Hundreds of thousands of UK pensioners could face a clawback of up to £300 from their Winter Fuel Payment beginning 15 October, as HM Revenue and Customs (HMRC) implements a new income-linked rule. The measure targets pensioners with taxable incomes above £35,000, marking one of the most significant welfare payment reforms in more than a decade.

Table of Contents

HMRC Rule Change

| Key Fact | Detail |

|---|---|

| Threshold | £35,000 annual taxable income |

| Maximum repayment | £300 per person |

| Implementation date | 15 October 2025 |

| Recovery method | Self Assessment or tax code adjustment |

What Is Changing — and Why

The Winter Fuel Payment is a long-standing government benefit paid to older people to help cover rising heating costs during the colder months. The amount, typically between £100 and £300, depends on age and household composition.

From 15 October, pensioners with taxable income exceeding £35,000 will have to repay part or all of this payment through the tax system. The government says this ensures support remains targeted at those most in need, while easing pressure on public finances.

“This reform ensures that scarce public funds are used where they make the biggest difference,” said Chloe Townsend, a Treasury spokesperson. “Lower-income pensioners will continue to receive full support.”

The policy forms part of a wider fiscal package introduced in the 2025 Spring Budget, which aimed to close a £12 billion gap in the UK’s welfare spending over the next five years.

Historical Context: A Benefit Under Pressure

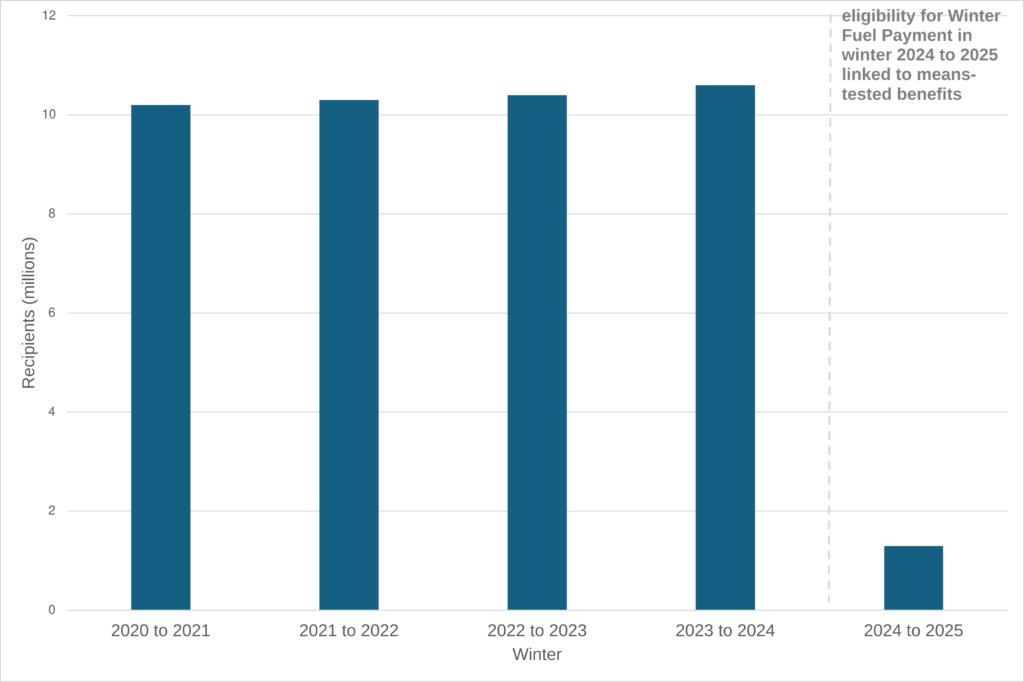

The Winter Fuel Payment was introduced in 1997, when energy costs were more stable and inflation lower. Initially, all pensioners over 60 were eligible. Over time, the cost of the programme soared due to demographic shifts and energy price volatility.

| Year | Recipients (millions) | Total cost (£bn) | Policy milestone |

|---|---|---|---|

| 1997 | 7.2 | 0.8 | Introduction |

| 2008 | 11.9 | 2.3 | Expansion under Labour |

| 2024 | 12.5 | 2.1 | Cost review announced |

Office for Budget Responsibility (OBR) data shows that the scheme now costs the government more than £2.1 billion annually, making it one of the largest winter welfare expenditures in Europe.

