HMRC Confirms £300 Pension Cut: If you’ve seen headlines screaming “£300 pension cut from October 9”, you’re probably wondering what in the world is going on. Are pensions really being slashed again? The short answer is: no, not exactly — but there’s a twist involving HMRC, a Winter Fuel Payment, and an income threshold that’s causing a lot of confusion (and anxiety) among UK pensioners. Let’s unpack the facts carefully — because while this isn’t a cut to your State Pension, it could mean some pensioners lose up to £300 of their expected winter benefit through tax recovery.

Table of Contents

HMRC Confirms £300 Pension Cut

Let’s be real: the headline “£300 pension cut” makes a great soundbite — but the truth is more complicated. This is not a reduction to your State Pension. It’s a means-tested clawback on the Winter Fuel Payment, designed to limit payouts to higher-income pensioners. The government hopes to save money while maintaining support for lower-income retirees. But for those just over the threshold, it feels unfair — a bureaucratic tug-of-war between need and numbers. The best move? Know where you stand, keep documentation, and stay alert for HMRC letters or tax adjustments next year. And most importantly — if you’re eligible, don’t leave money on the table.

| Topic | Summary | Official Source |

|---|---|---|

| What’s changing | Winter Fuel Payment to be reclaimed for pensioners earning over £35,000 | GOV.UK |

| Amounts involved | Between £100 and £300, depending on age and household | |

| Age eligibility | Born on or before 21 Sept 1959 (State Pension age by 15–21 Sept 2025) | |

| Affected group | Roughly 1 in 5 pensioners earn above the £35k threshold | Parliament UK (Hansard) |

| How clawback works | HMRC adjusts tax code or adds charge to Self Assessment | |

| Timeline | Payments expected Nov–Dec 2025; clawback during 2026/27 tax year | |

| Fiscal impact | Expected to save government ~£450 million annually |

What’s really happening?

The Winter Fuel Payment is a tax-free annual benefit designed to help older people cover heating costs during cold months. It’s typically worth between £100 and £300, depending on your age and living situation.

In 2024, the government tightened eligibility to focus only on lower-income pensioners claiming means-tested benefits such as Pension Credit. That meant millions of retirees lost access. After a public backlash, the policy was partially reversed in June 2025 — reopening the payment to more pensioners, but with a means-test twist.

If your taxable income exceeds £35,000 per year, you’ll still receive the Winter Fuel Payment — but HMRC will claw it back later through your tax code or Self Assessment. That’s what sparked the panic about a “£300 pension cut.”

The policy backstory — why this “cut” exists

To get why this matters, it helps to look at the political and economic context.

