The Bank of England (BoE) will set interest policy on 6 November, with markets split on whether rates hold at 4.0% or fall again, and analysts say renewed competition in fixed-rate deals plus a potential cut could help UK borrowers reduce overall interest costs sometimes framed as savings approaching £9,700 over a mortgage lifetime by moving quickly to remortgage or overpay where appropriate, a claim that depends on loan size, term, and product choice according to lender data and expert forecasts.

Table of Contents

Huge Mortgage Savings in November

With the decision approaching, borrowers considering a switch should gather quotes and check overpayment leeway now, knowing that the headline savings depend on individual circumstances and that lenders may move quickly after the announcement. “It wouldn’t take much to stop that from happening,” one analysis said of a November cut, underscoring how sensitive the outlook remains to the next inflation prints.

Why November matters for mortgages

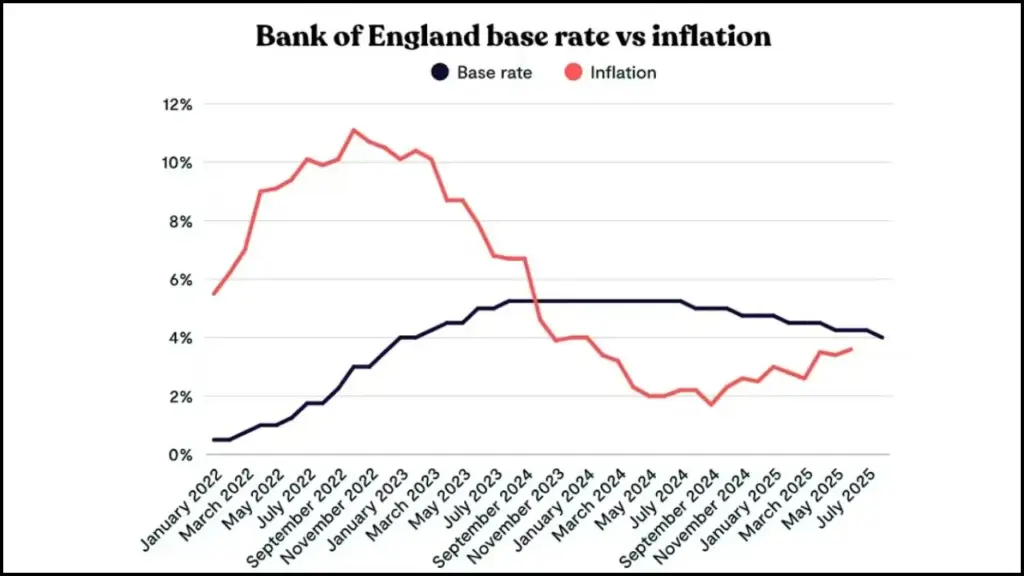

The Monetary Policy Committee meets in early November with two live options: hold at 4.0% to assess prior easing or cut to 3.75% if inflation and growth data allow, leaving lenders room to adjust pricing into year‑end. Markets still imply scope for at least one further quarter‑point reduction over the next several months, though path uncertainty and inflation dynamics limit confidence. Live coverage in August confirmed the base rate at 4.0%, the lowest in more than two years, creating the backdrop for gradual mortgage repricing.

What lenders are doing ahead of the decision

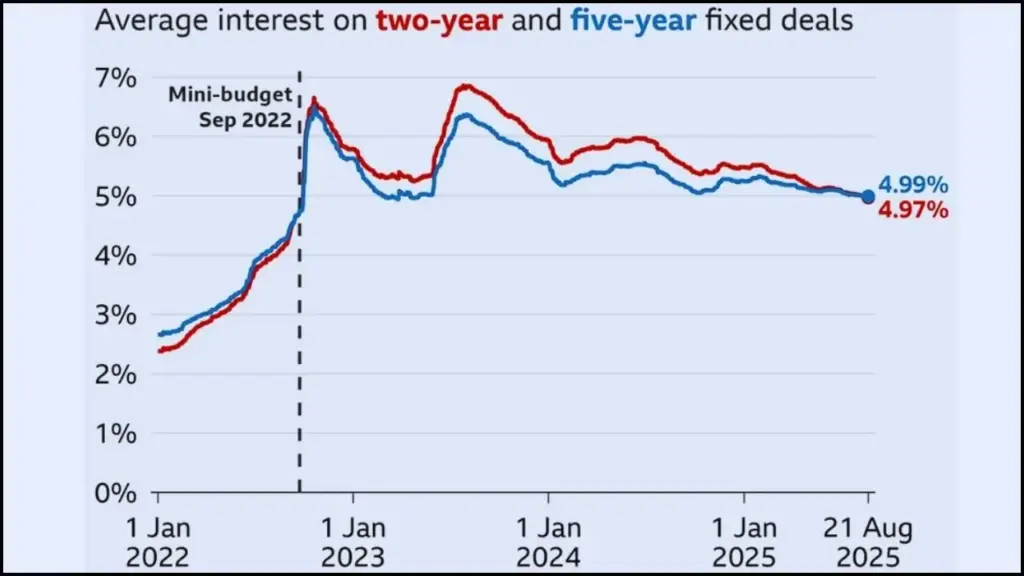

Pricing remains fluid, with some lenders trimming selected products while others pause or nudge rates higher, reflecting gilt moves and funding costs. This week’s averages edged up, with two‑ and five‑year fixes around 4.98% and 5.02% respectively, underscoring the day‑to‑day volatility borrowers face. Comparison services show best‑buy five‑year fixes near the low‑4% area in mid‑September, but not uniformly available across loan‑to‑value bands or borrower profiles.

