The Canada Revenue Agency (CRA) has confirmed the November 2025 benefit payment schedule, covering key federal programs such as the Canada Child Benefit (CCB), Old Age Security (OAS), and the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit.

Officials have reiterated that no new one-time benefit or “extra payment” has been announced, cautioning Canadians against misinformation circulating online about additional cash disbursements.

Table of Contents

Major Benefit Updates

| Key Fact | Detail / Statistic |

|---|---|

| CCB payment date | November 20, 2025 |

| OAS and CPP payments | November 26, 2025 |

| Ontario Trillium Benefit (OTB) | November 10, 2025 |

| CRA statement on misinformation | “There is no new one-time $680 payment.” |

| Filing requirement | 2024 tax return must be filed to remain eligible |

| Official Website | Government of Canada |

Understanding the November 2025 CRA Payment Schedule

The CRA’s official benefit calendar outlines regular monthly or quarterly payments to millions of Canadians. For November 2025, the schedule includes major disbursements that support children, seniors, and low-income households.

Major Benefit Dates

- Canada Child Benefit (CCB): November 20, 2025

- Old Age Security (OAS): November 26, 2025

- Canada Pension Plan (CPP): November 26, 2025

- Ontario Trillium Benefit (OTB): November 10, 2025

- GST/HST Credit: Distributed quarterly; next instalment falls within the October–December 2025 period.

These programs collectively provide vital income supplements to more than 15 million Canadians, helping offset costs related to childcare, aging, disability, and living expenses.

“For many families, the November payments arrive at a crucial time — ahead of winter expenses and holiday costs,” said Dr. Marie Lamont, an economist at the University of Ottawa specializing in social policy. “While these are routine benefits, their timing offers real relief in the context of inflationary pressures.”

Eligibility and Filing Requirements

While dates are pre-set, eligibility is not automatic. The CRA bases its benefit calculations on each taxpayer’s 2024 income tax return, marital status, and number of dependents.

If returns are missing or incomplete, payments may be delayed or withheld until the information is updated.

Who Qualifies?

- CCB: Parents or guardians caring for children under 18. The benefit is income-tested and indexed annually to inflation.

- OAS and CPP: Seniors aged 65 and older (OAS) or contributors to the national pension system (CPP).

- GST/HST Credit: Low- and modest-income Canadians, issued quarterly to offset consumption taxes.

- OTB: Ontario residents who qualify for provincial energy, sales, or property tax credits.

The CRA urges taxpayers to maintain up-to-date banking details in their CRA My Account to prevent payment interruptions.

CRA’s Warning on Benefit Misinformation

In October 2025, the CRA issued a public notice refuting widespread social media claims about a new $680 one-time payment. The agency clarified that such messages were false and likely linked to phishing or fraud attempts.

“We’ve seen an increase in misleading posts that mimic government language,” said CRA spokesperson Michelle Desrosiers. “There is currently no special or new payment scheduled beyond the standard benefit programs.”

Canadians are advised to cross-check announcements exclusively on official Government of Canada domains ending in “.gc.ca”.

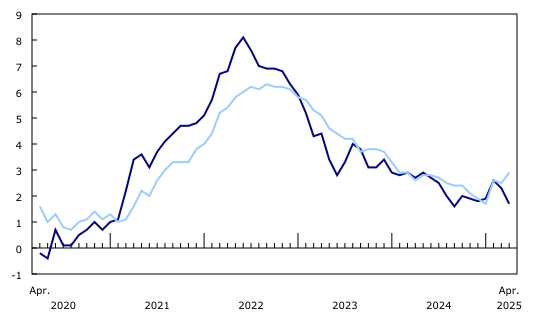

Economic Context: Benefits Amid Persistent Inflation

Although headline inflation in 2025 has eased from its 2022 peak, core living costs remain elevated, particularly for food, rent, and utilities. According to Statistics Canada, grocery prices were still 3.8 percent higher in September 2025 than a year earlier.

