The Internal Revenue Service (IRS) has confirmed the issuance of $1390 relief payments to eligible individuals in late 2025. These payments are part of a broader federal initiative aimed at providing financial relief to qualified taxpayers. The announcement has generated considerable interest as millions of Americans prepare to receive financial support. This article explores the eligibility criteria, expected distribution timelines, and key details for individuals awaiting their direct deposit payments.

Table of Contents

$1390 IRS Relief Payment

| Key Fact | Detail/Statistic |

|---|---|

| Payment Amount | $1,390 |

| Eligibility Criteria | Individuals with 2021 tax filings |

| Expected Payment Date | By late November 2025 |

| Direct Deposit | Available for those with bank information on file |

| Official Website | IRS |

Overview of the IRS $1390 Relief Payment

In response to the ongoing economic pressures resulting from the COVID-19 pandemic, the IRS has confirmed that $1,390 relief payments will be issued to individuals who meet specific eligibility criteria. The initiative, part of the broader government effort to support households during these challenging times, follows a series of similar economic relief programs enacted in recent years.

Who is Eligible for the $1390 Payment?

To qualify for the relief payment, individuals must have filed their taxes in 2021. The IRS will use these tax filings to identify eligible recipients. The payments are designed to assist those who continue to experience financial hardship, particularly lower-income households that have been most affected by inflation and rising living costs.

The eligibility criteria for the relief payment include:

- Filing Status: Individuals who filed their taxes as single, married, or head of household in 2021.

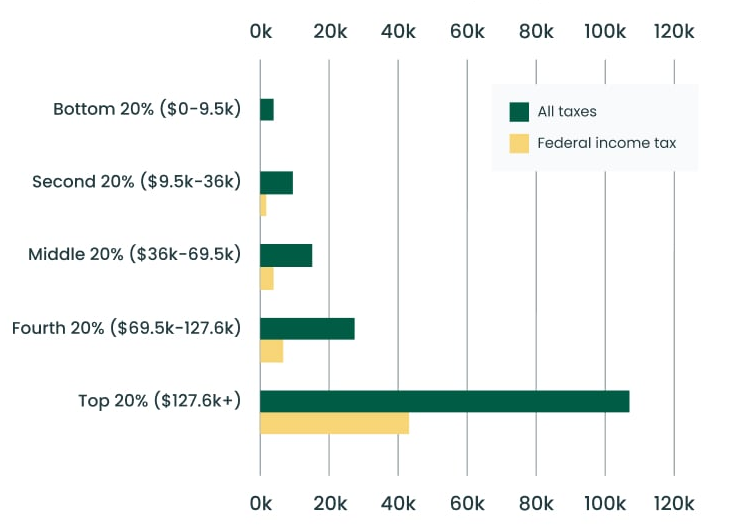

- Income Thresholds: Payments are available to those who meet income limits defined in the 2021 tax year. Specific income levels are calculated based on adjusted gross income (AGI), and the IRS has set these thresholds to prioritize aid for lower- and middle-income taxpayers.

- Non-filers: Individuals who did not file taxes for 2021 may still be eligible if they meet certain criteria, such as receiving Social Security or other federal benefits. In such cases, the IRS encourages individuals to file a 2021 tax return to ensure eligibility.

“The $1390 relief payment aims to address the ongoing needs of vulnerable communities, helping to mitigate the financial strain of inflation, healthcare costs, and other rising expenses,” said Karen White, a spokesperson for the IRS.

