NZ Superannuation Payment: If you’re nearing retirement or already enjoying your golden years in New Zealand, understanding the NZ Superannuation payment for November 2025 is essential. Whether it’s your first time or you’ve been receiving it for years, this article breaks down everything clearly and conversationally—without the confusing jargon—so you can confidently handle your financial future.

Table of Contents

NZ Superannuation Payment

Knowing the full scoop on the NZ Superannuation payment for November 2025 equips you to plan ahead, manage your money smoothly, and live your retirement life in confidence. From eligibility to payment dates, amounts, and the system’s rich history, this guide blends practical advice with expert insights. Make sure to apply early, keep your info current with Work and Income for the latest updates. Retirement is your time to enjoy—NZ Super is your reliable partner on that journey.

| Feature | Details |

|---|---|

| Payment Dates | November 4 and 18, 2025 |

| Eligible Age | 65 years and above |

| Residency Requirement | At least 10 years in NZ since age 20, including 5 years after 50 |

| Payment Amounts (Fortnightly) | Single (alone): NZ$1,038.94 Single (sharing): NZ$959.02 Couple (both qualify): NZ$1,656.68 |

| Tax Status | Payments are taxable income |

| Application | Apply online or in person via Work and Income NZ |

| Official Info | Work and Income NZ Superannuation |

What Exactly is NZ Superannuation Payment?

NZ Superannuation (NZ Super) is New Zealand’s universal government pension system available to residents aged 65 and older who meet certain eligibility rules. It offers a foundational income to cover living essentials in retirement—helping kiwis maintain dignity and financial stability in their later years. Unlike private pensions that rely on individual contributions, NZ Super is funded by taxpayers through government revenues, meaning there’s no formal savings requirement. Its universal nature means it’s designed to be straightforward, providing everyone eligible with a base income to rely on.

Since its establishment in the early 1900s, NZ Super has evolved into a pillar of social security, emphasizing fairness and ensuring that older adults can enjoy their retirement without financial fear. The government continues to adjust payments to keep pace with the cost of living, inflation, and wage growth, reflecting New Zealand’s commitment to seniors.

Payment Dates for November 2025

Knowing when your superannuation hits your bank account helps keep your budgeting sharp. NZ Superannuation payments come fortnightly on Tuesdays, with November 2025 payments scheduled as:

- Tuesday, November 4, 2025

- Tuesday, November 18, 2025

If a statutory public holiday coincides with a payment date, payments are issued earlier to avoid delays. These pre-set dates provide reliability and peace of mind for pensioners across the country.

Who Qualifies for NZ Superannuation Payment?

It’s more than just the birthday bash at 65. To be eligible, you must:

- Have reached age 65 to qualify for NZ Super.

- Be a New Zealand citizen, permanent resident, or hold a residence class visa.

- Have lived in New Zealand for at least 10 years since turning 20, with at least 5 of those years after age 50. These years can be cumulative and don’t have to be continuous.

- If you’ve lived in countries with social security reciprocity agreements (like Australia, Canada, UK, or South Korea), some of those years might count towards your residency requirement.

This residency rule balances fairness and inclusivity—rewarding those who have genuinely made NZ their home while allowing credit for time spent in partner countries via social security agreements.

Example Scenario:

Imagine your uncle moved to NZ at 30 but spent 10 years abroad in Australia working and raising family. Thanks to a social security agreement, his Australian years count, helping him qualify for NZ Super once he turns 65 in NZ.

What Are November 2025 Payment Amounts?

Your living arrangements influence your pension size. As of November 2025:

| Living Situation | Fortnightly Payment (Post-Tax) |

|---|---|

| Single (living alone) | NZ$1,038.94 |

| Single (sharing accommodation) | NZ$959.02 |

| Couple (both qualified) | NZ$1,656.68 combined |

Payments adjust yearly to reflect inflation and wage trends, ensuring seniors aren’t left behind as costs rise. Knowing these amounts helps make smart budgeting decisions and plan your retirement lifestyle.

Applying for NZ Superannuation Payment

Signing up is simpler than you think:

- Apply up to 3 months before you turn 65 using the official Work and Income NZ website.

- Gather documents like your birth certificate, proof of residence or citizenship, your current address, and your bank account details.

- You’ll be asked about your living arrangements and income to set your correct payment rate and tax deductions.

- Once approved, payments start from the week you turn 65 (or soon after).

Applying early avoids payment delays and allows you to focus on enjoying your retirement rather than paperwork.

Can You Work and Still Receive NZ Super?