Economists say that while benefits like the CCB and OAS provide a cushion, they have not fully kept pace with cost-of-living increases.

“Indexation helps maintain purchasing power, but it’s not a full offset,” explained Dr. Rahul Chowdhury, a senior economist at the Conference Board of Canada. “Lower-income households remain vulnerable, especially as energy costs rise heading into winter.”

The November 2025 benefit cycle, therefore, arrives at a time when many Canadians are drawing on these programs to bridge shortfalls in monthly budgets.

A Closer Look: Key Programs Explained

Canada Child Benefit (CCB)

The CCB remains one of Ottawa’s most significant income-support programs, providing up to $7,787 annually per child under 6, depending on family income. The benefit is non-taxable and recalculated every July based on tax-return data.

November’s payment continues the current fiscal year’s rate, which rose modestly in July 2025 following the standard inflation adjustment.

Old Age Security (OAS)

OAS supports Canadians aged 65 and over who have lived in the country for at least 10 years after age 18. Monthly payments are automatically indexed to inflation every quarter. For higher-income seniors, part of the benefit may be subject to the OAS clawback, reducing payments if net income exceeds a federal threshold (about $90,000 for 2025).

Canada Pension Plan (CPP)

CPP provides retirement, disability, and survivor benefits based on an individual’s contributions during their working years. The November payment is routine, but the program continues to undergo phased enhancements introduced in 2019 to improve future retirement income.

GST/HST Credit and Other Supplements

The GST/HST credit, paid quarterly, helps low-income individuals offset sales taxes. Many provinces, including Ontario, add top-up payments such as the Ontario Trillium Benefit (OTB). Some recipients also qualify for the Canada Workers Benefit (CWB), a refundable tax credit aimed at supporting low-income workers.

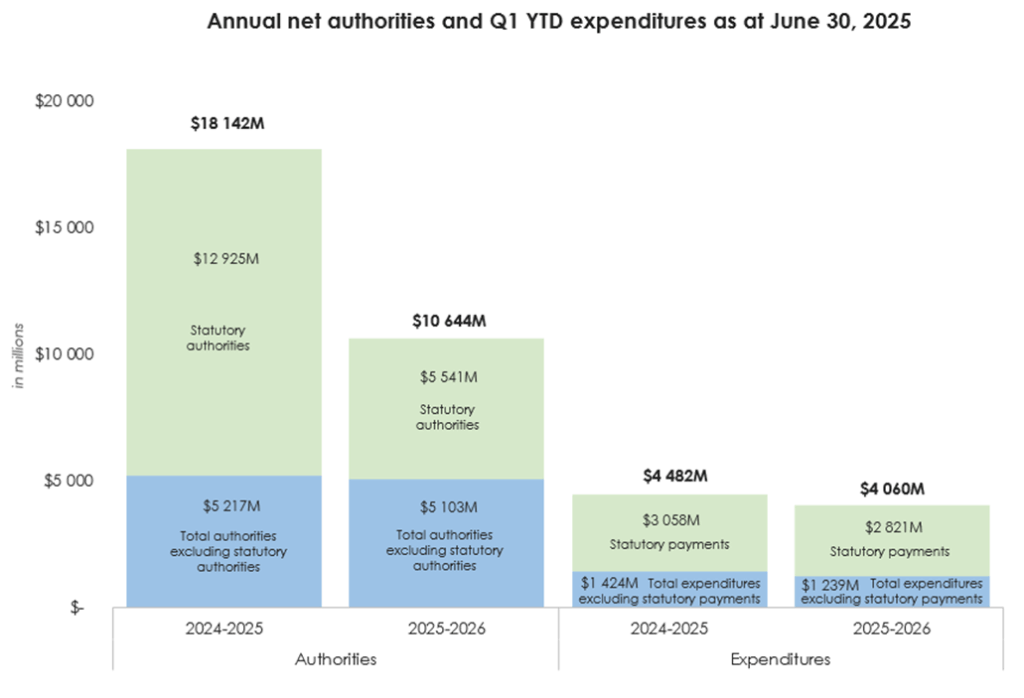

Together, these layered programs form Canada’s social-transfer framework, accounting for billions of dollars in direct support annually.

