Keir Starmer Confirms New Cost-of-Living Payments: In 2025, faced with skyrocketing living costs, Keir Starmer’s government has introduced new cost-of-living payments aimed at easing financial pressures on millions of UK low-income households. These payments, targeted at those receiving means-tested benefits, are designed to help families stay afloat amid soaring energy prices, food inflation, and everyday expenses. Understanding these payments matters both for individuals relying on government aid and professionals monitoring welfare programs. This article dives into the nuts and bolts of these payments, eligibility criteria, timelines, and practical tips, all explained simply but with expert insight to give clarity and confidence.

Table of Contents

Keir Starmer Confirms New Cost-of-Living Payments

Keir Starmer’s 2025 cost-of-living payments provide critical help to millions of UK families facing enduring financial hardship. Through a combination of automatic DWP payments totaling up to £500 and a £200 locally administered Household Support Fund, the government aims to ease pressure on those most affected by inflation, high energy bills, and rising food prices. To maximize benefits, stay informed via official channels, update your benefit status, and connect proactively with local councils. Coupling financial aid with practical money management can make life more manageable during these tough times.

| Aspect | Details |

|---|---|

| Total Payment Amount | Up to £500 paid in multiple instalments during 2025 |

| Payment Schedule | First instalment March-May 2025; subsequent instalments later in the year |

| Eligible Households | People receiving Universal Credit, Pension Credit, Income Support, others |

| Additional Support | Extra help for disabled, carers, medically dependent households |

| Local Council Involvement | £200 payment via Household Support Fund, distributed locally through councils |

