Labour’s £45m Pension Plan Sparks Outrage: If you’ve scrolled through the news lately, you’ve probably seen headlines screaming about Labour’s £45 million pension plan—and that you, dear taxpayer, are picking up the tab. Sounds unfair? A lot of Brits think so. The plan has become the hot-button issue this fall, hitting a nerve among citizens already juggling stubborn inflation, high mortgage rates, and an upcoming budget that could pinch even harder. Let’s break this story down—why it’s controversial, how it affects ordinary people, what the government says it’s trying to do, and what experts suggest for protecting your retirement.

Table of Contents

Labour’s £45m Pension Plan Sparks Outrage

Labour’s £45 million pension revival may be legally sound and rooted in fairness, but politically, it’s a lightning rod. With taxpayers footing the cost, private schemes tightening belts, and the economy teetering on deficit edge, timing couldn’t be worse. As the country inches toward November’s Budget, pension policy remains the battleground between government credibility and public trust—a debate far from over.

| Topic | Details |

|---|---|

| Policy Name | Labour’s £45 Million Councillor & Mayor Pension Plan |

| Estimated Annual Cost | £40–45 million |

| Who Pays | Taxpayers (via council funding and national transfers) |

| Scheme Type | Local Government Pension Scheme (LGPS) – Defined Benefit |

| Contribution Range (2025/26) | 5.5%–12.5% of pensionable pay (Source: LGPS Member Guide 2025) |

| Government Department | Department for Housing & Local Government |

| Public Response | Criticism over “gold-plated” pensions for politicians |

| Council Tax Impact | Forecast + £9.4 billion by 2029 |

What Exactly Happened?

This summer, Labour quietly announced plans to reinstate pensions for councillors and mayors, a benefit scrapped in 2014 by the Conservative government. Under the new move, local officials will again be allowed into the Local Government Pension Scheme—a secure plan guaranteeing inflation-linked lifetime income.

The twist? The estimated price tag—£45 million per year—won’t be funded by new revenue. Instead, existing taxpayer money will cover it. So even though councillors will now enjoy reliable retirement security, the funding pool comes straight from ordinary people’s wallets.

Why Labour’s £45m Pension Plan Sparks Outrage?

Opponents call this rollout tone-deaf. The nation’s cost-of-living crunch shows no mercy, private pensions are underperforming, and the government’s Autumn Budget (Nov 26) could introduce new tax hikes. So naturally, many see this as political self-rewarding at public expense.

And timing matters. The controversy dropped the same week the Pension Protection Fund (PPF) announced a £45 million “zero levy” break for private employer pension schemes. While public budgets stretch to fund councillors, private DB (defined-benefit) sponsors are literally saving the same sum thanks to government reforms. That comparison didn’t go unnoticed.

Throwback: Why Pensions Were Scrapped in 2014

A decade ago, councils argued that paying pensions to elected officials blurred the line between public service and personal benefit. When local government allowance budgets ballooned, critics claimed council membership was becoming a career, not a civic duty.

So, in April 2014, then-Communities Secretary Eric Pickles axed councillor pensions, emphasizing “transparency and fairness.” That policy reportedly saved taxpayers £7 million annually.

Now Labour is effectively hitting “undo”—with a six-times larger annual price tag.

The Hidden Cost for Taxpayers

Labour hasn’t introduced any new funding stream for the plan. That means:

- Councils must finance pensions from existing budgets.

- If local surpluses don’t stretch, they’ll resort to raising council tax or cutting local services.

- The Treasury is already struggling to find £30 billion in offset savings ahead of the Autumn Budget.

Combine those realities, and it’s easy to see public frustration. The optics are brutal—premium pensions for politicians, belt-tightening for citizens.

Understanding the LGPS: What Makes It “Gold-Plated”

Here’s a quick plain-English primer on how the Local Government Pension Scheme (LGPS) works:

- It’s a defined-benefit plan, meaning payouts are guaranteed by law.

- Benefits rise each year with the Consumer Price Index (CPI).

- Members contribute based on salary: typically 5.5% to 12.5% of pay.

- Employers (i.e., councils) cover the rest.

For comparison, a normal private-sector worker depends on market-linked pension pots that may shrink during recessions. That’s why people call LGPS pensions “gold-plated.”

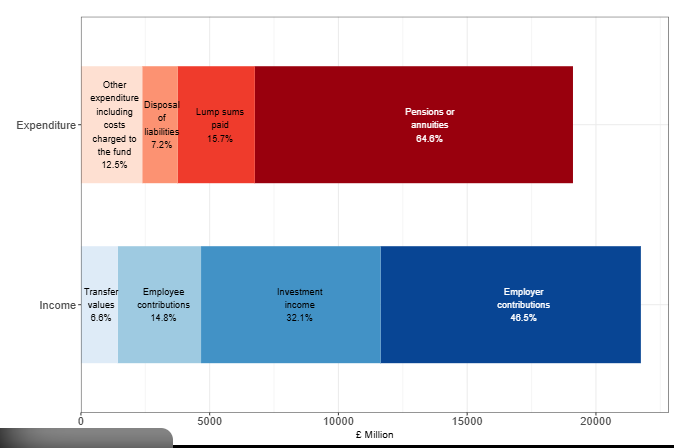

Latest Data on LGPS

As of April 1, 2025, the LGPS includes 77 pension funds in England and 8 in Wales. It’s one of the UK’s largest pension schemes, covering over 6 million members. Market value of LGPS funds reached £402.3 billion as of March 2025, growing 2.7% compared to the previous year.

