Nationwide Is Sending £275 to Customers: If you’ve seen headlines or TikTok videos shouting that “Nationwide is sending £275 to customers who follow two simple steps,” you’re not alone. It sounds too good to be true — and, spoiler alert — it is. There’s a real offer, but the real number is £175, not £275. And it’s not as effortless as the internet wants you to believe. But hey, it’s not a bad deal either — if you know how to play your cards right.

In this piece, we’ll break it all down in plain language that even a 10-year-old could understand, while still delivering insights professionals and financial pros will appreciate. You’ll learn what’s real, how to qualify for the actual Nationwide switch bonus, how to spot scams, and why banks even hand out these bonuses in the first place.

Table of Contents

Nationwide Is Sending £275 to Customers

The internet loves drama and big numbers — £275 sounds better than £175, but it’s not the truth. The real Nationwide offer is still solid, but it comes with strings attached. If you’re careful, read the terms, and switch via official channels, it’s an easy £175 in your pocket. But never fall for vague “two-step” claims, random email links, or “instant reward” posts.mAlways verify, always protect your data, and always read the fine print.

| Feature | Details |

|---|---|

| Actual Offer | £175 switching bonus |

| Eligible Accounts | FlexAccount, FlexDirect, FlexPlus |

| Conditions | Full CASS switch, 2 Direct Debits, £1,000 deposit, 1 debit card transaction |

| Payment Time | 10 working days post-qualification |

| Offer Withdrawal | 31 March 2025 |

| Competitors’ Bonuses | NatWest: £200, Santander: £185, Lloyds: £175 |

| Switch Volume 2024 | 1.2M customers switched |

| Official Source | Nationwide Official Site |

What’s Going On with the “Nationwide Is Sending £275 to Customers” Claim?

Here’s the truth: Nationwide does have a switching bonus — but it’s £175, not £275. The confusion likely started when social media posts and clickbait articles exaggerated the amount or mashed up different offers.

According to Nationwide’s official press release (Sept 2025), the £175 Current Account Switch Offer applies to customers who open a new account and switch from another bank using the Current Account Switch Service (CASS).

That means:

- You need to switch your existing current account completely.

- Move at least two Direct Debits over.

- Deposit at least £1,000.

- Make at least one debit card payment.

- And you must not have received a previous Nationwide switch bonus since August 2021.

Then — and only then — you’ll see that sweet £175 drop into your account within 10 working days.

So, no, there’s no secret £275 payment, no “two magic steps,” and no hidden loophole. The viral claim is just misinformation.

Why Banks Like Nationwide Offer Free Cash?

Banks aren’t being charitable — they’re investing in customer acquisition.

Every time you switch, they gain access to:

- Your direct debits and income deposits (which create long-term engagement).

- The potential to upsell you on savings accounts, loans, or insurance.

- Valuable data insights about your spending habits (all anonymized, of course).

This isn’t about “giving away money.” It’s a strategic marketing move. And as a consumer, you can benefit — but only if you follow the rules.

Step-by-Step: How to Get Nationwide Is Sending £275 to Customers

1. Open an Eligible Account

Choose one of these:

- FlexAccount: Great for everyday use, no monthly fees.

- FlexDirect: Pays 5% AER on balances up to £1,500 for the first year.

- FlexPlus: Includes travel, breakdown, and mobile insurance (for £13/month).

2. Use the Current Account Switch Service (CASS)

CASS handles everything for you — payments, direct debits, even incoming transfers. The switch is completed within 7 working days, backed by a government guarantee that ensures you’ll never lose a payment.

If your employer or a company pays into your account, they’ll automatically be notified.

3. Meet the Eligibility Requirements

This is the part most people miss:

- Two active Direct Debits (not standing orders).

- Deposit at least £1,000 into your new account within 31 days.

- Make one debit card payment.

- No prior switch bonus since August 2021.

Once you’ve done all that, sit back — your £175 reward will be paid within 10 working days.

4. Don’t Close the Account Too Soon

Nationwide can revoke the reward if you close your account immediately. Keep it open for at least a couple of months.

