Massive Mortgage Relief This November: If you’ve seen headlines like “Massive Mortgage Relief This November” and wondered whether it’s just another piece of financial clickbait or something real—good news: there’s actual weight behind it. With interest rates starting to settle and lenders launching more competitive mortgage products, many UK homeowners are now in a position to save thousands of pounds over the life of their loan. But here’s the catch: this isn’t a cash handout or a government program. It’s about being financially smart, acting at the right time, and using the current market conditions to your advantage. The £9,700 figure you’re seeing is not guaranteed—but for many households, it’s entirely achievable, and in some cases, people can save even more.

Table of Contents

Massive Mortgage Relief This November

Massive Mortgage Relief This November isn’t about free money. It’s about making informed financial choices in a favorable market. For many households, switching to a lower mortgage rate could mean thousands of pounds saved over the life of their loan, increased financial stability, and breathing room in monthly budgets. With the Bank of England base rate stable, inflation cooling, and lenders competing hard for customers, now is a powerful moment to act strategically. Check your deal, compare your options, and—if the numbers work—lock in a better rate before the market shifts again.

| Key Highlights | Details |

|---|---|

| Potential Savings | Up to £9,700 in interest over the loan term |

| Why Now | Base rates are stable, and lenders are offering competitive remortgage deals |

| Who Benefits Most | Homeowners with expiring fixed-rate mortgages or high SVRs |

| When to Act | November 2025 |

| Average UK Mortgage | £193,000 (UK Finance) |

| Official Resource | Bank of England |

A Quick Look Back: How We Got Here

The UK mortgage market has been through a roller coaster over the past few years.

