In 2025, many Canadians will be able to access a one-time payment of $680 from the Canada Revenue Agency (CRA). This initiative is part of the government’s ongoing efforts to provide financial support to individuals and families facing economic challenges. However, the details of eligibility, the purpose of the payment, and how Canadians can claim it are essential to understand before assuming any benefits.

This article explores the essential facts surrounding the CRA’s $680 One-Time Payment, focusing on eligibility, the payment distribution process, and its broader impact on those who qualify.

Table of Contents

What is the CRA’s $680 One-Time Payment?

The $680 One-Time Payment in 2025 is a federal initiative aimed at assisting low- and middle-income Canadians. This payment, issued directly by the Canada Revenue Agency, is designed to alleviate some financial strain. Although details surrounding the specific conditions of the payment are still being finalized, it is part of ongoing efforts to provide targeted economic relief to citizens as the nation navigates an evolving economic landscape.

The payment is expected to provide financial support to various demographic groups, including families, seniors, and individuals facing financial hardship.

$680 One-Time Payment

| Key Fact | Detail |

|---|---|

| Payment Amount | $680 |

| Eligibility | Low to middle-income Canadians |

| Distribution Timeline | Expected for the 2025 calendar year |

| Payment Mode | Direct deposit or cheque, depending on setup |

| Official Website | Canada Revenue Agency (CRA) |

The $680 One-Time Payment serves as a short-term relief for eligible Canadians, addressing immediate financial pressures caused by inflation. While important, this measure does not offer a comprehensive solution to long-standing issues such as affordable housing, wage inequality, and rising healthcare costs. Experts urge policymakers to continue to implement systemic changes alongside such temporary relief measures.

As Canada continues its recovery from global economic challenges, relief programs such as this one will likely remain a central part of the government’s strategy to protect vulnerable populations.

Eligibility Criteria: Who Can Claim the Payment?

To qualify for the $680 One-Time Payment, applicants must meet specific income criteria. As the payment is designed to support those facing financial difficulties, it is primarily intended for low- to middle-income Canadians, as well as families with children.

According to the Canada Revenue Agency, eligibility for the payment will depend on several factors:

- Income Thresholds: The CRA uses your tax filings to assess income levels and determine eligibility. Typically, this applies to individuals with taxable income below a certain threshold, which the government sets annually.

- Dependents: Families with dependent children may be eligible for additional assistance as part of the broader relief measures. The government recognizes the financial demands faced by parents and guardians.

- Previous Year’s Tax Return: Similar to other benefits such as the GST/HST Credit, eligibility will be automatically determined based on the most recent tax return filed with the CRA.

Individuals must have filed their tax return for the previous year to qualify. Even if no income was earned, filing a return ensures that the CRA can assess your eligibility for this and other government assistance programs.

How to Apply for the $680 Payment

The CRA typically distributes such payments automatically to individuals who qualify. There is no need for an active application process, as the agency uses personal tax filings to determine eligibility.

However, it is important to ensure that personal details, such as direct deposit information, are updated in the CRA’s system. Canadians can check their status or update their information through the CRA’s online portal, or by contacting the agency directly.

For those who have not yet filed a tax return for the previous year, filing one promptly will allow the CRA to assess whether they qualify for the payment.

Broader Impact and Purpose of the Payment

The introduction of the $680 One-Time Payment is part of Canada’s continued effort to provide financial relief to vulnerable populations. Over the past years, the Canadian government has expanded direct financial support to citizens through various programs like the Canada Emergency Response Benefit (CERB) and GST/HST credits.

The CRA’s relief payment is seen as an essential lifeline for households facing inflationary pressures, particularly as the cost of living continues to rise. Canadians in lower-income brackets may find such payments particularly useful in offsetting increased household expenses, such as energy bills and groceries.

The government has emphasized that targeted economic relief programs are essential in supporting Canada’s ongoing recovery from past economic setbacks, including the effects of the COVID-19 pandemic.

Expert Analysis: What Does This Payment Mean for Canadians?

Dr. Emily Thompson, an economist at the University of Toronto, notes that such payments provide immediate relief but should be considered part of a broader economic strategy.

“While one-time payments offer short-term financial support, they are not a substitute for long-term policy changes that address the root causes of inequality,” said Dr. Thompson. “These payments are crucial for those struggling, but there must be a continued focus on systemic solutions, such as affordable housing, healthcare access, and more robust income security.”

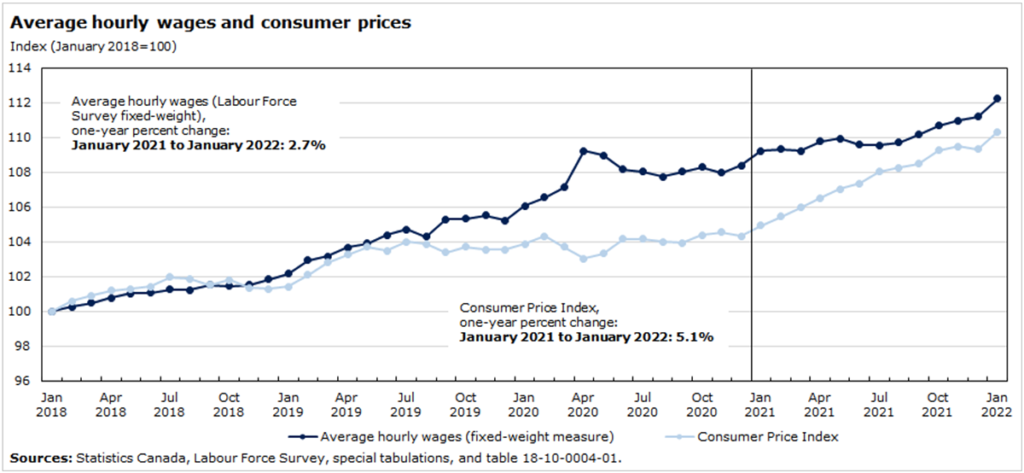

The Economic Context: Why the Government is Stepping In

Canada’s inflation rate has remained high, contributing to an increase in the cost of living. Many Canadians are feeling the strain of rising prices for everyday goods and services, such as groceries, gas, and utilities. In this context, the $680 One-Time Payment is seen as a necessary intervention to provide immediate relief to those most affected.

In a broader sense, these one-time payments reflect the government’s ongoing efforts to support Canadians through economic volatility. As the country faces global financial uncertainties, including supply chain disruptions and geopolitical tensions, targeted relief programs like this one help to reduce financial strain on households, especially in areas like energy and food security.

Comparisons with Similar Programs: How Does Canada Stack Up?

The $680 One-Time Payment has similarities to relief measures seen in other countries, such as the United States’ stimulus checks or the UK’s cost of living support packages. These payments, while often intended as short-term relief, aim to mitigate the negative effects of inflation and economic instability.

In the U.S., direct payments were issued during the COVID-19 pandemic in the form of stimulus checks, which ranged from $1,200 to $3,200 per household. These payments were designed to quickly inject cash into the economy and support American families during times of widespread economic shutdown.

Similarly, the UK government issued Cost of Living Payments to eligible households, particularly those receiving benefits. These payments ranged from £150 to £650, depending on household circumstances, and were structured to provide targeted support.

Canada’s $680 One-Time Payment follows a similar model, focusing on those most affected by the increased cost of living. However, critics argue that one-time payments, while beneficial, may not be sufficient to address deeper structural issues such as rising housing costs and wage stagnation.

Looking Ahead: What’s Next for Canadians?

The $680 One-Time Payment is part of the broader fiscal policies that the government of Canada is implementing to support citizens through the challenges of economic uncertainty. With inflation remaining high and many Canadian households under financial pressure, similar relief programs are likely to continue in the near future.

As of now, no additional one-time payments for 2025 have been officially announced, but the government has expressed a commitment to re-evaluating financial support programs as needed. This suggests that the CRA could continue to introduce targeted relief packages depending on future economic conditions.

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

$2100 Direct Deposit For Canadian Seniors 2025: Check Payment Date & Eligibility Criteria

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it?

FAQ

1. How do I know if I’m eligible for the $680 payment?

Eligibility will be determined based on your 2024 tax return. Make sure to file your taxes to be automatically assessed by the CRA.

2. When will the $680 payment be issued?

The payment is expected to be issued later in 2025, with details on exact dates provided by the CRA closer to the time.

3. Do I need to apply for the $680 payment?

No, the payment will be automatically distributed to eligible Canadians based on their tax filings. However, make sure your CRA account has up-to-date information, including direct deposit details.