Gold Hits $4,000 Amid Global Jitters: When gold hits $4,000 per ounce, it’s not just a finance-world headline — it’s a reflection of global anxiety and shifting trust. In a year marked by economic uncertainty, interest rate debates, and geopolitical tensions, gold has become the talk of Wall Street, Main Street, and even TikTok finance circles. From retirees seeking safety to central banks hoarding reserves, everyone’s looking at gold again. But what’s really fueling this surge, and is the rally only getting started? Let’s break it down in plain, easy-to-understand terms.

Table of Contents

Gold Hits $4,000 Amid Global Jitters

Gold’s march past $4,000 per ounce marks a historic moment — one shaped by inflation fears, weakening faith in fiat currencies, and a renewed global appetite for security. From central banks to small investors, confidence in paper money is giving way to trust in tangible assets. Still, it’s important to stay grounded. Gold is powerful as part of a diversified portfolio, not as a one-way ticket to riches. The smart move? Use gold as protection, not speculation. Or as an old trader might say:

“You don’t buy gold because the world’s ending — you buy it so you can sleep when it feels like it might.”

| Topic | Details |

|---|---|

| Current Gold Price (October 2025) | $4,000 per ounce (all-time high) |

| YTD Performance | Up 28% from January 2025 |

| Main Drivers | Inflation fears, Fed rate cuts, weak U.S. dollar, central-bank buying |

| Top Buyers | China, India, Turkey, Poland, U.S. retail investors |

| Analyst Forecasts | Goldman Sachs: $4,900 by 2026 • HSBC: $4,200 short-term |

| Risk Factors | Overbought momentum, Fed policy reversal, dollar rebound |

| Official Data Source | U.S. Geological Survey (USGS) |

Why Gold Hits $4,000 Amid Global Jitters?

Gold has always been more than a metal. It’s a symbol of security, value, and protection — something solid in a world that often feels like it’s spinning off its axis. In 2025, that sentiment is stronger than ever.

1. A Flight to Safety in Uncertain Times

Let’s start with the basics: when people get nervous about the future, they buy gold.

Between U.S. political gridlock, global conflicts, and economic slowdown fears, investors are searching for assets that can weather the storm. According to Reuters, demand spiked after renewed tensions in Eastern Europe and the Middle East pushed investors away from volatile equities.

The Federal Reserve’s recent hints of potential rate cuts also fueled demand. Lower interest rates make gold more appealing because it doesn’t pay interest or dividends — and when bond yields fall, gold shines brighter.

In short, investors are saying: “If I can’t trust markets or policymakers, I’ll trust metal.”

2. The Weak Dollar Boosts Gold

The U.S. dollar index (DXY) has fallen roughly 6% year-to-date, largely due to expectations of rate cuts and ballooning federal debt.

As of September 2025, U.S. national debt surpassed $35 trillion, according to the U.S. Treasury Department. A weaker dollar means gold — priced in dollars — becomes cheaper for foreign investors, pushing global demand even higher.

Historically, every dollar slump has coincided with a strong gold rally. That inverse relationship remains one of the clearest patterns in macroeconomics.

3. Inflation: The Ghost That Won’t Go Away

Even though inflation cooled to 3.2% (per the Bureau of Labor Statistics, BLS.gov), Americans still feel the pinch. Grocery bills, rent, and healthcare haven’t returned to pre-pandemic levels.

This “sticky inflation” environment keeps gold in the spotlight as a hedge — meaning it protects the real value of your money.

When paper money loses purchasing power, gold historically holds or increases its value. That’s why financial advisors often call gold “insurance against inflation.”

4. Central Banks Are Loading Up

It’s not just individual investors driving demand — central banks around the world are quietly building gold reserves like never before.

- China’s People’s Bank bought more than 160 tons of gold this year.

- Turkey and Poland added over 40 tons each.

- The International Monetary Fund (IMF) notes that global gold holdings are at their highest level since the 1970s.

This shift isn’t random. Many countries are diversifying away from the U.S. dollar amid rising geopolitical tension and trade fragmentation. It’s part of a broader move toward what economists call de-dollarization.

When even governments hedge with gold, you know the trend is serious.

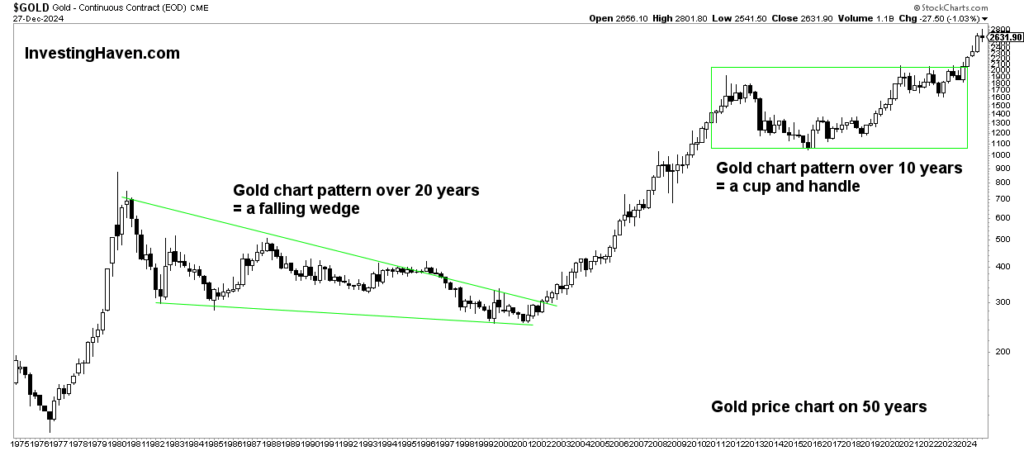

A Look Back: How Rare Is This Rally?

