Planning to Empty Your NS&I Account: Thinking about emptying your NS&I account? Hold up before you make a move. There’s an essential two-word alert every NS&I saver must know to avoid costly mistakes, penalties, or falling victim to scams. This comprehensive, friendly, yet authoritative guide explains what NS&I is, details about products, how to withdraw safely, and how to protect your money — all broken down in simple terms for beginners, while providing detailed insights for savvy investors.

Table of Contents

Planning to Empty Your NS&I Account

Deciding to empty your NS&I account deserves careful consideration. That critical “Act Now” alert is a lifesaver warning you not to panic or act hastily, avoiding scams and penalties. Understand your specific product terms, withdrawal rules, and tax responsibilities before making moves. NS&I remains a trusted, government-backed option with diverse savings products to fit a range of needs. Make informed decisions to safeguard your savings and grow them wisely.

| Topic | Details |

|---|---|

| NS&I Definition | Government-backed UK savings products such as Premium Bonds, Savings Certificates, and Bonds |

| Withdrawal Flexibility | Most accounts allow withdrawal anytime; fixed-term products may have early withdrawal penalties |

| Penalty Warning | Early withdrawal on some fixed-term Savings Certificates reduces interest by 90 days and loses index-linking |

| Minimum Withdrawals | Income Bonds require minimum £500 withdrawals; Premium Bonds and others as low as £1 |

| Scam Alert Action Words | Beware “Act Now” texts which often signal scams for NS&I customers |

| Government Guarantee | NS&I savings fully backed by HM Treasury, unlike banks with FSCS protection up to £85,000 |

| Tax Implications | Interest mostly taxable except tax-free Premium Bonds prizes and ISAs |

| Product Variety | Includes Premium Bonds, tax-free ISAs, fixed bonds with up to 4.04% AER, income bonds with monthly interest |

| Official Resources | All info and secure services available on the NS&I website |

What Is NS&I and Why Does It Matter?

National Savings and Investments (NS&I) is a UK government-backed savings institution with over 160 years of history helping people securely save money. Unlike regular banks or building societies, NS&I has the full financial backing of the government, making it one of the safest places to keep your money.

NS&I offers various products designed for different saver needs, ranging from:

- Premium Bonds: Tax-free prizes with full capital protection and instant accessibility.

- Savings Certificates and Bonds: Fixed-term investments paying guaranteed interest, ideal if you can lock in money for longer.

- Income Bonds: Flexible accounts paying monthly taxable interest, suited for regular income seekers.

- ISAs: Tax-efficient options with relatively competitive interest rates.

This government backing means your money is secure even if banks fail—a unique benefit that’s especially important if you hold large sums over the FSCS protection limit of £85,000.

Why Would Someone Planning to Empty Your NS&I Account?

People withdraw funds from NS&I accounts for many reasons:

- Emergency needs: Access cash for sudden expenses.

- Investment changes: Move money into higher-yield investments or diversify portfolios.

- Large purchases: Home renovations, vehicles, or significant expenditure.

- Retirement: Access savings as part of retirement planning.

- Better rates: Lock in higher interest rates available elsewhere.

However, rushing to withdraw without understanding product-specific rules may come with downsides like losing earned interest, missing bonuses (such as Premium Bond prizes), or triggering penalties. It’s crucial to know your account’s terms.

The Critical Two-Word Alert: ACT NOW

Whenever you receive a text, email, or call that says “Act Now” regarding your NS&I account, take a pause. This phrase is widely used by scammers trying to create a false sense of urgency. Their goal? To pressure you into transferring money quickly, sharing sensitive data, or clicking unsafe links.

How to Spot NS&I Scam Messages:

- Genuine texts start with NSandI and end with NS&I.

- NS&I never sends clickable links requesting login or personal information.

- Suspicious messages often use urgent or threatening language.

- They may ask for bank details or immediate actions without verification.

Tip: Never respond or click on suspicious links—forward scam texts to 7726 and report to NS&I directly.