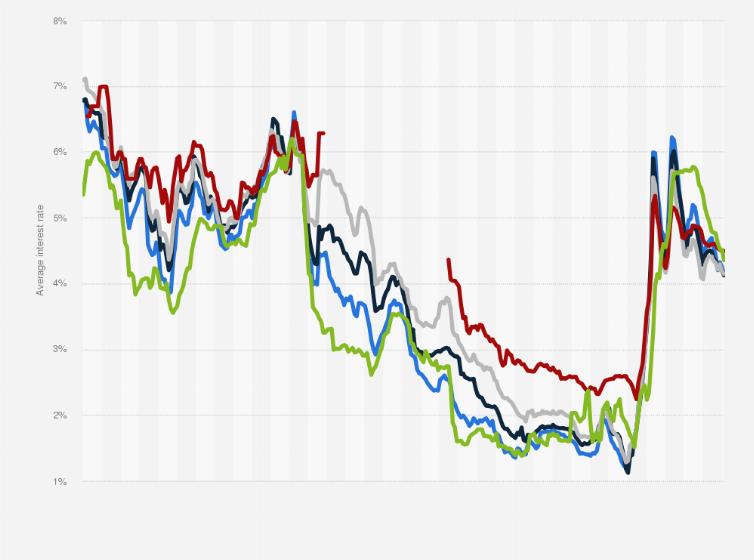

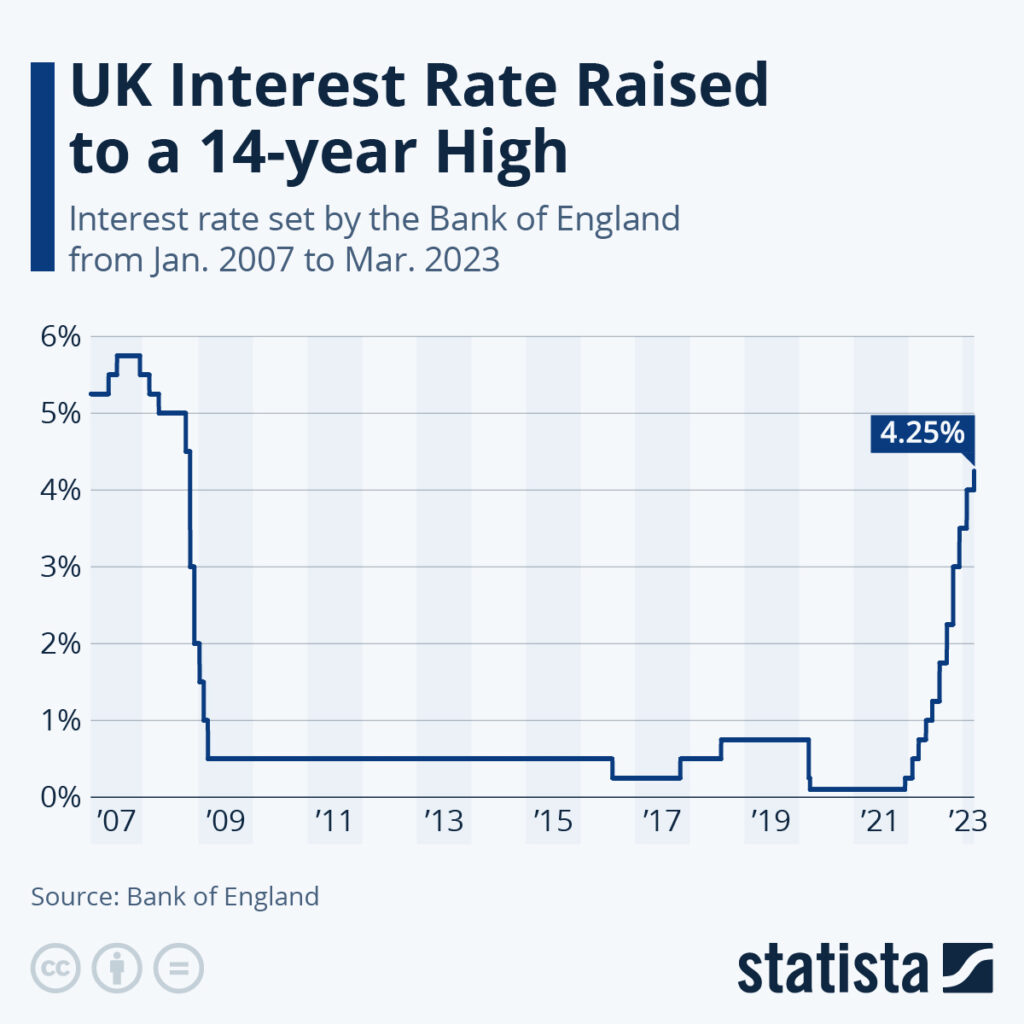

During the pandemic (2020–2021), the Bank of England base rate was cut to record lows—0.1% at one point. This meant homeowners could secure mortgages at incredibly low fixed rates, sometimes below 2%. But by mid-2022, inflation began surging, driven by energy price shocks, global supply chain issues, and broader economic pressures.

To tame inflation, the Bank of England increased the base rate multiple times, peaking at 5.25% in 2023. Mortgage rates climbed sharply, leaving many borrowers on variable or expiring fixed-rate deals facing steep jumps in their monthly payments. For some households, that meant hundreds of pounds more each month.

Fast forward to late 2025: inflation has moderated, the base rate has stabilized around 4%, and mortgage lenders are competing aggressively again. This period of relative stability has opened a window for homeowners to remortgage or switch products at better rates, which is where those eye-catching savings numbers come from.

What “Massive Mortgage Relief” Actually Means?

The term “mortgage relief” can be misleading. It doesn’t mean the government is writing off debts or handing out cash. Instead, it refers to financial opportunities created by changing interest rates and market conditions.

In practical terms, this usually involves:

- Switching to a lower interest rate with your current or a new lender.

- Remortgaging before or at the end of your fixed-rate term to avoid expensive standard variable rates (SVR).

- Making overpayments to reduce your balance and total interest costs over time.

For example, if you currently pay 6.5% interest and refinance to 4.5%, the difference over 20 years can be substantial.

Example Scenario

| Factor | Old Deal | New Deal |

|---|---|---|

| Mortgage Balance | £200,000 | £200,000 |

| Interest Rate | 6.5% | 4.5% |

| Term | 20 years | 20 years |

| Monthly Payment | £1,491 | £1,265 |

| Total Interest | £157,840 | £139,760 |

| Total Savings | — | £18,080 |

Even after factoring in remortgaging costs (around £1,000), you could save more than £17,000 over the life of the mortgage. For many borrowers with smaller balances or shorter terms, the savings might be closer to £9,000–£10,000, but it’s still significant money that stays in your pocket.

Why Massive Mortgage Relief This November Is a Key Opportunity?

Timing is everything in finance. Lenders are currently under competitive pressure to attract new borrowers and retain existing ones. November often sees end-of-year mortgage deals and rate adjustments before the financial year closes.

There are three major reasons this November stands out:

- Stable Base Rate: The Bank of England has kept the base rate steady for several months, creating more predictable borrowing costs.

- Lender Competition: With inflation cooling and funding conditions easing, lenders are cutting rates to win customers.

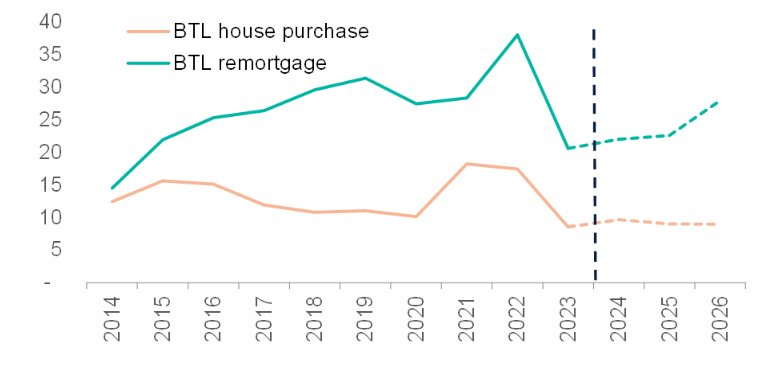

- Expiring Fixed Deals: A large wave of fixed-rate deals from 2020 and 2021 are ending in 2025, meaning many borrowers are now looking for new deals. Lenders want that business.

