Property Laws in the UK: The United Kingdom’s 2025 property law reforms could see many older homeowners facing higher annual taxes and reduced access to benefits. The wide-ranging measures, which include changes to tax thresholds, benefit calculations, and property ownership rules, are expected to affect thousands of pensioners across England, Wales, and Scotland, according to government statements and housing policy experts.

The reforms are intended to modernise the property taxation system, better reflect current house prices, and redistribute tax burdens. Critics argue that they may also place new financial pressures on people living on fixed incomes, especially those who own property but have limited savings.

Table of Contents

New 2025 Property Laws in the UK

| Key Fact | Detail / Statistic |

|---|---|

| Proposed property wealth tax | Annual levy on homes valued above £500,000 |

| Additional dwelling surcharge | Increased to 5% |

| Benefit eligibility | Home equity more heavily factored into means testing |

| Leasehold reform | Abolishes “marriage value” and simplifies lease extensions |

| Seniors potentially affected | Hundreds of thousands of pension-age homeowners |

| Official Website | GOV.UK |

A Major Shift in UK Property Policy

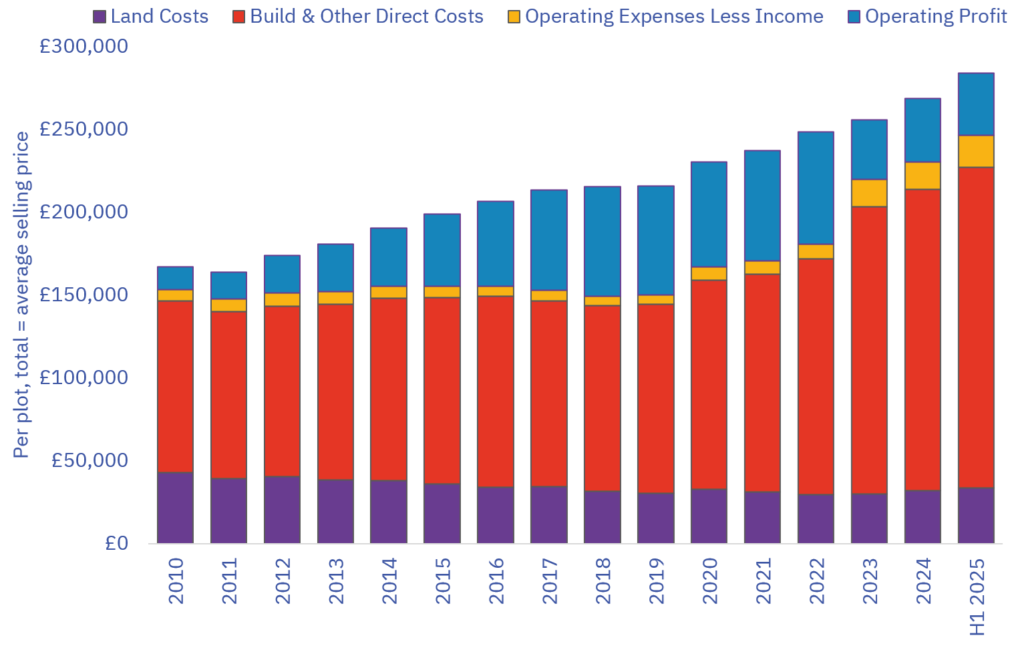

The 2025 property law reforms mark one of the most significant overhauls of the UK’s housing and tax system in decades. Officials say the changes are intended to create a “fairer and more sustainable” structure, aligning taxation with property values that have soared in many regions.

Treasury officials argue that decades-old council tax bands are “out of step with today’s housing market.” Introduced in 1993, the council tax system still relies on property valuations from 1991 in England and Scotland. In London, average house prices have more than quadrupled in that time.

Under the proposed legislation, properties valued above £500,000 may be subject to a new annual property wealth tax. This would effectively replace or supplement existing council tax rates, creating a sliding scale of payments tied to a home’s current market value rather than its outdated banding.

UK Leasehold Reform and Ownership Rights

The Leasehold and Freehold Reform Act 2024, fully effective from 2025, removes long-standing barriers for leaseholders. The Act abolishes the two-year rule for lease extension, eliminates “marriage value” in many cases, and gives owners more power to challenge service charges.