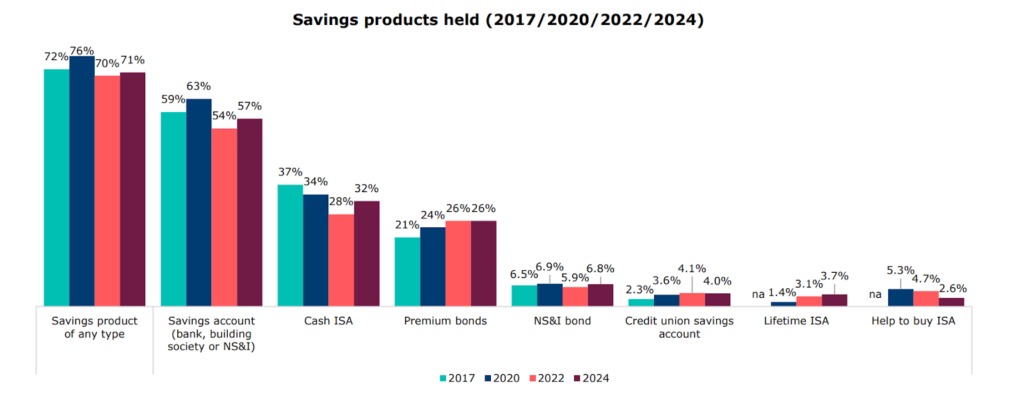

Overview of NS&I Account Types and Their Features

Premium Bonds

- A unique savings product combining security with tax-free prize draws every month.

- Each £1 bond gives you a chance to win prizes ranging from £25 up to £1 million.

- Withdraw anytime without penalty.

- Prize fund rate currently approx. 3.6% variable.

- Suitable for risk-averse savers who like a chance to win tax-free.

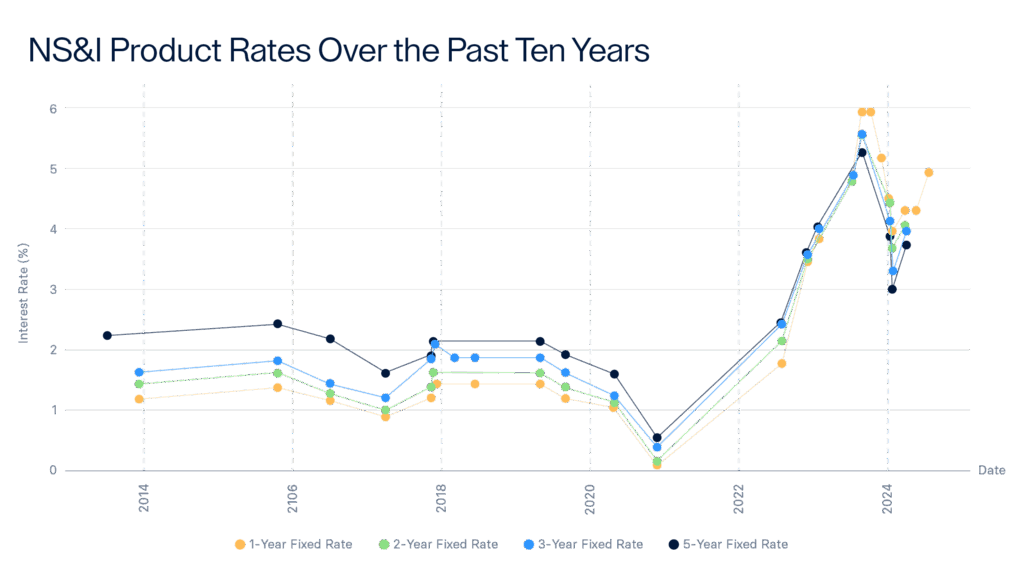

Fixed-Term Savings Certificates and Bonds

- Options for 1, 2, 3, or 5-year fixed investments.

