How to Save £9,700 on Your Mortgage: You’ve probably seen headlines like “Save £9,700 on your mortgage this November” and thought, Yeah right, sounds too good to be true. But here’s the thing — it’s not magic, it’s math. With the right timing, strategy, and awareness, you could genuinely cut years off your mortgage and save thousands in interest.

This article breaks it all down, in plain English, so that anyone — from a 10-year-old to a seasoned financial planner — can understand exactly how it works. We’ll talk about mortgage timing, interest rates, overpayments, market trends, and even psychology — because your habits matter as much as your lender’s fine print. The key takeaway? You’re not stuck with your current deal. Smart homeowners act before lenders change the game.

Table of Contents

How to Save £9,700 on Your Mortgage

Saving £9,700 on your mortgage this November isn’t fantasy. It’s what happens when you combine awareness, math, and timing. Lenders count on inaction — most people simply let their deals expire and pay whatever rate they’re handed. By taking control — comparing rates, overpaying, negotiating, and timing your switch — you can flip that script. The difference between passive and proactive can easily run into five figures over your mortgage life. If you want to find out what your personal saving could be, grab your mortgage numbers (balance, rate, term, and fees), and plug them into a calculator. You might be closer to that magic £9,700 than you think.

| Topic | Data / Insight |

|---|---|

| Potential savings with smart remortgaging | Up to £9,700 or more depending on balance, rate, and term |

| UK total outstanding mortgages | ~£1.68 trillion (Q1 2025) |

| Arrears rate (missed payments) | 1.03% (Q1 2025) |

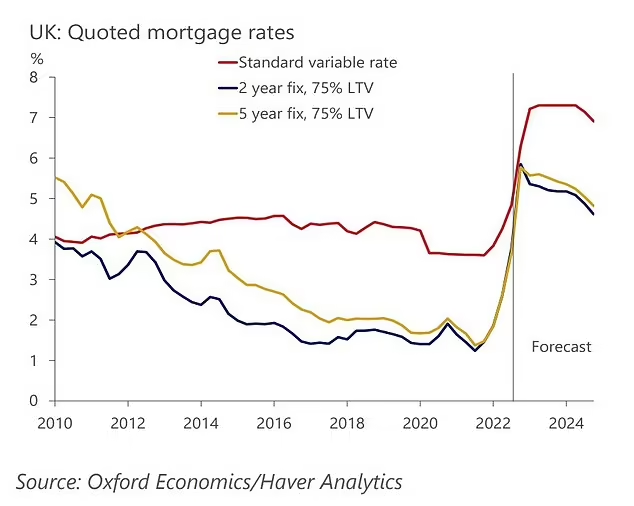

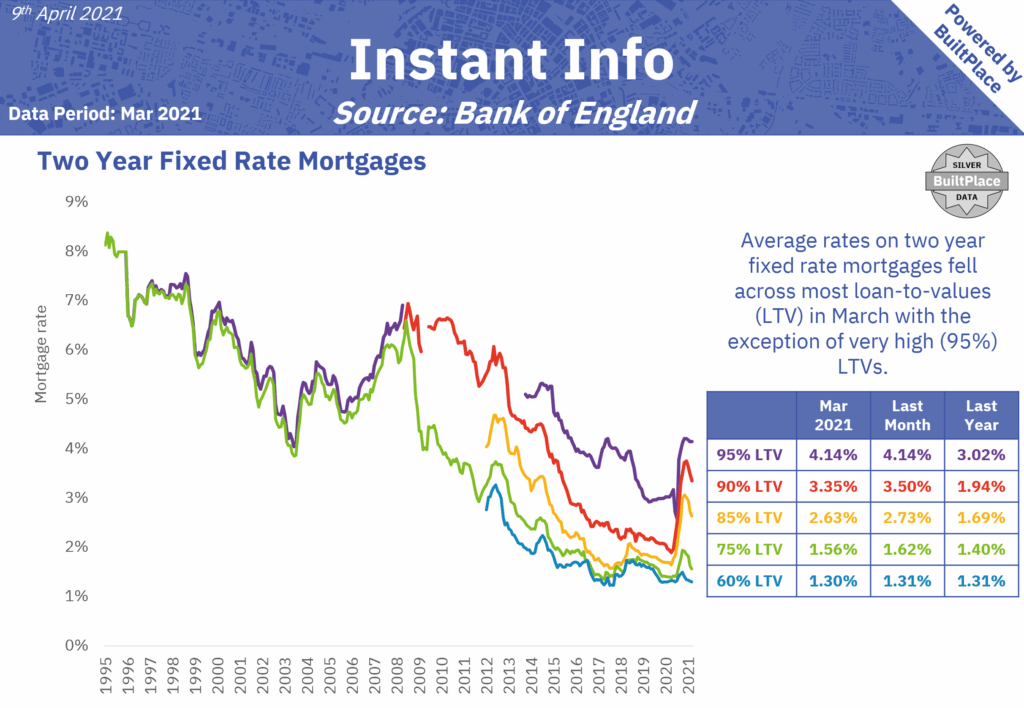

| Base rate trend | Expected to fall to ~3.75% by late 2025 |

| Forecast net lending growth | Set to double to 3.1% in 2025 |

| Average UK mortgage rate (Oct 2025) | 4.65% fixed for 2 years, 5.2% variable |

| Source | FCA Mortgage Lending Stats |

Why This November Could Be Your Best Shot To Save £9,700 on Your Mortgage?

