CRA Slaps Taxpayer With $5,000 Penalty: If you’ve ever wondered how one small reporting slip could cost you thousands, here’s your wake-up call. Recently, a Canadian taxpayer was slapped with a $5,000 penalty by the Canada Revenue Agency (CRA) for a seemingly minor U.S. reporting mistake. It sounds harsh, but in the age of international data-sharing, a “simple error” can trigger massive headaches. Whether you’re a dual citizen, an investor with U.S. holdings, or a professional handling clients’ cross-border taxes, this story matters.

Table of Contents

CRA Slaps Taxpayer With $5,000 Penalty

Cross-border tax rules might seem like alphabet soup — FATCA, T1135, CRA — but they’re manageable once you understand the basics. A missed form can cost thousands, but honesty, awareness, and quick action go a long way. The CRA’s $5,000 penalty isn’t random; it’s a wake-up call. So if you’ve got U.S. accounts or assets, double-check your filings, stay current, and don’t hesitate to ask for help. Staying compliant is way cheaper than getting caught off guard.

| Topic | Key Insight / Stat | Official Source |

|---|---|---|

| CRA Foreign Reporting Penalties | $25/day up to $2,500 or higher under negligence | CRA Foreign Reporting Penalties |

| FATCA Data Exchange | Over 600,000 Canadian accounts reported to IRS since 2014 | Canada–U.S. FATCA Agreement |

| T1135 Filing Threshold | Required for foreign assets over CAD 100,000 | |

| Relief Programs | CRA allows penalty relief under “Taxpayer Relief Provisions” | |

| Real Penalty Cases | $2,500–$24,000 range for missed T1135s |

Understanding the Background

The CRA enforces Canada’s tax laws and, thanks to international agreements like FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard), now gets data directly from U.S. and global banks. That means your U.S. accounts, investments, and even property ownerships can easily show up in CRA databases.

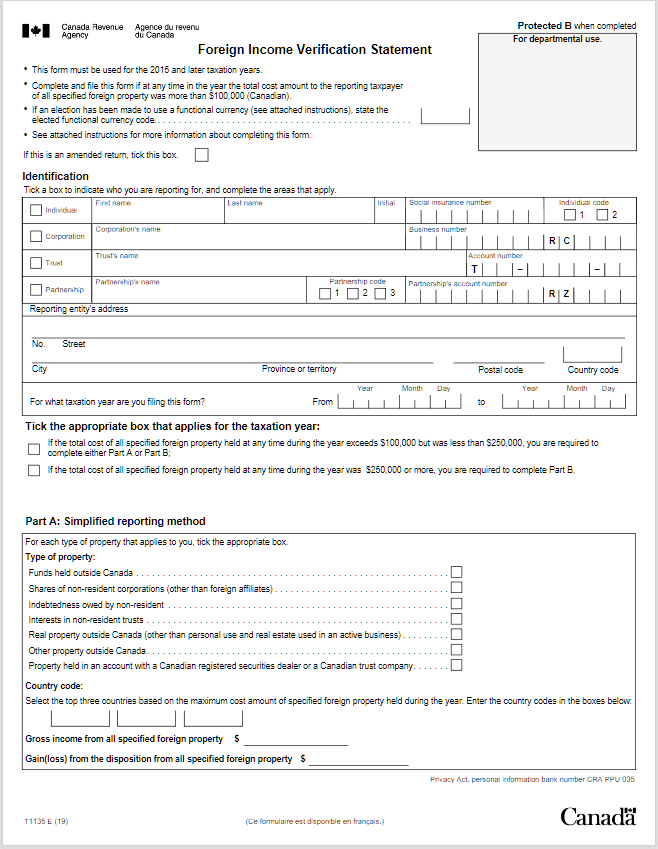

In this recent case, a taxpayer missed reporting a small U.S. investment account. It wasn’t intentional — but the CRA found it anyway and levied a $5,000 fine for failing to file the Form T1135 (Foreign Income Verification Statement). That form, often ignored, is one of the most common traps for Canadians with U.S. ties.

How Does a “Simple” Mistake Lead to a Big Fine?

Let’s simplify this. Imagine you’re a Canadian who invests in U.S. stocks through an American brokerage. You earn dividends and the account’s total cost hits $120,000 CAD. If you forget to disclose this to CRA — even if no extra tax is owed — you’ve technically broken the foreign reporting rules.

