Hidden Pension Trap: If you were born after April 6, 1960, there’s a good chance you’ll lose a big chunk of your expected retirement income—around £13,000—because of a change many people still don’t know about. This isn’t some exaggerated scare story. It’s a real financial impact tied to UK State Pension age changes set to take effect starting in 2026. The change is simple but serious: the pension age will rise from 66 to 67. But the ripple effect is huge—especially for those who planned their retirement around that 66-year mark.

The so-called “Hidden Pension Trap” has been making headlines because thousands of everyday people will unknowingly miss out on a full year of pension payments. That can mean a lot of lost income for retirees who were counting on that money to cover living costs, medical bills, or simply enjoy the fruits of their hard work.

Table of Contents

Hidden Pension Trap

The Hidden Pension Trap is a very real financial issue for people born after April 6, 1960. With the UK State Pension age increasing from 66 to 67, many will lose out on roughly £13,000 in income they might have otherwise expected. But here’s the upside: this change doesn’t have to catch you off guard. By understanding your pension age, topping up contributions, strengthening private savings, and planning ahead, you can navigate the transition smoothly. Retirement is supposed to be a time of stability, not surprise. The sooner you prepare, the better positioned you’ll be to enjoy it on your terms.

| Key Highlights | Details |

|---|---|

| What’s happening | UK State Pension age increasing from 66 to 67 |

| Who’s affected | Anyone born on or after April 6, 1960 |

| Potential loss | About £13,000 (equivalent to one year of State Pension payments) |

| Timeline | Changes begin between 2026 and 2028 |

| Why it matters | Delayed pension means delayed income and increased financial planning pressure |

| Historical context | Pension age has gradually risen over the past two decades |

| How to check | gov.uk/state-pension-age |

| How to prepare | Review NI record, increase savings, adjust retirement plans |

Historical Context: How the Pension Age Got Here

The State Pension age in the United Kingdom wasn’t always 66 or 67.

- For most of the 20th century, men retired at 65 and women at 60.

- In 1995, the Pensions Act began the process of equalizing retirement ages for men and women.

- By 2018, both genders had the same retirement age: 65.

- In 2020, it rose to 66.

- The next scheduled increase to 67 will occur between 2026 and 2028 under the Pensions Act 2014.

- A future rise to 68 has already been signaled, although the timeline isn’t set in stone yet.

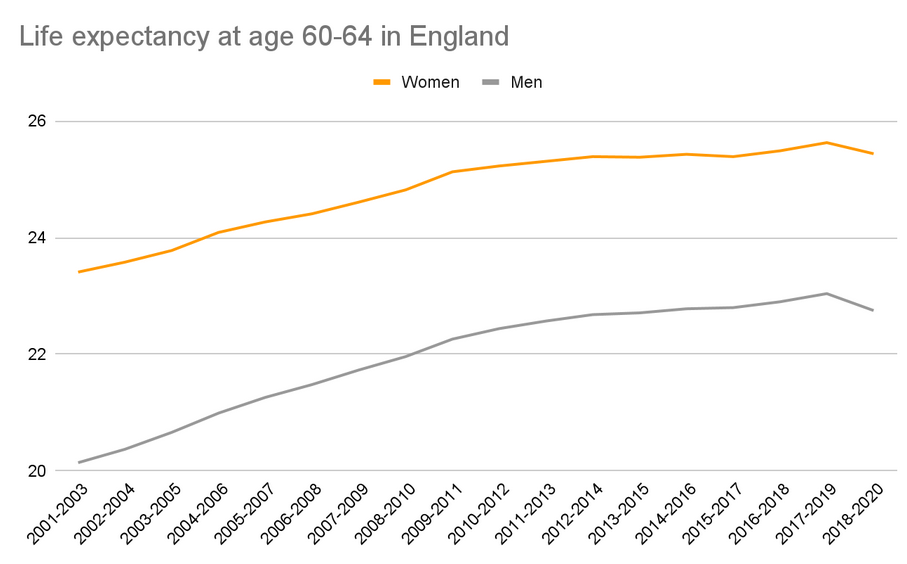

The government argues these steps are necessary to reflect longer life expectancy and to keep the pension system sustainable. The shift may seem like “just one more year,” but in real terms, it represents thousands of pounds lost for individuals expecting to claim at 66.

What Exactly Is the “Hidden Pension Trap”?

The “Hidden Pension Trap” refers to the financial loss caused by the delayed start date of the State Pension for people born after a specific cutoff—April 6, 1960.

Here’s what happens:

- The full new State Pension currently pays £221.20 per week.

- That adds up to £11,502.40 per year.

- Because of the pension age shift, anyone whose eligibility moves from age 66 to 67 will lose out on roughly £13,000 in payments.

That number is based on expected annual pension payments plus cost-of-living increases tied to the triple lock system, which guarantees annual rises in line with the highest of wage growth, inflation, or 2.5%.

This is not a theoretical loss. It’s an actual gap in income that people would have received if the pension age hadn’t moved. And unlike some private pension plans, the UK State Pension cannot be claimed early to bridge that gap.

Who Will Be Affected and When?

The timing of your birth determines how much of a delay you’ll face.

| Birth Date | New Pension Age |

|---|---|

| April 6, 1960 – May 5, 1960 | 66 years + 1 month |

| June 6, 1960 – July 5, 1960 | 66 years + 3 months |

| August 6, 1960 – September 5, 1960 | 66 years + 5 months |

| April 6, 1961 and beyond | 67 years |

Someone born just one day earlier—April 5, 1960—will receive their pension at 66. But someone born April 6, 1960 will face a delay of at least a month, and potentially up to a year.

For many, this one-day difference can represent a loss of nearly £13,000.

The Bigger Picture: Why the Government Is Making the Change

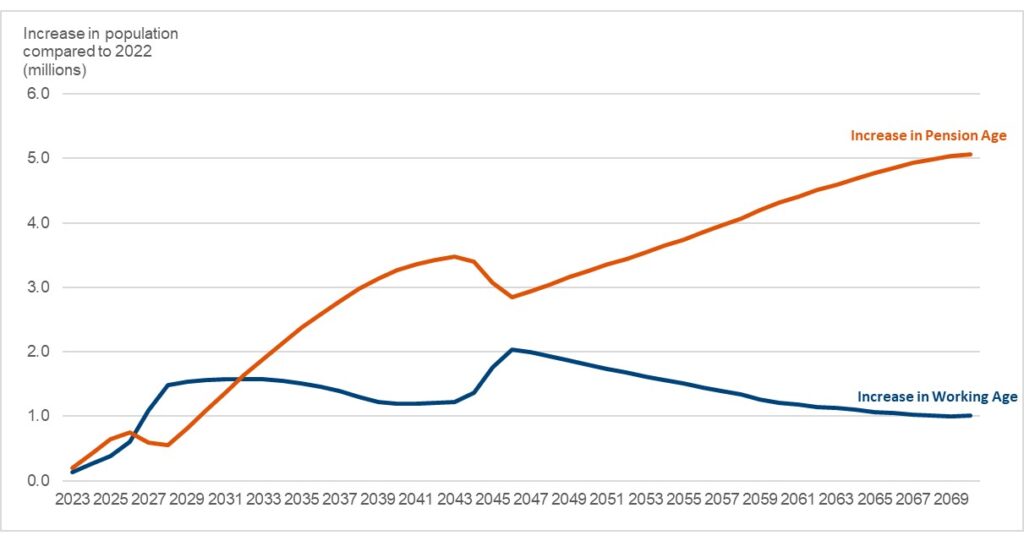

The UK population is aging. According to the Office for National Statistics (ONS):

- The average life expectancy is 79.3 years for men and 83.1 years for women.

- By 2030, one in five people in the UK will be aged 65 or older.

- The proportion of people over 85 is expected to double in the next 25 years.

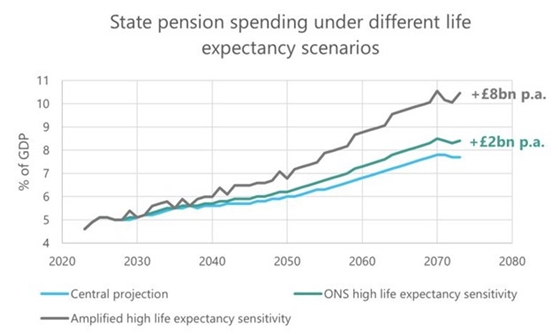

The government says the pension system simply isn’t sustainable if people are retiring earlier and living longer. Raising the pension age is their way of keeping the system financially stable.

But critics argue that this approach hits lower-income workers hardest, especially those in manual or physically demanding jobs, who may not have the same life expectancy or ability to work longer as white-collar professionals.

Economic Impact of Hidden Pension Trap

Losing £13,000 might not sound like a fortune to some, but it represents:

- A year’s rent or mortgage for many households

- A significant portion of annual living costs for retirees

- Money that could be invested or used to delay drawing down private savings

For someone living on a fixed income, this delay can be the difference between a comfortable retirement and a tight financial stretch. And since the State Pension is a guaranteed income, it often forms the backbone of retirees’ financial security.

Financial experts also point out that £13,000 invested in a moderate portfolio with 4% annual returns could generate additional retirement income or cover unexpected costs like medical bills or home repairs.

Comparison: How Other Countries Handle Retirement Age

While the UK is raising its pension age, it’s not alone.

- In the United States, the full retirement age for Social Security is already 66–67. Americans can claim reduced benefits at 62, but doing so permanently lowers their monthly payments.

- In Germany, the retirement age is gradually increasing to 67.

- In France, recent pension reforms have pushed the retirement age from 62 to 64, sparking widespread protests.

- Many other developed countries are following similar paths.

The key difference is that some countries allow early claiming with reduced benefits, giving retirees more flexibility. The UK does not.

Expert Commentary: Why This Matters

Mark Reynolds, a veteran financial advisor with over two decades of retirement planning experience, explains it this way:

“When the pension age moves, it’s not just a number on paper. It’s a real, tangible loss of income for people who’ve been planning their lives around it for years. For someone who expected to stop working at 66, this can be a real shock.”

He adds:

“The problem is that many people won’t realize it until they’re just a few years away from retirement. And by then, it’s much harder to make up the shortfall.”

How to Protect Yourself from the Hidden Pension Trap?

The good news is that there are practical steps you can take to minimize the impact of this change.

1. Check Your State Pension Age

Use the official tool at gov.uk/state-pension-age.

This tells you exactly when you’ll be eligible to start receiving your pension.

2. Review Your National Insurance Record

You usually need 35 qualifying years of National Insurance contributions to receive the full new State Pension. If you’re short, you may be able to top up your contributions.

3. Consider Voluntary NI Contributions

Topping up missing years can boost your pension entitlement significantly and may offer one of the best returns on your money.

4. Increase Private Savings

Relying solely on the State Pension can leave you vulnerable.

- Contribute more to workplace pensions

- Use ISAs or private pension plans

- Consider diversified investments

Even small contributions can make a big difference over time.

5. Adjust Your Retirement Timeline

If your pension age is shifting, plan ahead. That could mean:

- Working an extra year

- Bridging the gap with personal savings

- Reassessing retirement spending plans

6. Stay Informed About Policy Changes

Pension policy is constantly evolving. Another increase to age 68 is already being discussed, and early planning is your best defense.

Real-Life Example: Linda’s Story

Linda was born on April 7, 1960. She always planned to retire at 66, assuming her pension would kick in right away. When she learned about the pension age increase, she realized she’d face a 12-month gap.

Instead of being caught off guard, Linda took action five years before her planned retirement date. She:

- Checked her pension age

- Topped up missing NI years

- Increased her personal pension contributions by £200 a month

- Created a budget to bridge the one-year gap without debt

By being proactive, Linda avoided the hidden pension trap and kept her retirement plan on track.

Political and Policy Debate

The increase to 67 has sparked debate across the political spectrum.

Supporters of the change argue:

- It’s necessary to ensure long-term sustainability of the pension system.

- People are living longer, and the system must adapt.

- Encourages individuals to save more privately.

Critics, however, counter:

- It unfairly impacts working-class people, especially those in physically demanding jobs.

- Life expectancy isn’t equal across all socioeconomic groups.

- Many people won’t live long enough to receive full benefits.

Research from the Institute for Fiscal Studies (IFS) suggests that people in lower-income areas often have shorter life expectancies, meaning they will receive fewer years of pension compared to wealthier individuals.

DWP £470 Pension Bonus In October 2025: Eligibility Criteria & Payment Dates

New DWP Rule Triggers £416 Monthly Cut – UK Families Urged to Check Payments Immediately

State Pension Overhaul Coming in 2026 – DWP Reveals 5 New Rules That Could Impact Your Retirement