Lloyds Bank Is Giving Customers £200: Looking to switch banks and get a little extra cash in your pocket? Well, Lloyds Bank has rolled out a £200 switching bonus that could be yours if you open a Club Lloyds or Lloyds Premier current account and switch before November 12, 2025. This offer is all about making banking easier, rewarding, and, well, a bit more fun. Switching banks might have seemed like a hassle back in the day, but Lloyds is here to change the game with a smooth, reliable service and some sweet perks to boot. Whether you’re a payday pro or just looking for a better home for your hard-earned money, this guide breaks down everything you need to know about this offer—from eligibility and the switching process to what benefits you get beyond the £200.

Table of Contents

Lloyds Bank Is Giving Customers £200

Switching your current account to Lloyds Bank by November 12, 2025, could land you a £200 bonus alongside a suite of benefits tailored to your lifestyle and financial needs. With a simple, stress-free switching process backed by reliable customer support and innovative features, Lloyds makes moving your money easier than ever. From fee-free worldwide spending to cashback and exclusive perks, Lloyds Bank is positioning itself as a go-to for savers, spenders, and investors alike. Don’t miss out on this chance to boost your finances and experience next-level banking.

| Feature | Details |

|---|---|

| Offer | £200 cash bonus for switching account |

| Eligible Accounts | Club Lloyds, Club Lloyds Silver, Club Lloyds Platinum, Lloyds Premier |

| Switch Deadline | November 12, 2025 |

| Switch Process Time | About 7 working days |

| Account Fees | Fees vary from £5 to £22.50 monthly (refunded on meeting pay-in conditions) |

| Overdraft Offer | Interest-free arranged overdraft for 3 months (subject to approval) |

| Eligibility | Minimum 3 active direct debits; no previous Lloyds switch bonus since April 2020; new switch required |

| Other Benefits | Fee-free worldwide spending, cashback, travel booking, 12-month Disney+ subscription |

| Official Resource | Lloyds Official Website |

What’s this Lloyds Bank Is Giving Customers £200 Offer All About?

Lloyds Bank wants to entice new customers to jump ship from their current banks by rewarding them with a £200 bonus when they switch to certain Lloyds accounts—the Club Lloyds or Lloyds Premier accounts. The best part? There’s no catch, no hoops to jump through, just a straightforward switch that will add some cash to your wallet within 10 working days of completing the switch.

Switching can sometimes sound like a headache because, well, nobody wants to juggle payments and bills during the hustle. Lloyds has simplified this with its Current Account Switch Service, designed to take the stress off your shoulders by moving all your payment arrangements, salary deposits, and direct debits over to the new account. Plus, if any payments accidentally go to your old account, Lloyds automatically redirects them so you won’t miss a dime.

Who Qualifies for the £200?

To snag the cash, you’ll need to:

- Switch from another bank or building society using the Current Account Switch Service.

- Open a new Club Lloyds, Club Lloyds Silver, Club Lloyds Platinum, or Lloyds Premier account.

- Have at least 3 active direct debits on your new account.

- Not have received a Lloyds bank switch bonus since April 2020.

- Make sure the switch is completed before November 12, 2025.

If you already bank with Lloyds but want to switch your current account from elsewhere, you can do that via their mobile app—but only new eligible account openings count toward this offer, not just upgrading or switching between Lloyds accounts.

Breaking Down the Eligible Accounts and Their Features

Club Lloyds

The Club Lloyds account is a fan favorite, with perks aimed at rewarding everyday banking. Highlights include:

- Club Lloyds Monthly Saver paying 6.25% gross/AER on monthly savings between £25 and £400.

- Fee-free debit card spending worldwide.

- Lifestyle extras such as Disney+ (Standard with ads, for 12 months), cinema ticket deals, and coffee club memberships.

- Access to everyday cashback offers at popular retailers.

- Save the Change® feature rounds up purchases to the nearest pound, transferring the extra change to savings automatically.

Club Lloyds Silver & Platinum

For those seeking extra coverage, these accounts include:

- Family travel insurance covering Europe and UK (Silver, up to age 65) or worldwide (Platinum, up to age 80).

- AA Breakdown Family Cover with roadside, at home, and national recovery services.

- Mobile phone insurance.

- Monthly fees: £11.50 plus £5 Club Lloyds monthly fee for Silver; £22.50 plus £5 Club Lloyds monthly fee for Platinum. Fees are refunded if you pay in £2,000 or more monthly.

Lloyds Premier

Lloyds Premier caters to customers with higher income or saving balances:

- Monthly fee of £15, refunded if monthly pay-in of £5,000 or more or savings/investments of £100,000+ are maintained.

- 1% cashback on eligible debit card spending, up to £10 monthly.

- Bupa Family GP & wellbeing subscription for accessible remote healthcare.

- Preferential mortgage rates and better savings bonuses.

- Financial coaching services, including tailored investment portfolios with zero fees for the first year.

- Access to the Premier Planning Hub for wealth forecasting and net worth tracking.

- Dedicated Premier servicing team for personalized support.

How to Switch Your Account (Step-by-Step)?

Switching to Lloyds is designed to be simple and quick — here’s how the typical 7 working days usually break down:

- Day 1: You initiate the switch. Lloyds contacts your old bank to start the transfer.

- Day 2: Lloyds confirms your old bank received the request, and transfers for direct debits and payments begin.

- Days 3-5: Payment arrangements finalize, prepping your new account.

- Day 6: Cover any debit balance from your old account if applicable.

- Day 7: Switch completes; your old account is closed, and funds move to your Lloyds account.

The Current Account Switch Service guarantees complete transfer of all payments and closes your previous account automatically. If any payments come through to your old account, Lloyds redirects them to your new one.

What About Overdrafts?

Not to worry if you sometimes dip into your overdraft. Lloyds offers an interest-free overdraft for the first 3 months after switching, subject to approval. Conditions include:

- Using the Current Account Switch Service.

- Not having used a similar interest-free overdraft offer in the past 12 months.

- Being approved for an overdraft on your new account.

This feature helps cushion any short-term cash flow issues as you settle into your new account.

Security and Customer Support You Can Rely On

Your financial security is paramount. Lloyds deploys advanced encryption and fraud detection systems to guard your money and details during and after the switch.

Moreover, their friendly customer service team is available to help with questions or concerns anytime — over the phone, online, or through their app. Biometric authentication and app security features give you easy but secure access to your account on the go.

What Else Makes Lloyds Stand Out?

Beyond the bonus, Lloyds offers:

- Fee-free worldwide debit card spending with no hidden charges.

- A travel booking feature in the Lloyds app allowing you to book flights and hotels with a ‘Best Price’ guarantee.

- Lifestyle perks including cinema tickets, Disney+ streaming, coffee memberships, and cashback.

- A user-friendly app experience designed for banking convenience.

- Flexible savings options integrated with your current account.

Real Life Feedback and Why This Offer is Hot

Many customers highlight how seamless the switching process is, with the bonus acting as a welcome extra. Users appreciate the ongoing perks like cashback, free travel insurance, and Netflix-style entertainment offers included in accounts like Club Lloyds.

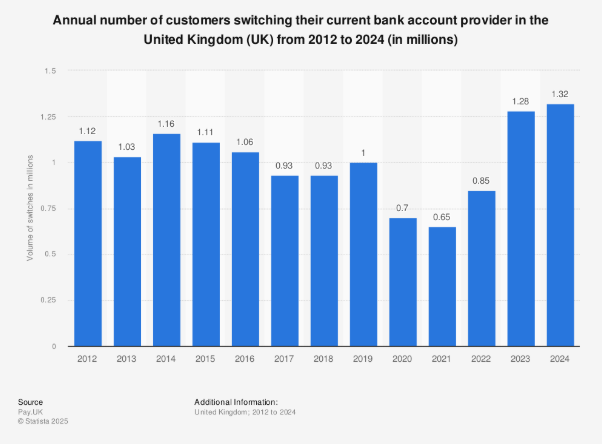

Industry experts call this one of the most generous current account switch incentives available in the UK this year, especially in an era where switching banks is easier and more beneficial than ever.

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

How to Save £9,700 on Your Mortgage in November; The Secret UK Lenders Don’t Want You to Know

Why Switch to Lloyds Bank Now?

Between the £200 cash incentive, easy switching process, and ongoing perks, Lloyds Bank offers a compelling reason to revisit your banking relationship. Their account options cater to a range of financial lifestyles, from budget-conscious savers to high-net-worth clients looking for premier services.

If you want straightforward banking with no hidden catches, flexible benefits, and a reward to sweeten the deal, now’s the perfect time to switch. Remember, the offer ends on November 12, 2025, so the sooner you act, the better.