- 1-year bonds recently offer 4.04% AER, with £500 minimum investment.

- Interest rates are generally competitive but lower than some high street offerings.

- Early withdrawals on certificates started before July 23, 2023, incur a 90-day interest deduction; those after cannot be withdrawn early.

- Interest taxable; choose between annual or monthly payments depending on product.

Income Bonds

- Pay interest monthly directly to your bank account, suitable for bringing an income stream.

- Minimum £500 investment.

- Withdraw anytime with no penalties but withdrawals must meet minimum amounts (£500).

- Interest taxable.

ISAs (Individual Savings Accounts)

- Direct ISA offers 3.50% tax-free/AER interest for up to £20,000 annual investment.

- Junior ISA allows parents to save tax-free for children with 3.55% AER.

- ISAs are ideal for tax efficiency and savers wanting to shield interest from tax.

Green Savings Bonds and Investment Account

- Green Savings Bonds support environmental projects with 3-year fixed terms, 2.95% gross/AER rates.

- Investment Account is postal-only, paying lower rates (~1.00% gross/AER).

How to Safely Empty Your NS&I Account?

Step 1: Understand Withdrawal Terms and Penalties

- Check your product’s availability for early withdrawal.

- Fixed-term certificates after July 2023 cannot be cashed early.

- Earlier certificates allow early exit but lose 90 days’ interest and index-linking.

- Premium and Income Bonds are flexible with no penalties.

Step 2: Get or Set-Up Online or Phone Access

- Register online or phone NS&I to get quick access for withdrawals.

- Using official methods reduces risk of fraud and delays.

Step 3: Have Your Documents Ready

- Gather account information, bond numbers, and bank details to avoid delays.

Step 4: Choose Withdrawal Method

- Online or phone requests typically clear in 1–2 business days.

- Postal requests take longer, up to 5 business days or more.

Step 5: Confirm Minimum Withdrawal Limits

- Some products like Income Bonds have minimum withdrawal amounts (£500).

- Others may allow as low as £1 withdrawal.

Step 6: Track Your Withdrawals

- Always verify money has reached your bank before closing or continuing further transactions.

Tax Considerations When Withdrawing

- Interest paid on most NS&I products is subject to income tax (unless in ISAs).

- NS&I does not deduct tax at source; declare and pay tax accordingly.

- Premium Bonds prize money is tax-free.

- ISAs are tax-advantaged; no tax on interest or gains within allowance limits.

- Be mindful of your Personal Savings Allowance (PSA) where earnings above £1,000 (basic rate taxpayers) are taxable.

Comparing NS&I with Other Savings and Investment Options

| Aspect | NS&I Savings | High Street Banks | Stocks & Shares ISAs |

|---|---|---|---|

| Guarantee | 100% backed by HM Treasury | FSCS protection up to £85,000 | No guarantee, market risk |

| Interest Rates | Competitive (1–4.04% AER) | Often lower average | Potentially higher but volatile |

| Access to Funds | Varies: Premium Bonds flexible; bonds fixed | Generally flexible | Flexible but subject to market conditions |

| Tax Treatment | Mostly taxable interest; tax-free Premium Bonds and ISAs | Taxable interest | Tax-free in ISA wrapper |

| Investment Limits | Up to £1m+ per product | Varies, often unlimited | Up to £20,000 per year in ISA |

Why Choose NS&I as Part of Your Savings Strategy?

NS&I’s key strengths lie in its unrivaled safety, backed by the UK government, and diverse range of products suited for cautious savers and those looking for predictable returns or tax benefits. Its products are especially appealing if you’re safeguarding larger sums over typical bank FSCS limits or seeking unique tax-free savings via Premium Bonds and ISAs.

The recent launch of fixed-rate bonds paying 4.04% AER offers competitive returns just above inflation, making NS&I an excellent place to park money you won’t need immediately, with peace of mind.

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

£300 Pension Blow for UK Retirees – HMRC’s October 9 Rule Change Sparks Outrage