Who Will Be Affected

The clawback applies to individuals receiving the Winter Fuel Payment and whose taxable income crosses the £35,000 threshold. That includes income from:

- The State Pension,

- Private pensions,

- Investment returns,

- Savings interest, and

- Certain taxable benefits.

HMRC estimates that 15–20% of recipients fall into this category. For many, the repayment will be gradual:

- Through tax code adjustments beginning in the 2026/27 tax year, or

- Directly through Self Assessment for those already filing tax returns.

Pensioners below the threshold will not be affected.

“It’s a blunt tool, but one that reflects a shift toward means-tested welfare,” said Dr. Anya Sharma, Senior Fellow at the Institute for Fiscal Studies (IFS).

Human Stories Behind the Numbers

For Eileen Parker, 72, from Manchester, the Winter Fuel Payment has helped cover heating costs during harsh winters. But her modest private pension now places her just above the threshold.

“It feels unfair. I worked hard, saved carefully, and now I’ll lose what has always been a small but important help,” she said.

Age UK has raised concerns that pensioners like Parker—those just over the threshold—could face financial uncertainty at a time of high living costs.

“A fixed income threshold fails to reflect real household expenses,” said Caroline Abrahams, Charity Director at Age UK. “It’s essential to consider flexibility and indexing.”

How HMRC Will Recover the Payment

Under the new system:

- Self Assessment taxpayers will declare their Winter Fuel Payment, and it will be deducted as part of their year-end tax reconciliation.

- Non-filers will have their tax codes adjusted, spreading repayment over several months to avoid sudden financial strain.

- Repayments will begin appearing in the 2026/27 tax year.

HMRC emphasised that no pensioner will face an unexpected bill. Advance notification letters are expected to be sent out in late 2025.

Political Debate Intensifies

The policy has divided Westminster.

Shadow Chancellor Rachel Reeves has criticised the move, calling it “a stealth tax on older people,” and urging the government to adjust the threshold for inflation.

“A pensioner earning just over £35,000 in London faces different pressures than one in rural Yorkshire,” Reeves said.

Treasury Minister James Cartwright, defending the decision, countered that the policy is “a fair and fiscally responsible step.”

The Liberal Democrats have proposed a regional adjustment to account for variations in living costs, while some Conservative backbenchers have warned against “undermining the principle of universal benefits.”

International Comparisons

The UK is not alone in revising pensioner support schemes. Several European countries have already linked winter energy payments to income:

- Germany applies a sliding scale, with higher-income retirees receiving reduced or no payment.

- France offers a targeted energy cheque to lower-income households only.

- Sweden uses an automatic income-tested system tied to inflation indexing.

“The UK is aligning itself with a broader European trend toward targeting benefits,” said Prof. James O’Connor, economist at the London School of Economics (LSE). “The difference is in how transparent and gradual the transition is.”

