NZ Pension Dates For October & November 2025: If you’re one of the many New Zealanders planning life after 65, knowing when your next pension payment hits your account can make all the difference. The NZ Superannuation (NZ Super) is more than a government check — it’s the foundation for thousands of Kiwis’ retirement plans. So if you’ve been searching for the NZ Pension Dates for October and November 2025, this guide gives you everything you need — payment dates, eligibility, new rates, and pro budgeting tips to help you stay confident and financially secure.

Table of Contents

NZ Pension Dates For October & November 2025

The NZ Pension Dates for October and November 2025 — October 7, October 21, November 4, and November 18 — mark the key weeks retirees should circle on their calendars. Remember that the Winter Energy Payment ends 1 October, slightly reducing your payout, so plan your spending accordingly. Whether you’re applying for the first time or managing your budget mid-retirement, staying informed on payment schedules, tax codes, and eligibility rules helps you make every dollar work harder.

| Category | Details |

|---|---|

| Payment Dates (October 2025) | Tuesday, 7 October 2025 & Tuesday, 21 October 2025 |

| Payment Dates (November 2025) | Tuesday, 4 November 2025 & Tuesday, 18 November 2025 |

| Payment Frequency | Fortnightly (every two weeks, usually Tuesday) |

| Official Source | Work and Income NZ |

| After-Tax Rates (from April 2025) | Single living alone – NZ$ 538.42 per week / Couple (both qualify) – NZ$ 828.34 per week |

| Winter Energy Payment Ends | 1 October 2025 |

| Eligibility Age | 65 years |

| Apply Online | Apply for NZ Super |

What Is NZ Superannuation (NZ Super)?

The New Zealand Superannuation — often shortened to NZ Super — is the country’s public pension system. It’s designed to give citizens and long-term residents a steady, reliable income once they reach 65, similar to Social Security in the United States.

Unlike many overseas pension schemes, you don’t “pay into” NZ Super directly. It’s funded through general taxes, and eligibility is based on age and residency, not employment history. That means whether you were a teacher, tradesperson, or stay-at-home parent, you still qualify once you meet the basic conditions.

NZ Pension Dates For October & November 2025

The Ministry of Social Development releases an annual payment calendar so retirees can plan ahead. For the second half of 2025, pension payments will arrive on the following dates:

- Tuesday 7 October 2025

- Tuesday 21 October 2025

- Tuesday 4 November 2025

- Tuesday 18 November 2025

Payments are automatic deposits, so there’s no need to visit a bank or call Work and Income. If a payment date ever lands on a public holiday, the deposit is generally processed earlier, ensuring you never go without your fortnightly income.

Many Kiwis find it helpful to set up calendar reminders or mobile banking alerts. A quick notification helps you track deposits, manage bills, and keep an eye on spending — especially handy for retirees on fixed budgets.

The End of the Winter Energy Payment

The Winter Energy Payment (WEP) is an annual top-up provided to help retirees and low-income households cover higher winter heating costs. It typically runs from 1 May through 1 October each year.

In 2025, the final WEP installment will appear with the 7 October payment, covering the last few days of the eligibility period. From the 21 October payment onward, the WEP will stop, and your pension will revert to its standard rate.

For many households, this means a drop in fortnightly income of NZ$ 20–30 per week (single) or NZ$ 30–45 (couples). Budget accordingly by adjusting energy usage or reviewing utility payment plans.

Current NZ Super Rates (April 2025 – March 2026)

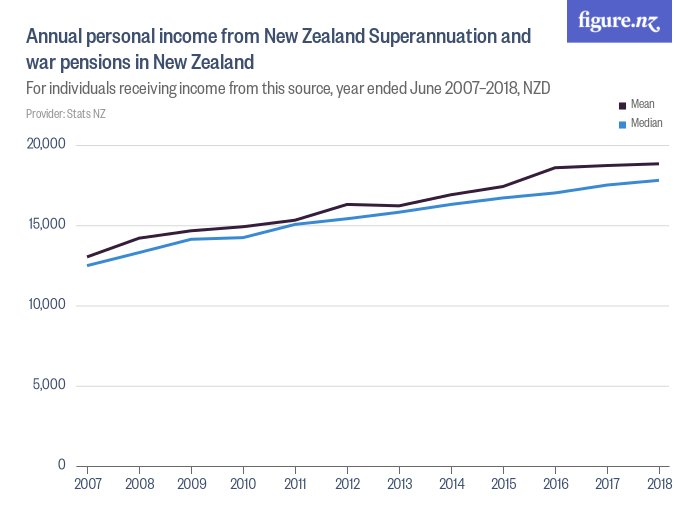

Every April, the government reviews benefit and pension rates based on average wage growth. As of 1 April 2025, here are the after-tax weekly amounts for most recipients:

| Living Situation | Weekly Rate (After Tax) |

|---|---|

| Single, living alone | NZ$ 538.42 |

| Single, sharing accommodation | NZ$ 497.00 |

| Couple – both qualify | NZ$ 828.34 (NZ$ 414.17 each) |

| Couple – one qualifies | NZ$ 414.17 |

These rates are net amounts under the “M” tax code, which applies to most retirees whose pension is their primary income. Your amount may differ if you have additional income or use a different tax code.