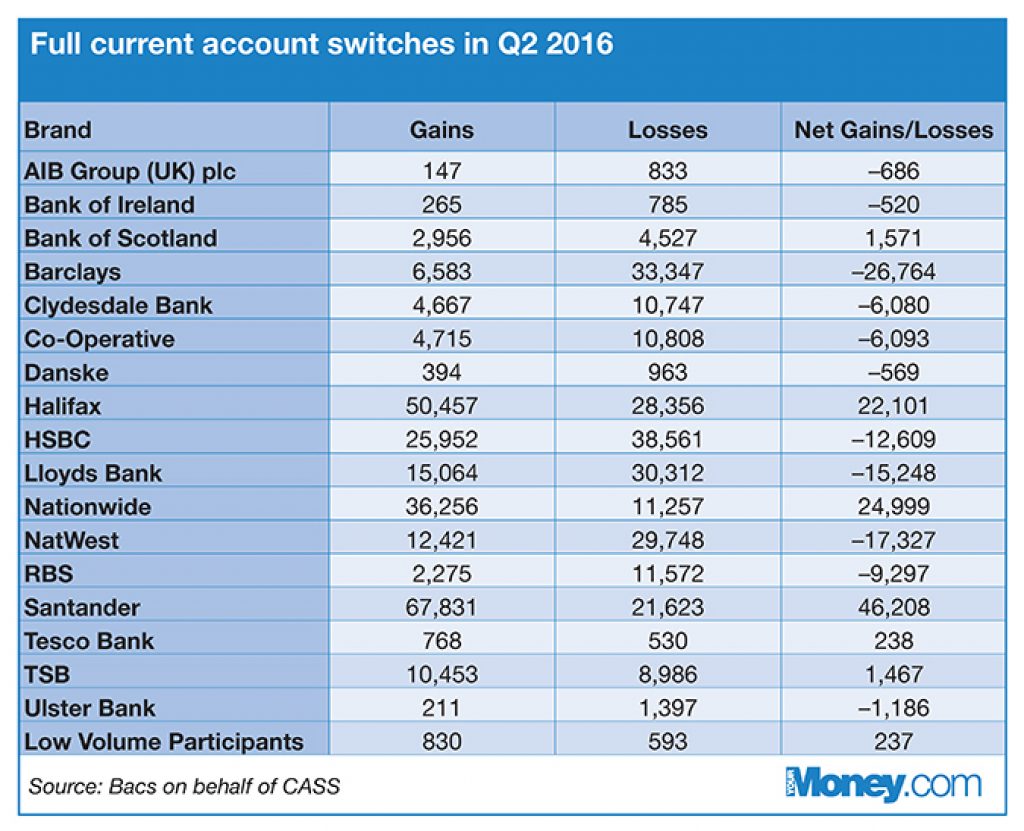

How Nationwide Compares to Other Banks

| Bank | Bonus | Conditions | Notes |

|---|---|---|---|

| Nationwide | £175 | 2 Direct Debits, £1,000 deposit | Ends March 2025 |

| NatWest | £200 | App registration + £1,250 deposit | Highest current offer |

| Santander | £185 | 1 | 2 |

| Lloyds | £175 | 3 Direct Debits | Solid mobile app |

| HSBC | £200 | Maintain £1,500 balance | Limited window |

So yes, Nationwide’s offer is real and competitive — but not the biggest.

How the “Nationwide Is Sending £275 to Customers” Claim Went Viral?

The £275 myth likely spread from:

- Old Facebook posts merging different offers.

- TikTok videos exaggerating amounts for clicks.

- Phishing websites impersonating banks to steal personal data.

It’s a textbook example of digital misinformation — one that even well-meaning influencers accidentally share.

Why Offers Like This Keep Coming Back?