| Energy Price Cap Impact | 7% reduction in July 2025 but bills remain high |

| Official Info Website | www.gov.uk |

The Background: Why Cost-of-Living Payments Are Needed in 2025

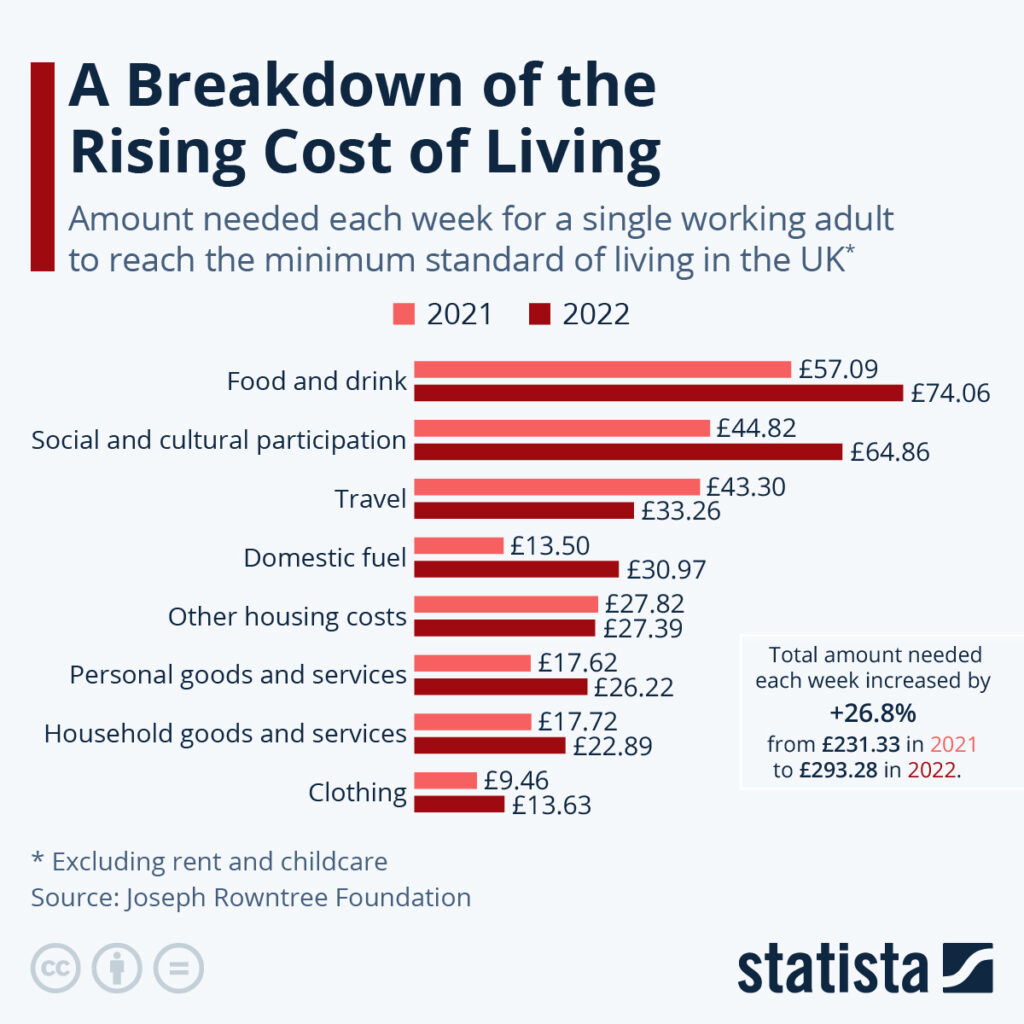

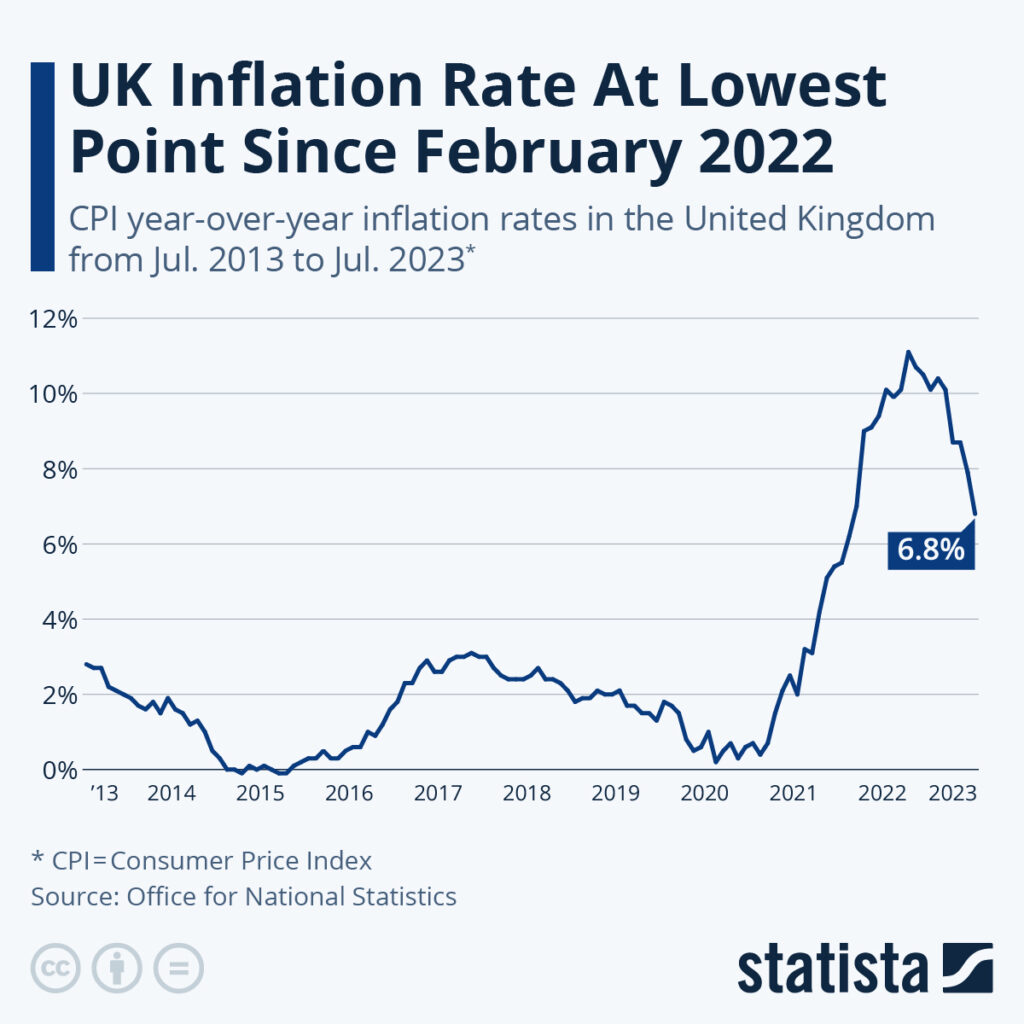

The UK has been grappling with a cost-of-living crisis since late 2021, driven by inflation rates that surged past 11% in 2022 and are still persistently high. By August 2025, inflation remained elevated at around 3.8%, with food prices increasing about 25% over the past four years. Energy bills have historically spiked, peaking with the energy price cap reaching £3,549 annually in late 2022 before governmental caps and recent 7% reductions in 2025.

Despite some inflation easing from the highs seen in 2022/2023, for many households—especially low-income families—prices remain