The reason this “November saving” narrative exists has to do with timing. Each autumn, lenders reset or launch new mortgage products before year-end to hit their lending quotas. At the same time, the Bank of England’s monetary policy decisions affect interest rate expectations — and when cuts seem likely, competition spikes.

If you’re alert in November, you’re basically catching the sweet spot: when lenders are motivated, and before the market adjusts.

Market Context: The Calm Before the Cut

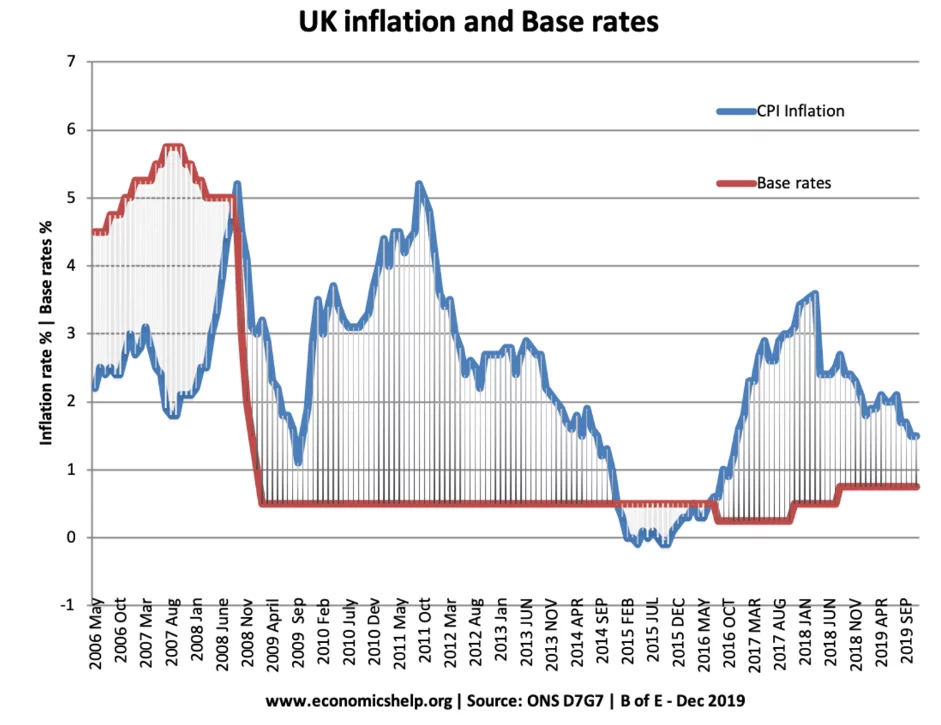

- The Bank of England base rate has remained steady around 4.0% since mid-2025.

- Inflation cooled slightly, giving analysts confidence in upcoming rate cuts.

- According to EY ITEM Club, net mortgage lending growth is expected to more than double in 2025 — meaning lenders want borrowers.

- Many are trimming fixed-rate offers to attract early movers before competitors catch on.

If you’re sitting on a mortgage with a rate above 4.5%, there’s a strong case to shop around now, before the best deals vanish.

The Real Secret: Compound Interest (and How to Flip It)

Most people underestimate the power of compound interest — both as a weapon and a trap. If you’re paying interest on £250,000 for 20 years, every small percentage matters.

Example:

At 4.5%, you’ll pay around £127,000 in interest over 20 years.

Drop that to 3.8%, and your total interest falls to roughly £108,000 — a £19,000 difference.

Even if fees and penalties eat £5,000, you’re still £14,000 ahead. That’s where the £9,700 average saving comes from — it’s not magic, just math done right.

Step-by-Step Guide to Save £9,700 on Your Mortgage

Step 1: Gather the Facts

Before you do anything, know your numbers. Collect:

- Your current rate and type (fixed, variable, tracker)

- Remaining balance and term

- Early repayment charge (ERC) or exit penalty

- Whether overpayments are allowed (and limits)

- Any administrative or legal fees

You can find most of this on your latest mortgage statement or your lender’s online portal.

Pro Tip: Create a spreadsheet with these details. You’ll need them to model your savings accurately.

Step 2: Get Competing Quotes

Visit major comparison sites like MoneySuperMarket or Compare the Market. Then, call at least one independent mortgage broker.

Ask for:

- Fixed-rate deals over similar terms

- No-fee or low-fee products

- Flexible overpayment terms

- Options to lock rates early

Example: If your rate is 4.7% and you find a 3.9% deal with £1,000 in total costs, that 0.8% gap could save you over £10,000 in interest on a £300,000 mortgage over 20 years.

Step 3: Calculate the Net Gain

Use this simple formula:

(Old Interest – New Interest) – (Fees + Penalties) = Net Savings

If your net savings are above £5,000, and you can switch without major hassle, it’s likely worth it.

Step 4: Overpay (Even a Little)

Here’s the part lenders really don’t want you to do — because it cuts into their profits.

Overpaying by even £100 a month on a £300,000 mortgage at 4% can:

- Shave 2–3 years off your term

- Save over £15,000 in interest

Most lenders let you overpay 10% per year of your balance without penalty.

If you have extra savings sitting idle at 1% interest, it makes far more sense to throw it against your 4–5% mortgage.

Step 5: Negotiate Directly With Your Lender

Before remortgaging elsewhere, call your lender. They might offer a product transfer (an internal switch) that saves you time and fees.

Ask:

- “Can I move to a lower rate internally?”

- “Will you match competitor offers?”

- “Can you waive the admin or valuation fee?”

Some banks quietly reward loyal, low-risk borrowers — but they rarely advertise it. You just have to ask.

Step 6: Watch the Timing — Don’t Wait Too Long

Lenders adjust rates based on Bank of England announcements, usually every six weeks. Locking a deal before a potential base rate rise could save you thousands.

Historically, mortgage rates rise faster than they fall.

That means acting early — even by a few weeks — can mean locking in a lower fixed rate before competitors reprice.

What Else You Can Do (Beyond Remortgaging)

1. Check Government Incentives

If you’re a first-time buyer or key worker, there are schemes that can make switching or buying easier:

- Lifetime ISA (LISA): 25% government bonus on savings up to £4,000 per year.

- Shared Ownership: Buy part of a home and pay rent on the rest.

- Mortgage Guarantee Scheme: Low deposit (5%) options extended into 2025.

These won’t directly save £9,700, but they reduce overall mortgage costs or unlock cheaper rates.

2. Watch for Hidden Fees

Always read the small print. Common hidden costs include:

- Exit fees

- Valuation and legal costs

- Product or booking fees

- Broker commissions

These can quickly eat into savings. Always ask for the “total cost of comparison (APRC)”, which includes all fees over the loan term.

3. Protect Your Credit Score

Before applying for a new deal:

- Check your credit report at Experian or Equifax.

- Pay off short-term debts and keep utilization under 30%.

- Avoid multiple credit applications in a short window.

A better credit score can unlock lower rates, compounding your savings.

4. Consider Offsetting Mortgages

If you have substantial savings, an offset mortgage links your savings account to your mortgage balance.

You only pay interest on the difference — potentially saving thousands while keeping access to your cash.

For example, if you owe £250,000 but have £25,000 in savings, you’ll only pay interest on £225,000. Over time, that gap compounds in your favor.

5. Think Long-Term Strategy

Don’t just chase the lowest rate. Consider:

- Fixed vs variable tradeoffs (security vs flexibility)

- Future interest rate trends

- Potential job changes or income fluctuations

- Your plans to move, rent out, or sell

Being strategic today could prevent expensive mistakes later.

Real-Life Example: Emma’s £10,200 Win

Emma, a 37-year-old teacher from Leeds, had £350,000 left on a 22-year mortgage at 4.6%. Her deal expired in December 2025, but she decided to shop around early.

She found a 3.8% 10-year fixed deal from a competing lender. After accounting for a £3,500 early repayment penalty and £1,200 fees, her model still showed:

- Gross interest saving: ~£15,000

- Net saving after costs: ~£10,300

By acting in November, before rates moved again, she secured that saving and peace of mind — all from a few phone calls.

Common Mistakes to Avoid

| Mistake | Why It Hurts |

|---|---|

| Ignoring ERCs or small print | You may lose your entire saving to penalties |

| Not comparing multiple lenders | You’ll miss better rates |

| Waiting until after your fix ends | You’ll default to a higher standard variable rate |

| Forgetting to include fees | Your “cheap” deal may not be so cheap |

| Overpaying without liquidity buffer | You could trap cash you need later |

Government Confirms £200 Cost of Living Support for October 2025 – Check Payment Date! Eligibility

DWP Confirms £416 Monthly Benefit Cut – Urgent Action Required for Thousands of UK Families

New 2025 Property Laws in the UK Could Cost Seniors Thousands: What You Need to Know Now