Eligibility Requirements for NZ Super

To qualify for NZ Super, you must meet age, residency, and citizenship requirements. Here’s what’s currently in place:

- Age: You must be at least 65 years old.

- Residency: You must have lived in New Zealand, the Cook Islands, Niue, or Tokelau for at least 10 years since age 20, including 5 years after turning 50.

- Citizenship or Permanent Residency: You must hold New Zealand citizenship or permanent residency status.

- Living Intentions: You must normally live in NZ and intend to stay here when you apply.

Starting from 2024, the government began gradually increasing the residency requirement toward 20 years by 2042. This ensures long-term residents continue to benefit fairly.

How to Apply for NZ Pension – Step-by-Step

Applying is easier than ever thanks to the MyMSD online platform. Here’s how the process works:

Step 1: Confirm Eligibility

Use the NZ Super Eligibility Checker to verify you meet all requirements.

Step 2: Gather Documents

You’ll need:

- Proof of identity (passport or birth certificate)

- Proof of residence (utility bill, tenancy agreement, etc.)

- IRD number and bank account details

- Details about any spouse or partner

Step 3: Submit Application

You can apply online via MyMSD or in person at a local Work and Income office. You’re allowed to apply up to 12 weeks before your 65th birthday.

Step 4: Wait for Processing

The review usually takes about 3 to 6 weeks. Once approved, your payments begin from the first scheduled Tuesday after your 65th birthday.

Pro Tip: Keep copies of all documents and note the name of any case officer you speak with. It’ll save headaches if you need to follow up.

Taxes and NZ Super

NZ Super counts as taxable income, similar to a paycheck. The amount withheld depends on your tax code and whether you earn income from other sources such as part-time work, investments, or rental property.

If NZ Super is your main income, the “M” tax code is usually correct. If you also have wages or business income, you might need a secondary tax code like “S” or “SH.

Managing Your Pension Like a Pro

Many retirees treat NZ Super as their “core” income and build around it. Here are a few expert-backed strategies to stretch your payments:

- Automate Your Bills:

Schedule recurring payments for rent, power, and groceries right after pension days. Automation prevents missed bills and avoids late fees. - Keep a Budget Cushion:

Aim to keep at least two weeks’ expenses aside in a savings account — especially helpful during months with major holidays or when the Winter Energy Payment ends. - Leverage Discounts:

Use your SuperGold Card for travel, entertainment, and local store discounts. Details at supergold.govt.nz. - Plan for Inflation:

Even though NZ Super rises yearly, inflation can outpace wage growth. Track costs annually and adjust savings or part-time income accordingly. - Review Your Will and Insurance:

Retirement is the right time to update legal and financial documents. Consider advice from Sorted.org.nz or a certified financial planner.

Living Overseas? Here’s What You Should Know

If you plan to live outside New Zealand, your pension may still be paid, depending on your destination and length of stay.

- Short trips (under 26 weeks): You can usually keep full payments.

- Longer stays: Payments may stop or be reduced unless your new country has a social security agreement with NZ (for example, Australia, Canada, or the UK).

- Permanent moves: You must inform Work and Income before you leave to avoid overpayment or penalties.

Future Outlook: What’s Next for NZ Super?

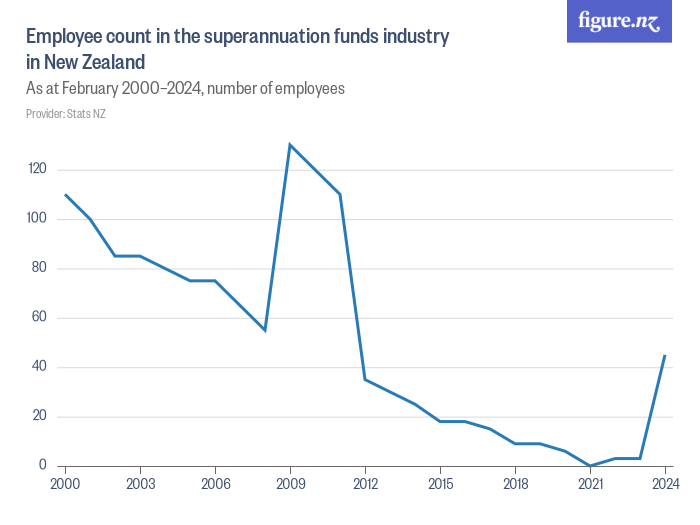

Policy discussions continue about the long-term sustainability of NZ Super. Demographic projections from Stats NZ suggest that by 2050, more than one in four New Zealanders will be over 65.

The government’s plan to gradually extend the residency requirement and maintain indexation to average wages helps ensure the system remains fair and affordable. Analysts also predict that digital services — like instant payment tracking through MyMSD — will continue to expand, making retirement administration even smoother.