New Car Tax Plan Could Hit All Rural UK Drivers: Hey y’all, if you’re living out in the rural UK and drive a new car, some big changes around car tax are rolling out this November 2025. This article breaks down everything you need to know about the new car tax plan that could affect all rural drivers starting next month. We’re gonna talk facts, figures, and what you can expect in plain ol’ American talk — so whether you’re just curious or you’re a business pro sizing up the impact, we got you covered. Whether you’re cruisin’ through countryside lanes or managing fleet vehicles in rural areas, understanding these changes will set you up for smooth rides ahead. Let’s dive into the details, practical advice, and everything else to keep you informed.

Table of Contents

New Car Tax Plan Could Hit All Rural UK Drivers

Starting this November 2025, rural UK drivers face new electric and low-emission vehicle taxes aimed at fairness and revenue for road upkeep. The £195 minimum annual charge and £425 supplement for pricier EVs mean budget adjustments are crucial. Using grants, staying informed, and smart vehicle choices will help rural motorists thrive during this transition.

| Highlight | Details |

|---|---|

| Implementation Date | November 2025 |

| Who is Affected | All rural UK drivers with new and electric vehicles |

| First-Year Tax Rates | £10 for new electric vehicles registered from April 2025; higher for hybrids/petrol cars |

| Annual Tax After First Year | £195 minimum for electric vehicles |

| Expensive Car Supplement | £425 per year for electric vehicles costing over £40,000 (for first 5 years) |

| Previous Exemptions Ending | Full exemption for many electric vehicles phased out |

| Reason for Change | Fairer tax system, generate revenue for road upkeep and infrastructure |

| Impact on Hybrids | £10 discount removed; taxed at higher first-year rates depending on emissions |

| Local Economy Effects | Potential shifts in car sales, repair jobs, EV infrastructure growth in rural areas |

| Advice for Drivers | Budget for increased tax, check vehicle tax band, explore local grants and subsidies |

| Business Impact | Fleet owners should reconsider vehicle choices and tax budgets |

| Environmental Goal | Supports UK net-zero 2050 target balancing green incentives with road funding needs |

| Official Reference | UK Government Vehicle Tax |

Understanding the New Car Tax Plan Could Hit All Rural UK Drivers

The UK government is shaking things up with an overhaul of Vehicle Excise Duty (VED), commonly called car tax. This new plan, effective from November 2025, impacts rural drivers the most, especially those with new, electric, or low-emission vehicles that previously enjoyed tax breaks.

Previously, electric vehicles (EVs) were largely exempt from road tax to encourage their adoption. However, from April 2025, the game changes: new EVs will pay a minimum of £10 in their first year, then £195 annually afterward. Moreover, if your electric ride costs more than £40,000, you’ll cough up an extra £425 per year for five years — something called the expensive car supplement. This aims to close loopholes where high-value EVs previously evaded extra tax.

The rationale? To create a fairer tax system ensuring all road users contribute to upkeep while balancing the government’s ambitious goals to cut emissions by 2050. The government expects this policy will generate over £500 million annually, funds slated to help improve roads and support clean energy initiatives. The new road tax framework also influences hybrids, phasing out their £10 discount and adjusting rates according to CO2 emissions.

Why the Change? Environmental and Economic Context

This isn’t just a tax hike — it’s part of a wider environmental push. With UK’s commitment to net-zero carbon emissions by 2050, moving toward cleaner vehicles is front and center. But there’s a flip side: road maintenance still costs money, and more EVs mean less fuel tax revenue, which traditionally contributed to road funding.

By equalizing tax obligations, the government seeks to ensure everyone pays fairly for road use, regardless of fuel type. Plus, the tax money will funnel into infrastructure upgrades, EV charging station rollouts, and renewable projects—key for supporting the green transition, particularly in rural areas.

Who Will Be Affected and How?

The new tax hits all rural UK motorists driving new or recently registered electric and low-emission vehicles:

- EVs registered from April 1, 2025, pay £10 first-year tax, then £195 yearly.

- EVs priced over £40,000 pay the £425 expensive car supplement for 5 years.

- Hybrids and low emission petrol/diesel cars lose their yearly £10 discount.

- Existing EVs registered between 2017 and March 2025 pay £195 rate from renewal.

- Older EVs (2001-2017) pay a lesser tax of £20 per year.

If you’re living rural and just added a new electric or hybrid ride, these taxes are now a new “must-pay” bill — even if your car is carbon-friendly.

Differences from Previous Rules

Before, zero-emission cars had full exemptions, making ownership cheaper. Hybrids enjoyed discounts too. The new rules treat EVs more like traditional cars for tax purposes but give a small first-year break. The expensive car supplement had been waived for EVs but returns now for pricier models, reflecting changing government priorities as electric car ownership scales up.