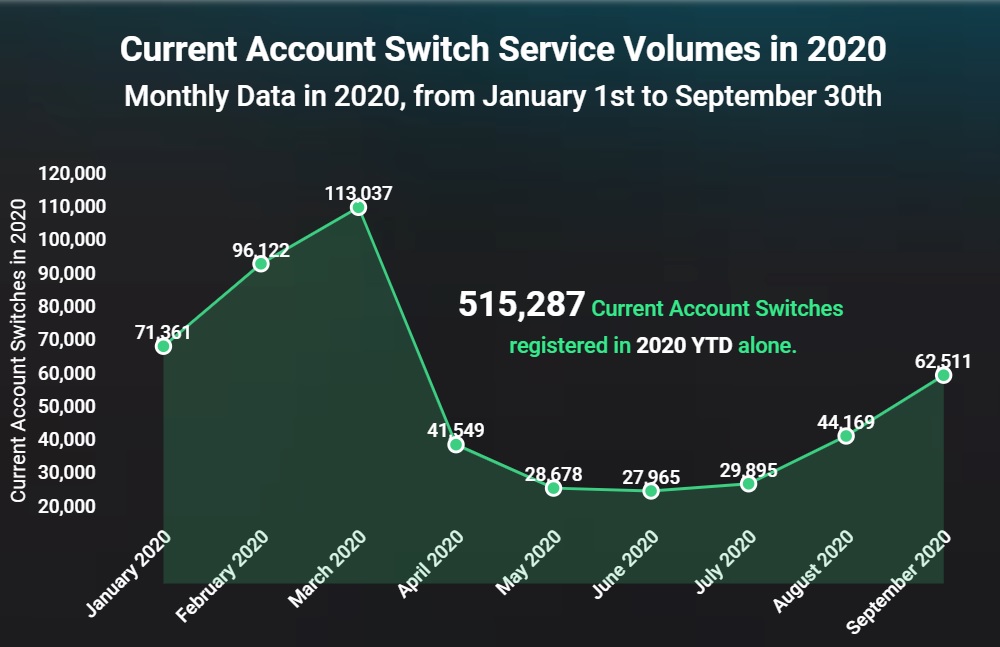

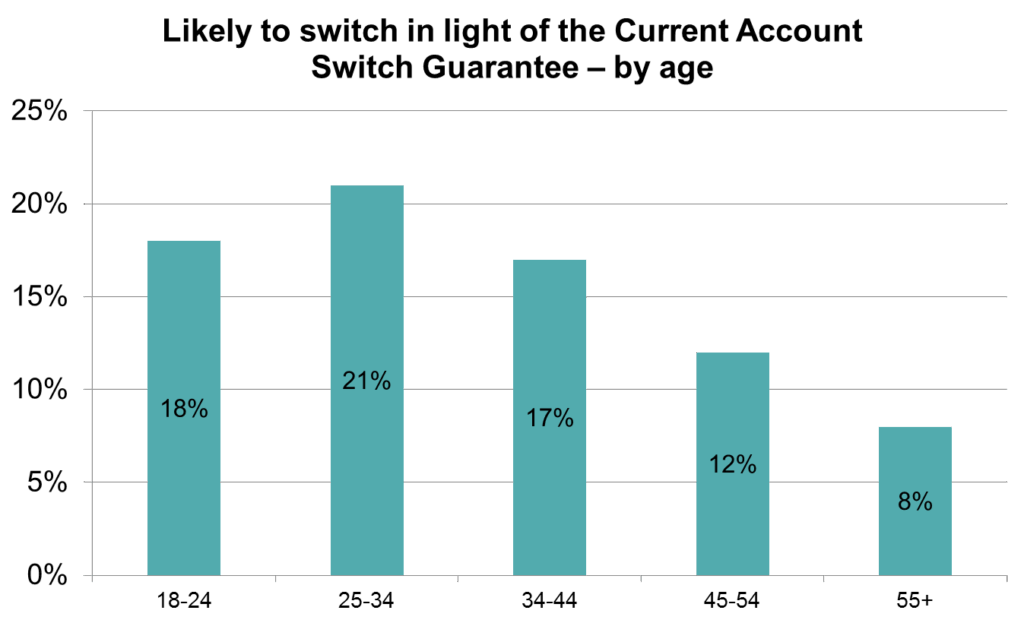

Banks recycle these switching deals because they work. In 2024, 1.2 million Brits switched current accounts, a record since the CASS system launched in 2013.

Nationwide alone gained over 55,000 net new accounts in early 2025, according to MoneyWeek. That’s a lot of new customers — and plenty of media buzz.

Spotting a Fake Offer: Red Flags to Watch

Before you click any “Get £275” link, check for these red flags:

- No official link to Nationwide’s website.

- Too few details — “two easy steps” is intentionally vague.

- Unsecured URL (no HTTPS) — fake sites often skip SSL certificates.

- Requests for sensitive info like your full login or card number.

- Pressure tactics (“Offer ends today!”) — scams thrive on urgency.

Understanding the Bigger Picture — Consumer Behavior and Loyalty

Let’s get real for a minute. These switching bonuses can be a goldmine if used wisely — but they don’t build financial loyalty.

According to Which?, over 60% of people who switch for a bonus switch again within 12 months. That means banks are fighting a retention war.

For consumers, that’s an opportunity:

- You can rotate through bonuses (legally) as long as you meet the terms.

- It’s like earning an interest-free side hustle if you’re organized.

- But beware of closing accounts too early — some banks share internal data to block “bonus hoppers.”

Expert Advice: How to Maximize the Bonus Safely

- Read the fine print. Always download the official PDF terms.

- Keep proof of actions. Save emails and screenshots showing your deposit, Direct Debits, and switch confirmation.

- Automate your switch. Use the CASS portal to avoid human errors.

- Track your reward. If it doesn’t arrive within 10 days, contact Nationwide with documentation.

- Compare other offers. You might earn more with NatWest or HSBC.

What Happens Behind the Scenes: The Economics of a Bonus

When a bank gives you £175, they’re betting you’ll:

- Stay long enough for them to earn it back through account fees, overdrafts, or product upsells.

- Keep money parked in the account, which boosts their liquidity ratio.

- Potentially take other products — credit cards, savings, mortgages.

To them, £175 is a customer acquisition cost, just like advertising.

Regulation and Protection

The good news? These offers are strictly regulated.

- The Financial Conduct Authority (FCA) monitors switching transparency.

- The Current Account Switch Guarantee protects you against payment loss or delays.

- Every bank participating in CASS is vetted for compliance and consumer protection.

So, if you switch via legitimate channels, your money — and your data — are safe.

Huge Mortgage Savings in November? UK Households Could Cut £9,700 in Interest—Don’t Miss Out

£416 Monthly Loss Confirmed by DWP; What Every Family in the UK Must Do Before It’s Too Late

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check