This combination has led to some of the most competitive fixed-rate remortgage offers since before 2022.

Step-by-Step Guide: How to Check If You Qualify for Massive Mortgage Relief This November

Step 1: Know Your Current Deal

Pull out your mortgage documents or log into your lender’s portal. You need to know your interest rate, remaining balance, term left, and whether early repayment charges apply.

Step 2: Check Your Loan-to-Value (LTV)

Your LTV is the percentage of your home’s value that’s covered by your mortgage. Lower LTVs get better deals.

- Below 60%: Best rates available.

- 60–80%: Competitive rates.

- Above 80%: Fewer options, but still possible.

You can calculate it by dividing your mortgage balance by your home’s estimated value.

Step 3: Review Your Credit Health

Lenders will assess your creditworthiness. You can check your score for free with Experian or other credit agencies.

A better score can mean lower interest rates.

Step 4: Shop Around

Don’t just call your bank. Use mortgage brokers and comparison websites like MoneySavingExpert or Compare the Market. A broker can often access exclusive deals not shown online.

Step 5: Run the Numbers

Use an online mortgage calculator like MoneyHelper to see what you could save by switching.

Step 6: Consider Overpayments

Even small extra payments—say £100 a month—can knock years off your mortgage and save thousands in interest.

Step 7: Lock in Quickly

Once you find a good deal, act. Mortgage rates can change weekly, and what’s available now might not be there in a month.

Risks and Red Flags to Watch Out For

While the opportunity is real, mortgage refinancing isn’t without pitfalls. Understanding the risks ensures you don’t turn savings into costly mistakes.

- Early Repayment Charges: If your fixed-rate deal hasn’t ended yet, switching might cost you thousands. Always calculate whether the savings outweigh the penalty.

- High Arrangement Fees: Some deals advertise ultra-low rates but come with expensive fees. Look at the total cost over the term, not just the headline rate.

- Credit Score Impact: Applying for multiple deals in a short time can lower your credit score. Be strategic.

- Scams and Unregulated Lenders: Stick to FCA-regulated lenders.

- Unrealistic Expectations: Not everyone will save £9,700. Your savings depend on your balance, rate, term, and fees.

Why It Matters for the Broader Economy?

This mortgage relief opportunity doesn’t just affect homeowners—it can also influence the wider economy. When people pay less in interest, they have more disposable income to spend elsewhere, which can stimulate local businesses and services.

For landlords and property investors, lower mortgage costs can improve profitability or give them the flexibility to hold rents steady, which benefits tenants, too.

For small business owners, freeing up personal cash flow can mean more capital to invest in their business, build reserves, or expand operations.

Expert Insight: What the Analysts Are Saying

Financial analysts and economists have been vocal about the significance of this moment in the mortgage market:

“This period feels similar to 2014–2016 when rates leveled off after a spike. Homeowners who refinanced then locked in thousands in savings.”

— Sarah Connors, Mortgage Analyst at UK Property Insight.

“The mortgage market has finally reached a phase of calm after stormy years. For disciplined borrowers, this is a golden window to secure stability.”

— James Patel, Senior Economist, London.

Their advice aligns with what many mortgage advisers are saying on the ground: act strategically and don’t wait too long.

Government and Regulatory Role

The Bank of England sets the base rate, which directly influences mortgage rates. While the government doesn’t hand out mortgage relief checks, the regulatory environment does play a key role in ensuring consumer protection and financial stability.

- The Financial Conduct Authority (FCA) oversees mortgage lending standards.

- The Bank of England influences rate trends.

Understanding this landscape is crucial—especially for borrowers considering fixed deals of 2, 5, or 10 years. Policy decisions can influence rates in the future.

Mortgage Glossary (Simple Definitions)

- LTV (Loan-to-Value): How much you owe compared to your property’s value.

- Fixed Rate: Your interest rate stays the same for a set period.

- Variable Rate: Your interest rate can go up or down with the market.

- Remortgage: Switching your mortgage to a new deal, often with a different lender.

- Base Rate: The Bank of England’s key interest rate that affects borrowing costs.

- Equity: The portion of your home you actually own.

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

Huge Mortgage Savings in November? UK Households Could Cut £9,700 in Interest—Don’t Miss Out

UK Homeowners Could Save £9,700 This November; Here’s How to Slash Your Mortgage Interest Fast

Final Tips from Mortgage Professionals

- Start Early: Don’t wait until your fixed deal expires to shop around. Many lenders allow you to secure a new deal up to six months in advance.

- Compare Total Costs: Look beyond the interest rate and consider fees, charges, and flexibility.

- Seek Professional Advice: A good mortgage adviser can save you time and money.

- Don’t Rush, But Don’t Stall: Rates can shift, so once you find a great deal, move quickly.