Northern Minnesota Utility Sold to Private Investors: that headline has been sparking debate across town halls, tribal councils, and even coffee shop counters in Duluth and Hibbing. The deal centers around Minnesota Power, the state’s northern powerhouse utility, which supplies electricity to families, small businesses, and massive industries like mining and paper mills. This isn’t just a financial transaction. It’s a shift in who controls the energy lifeline of a region that depends on reliable, affordable electricity to survive harsh winters and support its economic backbone. When Wall Street-connected private investors step in, locals naturally start to wonder: What’s next for our bills, our jobs, and our communities?

Table of Contents

Northern Minnesota Utility Sold to Private Investors

| Point | Details |

|---|---|

| Utility Sold | Minnesota Power (owned by Allete) sold to Global Infrastructure Partners & Canadian Pension Plan Investment Board |

| Deal Value | $6.2 billion |

| Customer Base | ~150,000 customers in 15 counties; major supplier to taconite mines and paper mills |

| Conditions | No rate hikes until Nov. 2026, $50M in bill credits, renewable energy commitments, profit limits |

| Concerns | Rate increases after 2026, job cuts, clean energy delays, reduced transparency, possible resale |

| Jobs & Economy | Nearly 1,000 employees; large share unionized; supports regional tax base |

| Oversight | Deal approved by Minnesota Public Utilities Commission (PUC) with safeguards |

| Learn More | Minnesota PUC Official Site |

The Backstory: What’s Happening in Northern Minnesota

Minnesota Power, a subsidiary of Allete, has operated for over 100 years. Today, it provides electricity to about 150,000 residential and small business customers in northern Minnesota, plus huge industrial loads from iron ore mines and paper mills — industries that form the heartbeat of the Iron Range economy.

This year, Allete agreed to sell Minnesota Power to Global Infrastructure Partners (GIP), backed by BlackRock, and the Canadian Pension Plan Investment Board (CPP). The transaction totals $6.2 billion, instantly making northern Minnesota’s utility part of a global financial network.