Heck yes! NZ Superovirates gives you freedom to keep working without losing eligibility. Your payments might be taxed a bit differently as income rises, but the key thing is you maintain flexibility and extra earnings. Many retirees blend working part-time with pension benefits to maximize income and social engagement.

What If You Live Overseas?

NZ Super payments generally continue for up to 26 weeks (around 6 months) when you go overseas. After this:

- Payments may reduce depending on the country or stop completely.

- However, countries with social security agreements, like Australia and the UK, often allow full or partial payment continuation.

- Permanent overseas residents need to check with Work and Income about specific eligibility and payment rules.

- Remember to update your location promptly to keep payments smooth.

The Rich History Behind NZ Superannuation

To appreciate NZ Super today, let’s look at where it came from:

- 1898: NZ launched one of the world’s first means-tested pensions for those over 65.

- 1938: New Zealand introduced the first universal, non-means-tested pension for over-65s globally—a pioneering social security model.

- 1977: National Superannuation replaced earlier schemes with a universal flat-rate pension for all over 60, raising payment rates significantly.

- 1992-2001: The eligibility age gradually increased from 60 to 65 to reflect demographic changes.

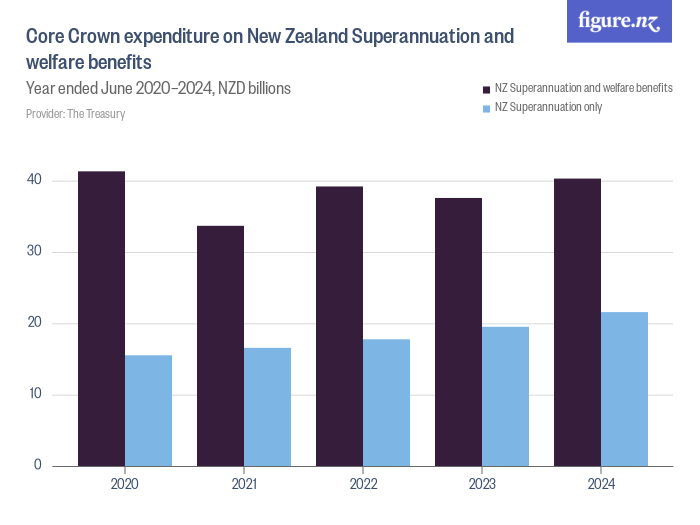

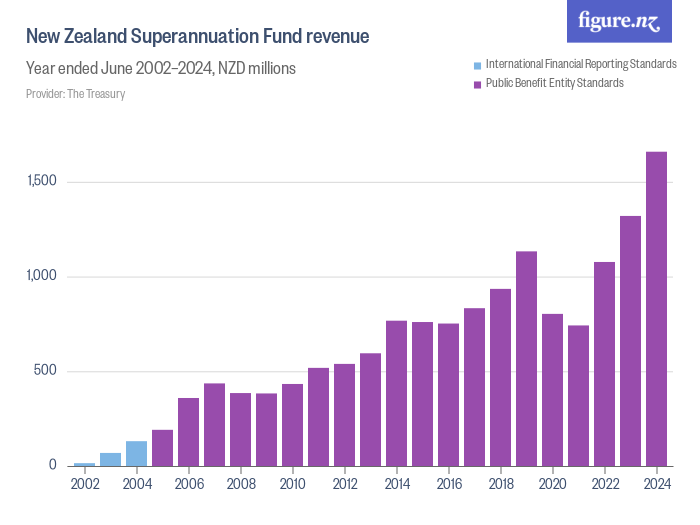

- 2001: The New Zealand Superannuation Fund (often called the “Cullen Fund”) was created to pre-fund future costs amid concerns about an aging population. The fund began investing government money independently in 2003 and has grown to over NZ$76 billion by 2024.

- This fund significantly supports sustainability of the NZ pension system by growing capital investments for future payouts.

Practical Tips to Make the Most of Your NZ Superannuation Payment

- Apply early: Start the process 3 months before your 65th birthday to avoid payment gaps.

- Keep your info updated: Move, change banking details, or switch living arrangements? Let Work and Income know ASAP.

- Choose the right tax code: This impacts your take-home pension amount.

- Plan finances wisely: Fortnightly payments make budgeting easier—spread your savings and bills accordingly.

- Consider KiwiSaver: Pairing NZ Super with private savings plans like KiwiSaver can boost your retirement finances.

- Check eligibility for additional benefits: Like the Winter Energy Payment or healthcare subsidies for seniors.

New Zealand Disability Allowance: Up to $78.60/Week for Ongoing Disability Costs

NZ Pension Dates For October & November 2025: Latest Updates on Payment Schedule & Eligibility!