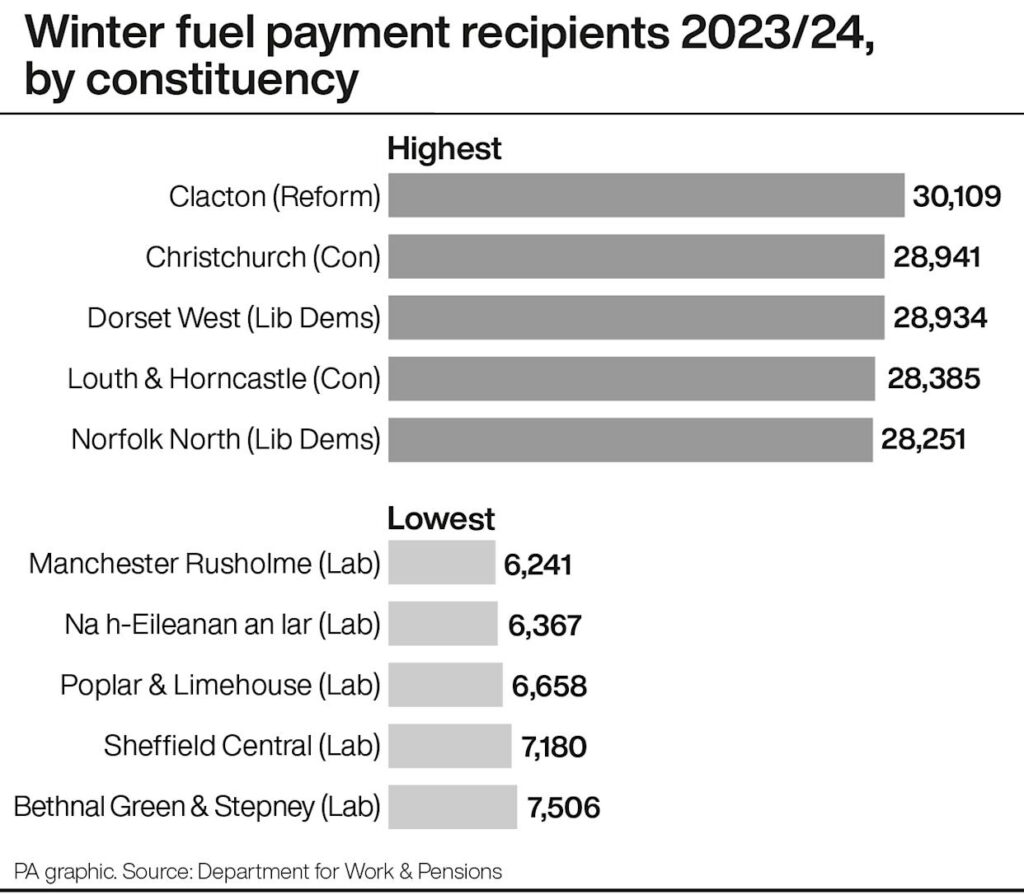

The Winter Fuel Payment began in the late 1990s as a universal benefit for older Britons. Every pensioner got it, regardless of income. But with over 9 million recipients and energy prices surging, the cost ballooned to billions annually.

In 2024, Chancellor Rachel Reeves announced that only pensioners on Pension Credit or similar benefits would receive it. That move was expected to save around £1.5 billion a year — but triggered outrage. Senior groups, opposition MPs, and economists accused the government of “punishing the prudent” — pensioners who saved modestly now excluded from help.

Facing mounting criticism, the Treasury backtracked in mid-2025. The new compromise: reintroduce the payment but claw it back from those earning over £35,000. This way, the government can still claim fiscal responsibility while softening the political fallout.

However, this complexity created a communication nightmare — and misleading headlines suggesting “pensions are being cut.”

Who gets what — and how it’s calculated

The payment varies depending on your age and household:

- Aged 66–79: up to £200

- Aged 80 or over: up to £300

- Couples where both qualify may see their payment split (each gets half).

- Payments are usually made automatically to those receiving State Pension or certain benefits.

But here’s where it gets tricky.

If your taxable income exceeds £35,000, HMRC will classify the Winter Fuel Payment as taxable income to reclaim. So, even though it’s technically tax-free, it’s clawed back through taxation later.

Example:

John is 82 and earns £36,500 from his pensions and savings. He’ll receive a £300 Winter Fuel Payment in November 2025. But when his 2026/27 tax code is adjusted, HMRC will recover £300 across the year — leaving him with no net gain.

Meanwhile, Margaret, age 77, earning £28,000, keeps her full £200 payment.

So yes — to some, it feels like losing £300. But it’s a means-tested adjustment, not a direct pension deduction.

The real impact of HMRC Confirms £300 Pension Cut— who’s affected most

Experts estimate about 1.5 to 2 million pensioners will face full or partial clawback. The Institute for Fiscal Studies (IFS) says the £35k threshold will exclude roughly 18% of recipients — but save the Treasury nearly half a billion pounds a year.

Financial planners warn of a “grey zone” — pensioners hovering near £35,000, whose eligibility may shift due to small fluctuations in savings interest, private pension withdrawals, or cost-of-living adjustments.

Moreover, the £35,000 cap is not indexed to inflation. That means as pensions and incomes rise, more people will cross the line each year, effectively tightening eligibility without new legislation.

In short: it’s a soft cut that grows over time.

How the clawback works — step by step

- Receive payment (Nov–Dec 2025):

- Paid automatically if eligible.

- Letter from DWP confirms the amount.

- HMRC review (early 2026):

- Cross-checks tax data to see who exceeded £35k.

- Tax adjustment (2026–27):

- If you’re under PAYE, your tax code changes to collect the £200 or £300 back gradually.

- If you file a Self Assessment, the Winter Fuel Payment appears as a taxable benefit to be repaid in full.

- Opt-out option:

- You can contact the Winter Fuel Payment Centre and refuse the payment upfront if you prefer not to have it clawed back later.

- Recordkeeping:

- Keep your DWP letter and tax notice for at least one year in case of error or appeal.

What about Scotland, Wales, and Northern Ireland?

- Scotland runs its own scheme, the Pension Age Winter Heating Payment, which mirrors the UK system but is handled by Social Security Scotland.

- Wales follows the England model.

- Northern Ireland operates separately under the Department for Communities but uses similar eligibility rules.