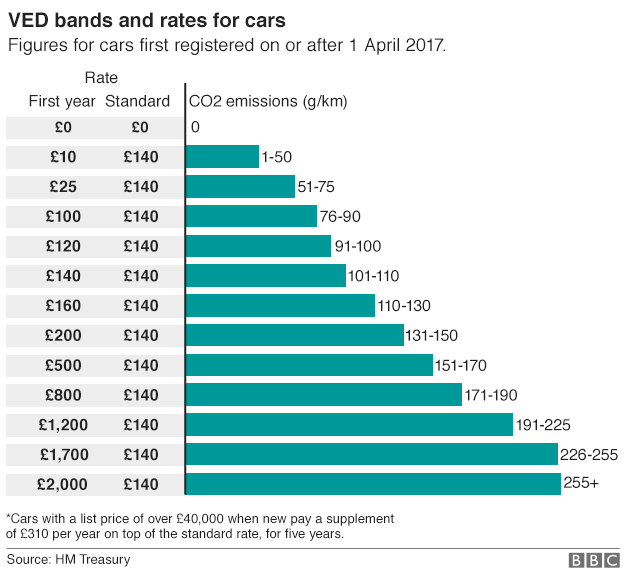

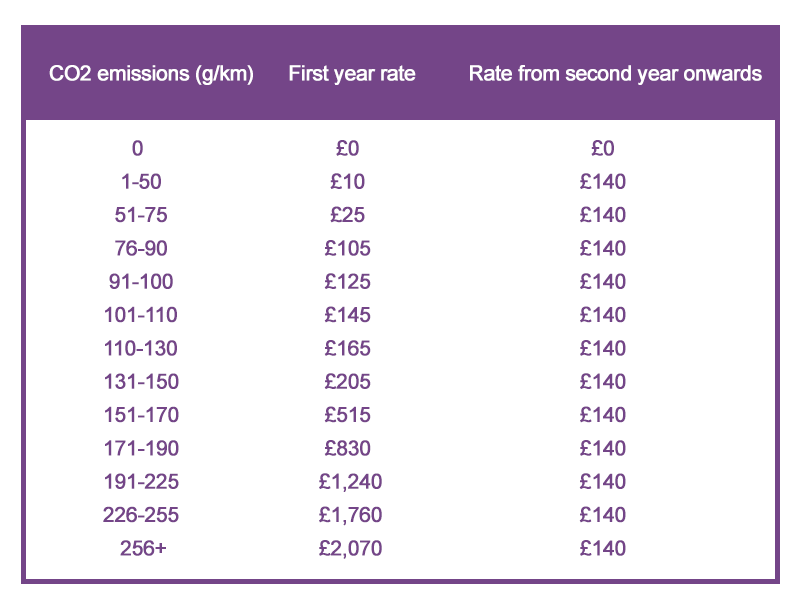

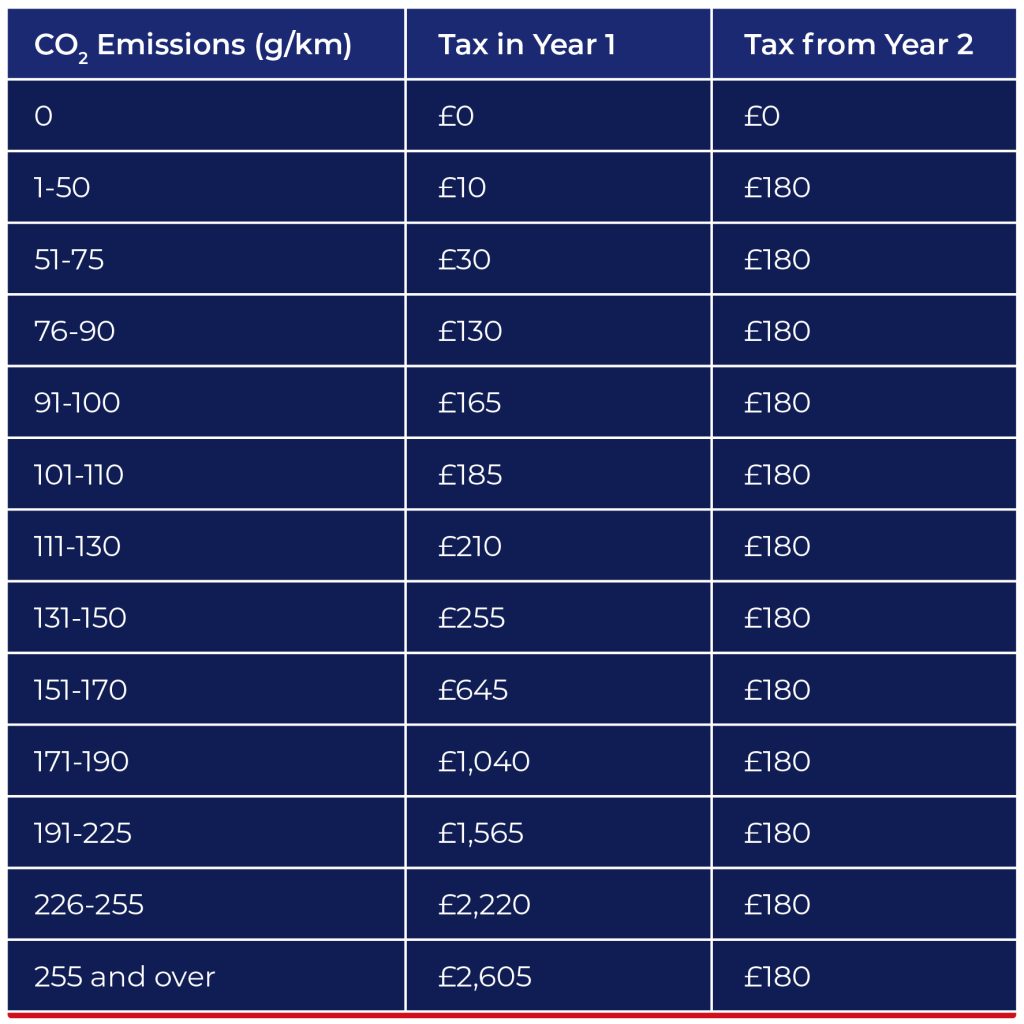

Key Tax Changes and Rates

Here’s a detailed tax band snapshot for the 2025-26 tax year:

| Vehicle Type | First Year Tax (from April 2025) | Annual Tax After First Year | Expensive Car Supplement (5 years) |

|---|---|---|---|

| Electric Vehicles (EVs) | £10 | £195 | £425 (if price > £40k) |

| Low Emission Hybrids | £110 – £130* | £195 | N/A |

| Petrol/Diesel New Cars | £10 – £5,490 (depending on emissions) | £195 | N/A |

*Low emission hybrids (1-75g/km CO2) see increased first-year rates from £10 to up to £130.

Higher emission vehicles (>76g/km CO2) face sharply rising first-year taxes, with some exceeding £2,000 for new registrations.

The £195 annual standard rate is expected to increase with inflation, so budgeting ahead is wise.

Inflation and Future Projections

The government indexes the VED rates to inflation via the Retail Price Index (RPI), so charges will likely tick upward each year. For 2025-26, forecasts estimate the UK will raise around £9 billion from VED. The high demand for EVs means the expensive car supplement revenue, previously void for zero-emission vehicles, will bring significant income.

Impact of New Car Tax Plan Could Hit All Rural UK Drivers on Rural Economy and Jobs

These tax changes have widespread knock-on effects across rural economies:

- Local dealerships may need to recalibrate incentives as new car prices shift with tax.

- Repair shops could see higher demand for servicing EVs and hybrids as ownership increases.

- Charging infrastructure jobs may grow due to increased government and private investment.

- Meanwhile, higher ongoing ownership costs could impact rural residents on fixed budgets, sometimes slowing new vehicle purchases.

In sum, while some sectors stand to gain from green transitions, others must brace for changing demand patterns.

Practical Advice for Rural Drivers

Navigating the new tax environment can be straightforward with these tips:

- Know Your Car’s Tax Band: Use official tools to find your vehicle’s CO2 emissions and tax band before buying.

- Budget Early: £195 annually is a new baseline tax for EVs. Factor this into your yearly costs.