Public Reaction and Awareness

Although the CRA regularly publishes its payment calendar, each announcement draws heightened attention on social media — sometimes leading to confusion about which programs apply to whom.

A recent survey by the non-profit Canadian Policy Research Centre found that 42 percent of respondents were “unsure” whether new one-time payments announced during the pandemic still applied today. Experts say the persistence of such confusion underscores the need for clear public communication.

“People remember the 2020–2022 emergency payments and often assume similar support continues,” said Dr. Jessica Nguyen, a sociologist at McGill University. “The CRA’s role now is to reset expectations toward regular, predictable programs rather than ad-hoc relief.”

Protecting Against Fraud

Phishing campaigns that imitate CRA notifications have grown increasingly sophisticated. Scammers often use text messages or emails with phrases like “bonus benefit” or “additional tax refund.”

The CRA reiterates that it never sends text messages with payment links, and legitimate correspondence occurs only through its secure online portal or mail. Canadians who suspect fraud are encouraged to contact the Canadian Anti-Fraud Centre or forward suspicious messages to [email protected].

Regional and Demographic Impact

While benefits are national, their significance varies by region. Rural and Northern communities often depend more heavily on federal transfers due to higher living costs and fewer local employment opportunities.

In Atlantic Canada, where energy costs are projected to rise 7 percent this winter, recurring payments like the OAS and GST/HST credit help offset seasonal expenses. In contrast, large urban centres such as Toronto and Vancouver experience higher childcare costs, making the CCB particularly important for working families.

Provincial supplements, including the Alberta Child and Family Benefit and the British Columbia Climate Action Tax Credit, also align with federal disbursements, helping streamline support.

Broader Policy Outlook

The federal government continues to review long-term affordability measures, including potential adjustments to indexed benefits in its 2026 budget. Social-policy analysts argue that while automatic indexation provides stability, broader structural reforms may be necessary to address housing and childcare costs that outpace inflation.

“The CRA is the delivery arm, not the policymaker,” noted Professor Hannah Belcourt of Carleton University’s School of Public Policy. “But these payments reflect the federal commitment to a minimum standard of living, and their reliability is one reason Canada’s poverty rate has declined over the past decade.”

With parliamentary pre-budget consultations under way, advocates are calling for expanded eligibility for working-age adults without children — a group often left out of current benefit structures.

Staying Informed

Canadians seeking reliable updates can consult the following official pages:

- CRA Benefit Payment Dates Calendar

- CRA My Account portal for personal schedules

- Tax credits and benefits for individuals section on Canada.ca

- Government of Canada Newsroom for press releases

The CRA also operates a verified @CanRevAgency account on X (formerly Twitter) and Facebook, both used solely for public information and not direct outreach.

CRA Update: $496 GST/HST Credit Coming in October 2025 – How to Check If You’re Eligible

Canada CRA $2,600 Payment Arriving in October – Who Qualifies and When You’ll Get Paid

Massive $7,997 Canada Child Benefit 2025 – CRA Announces New Monthly Payouts for Families!

Looking Ahead

With the November 2025 benefit cycle confirmed, attention will soon shift to the December 2025 payment schedule, which often sees heavier administrative volume ahead of year-end. Analysts expect continued emphasis on fraud prevention, taxpayer education, and streamlined digital services.

“Predictability is critical,” said economist Marie Lamont. “Even without new programs, the consistency of CRA’s delivery is what keeps millions of Canadians financially stable month to month.”

For now, the CRA’s message is clear: benefits are proceeding on schedule, eligibility depends on timely tax filing, and Canadians should rely exclusively on official channels for information.