painfully high relative to incomes. The average UK family now spends a disproportionately large chunk of their earnings on essentials like rent, energy, and groceries, resulting in a sharp decline in living standards for millions.

What Are the New Cost-of-Living Payments?

The government, through the Department for Work and Pensions (DWP), has announced a support package delivering up to £500 to eligible households in 2025, split into instalments throughout the year. These payments are automatic and require no application for those already receiving benefits.

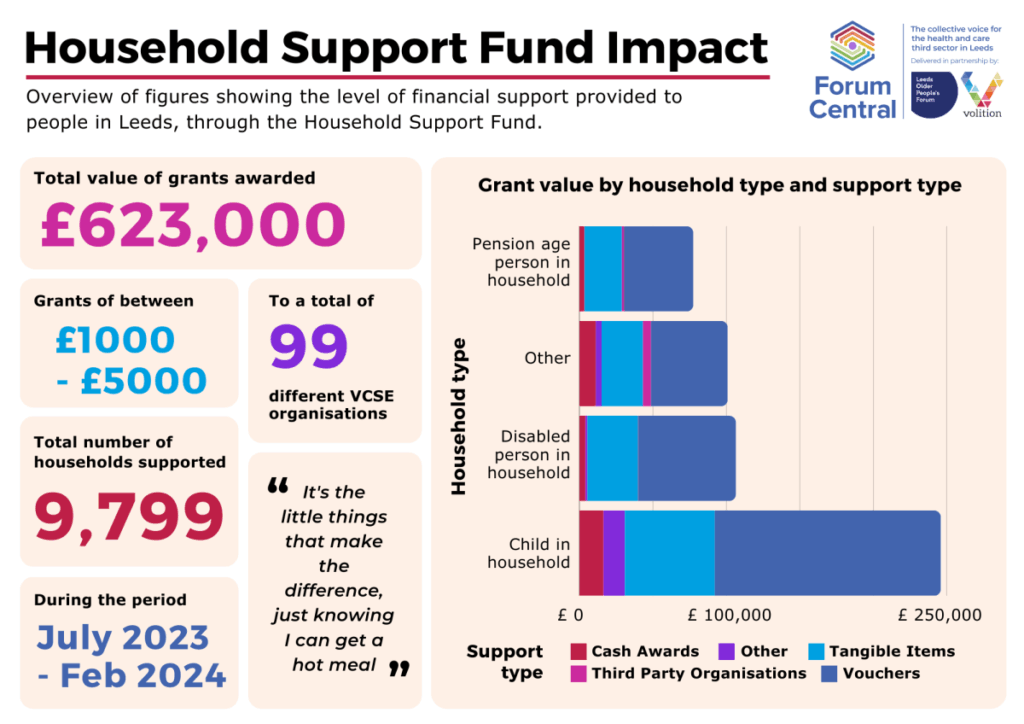

Along with this, local councils administer a £200 Household Support Fund, tailored to meet local needs. This fund provides additional support in forms like food vouchers, heating aid, or direct cash grants, depending on regional priorities.