“This is the biggest leasehold shake-up in more than a generation,” said Dr. Laura Jenkins, property law researcher at the London School of Economics. “For older flat owners, especially in urban centres, this could make retaining or extending their homes significantly cheaper.”

However, the combined impact of leasehold savings and increased property taxation remains uncertain. Analysts warn that some homeowners may save on lease extension costs but face higher annual tax bills.

Historical Context: Why the System is Changing

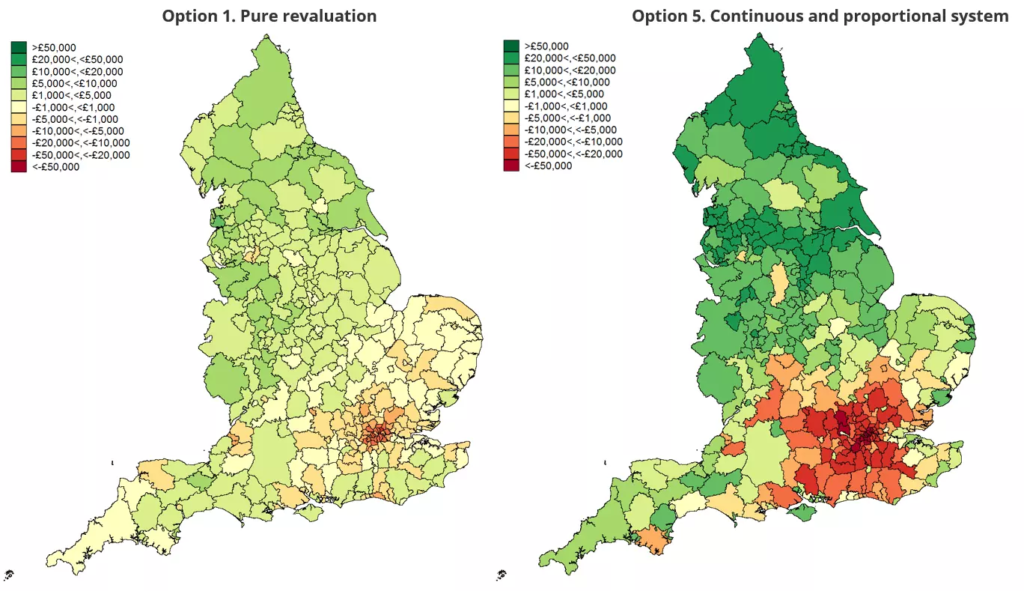

The UK’s property tax system has long been criticised as regressive and outdated. Council tax bands have not been revalued in England since 1991. As property prices rose dramatically, particularly in London and the South East, homeowners in lower-value regions have paid a higher proportion of their home’s value in tax than those in expensive areas.

Previous governments have attempted but failed to address the imbalance due to political sensitivity. The 2025 reforms represent a decisive shift toward aligning taxation with real market values. The Treasury has argued that “those with more valuable properties should make a fairer contribution to local services.”

This context helps explain why the reforms are controversial: they correct a long-standing imbalance but hit hardest those in areas with high but illiquid property wealth, such as retirees who bought homes decades ago.

Financial Impact on Seniors

For many seniors, the proposed property wealth tax could mean annual bills running into thousands of pounds. A home valued at £600,000 may attract an annual levy of around £2,500, while homes over £1 million could face bills exceeding £5,000, based on Treasury modelling.

“These are not just numbers on a page,” said Caroline Abrahams, Charity Director at Age UK. “For someone living on the state pension and modest savings, these taxes can make the difference between staying in their home or being forced to sell.”

The DWP’s new rules mean that home equity will now play a larger role in calculating Pension Credit and Housing Benefit. Pensioners who previously qualified based on low income could find themselves ineligible once property value is factored in.

Regional Variations: A North–South Divide

The impact will not be evenly felt across the country. In London and the South East, where median house prices exceed £500,000, a majority of homeowners could face the new tax. In contrast, in parts of the North East and Wales, relatively few properties meet the threshold.

This uneven distribution has already fuelled political debate. Opposition parties have argued that the reforms disproportionately target pensioners in the South of England. Treasury officials counter that the measures are progressive and fairer than existing bands.

“Policy like this always cuts unevenly,” said Professor David Miles, Senior Fellow at the National Institute of Economic and Social Research. “But if it’s implemented carefully, it can help address structural inequality in housing wealth.”

