CPP $1306 Payment Update: If you’re watching your retirement benefits or thinking about starting your Canada Pension Plan (CPP) payments, understanding the CPP $1306 payment update for November 2025 is a must. Whether you’re about to retire, already getting your pension, or just keen on the facts, this article breaks down EVERYTHING—eligibility, payments, benefits, and key tips—in a clear, friendly voice, backed by solid facts.

Table of Contents

CPP $1306 Payment Update

The CPP $1306 payment update for November 2025 gives you the lowdown on what to expect. Your payment lands November 29, 2025, and your monthly amount depends on how much you contributed and when you start your benefits. CPP supports you with a retirement income indexed to inflation and includes survivor and disability protections too. Plan smart: delay your benefits if possible, keep working past 65 for extra income, and monitor your contributions. This way, you maximize the pension you rightfully earned through years of hard work.

| Aspect | Details |

|---|---|

| November 2025 CPP Payment Date | November 29, 2025 |

| Average New Pension Payment (2025) | $848.37/month |

| Maximum Pension Payment (2025) | $1,433.00/month |

| Eligibility Age | 60 years (early start with reduced benefits) to 70 years (deferred start with increased benefits) |

| Payment Adjustment | Annually indexed to inflation |

| Official Website | Canada Pension Plan – canada.ca |

What’s the Deal with the CPP $1306 Payment Update Figure?

When you hear about the $1306 CPP payment for November 2025, here’s the scoop: this is an estimated average monthly CPP benefit for a large swath of Canadians. The actual payment you get depends on how much you paid into CPP through your work, and when you begin your pension.

- The maximum monthly CPP payment for 2025 is approximately $1,433 for those starting at age 65.

- The average new recipient gets around $848 per month.

- The $1306 figure falls between average and max, highlighting what many retirees with a solid contribution history might expect.

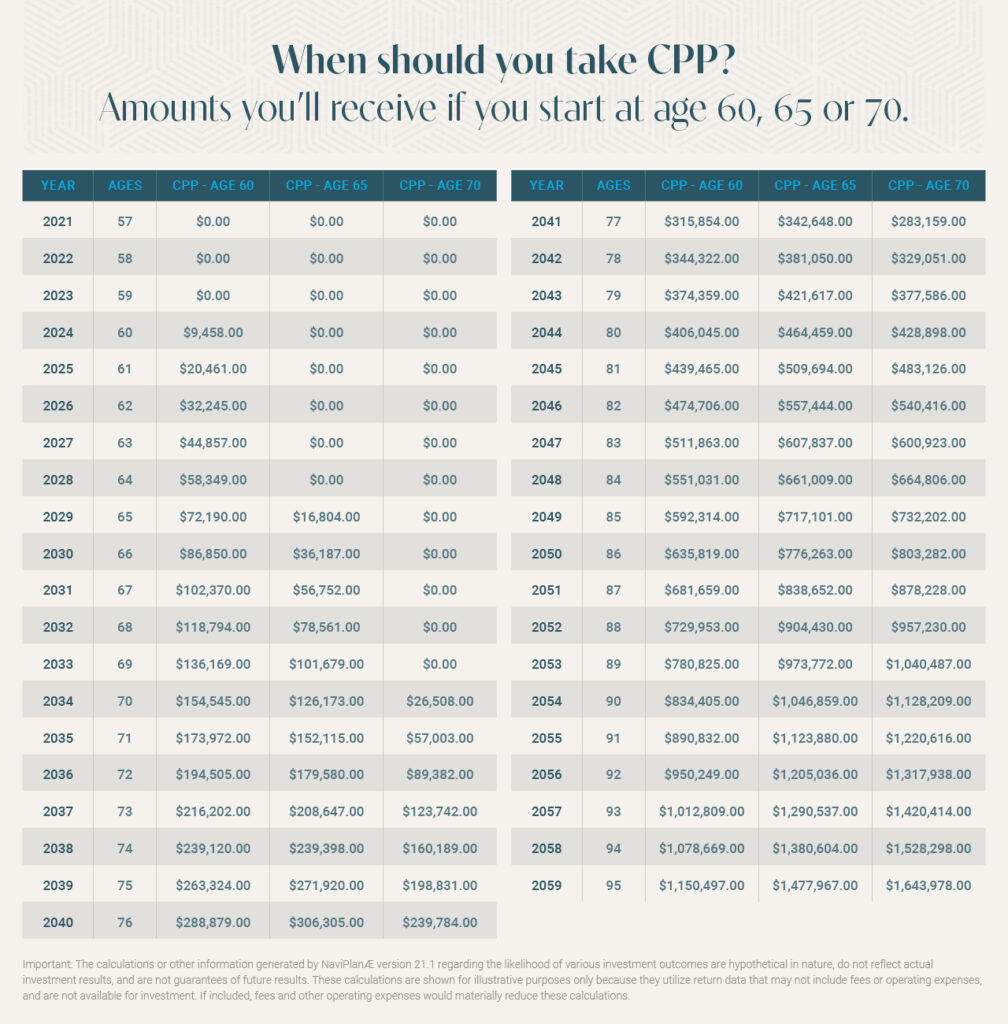

How Does CPP Eligibility Work?

Get this: CPP is basically like planting a money tree through your working life.

- You must make contributions through work (or your employer did).

- You can start receiving payments from age 60 to 70.

- Early start (before 65) cuts payments by 0.6% per month.

- Delaying payments until 70 boosts them by 0.7% per month, maxing out at about 42% more.

- You must have made at least one valid CPP contribution to qualify.

- Contributions can be made in Canada or transferred credits from a spouse after separation/divorce.

- CPP payments won’t be reduced if you keep working after starting your pension; instead, you may be eligible for the CPP Post-Retirement Benefit, which adds to your monthly income if you keep contributing between ages 60 and 70.

- If you worked in Quebec, you might have paid into the Québec Pension Plan (QPP) instead, but these work alongside CPP for coordination.

November 2025 Payment Date & Amounts

- The payment date for November 2025 is November 29.

- Payments drop into your bank if you have direct deposit.

- Here’s a quick look at 2025 pension amounts:

| Pension Type | Avg Monthly Payment | Max Monthly Payment |

|---|---|---|

| Retirement (Age 65) | $848.37 | $1,433.00 |

| Post-Retirement Benefit | $19.84 | $49.39 |

| Disability Benefit | $1,210.27 | $1,673.24 |

| Survivor’s Pension (<65) | $539.81 | $770.88 |

| Death Benefit (One-Time) | $2,559.30 | $2,500.00 |

What About Inflation?

Good news: CPP payments are indexed annually to inflation. This means every year your payments get a bump to keep pace with the cost of living, so your retirement money doesn’t get eaten up by rising prices.

Compare: CPP vs. U.S. Social Security

If you’re coming from the U.S. and scratching your head, here’s a quick breakdown:

| Feature | CPP (Canada) | Social Security (USA) |

|---|---|---|

| Eligibility Age | 60 to 70 years | 62 to 70 years |

| Max Monthly Payment | Around $1,433 (CAD) | Approx. $3,800 (USD) max (2025) |

| Inflation Adjustment | Yes (annually) | Yes (Cost-of-Living Adjustment) |

| Contributions | Pay as you work, employer matches | Pay as you work, employer matches |

| Survivor/Disability | Included benefits | Included benefits |

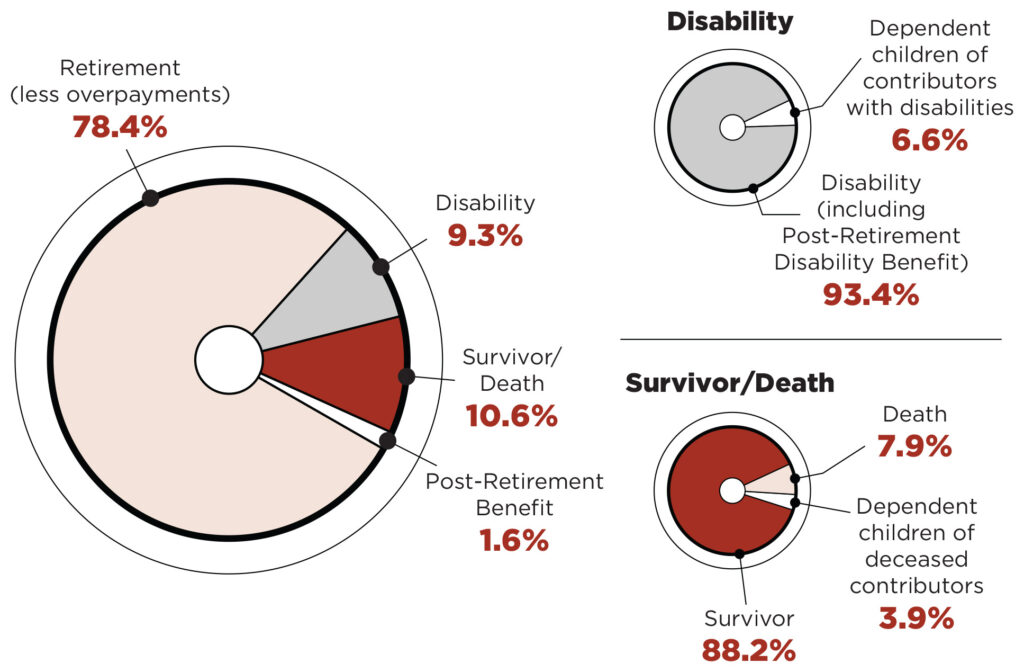

CPP Survivor & Disability Benefits

CPP isn’t just for retirement — it also supports you and your family in other ways:

- Survivor Benefits: If your spouse or common-law partner passes away, they may qualify for survivor’s pension to help with income support.

- Disability Benefits: Qualify if you become disabled before retirement age and are unable to work due to a long-term or severe disability. These payments help replace lost income.

- Children’s Benefits: Dependent children under 18 (or full-time students under 25) of disabled or deceased CPP contributors may receive monthly benefits.

Busting Common CPP Myths

Here are some myths worth busting:

- Myth: “CPP pays the same to everyone.”

Fact: Payments depend on your contributions and retirement age. - Myth: “You don’t have to apply for CPP.”

Fact: You must apply; CPP is not automatically paid. - Myth: “CPP payments aren’t taxable.”

Fact: CPP is taxable income, so plan accordingly. - Myth: “You can’t work and receive CPP.”

Fact: You can keep working and receive CPP. You may also get extra post-retirement benefits if you keep contributing.

How to Apply for CPP $1306 Payment: Step-by-Step Guide

- Sign up for My Service Canada Account. This online portal lets you track your contributions and payments.

- Check your contribution history and pension estimate.

- Apply for CPP online or by mail once you’re ready (minimum age 60).

- Set up direct deposit to get payments faster.

- Keep your contact details updated to avoid delays.

- If you see issues or delays, contact Service Canada directly for support.

Documents needed include your Social Insurance Number (SIN), proof of age (birth certificate or passport), banking info, and employment history.

Planning to Maximize Your CPP Benefits

Here’s the smart play:

- Delay claiming till 70 if you can—this boosts your payments by up to 42%.

- Keep working and contributing post-65, increasing your post-retirement benefit.

- Review your contribution history regularly to spot errors.

- Coordinate with other incomes like Old Age Security (OAS) and provincial plans.

- Prepare for taxation; consider splitting income with your spouse to cut tax burdens.

What If You Worked Outside Canada?

Canada has social security agreements with several countries. If you worked in both Canada and another country, you might qualify for CPP and a foreign pension. These agreements help combine work credits to maximize benefits. For specifics, check the Government of Canada’s international agreements page.

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it?

October $300 Canada Federal Payment 2025 – Is It Real? Find Out If You’re Eligible!

October 2025 Canada Carbon Rebate – How Much You Could Receive? Check Details