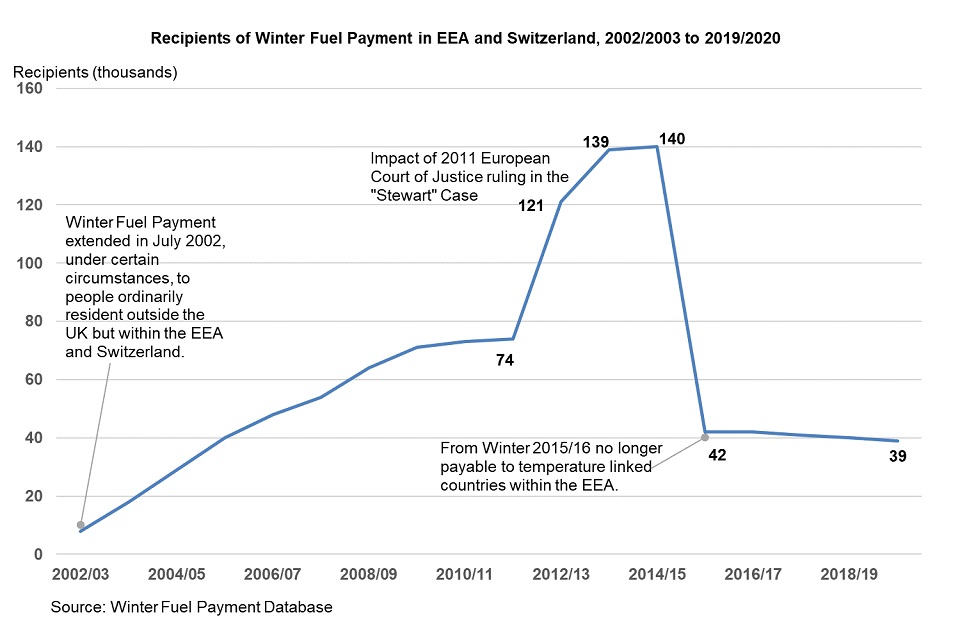

If you live abroad but maintain “genuine and sufficient links” to the UK (like paying UK tax or living in the EEA/Switzerland), you may still qualify — though rules are tightening.

Practical guide for HMRC Confirms £300 Pension Cut: What pensioners should do now

1. Check your eligibility

Use the GOV.UK tool to confirm your age and income criteria. Remember, taxable income includes pensions, wages, interest, and dividends — not tax-free ISAs.

2. Estimate your income

If you’re close to the £35k line, consider timing pension withdrawals or savings interest to stay under. Small adjustments can make a big difference.

3. Watch for your DWP letter

Expect it in October or November 2025. If nothing arrives, call the Winter Fuel Payment Centre at 0800 731 0160 (UK only).

4. Plan for clawback

If your income exceeds the limit, don’t budget that £200–£300 as permanent income. HMRC will reclaim it through your tax code in the following year.

5. Opt out if you wish

You can refuse the payment before it’s made — simply notify the DWP using the details on your letter.

6. Explore other support

If you miss out, consider:

- Warm Home Discount: up to £150 off your energy bill

- Cold Weather Payment: £25 per week when temperatures stay below zero

- Pension Credit: boosts income and unlocks more benefits

- Energy efficiency grants: for insulation, boilers, and home upgrades

Expert views — is this fair?

Economist Paul Johnson from the IFS calls it “a smart but confusing compromise.” It targets support, saves money, yet creates uncertainty for middle-income retirees.

Critics, including Age UK and Independent Age, argue that the £35k threshold unfairly penalizes modest savers who don’t consider themselves “wealthy.” They urge the Treasury to index the limit to inflation.

Meanwhile, HMRC insists the approach “balances fairness with fiscal sustainability,” saying the clawback ensures help goes to those most in need while avoiding blanket giveaways.

Potential problems and risks

- Inflation creep: With rising incomes, more pensioners will exceed £35k without real income growth.

- Administrative delays: Past HMRC clawbacks (like tax credit recoveries) have been messy, with thousands of pensioners overcharged.

- Public confusion: Many still believe pensions are being cut directly — proof that government communication remains poor.

- Scam alerts: Criminals often exploit benefit changes. Always verify emails or texts claiming to be from “HMRC” about Winter Fuel Payment.

UK £200 Cost of Living Payment in 2025 – Check Payment Date, Eligibility, and Status Here

DWP Confirms £2,500 Pensioner Bonus in October 2025 – Who will get it? Check Eligibility

£4,200 Income Boost for Pensioners in Oct 2025: Check DWP’s New Updates and How to Claim Yours!