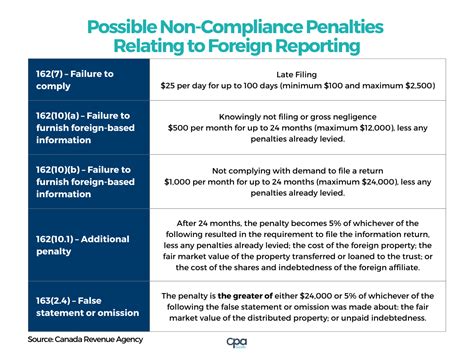

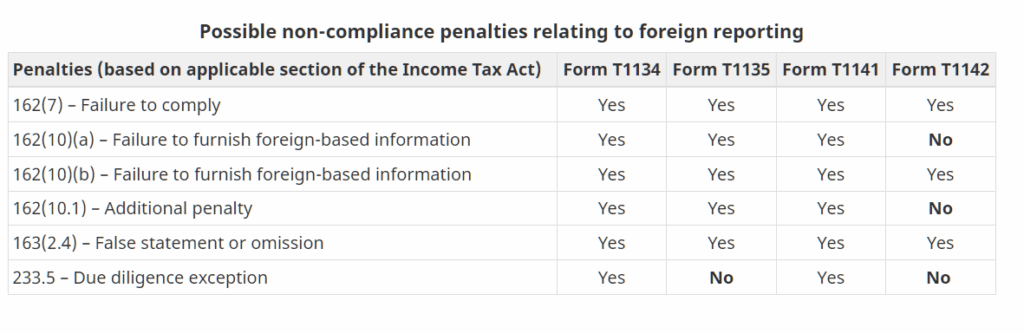

The CRA might assume you were negligent and issue:

- A basic late-filing penalty of $25/day (up to $2,500).

- If they believe you were careless, a gross negligence penalty up to $12,000.

- And if you ignore demands or fail to file after formal notice — it can jump to $24,000 or 5% of the asset value.

In this case, the CRA settled on $5,000, balancing between “careless” and “deliberate” negligence.

Why the CRA Slaps Taxpayer With $5,000 Penalty?

Since 2016, Canada has automatically exchanged account data with over 100 countries, including the U.S. Through FATCA and CRS, over $100 billion in foreign-held Canadian assets have been reported internationally.

CRA officials argue that penalties keep things “fair for compliant taxpayers.” In fiscal 2023, CRA imposed over 12,000 foreign reporting penalties, collecting roughly $20 million in fines.

(Source: Canada Revenue Agency Annual Report 2023)

From their point of view, data transparency is crucial — but for ordinary taxpayers, it can feel intimidating.

What Exactly Is Form T1135?

Form T1135, or the Foreign Income Verification Statement, must be filed if you own “specified foreign property” worth more than CAD 100,000 at any time during the year.

That includes:

- U.S. bank accounts or investment accounts

- U.S. stocks, bonds, and ETFs

- U.S. rental property

- Certain interests in U.S. partnerships or trusts

It doesn’t include things like personal-use property (like a vacation home you use personally), registered accounts like RRSPs, or Canadian mutual funds.

Filing it correctly requires listing country, type of income, and maximum cost amount for each holding.

Step-by-Step Guide: How to Avoid CRA Slaps Taxpayer With $5,000 Penalty?

Step 1: Identify Foreign Assets Early

Create an annual checklist for your tax return. Ask yourself: “Did I hold any account, investment, or property outside Canada this year?”

Step 2: Verify Value Thresholds

If your total foreign property exceeds CAD 100,000, you must file Form T1135 — even if those assets didn’t earn income.

Step 3: File On Time

You usually file it with your regular tax return (April 30 for most individuals). Late filing automatically starts daily penalties.

Step 4: Keep Records

Maintain account statements and fair-market-value documentation for at least six years in case CRA reviews.

Step 5: Correct Mistakes Fast

If you realize you missed a form, use the Voluntary Disclosures Program (VDP) to fix it before CRA contacts you. You’ll likely avoid most penalties.

Step 6: Ask for Relief

If you’ve received a CRA notice, apply for Taxpayer Relief citing reasonable cause — such as illness, misinformation, or accountant error.

Don’t Panic: If You Get a CRA Notice

Receiving a CRA notice doesn’t automatically mean you’re in big trouble.

Here’s what to do calmly:

- Read carefully — CRA letters specify the form, year, and reason.

- Respond on time — deadlines matter.

- Don’t ignore it — silence can escalate penalties.

- Gather your evidence — account statements, tax slips, emails.

- Consult a professional — a CPA or tax lawyer can guide your response.

According to tax advisors, roughly 40% of CRA foreign reporting penalties are successfully reduced or waived upon review. But acting quickly is key.

Pro Tips From the Experts

“CRA isn’t out to punish honest mistakes,” says Mark D., a Toronto-based cross-border CPA. “They just want full disclosure. If you show good faith — by filing late but voluntarily — you’ll often get leniency.”

Top practical tips:

- File electronically to avoid mailing delays.

- Double-check foreign currency conversions using the Bank of Canada’s annual average rates.

- Avoid duplicate reporting by coordinating with your U.S. tax preparer.

- Keep your CRA “My Account” up to date for secure notifications.

- If investing abroad, consult a cross-border tax specialist yearly.

Lessons for Professionals and Expats

For accountants, bookkeepers, and financial advisors — this case reinforces the importance of client education. Many clients assume their investment advisor or broker “automatically handles” tax forms. They don’t.

Expats and dual citizens should treat each year’s filing like an audit checklist:

- Confirm FATCA or FBAR filings (if U.S. citizen).

- Confirm T1135 filings (if Canadian resident).

- Reconcile income reported to both IRS and CRA.

Mistakes often arise from currency translation, misunderstanding cost vs. value, or forgetting small joint accounts.

The Real Takeaway

This $5,000 penalty story isn’t just a scare headline — it’s a reminder that the CRA and IRS talk to each other, and small mistakes can cost big. But with knowledge, organization, and proactive action, you can avoid the stress and stay in the clear.

Whether you’re a seasoned investor or just a hardworking professional with a few foreign shares, remember: tax transparency saves money.