DWP confirmed £5,600 per year to State Pensioner: If you’ve been scrolling through your feed and spotted headlines shouting about the “DWP confirming £5,600 per year to state pensioners born before 1959,” you’re not alone. Thousands of people across the UK have been Googling whether it’s a new bonus, a pension top-up, or some kind of government giveaway.

Here’s the truth: the Department for Work and Pensions (DWP) hasn’t launched a new universal payout for older citizens. What those viral posts are actually referring to is a benefit called Attendance Allowance, a payment that helps people over State Pension age who need help with personal care or supervision because of long-term health conditions. This guide breaks it all down in simple, friendly language—with facts, figures, and official references you can trust. Whether you’re retired, caring for an elderly parent, or helping clients navigate DWP benefits, this will give you everything you need to understand what’s really going on.

DWP confirmed £5,600 per year to State Pensioner

So, is the DWP really handing out £5,600 per year to all pensioners born before 1959? Not exactly—but if you qualify for the higher rate of Attendance Allowance, you could indeed receive that much or more annually. It’s not automatic, and it’s not a bonus, but it’s real money meant to help older citizens live independently, safely, and with dignity. Too many people miss out simply because they don’t apply. You’ve worked hard all your life—don’t leave money you’re entitled to sitting unclaimed.

| Topic | Key Data / Info |

|---|---|

| Benefit name | Attendance Allowance |

| Weekly rates (2025) | £73.90 (lower) / £110.40 (higher) |

| Annual value (higher rate) | Around £5,740 per year |

| Eligible group | Over State Pension age with daily care or supervision needs |

| Unclaimed benefits | £5.2 billion annually |

| Claim process | Form via GOV.UK or phone 0800 731 0122 |

| Tax impact | Tax-free and doesn’t reduce other benefits |

Understanding the DWP confirmed £5,600 per year to State Pensioner Figure?

The “£5,600 per year” rumor isn’t totally false—it’s just missing context. The figure is roughly the annual total of the higher rate of Attendance Allowance. At £110.40 a week, that’s about £5,740 over 52 weeks.

In other words, if you’re over State Pension age, have long-term health or mobility issues, and need help with personal care or supervision, you might qualify for up to that much each year—tax-free.

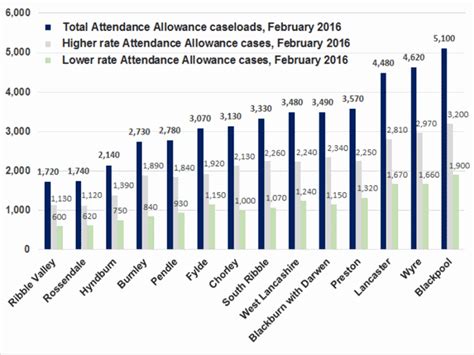

According to the latest DWP statistics (August 2025), around 1.9 million people in Great Britain receive Attendance Allowance. But experts estimate more than 1.1 million eligible pensioners haven’t claimed it—leaving over £5 billion unclaimed annually. That’s a lot of money staying in government pockets simply because people don’t know they can apply.

What Is Attendance Allowance?

Attendance Allowance (AA) is a non-means-tested, tax-free benefit for people over the State Pension age who need help with personal care or supervision because of illness or disability.

It’s designed to help with extra costs that come with needing care—like paying someone to help you bathe, getting home safety aids, or covering transportation to hospital appointments.

You don’t need a professional caregiver or a specific diagnosis. What matters is how much help or supervision you actually need on a daily basis.

Eligibility Criteria (Detailed Breakdown)

You can apply for Attendance Allowance if you meet all the following conditions:

- You’ve reached State Pension age.

Currently, that’s 66, but it may rise in future years. - You have a physical or mental condition that requires care or supervision.

This could include arthritis, dementia, heart disease, mobility problems, anxiety, Parkinson’s, or sensory impairments. - Your care or supervision needs have lasted at least six months.

The six-month rule doesn’t apply if you’re terminally ill. - You’re ordinarily resident in Great Britain.

You must have lived in the UK for at least two of the last three years. - You’re not subject to immigration control (unless allowed public-fund access).

- You’re not already receiving certain overlapping benefits.

For example, you can’t usually get Attendance Allowance if you’re receiving the Daily Living component of Personal Independence Payment (PIP). - Care home rules:

- If you pay for your own care, you can get Attendance Allowance.

- If your local council pays for your care, payments usually stop.

How Much You Can Receive?

| Rate | Conditions | Weekly Amount (2025) | Annual Equivalent |

|---|---|---|---|

| Lower Rate | Need frequent help or supervision during the day OR at night | £73.90 | £3,842.80 |

| Higher Rate | Need help both day and night, or terminally ill | £110.40 | £5,740.80 |

That’s where the headline figure of £5,600 per year comes from—it’s the higher rate.

Most claimants (about 65%) receive the higher rate, according to DWP data, because their needs are significant and ongoing.

How Attendance Allowance Works with Other Benefits?