- Explore Grants: Many rural councils offer subsidies for EV purchases or home chargers—check local schemes.

- Consider Total Cost of Ownership: Count insurance, maintenance, energy/fuel, and tax when evaluating vehicles.

- Plan for Expensive Car Supplement: If your EV costs over £40,000, be ready to pay an extra £425 yearly for 5 years.

- Watch for Updates: The UK government periodically adjusts policies—stay informed on official sites.

Case Study: Meet Sally, a Rural Driver

Sally, a rural post office manager, recently bought a £42,000 electric SUV. She found out that besides the £10 first-year tax, she’ll pay £195 yearly plus the £425 expensive car supplement for the next five years. With this, Sally is budgeting carefully, using local grants to offset charger installation costs and relying on lawnmower rides for short errands to save her car’s mileage.

Her approach shows adapting to new costs with smart planning and local resources.

Tips for Businesses and Fleet Owners

Rural businesses managing fleets must:

- Reassess vehicle types regarding tax bands before procurement.

- Prioritize EVs under £40,000 to dodge the supplement.

- Use online Vehicle Excise Duty calculators for financial planning.

- Renew vehicle tax promptly to avoid fines and maintain compliance.

- Account for Benefit-in-Kind tax changes on company vehicles, which will rise incrementally from 2% in 2025.

Technology Adoption and Future Trends

Rising EV taxes may nudge some motorists towards hybrids, smaller engines, or used low-emission vehicles to balance costs. Meanwhile, government incentives continue supporting EV uptake, especially through tax credits and grants. The increasing EV market might prompt a review of another tax model, such as pay-per-mile road use charging, expected to roll out in the next few years.

How to Stay Compliant?

Renew your car tax online at gov.uk/vehicle-tax, avoid lapsed tax, which could trigger fines or clamping. Set reminders for renewal deadlines and consult official updates regularly.

£11Bn Payout Ahead as Regulator Cracks Down on UK Car Finance Mis-Selling

New DVLA Law Hits Over-62s from October 9: What Every Older UK Driver Must Know Now

Drivers 62 and Over Warned: Huge DVLA Licence Rule Changes Take Effect Oct 15, Fines Confirmed