Huge Mortgage Savings and the £9,700 claim what’s realistic?

Some consumer finance content has highlighted scenarios where disciplined overpayments and switching from higher fixed rates can reduce total lifetime interest by several thousand pounds, with examples citing figures near £9,700 on typical balances. Actual outcomes hinge on loan size, remaining term, initial rate, new product rate, and whether the borrower uses allowed annual overpayments without incurring penalties. Many mainstream lenders allow up to 10% of the outstanding balance to be overpaid annually during fixed terms, amplifying interest savings when rates are elevated.

How a November cut would flow through

Tracker mortgages move in lockstep with the base rate, so a 0.25 percentage point cut typically reduces monthly cost immediately, roughly £25 per month on a £200,000 balance. Standard variable rate (SVR) changes are discretionary, and lenders may not pass on the full base‑rate move, though competitive pressure can still drive partial transmission. Fixed‑rate borrowers will not see a change during their term, but new fixed deals could re‑price lower if market funding costs and rate expectations continue to ease.

Remortgaging from 2023 peaks: the arithmetic

Average two‑year fixes peaked near mid‑6% in 2023, and October 2025 averages are closer to the mid‑4% range, meaning some borrowers rolling off 2023 deals could secure several hundred pounds per month in savings, depending on balance and term. Illustrative analysis shows a £200,000, 30‑year loan paying about £1,260 per month at 6.47% versus roughly £1,016 at 4.52%, a monthly difference near £244 that compounds into substantial multi‑year interest reduction. The BoE’s base rate path underpins these shifts, but lenders set retail pricing based on broader wholesale conditions, so product rates can move ahead of or lag policy decisions.

What current averages say and what they do not

Two‑ and five‑year averages around 5% give a directional snapshot, but many borrowers will qualify for higher or lower offers based on equity, credit, and loan size. Some lenders have nudged select rates down as others push up, reflecting mixed signals in inflation and funding markets rather than a one‑way decline. Best‑buy five‑year fixes near 4.00% earlier in the autumn show how quickly headline rates can move when markets price faster easing, but availability is constrained and often time‑limited.

Consumer strategies: switching, timing, and overpaying

Experts and guidance sites emphasize shopping the market well before a fix expires, as many lenders allow booking a new deal up to six months in advance. Overpayment remains one of the most reliable tools to reduce total interest, particularly when permitted up to 10% annually without penalties on many fixed products. Households on SVRs should test whether moving to a new fixed or tracker could outperform partial and uncertain SVR pass‑through after any policy cut.

The role of inflation and growth data

Analysts warn that upside surprises in inflation releases could stay the BoE’s hand in November, while softer labor market and price data would support another step down. Current context includes inflation near the high‑3% range and a cooling economy, which together underpin the case for cautious easing if the trend persists. Market‑implied curves show expectations for rates to drift toward 3.75% over the next half year, but the path remains conditional on incoming data.

Quotes from officials and experts

BBC reporting in August quoted BoE leadership describing the forward path for rates as likely to continue lower but “more uncertain,” tempering expectations for a straight‑line descent. Independent analysis suggests the committee may have “enough ammunition” to cut again in November, while cautioning that an inflation surprise could reverse that call quickly. Personal finance analysts note that even with prior cuts, borrowers transitioning from ultra‑low pandemic‑era fixes may still see higher payments unless balances have been materially reduced.

Who benefits most if November brings relief

Tracker borrowers would see the most immediate impact on monthly cash flow if a cut is delivered, with savings scaling with balance size. Remortgagers moving off 2023 fixes could capture meaningful reductions versus their expiring rates, though current averages suggest savings may be moderate rather than dramatic for some profiles. Savers have experienced falling returns as base‑rate cuts filtered through deposit products, which can partly offset household‑level gains from lower mortgage costs.

Risks to the outlook

Lender funding costs, gilt yields, and risk appetite can override base‑rate direction in the short term, leaving advertised fixed rates volatile through year‑end. If inflation proves stickier than expected, the BoE could pause easing, reducing the scope for further mortgage repricing in the near term. Conversely, faster cooling could accelerate cuts, but lenders might prioritize margin rebuilding, delaying full pass‑through to headline mortgage deals.

How to approach the £9,700 figure with caution

The headline savings number is best treated as a scenario rather than a guarantee, derived from specific assumptions on balance, rate differentials, and consistent overpayments. Independent calculators and broker advice can validate household‑specific outcomes, and borrowers should confirm overpayment allowances to avoid early‑repayment charges. While competitive fixed deals and possible BoE easing create an opening, switching costs, fees, and affordability criteria must be weighed against projected interest savings.

What to watch next

The CPI release and labor data in the run‑up to 6 November are pivotal, as a surprise could sway the committee’s vote between holding and cutting. Market‑implied paths still point to rates easing toward 3.75% within months, but lenders’ week‑to‑week pricing will reflect wholesale costs as much as policy expectations. Newsroom trackers show some banks trimming while others hike, a pattern likely to persist until the policy signal and data trend are clearer.

FAQ on Huge Mortgage Savings in November

Will my fixed rate fall in November?

How fast do tracker mortgages respond?

Are average mortgage rates falling now?

Could rates stay at 4.0%?

Yes, analysts say a hold is plausible if inflation or wage data disappoints between now and the meeting.