Timing and Method of Distribution

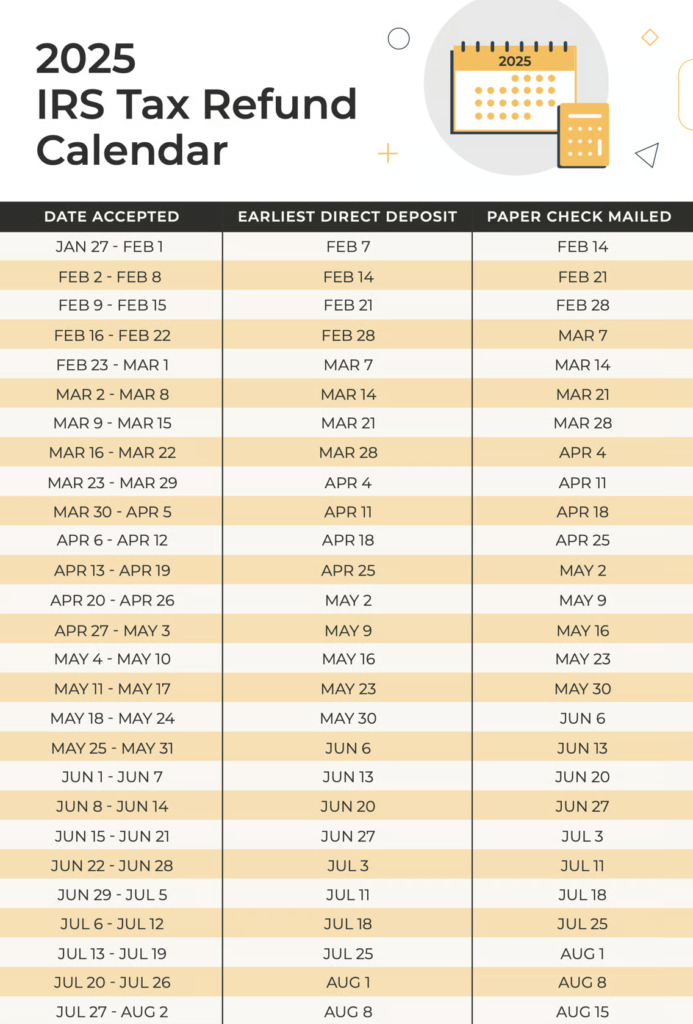

The payments are expected to be fully distributed by late November 2025. However, the precise date may vary depending on factors such as the volume of returns and individual tax situations. The IRS has confirmed that payments will be issued through direct deposit for individuals who have provided their bank account information.

For those who do not have direct deposit details on file, payments will be issued as paper checks or pre-paid debit cards, with the latter group facing potential delays. Direct deposit will ensure the fastest processing time.

Direct Deposit Details

For recipients with direct deposit information on file, the process will be relatively swift. Payments will be deposited directly into the bank accounts listed on the taxpayer’s most recent tax return. Individuals are encouraged to check their IRS accounts and ensure their bank details are updated to avoid delays.

“Direct deposit is the quickest and most secure method for receiving relief payments,” noted White. “We strongly advise taxpayers to confirm that their banking details are up-to-date to prevent any interruptions.”

Delays and Alternatives for Non-Direct Deposit Recipients

While direct deposit is the preferred method, individuals without updated bank information may experience delays. In such cases, physical checks or prepaid debit cards will be issued. The timing of these alternative methods can be affected by mail processing times, which may add several weeks to the delivery schedule.

The IRS has assured recipients that all payments will be issued by the end of November 2025, but individuals should prepare for the possibility of extended waiting times, particularly those who receive paper checks.

Additional Measures to Ensure Fair Distribution

The IRS has taken several steps to ensure that relief payments are distributed fairly and accurately. For instance, individuals who have received prior IRS payments, such as economic stimulus checks or child tax credits, may be automatically enrolled for the $1,390 relief payment. However, others will need to confirm their eligibility by either checking their IRS accounts or providing necessary documentation.

“We are working diligently to ensure that relief payments reach those who need them most,” said IRS Commissioner Charles Rettig in a recent statement.

Broader Context: The Role of Relief Payments in Economic Recovery

The IRS $1,390 relief payment is part of the federal government’s ongoing effort to provide direct financial support to households as they recover from the economic disruptions caused by the COVID-19 pandemic. This initiative builds on previous rounds of relief payments, including the $1,400 checks sent in 2021 and additional support provided through unemployment benefits, child tax credits, and other forms of assistance.

Economic Impact of Relief Payments

Research conducted by the U.S. Treasury Department suggests that relief payments have been an effective tool in sustaining household spending and alleviating financial stress. These direct payments have contributed to increased consumer spending, which has helped stabilize the economy during periods of high uncertainty. According to data from the U.S. Bureau of Economic Analysis, consumer spending accounted for more than two-thirds of economic growth in 2022.

Economists agree that direct payments to individuals are essential in supporting economic recovery. “Stimulus checks are an important part of economic stabilization efforts,” said Dr. John Davis, an economist at the National Economic Institute. “They ensure that families can continue to meet their immediate needs while the economy gradually recovers.”

How Does This Fit into Federal Policy?

The $1,390 relief payment is one of several measures aimed at bolstering the U.S. economy. Alongside initiatives to stimulate business investment and job creation, direct relief payments help offset the challenges posed by inflation, particularly in the context of rising food and energy costs. These efforts align with the federal government’s broader economic recovery plan, which focuses on returning the economy to pre-pandemic levels of growth.

Some critics, however, argue that continuous stimulus payments may contribute to inflationary pressures in the long run. They suggest that a more sustainable solution would involve strengthening the job market and reducing the reliance on government assistance.

“While stimulus payments provide immediate relief, long-term economic growth will depend on increasing workforce participation and productivity,” said Dr. Maria Lee, a senior economist at the American Economic Association.

What You Need to Do Now: How to Prepare for the Relief Payment

For most taxpayers, receiving the $1,390 relief payment will be as simple as waiting for the direct deposit or check to arrive. However, to avoid delays or issues, it’s essential to ensure that your tax information is current and correct.

Check Your IRS Account

The IRS allows individuals to check their eligibility and payment status via its online portal, the IRS “Get My Payment” tool. This tool provides up-to-date information on the status of your payment, including whether it has been processed and when you can expect to receive it.

If you have not filed your taxes for 2021 or need to update your direct deposit details, now is the time to do so. Filing a tax return for 2021 ensures that the IRS has accurate information for determining your eligibility and payment method.

Confirm Your Banking Details

If you receive your IRS payment via direct deposit, ensure that the bank account information on file is correct and up-to-date. This can prevent delays or payment errors, which may occur if the IRS has outdated information.

What to Do if You Haven’t Received Your Payment

The IRS expects all payments to be distributed by late November 2025, but some recipients may experience delays. Individuals who have not received their payment by December should take the following steps:

- Check the IRS Website: Use the “Get My Payment” tool to verify whether your payment has been issued or if there are any issues.

- Review Your Tax Filing Status: Ensure that your 2021 tax filings are complete and accurate.

- Contact the IRS: If there are still issues, you can contact the IRS to inquire about your payment status.

Final Thoughts: A Critical Financial Lifeline

The $1,390 relief payment is an important lifeline for millions of Americans as the nation continues to recover from the pandemic’s financial fallout. While these payments may not solve long-term economic challenges, they offer immediate support for individuals and families struggling with inflation and other financial pressures.

“These payments are a critical part of the ongoing efforts to stabilize the economy,” said IRS Commissioner Charles Rettig. “By providing direct financial assistance, we are helping Americans navigate difficult times while ensuring that economic recovery remains on track.”

$1000 PFD Stimulus For Everyone in this month – Is it true? Check Eligibility & Payment Date

Social Security 2026 COLA Update Pushed Back Due to US Shutdown – What You Should Know

FAQ

Q: How can I check my eligibility for the IRS $1390 relief payment?

A: Eligibility is determined based on your 2021 tax filings. You can check your payment status through the IRS online portal.

Q: When will I receive my $1390 payment?

A: The payments will be issued by late November 2025. Direct deposit recipients will see their payments first, followed by checks for others.

Q: What should I do if I don’t receive my relief payment?

A: If you haven’t received your payment by December, check your IRS account online or contact the agency for assistance.

Q: How do I ensure my direct deposit information is correct?

A: To ensure accurate payment, log into your IRS account and update any outdated banking details before the payment date.

Q: Can I still receive the payment if I didn’t file taxes for 2021?

A: Yes, you may still qualify if you received Social Security or other federal benefits. The IRS recommends filing a 2021 tax return to confirm eligibility.