistic: more jobs are likely, but they want guarantees workers—not just corporations—see the benefits.

Case Study: Ford F-150

The Ford F-150 isn’t just a truck—it’s an American icon. Built in Michigan and Missouri, it uses imported parts like semiconductors from Asia. Under Trump’s plan:

- Ford could save thousands per vehicle on tariffs.

- Some savings may be passed to consumers in lower prices.

- Production could expand in the U.S., boosting jobs in assembly plants.

Multiply that effect across millions of vehicles, and the economic impact becomes obvious.

International Comparisons

- China: Protects its domestic carmakers with tariffs up to 25% on imports.

- EU: Applies about 10% tariffs but offers green incentives for EVs.

- Mexico and Canada: As U.S. trade partners, they may face revised conditions under this proposal.

If America adopts a new tariff structure, it won’t be operating in isolation—global trade responses will follow.

Consumer Perspective: What This Means for You

- Lower Prices? U.S.-built models like Chevy, Ford, and Toyota sedans may get cheaper.

- Higher Prices? Luxury imports may rise if trade partners retaliate.

- Better Choices: Automakers could expand domestic production, leading to more models built in the U.S.

Example: If a Chevy Malibu costs $35,000, tariff credits could lower it by $1,000–$2,000. That’s not pocket change.

Practical Advice

For Professionals in the Auto Industry

- Supply Chains: Begin reshaping strategies to take advantage of tariff credits.

- Policy Monitoring: Stay engaged with trade updates and political negotiations.

- Investments: Expect volatility in automaker stocks—opportunities abound.

For Consumers

- Thinking of Buying? If it’s a U.S.-built vehicle, waiting may save you money.

- Luxury Imports: Buy sooner rather than later—prices may rise.

- Check Origins: Use the Monroney label (window sticker) to see where your car was built.

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy

The Political Angle

This isn’t just about economics—it’s politics at full throttle. By tying tariff relief to U.S. production, Trump reinforces his “America First” agenda. It’s a direct appeal to voters in the Rust Belt states like Michigan, Ohio, and Pennsylvania, where auto jobs mean everything.

Critics argue the plan risks:

- Favoring big automakers over small companies.

- Alienating trade partners.

- Raising long-term consumer costs if global retaliation escalates.