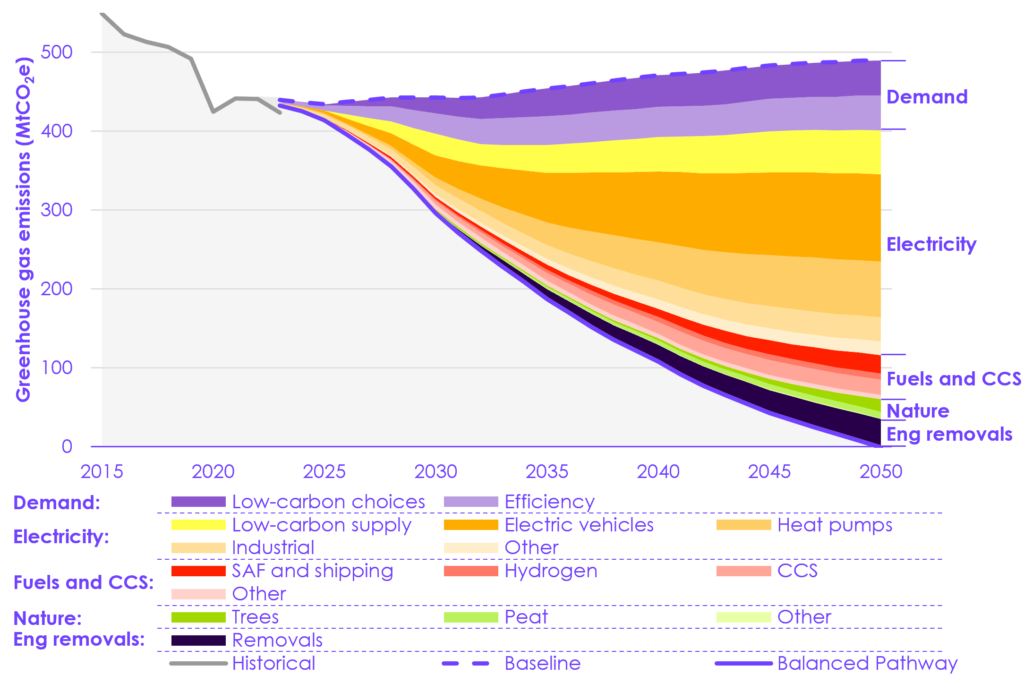

Economic and Fiscal Implications

Economists note that the policy is modest in fiscal terms but symbolically significant. According to the Resolution Foundation, the clawback is expected to save around £500 million annually by 2028.

This move also signals a longer-term shift toward targeted welfare rather than universal payments, as the government seeks to manage an ageing population and sustained energy price volatility.

“This is part of a wider recalibration of social support systems in advanced economies,” said Dr. Maria Lentz, senior researcher at the Resolution Foundation.

Practical Guidance for Pensioners

Pensioners who may be affected can take several steps to prepare:

- Check taxable income: Use HMRC’s online tools to estimate whether your income exceeds £35,000.

- Consider opting out: Pensioners can voluntarily decline the payment to avoid future clawbacks.

- Update contact details: Ensure HMRC has correct information to avoid missed communications.

- Seek professional advice: Financial advisers can help optimise income streams and tax planning.

Citizens Advice has also released a step-by-step guide to help pensioners understand their rights and obligations under the new rules.

Looking Ahead: Possible Adjustments

Policy analysts believe the government may adjust the income threshold annually for inflation starting in 2027, though no formal commitment has been made.

Think tanks have also suggested:

- Introducing tapered repayments rather than a hard threshold,

- Regional cost-of-living adjustments, and

- Automatic indexing to inflation or energy price trends.

A review of the policy’s first year is expected in mid-2026.

Free TV Licence for Life? Thousands of Over-60s in the UK Could Miss Out Without Checking This

New Driving Rules for Over-57s Just Announced – DVLA Issues Nationwide Update for All UK Regions

UK Homeowners Could Save £9,700 This November; Here’s How to Slash Your Mortgage Interest Fast

FAQ About Pensioners Hit With £300 Loss as HMRC Rule Change

Who is affected by the change?

Pensioners with taxable income over £35,000 who receive the Winter Fuel Payment.

How much can be reclaimed?

Up to £300, depending on entitlement.

When does it start?

The rule takes effect on 15 October 2025, with repayments phased in from 2026/27.

Why is this happening now?

Rising energy costs and fiscal pressures have prompted the government to target welfare spending more tightly.

Can you avoid the clawback?

Eligible pensioners may opt out of receiving the payment in advance.