One of the best things about Attendance Allowance is that it’s tax-free and non-means-tested, meaning:

- Your income, savings, or investments don’t affect eligibility.

- It doesn’t reduce your State Pension or other DWP payments.

- In fact, receiving Attendance Allowance can boost other entitlements, like Pension Credit, Housing Benefit, and Council Tax Reduction.

For instance, once you receive Attendance Allowance, you might automatically qualify for a Severe Disability Premium, which can increase other benefits by around £81.50 per week.

So it’s not just a single payout—it can unlock extra financial help worth thousands more each year.

Attendance Allowance vs. Other Senior Benefits

| Benefit | Age Range | Means-Tested? | Max Annual Value | Purpose |

|---|---|---|---|---|

| Attendance Allowance | Over State Pension age | No | £5,740 | For care/supervision needs |

| Personal Independence Payment (PIP) | Under State Pension age | No | ~£8,000 | For disability or long-term illness |

| Pension Credit | Over State Pension age | Yes | Varies | Tops up low incomes |

| Winter Fuel Payment | 66+ | No | £250–£600 | Helps with heating bills |

| Warm Home Discount | Low-income households | Yes | £150 (bill credit) | Seasonal heating help |

If you’re over State Pension age and have health issues, Attendance Allowance is usually the right route instead of PIP.

Real-World Example: How It Changes Lives

Take Margaret, a 78-year-old from Leeds. After a hip operation, she found it hard to bathe or climb stairs safely. Her daughter encouraged her to apply for Attendance Allowance.

With guidance from Age UK, she filled out the form and was approved for the higher rate—£110.40 per week. Margaret now uses it to pay for a home helper twice a week and taxis to the doctor.

“It’s not just about the money,” she says. “It’s about independence. I don’t have to rely on my kids all the time.”

Stories like Margaret’s are common. Many seniors simply need clear information to claim what they deserve.

Step-by-Step: How to Apply for DWP confirmed £5,600 per year to State Pensioner

1. Gather your information

Prepare your National Insurance number, GP details, medical history, and a list of how your condition affects daily life.

2. Get the form

You can download the Attendance Allowance claim form from GOV.UK or call 0800 731 0122 to request one by post.

3. Fill out the form carefully

Be honest and detailed. Describe difficulties as they are on your worst days. Include real examples, such as:

- “I need help getting out of bed each morning.”

- “I can’t bathe without support.”

- “I fall frequently when walking alone.”

4. Send it in

Mail your completed form to the address on the paperwork. Keep a photocopy for your records.

5. Wait for DWP decision

It can take six to eight weeks for a response. They may request more details or evidence.

6. Appeal if denied

If you’re turned down, don’t give up. You can ask for a “mandatory reconsideration,” and many applicants succeed on appeal.

Why So Many People Miss Out?

Despite being a long-standing benefit, over 1 million pensioners who qualify don’t claim it. The main reasons?

- Lack of awareness – People think it’s automatic or that it only applies to “serious disabilities.”

- Fear of paperwork – The forms can be long, but help is available.

- Pride or hesitation – Some feel uncomfortable asking for financial help.

- Misunderstanding – Many think savings disqualify them (they don’t).

Other Related Benefits to Explore

Attendance Allowance often opens doors to other valuable help, such as:

- Pension Credit – tops up income for low-income pensioners.

- Housing Benefit – helps cover rent costs.

- Council Tax Reduction – reduces local tax bills.

- Winter Fuel Payment – between £250 and £600 to help with heating.

- Carer’s Allowance – if someone looks after you at least 35 hours per week.

- Blue Badge – for easier parking if you have mobility issues.

Expert Tips for a Strong Application

- Keep a diary for a week or two noting how your condition affects you.

- Be specific—don’t just say “I need help,” explain what kind and how often.

- Attach supporting documents—doctor’s letters, prescriptions, care assessments.

- Mention mental health as well as physical limitations.

- Double-check before mailing to ensure nothing’s missing.

- Ask for help from local welfare advisers if needed.

£11Bn Payout Ahead as Regulator Cracks Down on UK Car Finance Mis-Selling

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details

DWP Confirms £2,500 Pensioner Bonus in October 2025 – Who will get it? Check Eligibility

Common Myths About Attendance Allowance

| Myth | Reality |

|---|---|

| “It’s only for people in care homes.” | False. Most claimants live independently. |

| “It’s income-based.” | False. It’s non-means-tested. |

| “You must have a carer.” | Nope. You just need care needs. |

| “It’ll reduce my pension.” | Never. It’s separate and tax-free. |

| “The form’s impossible.” | It’s long, but help is free from charities and advisers. |

The “Born Before 1959” Buzz—Why It Exists

That catchy headline likely originated from social media posts linking age groups to rising living costs and DWP updates. Since most people born before 1959 are now over 66 (the State Pension age), the claim sounds targeted. But legally, there’s no special birth-year cutoff.

If you meet the care need and residency criteria, you’re eligible—whether born in 1958 or 1940. The message is simple: if you’re old enough for a State Pension and struggle with daily tasks, you should check your eligibility today.