Historical Context: Why This Sale Hits Home

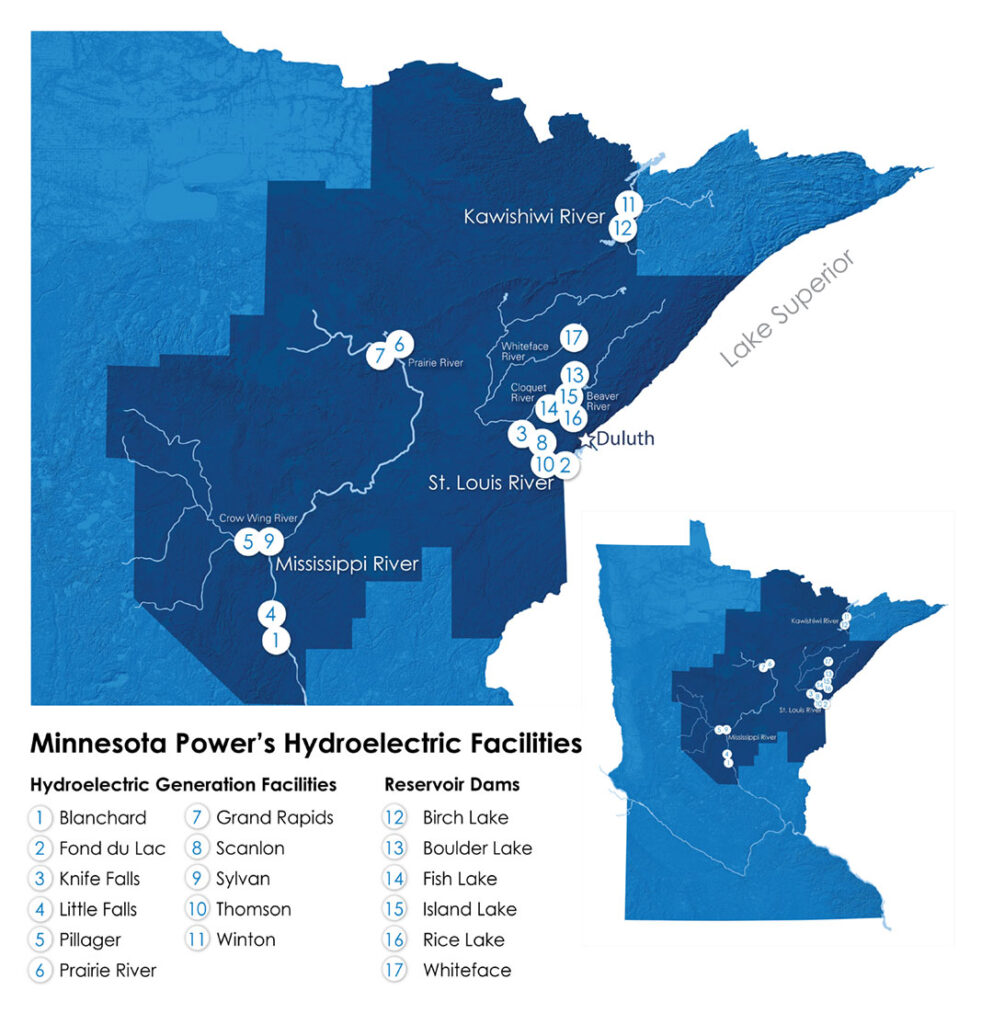

Minnesota Power isn’t just another business. For generations, it has been deeply tied to the region’s identity. It built hydroelectric dams along the St. Louis River, invested in large-scale wind projects on the prairies, and became a trusted employer for hundreds of union workers.

That sense of local stewardship matters. Unlike Wall Street firms, a locally based utility tends to focus on reliability, community programs, and steady employment. By selling to private investors whose primary goal is maximizing returns, many worry that community values will take a backseat to quarterly profits.

Why Locals Are Nervous About Northern Minnesota Utility Sold to Private Investors?

Here’s a breakdown of the main concerns bubbling up across northern Minnesota:

Rates and Bills

The rate freeze until November 2026 is welcome, but history shows what often happens when private equity enters utilities: rates climb faster than inflation. Once the freeze ends, Minnesotans may face hikes justified as “necessary investments,” but really aimed at boosting investor returns.

Jobs and Local Economy

Minnesota Power employs nearly 1,000 workers, many represented by unions. Locals fear the new owners could cut jobs, outsource services, or reduce pension benefits in the name of efficiency. The utility also pays significant property taxes, which support schools and local governments — any change in corporate structure could affect that flow of dollars.