Annual pension payments will increase by 1.7% from April 7, 2025, aligned with inflation measures to maintain retirees’ spending power.

Members’ contribution rates vary between 5.5% and 12.5% based on salary bands, with options to pay less through a 50/50 section during tough financial times while building lower pension benefits. Members also can exchange part of their pension for a tax-free lump sum on retirement.

This robust scheme contrast with private pensions’ volatility and offers substantial security—key reason why reinstating councillor access sparks debate about affordability.

The Bigger Picture – Labour’s Pension Reform Agenda

The £45 million councillor pension scheme arrives amid a flurry of broader pension reforms. Chancellor Rachel Reeves is pushing a new Pension Schemes Bill 2025, designed to unlock more capital from pension funds for domestic investment.

Highlights include:

- Allowing companies to tap into surplus funds in well-funded defined-benefit schemes.

- Establishing commercial “superfunds” to consolidate pensions and improve efficiency.

- Phasing in auto-consolidation for small defined-contribution pots, helping workers keep fewer scattered accounts.

Supporters say it boosts UK growth. Critics warn it weakens long-term pension safety nets—potentially trading retirement security for short-term fiscal breathing room.

Reeves’s Balancing Act – “Don’t Raid Pensions”

The Institute for Fiscal Studies (IFS) has cautioned the Treasury against “raiding pensions” to fill its £30–50 billion budget hole. The chancellor has pledged not to spike taxes on working families, but experts fear creative accounting—trimming pension reliefs or freezing personal allowances—could sneak into the November Budget.

In short, pension policy has become the go-to political piggy bank.

The PPF’s £45 Million Paradox

Meanwhile, the Pension Protection Fund (PPF)—the UK body protecting members of failed pension schemes—announced it’s dropping its annual levy to zero for 2025–26. This decision saves private employers about £45 million collectively, nearly the same cost as Labour’s new councillor pensions.

PPF Chair Kate Jones said the move proves “financial self-sufficiency” has been achieved after nearly 20 years. Still, critics compare the two numbers as ironic opposites—private schemes relieved, public coffers burdened.

Why This Matters to Your Wallet?

Even if you aren’t a councillor (and chances are, you’re not), these changes shape the financial ecosystem you live in:

- Rising council spending trickles down through service fees and local tax bands.

- Shifts in national pension policy could redefine how much future retirees receive versus contribute.

- Budget shortfalls risk policy trade-offs—fewer benefits, more taxes, or both.

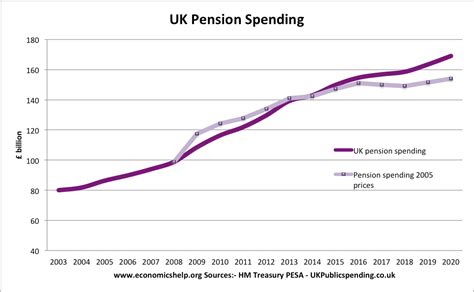

For context, the state pension age might rise toward 80 years by 2070 unless massive reforms happen. That’s the scale of the crisis policymakers are juggling.

Expert Takes – “Good Idea, Wrong Time”

Independent pensions consultant John Ralfe calls Labour’s decision “symbolically tone-deaf.” While he acknowledges councillors deserve fair compensation, Ralfe argues it “shouldn’t happen when inflation-linked benefits for pensioners are capped below CPI.”

Meanwhile, the Society of Pension Professionals urges Parliament to tie future councillor pensions to strict funding benchmarks rather than automatic guarantees.

Labour defends the policy, claiming council participation will remain optional. But transparency campaigners worry that peer pressure or political precedent will draw most councils in—echoing pre-2014 uptake patterns.

Practical Advice – How to Track and Protect Your Pension

Whether you’re a public employee, private worker, or self-employed, here’s how to stay ahead:

Step 1: Check Your Pension Scheme Status

Go to lgpsmember.org (for public-sector workers) or log in to your private scheme provider’s portal. Knowing your funding ratio and indexation method gives peace of mind.

Step 2: Monitor the November Budget

Bookmark Gov.uk Budget Page. Expect new rules on pension tax relief and possible cap adjustments.

Step 3: Diversify Retirement Savings

American-style financial planners often say: “Never put all your eggs in one 401(k).” The UK equivalent is not depending solely on one government plan. Explore ISAs, SIPPs, or workplace opt-ins to spread long-term risk.

Step 4: Engage Your Local Councillor

Ironically, the people gaining pensions from this decision represent you. Email or attend town-hall meetings to ask if your council plans to opt in, and how they’ll offset the cost.

The Road Ahead – Labour’s Tightrope

Pension policy may seem dry, but it sits at the crossroads of politics, economics, and generational fairness. The revived LGPS access for councillors symbolizes a deeper tension in UK governance: Who gets to feel secure in retirement, and who pays for it?

If history is any clue, this story will keep evolving. Expect:

- Further backlash as tax bills land early 2026.

- A public pensions commission relaunch, already in motion since July 2025 to study long-term reforms.

- Heated debate before Rachel Reeves’s first full-year fiscal review in 2026.

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules

New DWP Rule Triggers £416 Monthly Cut – UK Families Urged to Check Payments Immediately

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone