The Canada Revenue Agency (CRA) has confirmed that Ontario’s 2025 Ontario Trillium Benefit (OTB) payments were issued on October 10, 2025. The OTB, a financial assistance program designed to support eligible residents, includes the Ontario Energy and Property Tax Credit (OEPTC), Northern Ontario Energy Credit (NOEC), and Ontario Sales Tax Credit (OSTC). Here’s everything you need to know about this year’s payment schedule, eligibility requirements, and how much those eligible can expect to receive.

Table of Contents

CRA Confirms 2025 OTB Payment Date

| Key Fact | Detail/Statistic |

|---|---|

| Payment Date | October 10, 2025 |

| Eligibility Criteria | Residents of Ontario who filed taxes for 2024 |

| Maximum OEPTC Payment | Up to $1,461 for seniors, $1,283 for individuals |

| NOEC Eligibility | Available to Northern Ontario residents |

| OSTC Payment | Up to $371 per adult and child |

| Official Website | Canada Revenue Agency |

Ontario’s 2025 Trillium Benefit payment cycle is designed to provide financial relief to those who need it most. Whether through monthly payments or lump-sum disbursements, eligible Ontarians can expect assistance to help with property taxes, energy costs, and sales taxes. For the latest updates, residents are encouraged to stay informed through the CRA’s official communications and My Account portal.

As Ontario continues to support its residents, the Ontario Trillium Benefit plays a crucial role in alleviating financial burdens for individuals and families across the province.

What is the Ontario Trillium Benefit?

The Ontario Trillium Benefit is an important source of financial relief for eligible Ontarians. This benefit is composed of three separate credits aimed at reducing the burden of taxes, energy, and living costs for residents of Ontario.

- Ontario Energy and Property Tax Credit (OEPTC): Aimed at helping Ontarians with low to moderate incomes who pay property taxes or rent, as well as individuals who incur high energy costs. The credit varies based on age and residency.

- Northern Ontario Energy Credit (NOEC): A specific credit for residents of Northern Ontario, addressing the higher energy costs in these regions.

- Ontario Sales Tax Credit (OSTC): Aimed at providing financial support to low-income individuals and families to offset the sales tax burden.

Historical Context of the Ontario Trillium Benefit

The Ontario Trillium Benefit was introduced in 2010 as part of the Ontario government’s effort to provide direct financial relief to low- and moderate-income residents of the province. The OTB consolidated several different tax credits, including the Ontario Energy and Property Tax Credit, the Ontario Sales Tax Credit, and the Northern Ontario Energy Credit, into a single payment.

By simplifying the process and providing a lump sum to eligible residents, the government aimed to streamline the assistance process. The introduction of the OTB was particularly beneficial in reducing the administrative burden on both the provincial government and the citizens applying for various credits.

Since its introduction, the OTB has evolved to provide even more extensive support. For example, in recent years, the government has increased the eligibility thresholds and the amounts distributed under each credit, further expanding the program’s reach.

Who Qualifies for the October 2025 OTB Payments?

The eligibility for the OTB is contingent upon meeting several criteria. To receive this payment, individuals must:

- Be a resident of Ontario as of December 31, 2024.

- Have filed a 2024 income tax return, including the ON-BEN form for those applying for the OEPTC or NOEC.

- Meet the income requirements for the various credits.

According to the CRA, if a person’s annual OTB entitlement exceeds $360, they will receive monthly payments from July 2025 to June 2026. Those with an entitlement of $360 or less receive a lump-sum payment in July 2025. For those who prefer receiving their entire OTB in a single payment, the sum is typically delivered in a lump-sum in June 2026.

Payment Amounts and How They are Calculated

The amount of the OTB is calculated based on several factors, including the applicant’s income, age, family status, and the type of credit they qualify for.

- Ontario Energy and Property Tax Credit (OEPTC):

- Individuals aged 18-64 can receive up to $1,283 annually.

- Seniors aged 65 and older are eligible for up to $1,461.

- Renters, those who pay property taxes, and residents living in public care homes may also receive varying amounts depending on their specific circumstances.

- Northern Ontario Energy Credit (NOEC):

- Individuals living in Northern Ontario can receive up to $185 per year, while families may receive up to $285 annually.

- Ontario Sales Tax Credit (OSTC):

- The maximum OSTC payment is up to $371 for each eligible adult and child in a family.

- The OSTC is gradually reduced by 4% of an individual’s adjusted net income over certain thresholds.

Expert Insights: The Role of the OTB in Poverty Reduction

Dr. Emily Harris, a professor of economics at the University of Toronto, highlighted the importance of the OTB in reducing the financial strain on Ontario’s low-income residents. “The OTB acts as a direct form of support to those who need it most,” she explained. “For low-income families, seniors, and individuals with disabilities, this benefit is not just a nice-to-have; it’s often critical for covering basic living expenses.”

Dr. Harris also noted that the benefit helps stimulate local economies by putting money directly into the hands of consumers, who then spend it on essential goods and services. “When people spend this money, it supports local businesses and keeps the provincial economy moving, especially in rural areas.”

Social and Economic Impact of the Ontario Trillium Benefit

The OTB has been a lifeline for many low- and middle-income Ontarians, reducing financial pressure and helping alleviate poverty. It plays a key role in ensuring that Ontario’s residents can maintain a reasonable standard of living, especially in light of rising costs for energy, rent, and groceries.

A report from the Ontario Ministry of Finance found that more than 2.5 million households benefit from the OTB annually, with approximately 25% of recipients reporting that the benefit helped them cover the cost of energy bills. For seniors and vulnerable populations, the additional financial support is crucial in managing their limited income.

For instance, consider the impact on families with young children or single-parent households. The added support from the OSTC can make a significant difference in these families’ day-to-day lives. The government’s effort to reduce the tax burden on families not only improves their financial well-being but also allows them to better invest in their children’s future.

How to Check Your OTB Payment Status

Eligible individuals can check the status of their OTB payments through the CRA’s online portal, My Account. By logging in, users can access information on the amount of their entitlement, the payment schedule, and any other relevant details.

For those who have not yet enrolled in direct deposit, the CRA strongly encourages registering for this option. Direct deposit ensures faster and more secure payment transfers.

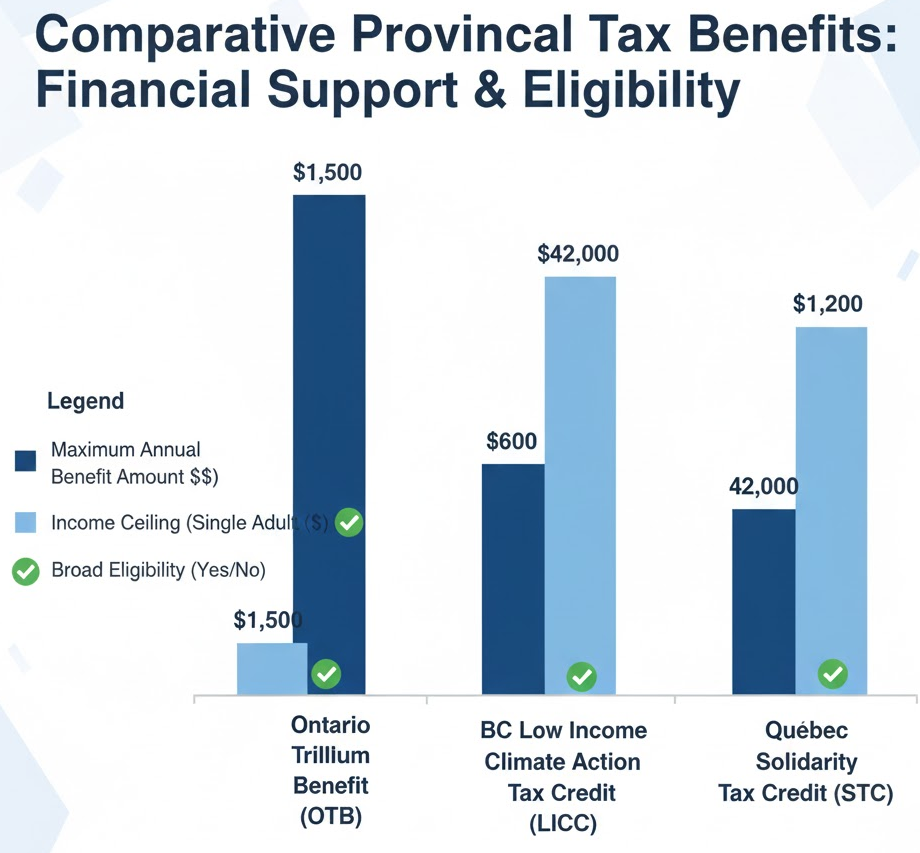

Comparison with Other Provinces

Ontario is not alone in providing targeted financial support to its residents. Other provinces in Canada, such as British Columbia and Quebec, also offer similar programs. However, Ontario’s OTB is among the most comprehensive, with the inclusion of the Northern Ontario Energy Credit and a wide range of eligibility for low-income individuals across various demographics.

In British Columbia, for example, the BC Low Income Climate Action Tax Credit provides support, but it doesn’t match the breadth of Ontario’s OTB in terms of eligibility or financial support. Similarly, Quebec offers the Solidarity Tax Credit, which targets low-income individuals and families, but it doesn’t provide the same energy or property tax relief as Ontario’s program.

Key Dates for Ontario Trillium Benefit Payments in 2025

The OTB payments for the 2025 year follow a consistent schedule, starting with monthly payments in July. However, for those who are not eligible for monthly payments, the first lump-sum payment is typically distributed in July 2025.

- July 2025: Lump-sum payment for those with an entitlement of $360 or less.

- October 10, 2025: Monthly payment for those eligible.

- Subsequent monthly payments: Issued through June 2026 for those eligible for ongoing support.

Future Projections and Potential Changes

There is growing speculation that Ontario may adjust the OTB in response to inflation or changes in the housing market. Experts believe that if housing costs continue to rise, the government could increase the amount of financial support for renters or those facing high energy costs. Additionally, with political shifts on the horizon, changes to the eligibility requirements or payment amounts are possible.

CRA $2700 Coming For Canadian Seniors In October 2025 – Is it true? Check Payment Date & Eligibility

$2100 Direct Deposit For Canadian Seniors 2025: Check Payment Date & Eligibility Criteria

$400 Increase In CPP/OAS Benefits in October 2025: Who will get this? Check Payment Date

FAQ

Q: How can I apply for the Ontario Trillium Benefit?

A: You must file your 2024 income tax return and, if applicable, complete the ON-BEN form. Ensure all required documents are submitted to the CRA.

Q: When will the next OTB payment be made after October 10?

A: Ongoing payments are made monthly, with the next one scheduled for November 10, 2025.

Q: Can I check my OTB payment status online?

A: Yes, you can use the CRA’s My Account portal to track your payments and view detailed information regarding your entitlement.