Eligibility: Who Gets the Support?

To qualify for the main DWP payments, adults in the household must receive one or more of these benefits during the qualifying period:

- Universal Credit

- Pension Credit

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Working Tax Credit or Child Tax Credit

Additional payments target vulnerable groups such as:

- People on Personal Independence Payment (PIP), Disability Living Allowance (DLA), or Attendance Allowance

- Carers providing unpaid support to disabled relatives

- Households requiring extra energy for medical devices (e.g., oxygen machines)

The £200 Household Support Fund is managed locally, so eligibility and method of delivery vary depending on your council’s policies.

Payment Breakdown and Schedule

The £500 payment is staggered through three installments to help distribute relief strategically across periods of high expense:

| Instalment | Approximate Payment Period | Amount (part of £500 total) |

|---|---|---|

| First | March to May 2025 | Around £300 |

| Second | Summer 2025 | Partial balance |

| Third | Autumn to Winter 2025 | Remaining balance |

The £200 local Household Support Fund is available throughout the year until March 2026.

Economic Impact and Official Data

According to official statistics from the Office for National Statistics (ONS) in 2025, inflation remained steady at about 3.8% in August 2025, reflecting ongoing price pressures especially on food and energy. Around 57% of UK households reported increased living costs recently, with many reporting arrears in utility bills and struggles to afford basic items.

The Joseph Rowntree Foundation’s low-income tracker indicates over 7 million low-income families still go without essential needs, with food poverty and utility arrears alarmingly common. The situation is most acute for families with three or more children, where nearly 90% experienced hardship.

Despite interest rate reductions to 4.25% easing borrowing costs somewhat, significant rent price increases and lagging benefit upratings mean real disposable incomes for lower-income households remain flat or declining.

Real People, Real Stories

Take Sarah and Mike from Birmingham, a family on Universal Credit with two kids. “When that first payment came through in spring, it helped us fix the heating just before winter hit hard. It’s like a little life raft in a sea of bills,” Sarah shares. Anecdotes like this highlight how these payments can provide immediate, tangible relief for families struggling to keep up with costs.

How Local Councils Are Making a Difference?

Councils play a vital role through the Household Support Fund, interpreting regional needs and distributing emergency aid. Some councils provide supermarket vouchers, others assist with fuel bills, and others offer grants for urgent housing costs. Because funding varies by council, local outreach is crucial. Beneficiaries should contact their council early to maximize access.

Practical Tips to Manage Costs

Beyond government aid, managing the cost-of-living effectively can help families stretch every dollar:

- Energy efficiency: Use LED bulbs, unplug devices, and insulate windows to reduce bills.

- Smart grocery shopping: Plan meals, buy in bulk, and use store brands to save.

- Financial literacy: Know your benefit entitlements and explore debt advice if needed.

- Local resources: Food banks, charity assistance, and community grants can provide temporary relief.

How Does the UK Compare Internationally?

Unlike the UK’s targeted approach, which limits payments to benefit recipients and vulnerable households, the US has used broader stimulus checks that provided lump sums directly to most citizens during COVID-19. The UK’s method focuses on sustainability and efficiency, ensuring funds address the worst hardships without broad fiscal strain.

Extra £90 Cost of Living Help for UK Families – How & When You’ll Get It!

£150 Cost of Living Voucher Announced – Where & How to Spend It?

UK £200 Cost of Living Payment in 2025 – Check Payment Date, Eligibility, and Status Here