Political Debate and Public Response

The reforms have sparked heated debate in Parliament. Government ministers insist the policy will create a fairer tax system, raise funds for public services, and support younger generations struggling to access housing.

The opposition Labour Party has called for hardship protections for low-income pensioners. Some Conservative MPs, particularly in suburban constituencies, have voiced concerns about the potential impact on their older constituents.

Public reaction has been mixed. Younger homeowners and renters have expressed support, seeing the tax as a way to reduce inequality. Pensioners’ groups and property owner associations have raised concerns about affordability and fairness.

Social Care and Asset Testing

The reforms will also tighten rules on how property assets are assessed for social care funding. Under current law, a homeowner’s property is disregarded for the first 12 weeks after entering residential care. After that, it can be used to calculate how much they must contribute to care costs.

Authorities will have stronger legal powers to challenge transfers of property designed to avoid care charges. “This is a clear warning to families considering gifting homes to avoid fees,” said James Patel, an elder law solicitor. “Such transfers can be reversed or treated as if they never happened.”

These measures are part of a broader government strategy to stabilise the social care funding system, which faces rising costs as the population ages.

International Perspective: How the UK Compares

The UK is not alone in shifting towards property wealth taxation.

- France and Switzerland impose annual wealth or property taxes tied to real-time valuations.

- New Zealand recently introduced similar measures as part of housing market reforms.

- In Canada, rising property values have also triggered debates about using property taxation to reduce inequality.

According to the Organisation for Economic Co-operation and Development (OECD), taxing property wealth can be an effective way to reduce inequality — but only if hardship protections are well designed.

“International experience shows that property wealth taxes work best when they are transparent and targeted,” said Dr. Anne-Marie Clausen, an OECD tax policy analyst. “Without careful design, they can hit vulnerable homeowners the hardest.”

What Homeowners Can Do Now

Experts recommend that pension-age homeowners begin preparing early for the new system.

Steps may include:

- Obtaining a professional property valuation to understand potential tax exposure.

- Reviewing benefit entitlements under the new means-testing rules.

- Seeking legal and financial advice before making any property transfers.

- Considering downsizing or releasing equity if staying in the home becomes unaffordable.

- Monitoring parliamentary debates and potential exemption schemes or relief programs.

“It’s crucial not to panic or make hasty decisions,” said Emma Ross, a senior adviser at Citizens Advice. “Many homeowners will qualify for relief or phased payments, but they need to act early.”

Policy Timeline

| Milestone | Event | Status |

|---|---|---|

| September 2025 | Government announcement and draft legislation | Complete |

| April 2025 | Start of phased implementation for benefit and care rules | Scheduled |

| Mid–Late 2025 | Parliamentary debate and potential amendments | In progress |

| 2026 | Full property wealth tax rollout in England and Wales | Planned |

| 2027 | Review of exemption criteria and hardship schemes | Planned |

Looking Ahead

The 2025 property law reforms are far from settled. The government faces pressure to amend the legislation before full rollout. Opposition parties, advocacy groups, and pensioner organisations have already signalled plans to lobby for changes or targeted relief measures.

For now, homeowners are being urged to seek professional guidance and prepare for an evolving tax and benefits landscape. As the political debate intensifies, the ultimate shape of the reforms — and their impact on older homeowners — remains uncertain.

DWP £812 Cost of Living Boost in Oct 2025: Every Britishers should know this, Check Update

UK’s £200 Cost of Living Payment in October 2025 – Payment Schedule, Eligibility & Latest Updates!

DWP Confirms £416 Monthly Benefit Cut – Urgent Action Required for Thousands of UK Families

FAQ

Q: Will all homeowners pay the new tax?

A: No. The property wealth tax is expected to apply only to homes valued over £500,000. Regional variations will significantly affect who pays.

Q: Will pensioners receive any exemptions?

A: No full exemption has been confirmed. The government has indicated it will consider hardship provisions.

Q: How will this affect benefits?

A: Home equity will play a larger role in means-testing for Pension Credit and Housing Benefit, potentially reducing eligibility.

Q: When will the reforms be fully implemented?

A: The benefit and care changes begin in April 2025, with the new tax system expected to roll out through 2026.

Q: How does this compare internationally?

A: Similar systems exist in France, Switzerland, and New Zealand. Outcomes depend heavily on how exemptions and reliefs are structured.