To understand today’s surge, it helps to look at history.

| Year | Average Gold Price (per oz) | Global Context |

|---|---|---|

| 2008 | $870 | Global financial crisis |

| 2011 | $1,900 | Eurozone debt crisis |

| 2020 | $2,070 | COVID-19 pandemic |

| 2024 | $3,100 | Inflation surge, Fed policy shift |

| 2025 | $4,000+ | Global uncertainty, central-bank buying |

Each of these milestones came during a period of fear or instability. The 2025 rally, however, stands out for one reason: it’s being fueled by both investor emotion and institutional strategy.

Gold vs. Other Investments

Gold isn’t the only game in town — but it’s currently beating most others.

| Asset Type | 2025 YTD Return | Risk Level | Comments |

|---|---|---|---|

| Gold | +28% | Low–Medium | Strong hedge; benefits from weak USD |

| S&P 500 Index | +12% | Medium | Corporate profits slowing |

| Bitcoin | +18% | High | Volatile; speculative |

| 10-Year U.S. Treasury | +3% | Low | Limited upside due to lower yields |

| U.S. Real Estate | +7% | Medium | Slower growth; high mortgage costs |

The takeaway? Gold is outperforming stocks, bonds, and crypto — and doing it with far less volatility.

How to Invest in Gold (Step-by-Step)

If you’re wondering how to get started, here’s a simple roadmap:

Step 1: Define Your Goal

Ask yourself: “Why am I buying gold?”

- Long-term hedge: Protect your savings from inflation.

- Short-term trade: Capitalize on price momentum.

Step 2: Choose Your Investment Type

- Physical Gold – Coins, bars, or jewelry. Tangible, but requires storage and insurance.

- Gold ETFs – Funds like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) that track gold prices and trade like stocks.

- Gold Mining Stocks – Companies such as Newmont (NEM) or Barrick Gold (GOLD) can offer leveraged exposure.

- Gold IRAs – Retirement accounts backed by physical gold for tax advantages.

Step 3: Buy from Reputable Sources

Use trusted dealers and exchanges. Verify spot prices at Kitco.com or JM Bullion.

Avoid unverified online sellers or high-pressure “limited offer” ads.

Step 4: Keep an Eye on Market Indicators

Gold responds to:

- Interest-rate changes by the Federal Reserve

- The strength of the U.S. dollar

- Inflation and global growth data

Monitoring these will help you avoid buying at emotional highs.

Step 5: Diversify and Rebalance

Most financial planners recommend keeping 5–10% of your portfolio in gold. It’s a cushion, not the core. Don’t put all your eggs in one golden basket.

Risks and What to Watch Out For

Gold’s rise has been impressive — but nothing goes up forever.

Here are a few red flags to keep in mind:

- Overbought Conditions: Technical indicators like the RSI (Relative Strength Index) above 75 suggest the market might cool off.

- Rate Surprises: If inflation spikes again and the Fed raises rates instead of cutting them, gold could face a temporary setback.

- Profit-Taking by Funds: Institutional investors often sell into strong rallies to lock in profits.

- Stronger Dollar: Any rebound in the U.S. dollar tends to put downward pressure on gold.

Even with these risks, analysts generally agree gold’s long-term foundation remains solid.

Expert Opinions: What Wall Street Says

Financial institutions are updating forecasts rapidly:

- Goldman Sachs: Expects gold to reach $4,900 by late 2026, assuming continued Fed easing.

- HSBC: Predicts prices will stabilize around $4,200 in the short term before resuming an upward trend.

- Bank of America: Warns of short-term volatility but maintains a bullish long-term view.

- CNBC Analysts: Call gold’s surge “a clear reflection of investor distrust in traditional monetary systems.”

These predictions vary, but the consensus is clear — gold isn’t done shining yet.

The American Angle: What It Means for Everyday Investors

For everyday Americans, the gold rally has practical implications:

- Retirement Accounts (401k, IRA): Adding gold ETFs can balance portfolios heavy in stocks or bonds.

- Homeowners and Small Businesses: Gold acts as a hedge against rising costs and currency fluctuations.

- Young Investors: Fractional-share investing apps now make it easy to own small portions of gold, democratizing access once limited to the wealthy.

Gold isn’t just a hedge — it’s becoming a lifestyle asset. From digital gold savings accounts to jewelry that doubles as investment, Americans are rediscovering gold’s appeal.

Data and Market Outlook

According to the World Gold Council, global gold demand is expected to exceed 5,000 tons in 2025 — a record figure.

Meanwhile, ETF inflows totaled $11 billion in the first nine months of the year, suggesting both institutional and retail investors are confident.

Economic models from Oxford Economics indicate that if the Fed cuts rates by more than 75 basis points in 2026, gold could average $4,300–$4,500 over the next year.

These numbers suggest the rally isn’t merely emotional; it’s built on macroeconomic fundamentals.

Tata Capital IPO Faces Final-Day Doubts – Key Factors Investors Should Know

Greystar’s $50M Deal in RealPage Case Could Disrupt the Entire U.S. Rental Market

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility