DWP WASPI £2,950 Compensation News: If you’ve heard whispers about the DWP WASPI £2,950 compensation arriving in October 2025, then you’re probably wondering what it really means for women affected by the UK’s pension age changes. This landmark payout is a critical step toward justice for thousands of women born in the 1950s—women who faced an unexpected and often financially devastating shift in their retirement plans. In this article, we’ll explore who qualifies, why this compensation exists, how it works, and what you can do to stay informed and safe.

Table of Contents

DWP WASPI £2,950 Compensation News

The forthcoming £2,950 compensation in October 2025 is a crucial milestone in addressing the long-standing grievances of women affected by rapid pension age changes. This automatic, tax-free payout provides some recognition and relief, acknowledging the hardships faced. While the government takes steps to rectify past mistakes, ongoing legal battles and policy reforms aim to ensure fairness and transparency for all. Women impacted by the pension age rise should stay informed, utilize official tools to understand their pension status, and take steps to safeguard their financial futures. This payout isn’t just about money—it’s about restoring trust, fairness, and dignity for those deserving it.

| Topic | Details |

|---|---|

| Compensation Amount | One-time tax-free payment of £2,950 |

| Eligibility Dates | Born between April 6, 1950, and April 5, 1960 |

| Reason | Late and inadequate notice of pension age increase |

| Payment Date | October 2025 |

| Application | No application needed; payment processed by DWP |

| Legal Status | Ongoing legal challenge by WASPI group |

| Affected Population | Approximately 3.6 million women |

| Official Website | DWP Official Site |

Understanding the Background of UK Pension Age Changes

Before diving into the details of the compensation, it’s helpful to understand the broader context of pension age adjustments in the UK. For decades, the UK government has been gradually increasing the state pension age to reflect longer life expectancy. However, the pace of change has varied, with some groups experiencing abrupt shifts.

- In the 1990s and early 2000s, reforms were announced to raise the pension age for women from 60 to 65, aligning it with men.

- Between 2010 and 2018, a major change was introduced: the pension age for women and men was further increased to 66, and plans were made to rise it to 67 by 2028, then 68 thereafter.

What makes the current situation unique is how the changes were communicated (or, more accurately, not communicated). Many women born between April 6, 1950, and April 5, 1960, didn’t get proper notice about the rising pension age. They believed they could claim at 60, only to find that the rules had unexpectedly shifted, leaving them financially vulnerable.

The Legal and Political Fight: Why Are Women Still Fighting?

The story of the WASPI campaign isn’t just about money; it’s about fairness and transparency. Many women argue that the government delayed informing them about the pension age hike, often by years, which left them little time to plan. The issue gained political prominence in 2015, sparking protests, petitions, and legal battles.

In 2024, the Parliamentary and Health Service Ombudsman concluded that the Department for Work and Pensions (DWP) had maladministered the process, and recommended compensation. The government agreed to pay £2,950 to affected women but refused to admit fault officially, instead framing it as a “fair resolution” for those hurt by prior miscommunications.

However, the ongoing legal challenge continues, with the WASPI campaign arguing for broader compensation and acknowledgment. The High Court scheduled a hearing for December 2025 that could influence further government action.

Who Will Get the DWP WASPI £2,950 Compensation in October 2025?

The government’s plan is to pay this sum automatically—you don’t need to apply or fill out forms. But eligibility is strict:

- Women born April 6, 1950, to April 5, 1960.

- Women who experienced financial hardship or emotional distress due to the pension age rise.

- Women who received little or no notice of the change from the government.

This targeted approach ensures that the maximum benefit goes to those most affected.

Practical examples of the impact

Sarah, a retired schoolteacher from Birmingham, shares, “I was blind-sided when I found out I couldn’t claim my pension at 60 like my friends. I had to keep working, which made me exhausted and stressed. Now, with this payout, I hope it can ease some of that burden.”

Linda, living in Manchester, said, “I didn’t get the letter telling me my pension age had changed. I had already planned my retirement around 60, so this upset my whole financial future.” These stories reflect the real human toll of policy decisions made far away from individual lives.

How Does the Payment Work and What Are the Next Steps?

The government plans to distribute the payments throughout October 2025 directly to eligible women. No need to apply. The Department for Work and Pensions (DWP) will use its records to identify those affected and process the payments automatically.

- The £2,950 is tax-free and will not impact other benefits or entitlements.

- Women should keep an eye on official contacts from DWP to avoid scams.

- Payments will be issued gradually, so patience is key.

Broader Implications: What This Means for Women’s Financial Independence

This compensation is more than a payout; it’s a recognition of the financial burden placed on many women—who, due to years of delayed notice, had to work longer, save less, or face financial hardship. It’s also a wake-up call for reformers to scrutinize how pension policies are communicated and implemented.

For some women, this payment provides immediate relief, but it also highlights the importance of personal financial planning. Women should review their current retirement strategies, explore private pensions, and use online tools to estimate future income.

How to Check DWP WASPI £2,950 Compensation Date and Future Entitlements?

To be proactive, women can:

- Use the official Government’s Pension Age Checker to find out their exact eligibility date.

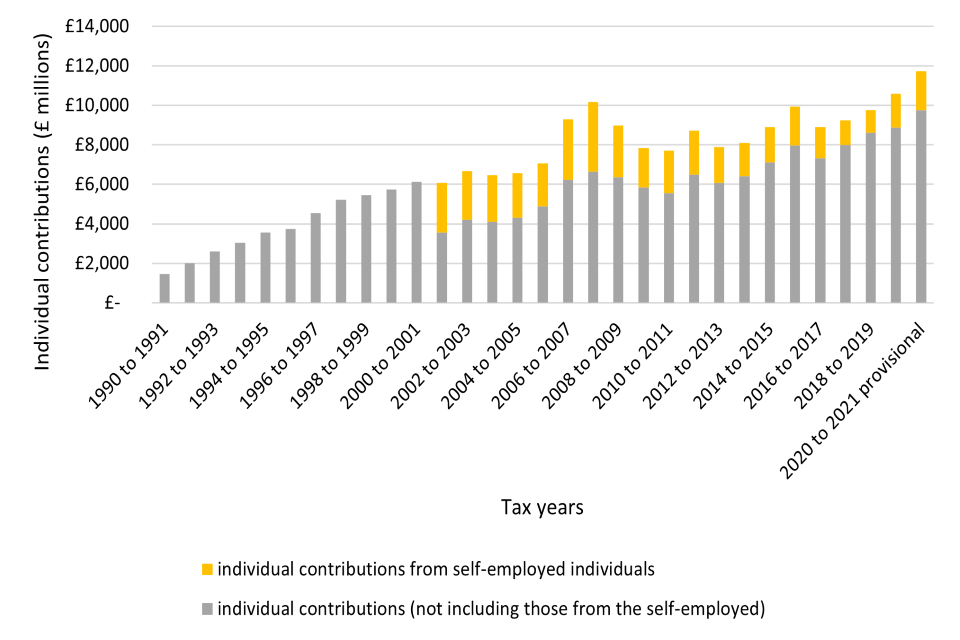

- Review their National Insurance contribution records at Check Your State Pension.

- Seek guidance from trusted financial advisors or consumer organizations like MoneyHelper.

Having a clear picture of your pension timeline helps you plan better for retirement, especially if you’ve faced adverse changes.

Future Outlook and Legal Developments

While the £2,950 payout is a temporary fix, many women press for broader recognition, including:

- Backdated compensation for those who lost significant funds.

- Official apologies from the government.

- Reform of the communication processes regarding pension changes.

The upcoming court case in December 2025 may open pathways for more comprehensive justice, or even additional compensation. The broader impact could shape pension policy and public trust in government in the long run.

Tips for Women Preparing for Retirement in Changing Times

- Start early: Check your pension status and contribute more where you can.

- Diversify: Rely on both state and private pensions.

- Stay informed: Follow official sources and updates from trusted organizations.

- Plan for uncertainties: Factor in potential delays or changes into your retirement age.

- Consult experts: Financial advisors can help craft a sustainable retirement plan.

Are You Missing £8,300? DWP Urges Pensioners to Check for Back Payments Now

£4,200 Income Boost for Pensioners in Oct 2025: Check DWP’s New Updates and How to Claim Yours!

Born After This Date? You Could Lose £13,000 in 2026; Experts Warn of ‘Pensions Steal’

Protect Yourself from Scams and False Claims

Scammers often exploit high-profile issues like pension changes. To stay safe:

- Never share your bank details unless verified through official channels.

- Be cautious of unsolicited calls or emails claiming to offer extra benefits.

- Always confirm with government websites or trusted organizations.