Clean Energy Transition

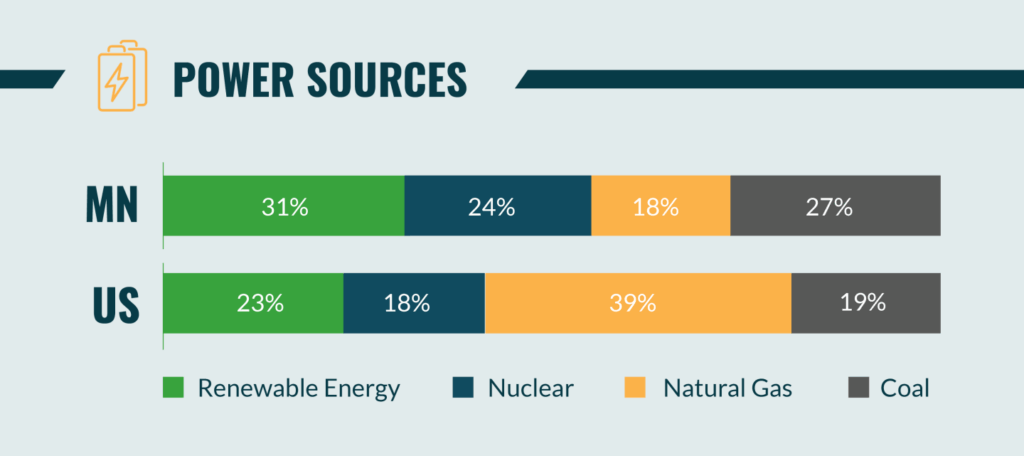

Currently, Minnesota Power gets about 50% of its electricity from renewable sources. That’s impressive compared to many utilities nationwide. But will new global investors stick to that path, or slow it down if wind and solar projects don’t meet profit targets?

Indigenous and Rural Impacts

Tribal nations in northern Minnesota already face high energy costs. Any rate hikes will hit these households hardest, compounding economic inequality. Many tribes also view energy sovereignty as part of their long-term goals. With a private investment firm now in control, questions about fairness and consultation loom larger.

Potential Resale

Private equity doesn’t usually buy to hold forever. Instead, they often sell within 5–7 years at a profit. That means communities could face another ownership shuffle within a decade — leaving long-term planning uncertain.

How the Deal Was Approved?

The Minnesota Public Utilities Commission (PUC) approved the sale unanimously, but only after securing concessions.

- $50 million in bill credits for customers.

- Rate freeze until Nov. 2026.

- Commitments to renewable projects.

- Caps on profit margins to prevent excessive investor gains.

These are meaningful protections, but they come with time limits. After 2026, and once profit caps expire, the future becomes less predictable.

National Comparison: Lessons from Other States

Minnesota isn’t alone. Across the country, utilities are becoming attractive targets for private equity and pension funds. The outcomes are mixed, but the warning signs are real.

- Texas: Transmission investments funded by private capital drove up costs faster than inflation in some regions.

- California: Investor-owned utilities like PG&E faced scandals over wildfire liability, sticking customers with billions in costs.

- Maine: Public frustration with private utility ownership grew so strong that citizens voted on a proposal to buy back the grid (though it failed narrowly in 2023).

- Illinois: After private equity entered some gas and power utilities, watchdogs documented higher fees and slower infrastructure investment.

The pattern is clear: when profit comes first, customers often pay more.

Broader Economic Impact

Minnesota Power isn’t just about keeping the lights on. It powers the taconite mines that supply the steel industry, the paper mills that anchor small towns, and the universities and hospitals that serve northern Minnesota.

If rates rise, industrial customers could cut jobs or relocate, hurting the entire Iron Range economy. Meanwhile, local governments depend on Minnesota Power’s property tax contributions. A change in ownership could alter how much stays in local communities versus being funneled to global investors.

Practical Advice: What Can Residents Do?

1. Stay Informed

Follow updates on the Minnesota PUC website. Regulatory filings can be dry, but they’re where decisions about your future bills are made.

2. Track Your Bill

Keep a record of your electricity costs. If increases hit after 2026, having your own history helps in challenging rate hikes.

3. Participate in Public Hearings

Minnesotans have the right to speak up. Attend PUC hearings, submit written comments, and push your elected officials to prioritize consumer protections.

4. Explore Alternatives

Community solar gardens, rooftop solar, and cooperative energy projects give households more independence from investor-owned utilities.

5. Work with Advocacy Groups

Groups like the Citizens Utility Board of Minnesota help consumers fight unfair rate increases and push for transparency.

For Professionals and Leaders

Business Owners

If you run a factory, mine, or even a small shop, your energy costs may rise in the future. Start planning now by:

- Negotiating long-term contracts where possible.

- Considering on-site generation like solar arrays.

- Joining trade associations that can lobby for fair rates.

Local Governments and Tribal Councils

- Demand transparency in utility filings.

- Explore grants for renewable energy independence.

- Engage in rate cases directly — local voices carry weight at the PUC.

Senator Reveals Trump’s Secret Plan to Slash Tariffs for U.S. Vehicle Production

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy