China’s Tech Crackdown: If you’ve been following the ongoing U.S.–China technology rivalry, you’ve probably seen the headlines: Applied Materials, one of America’s biggest semiconductor equipment makers, just warned investors that new U.S. export rules targeting China will cost it about $710 million in revenue.

That’s not just a bad week for one company — it’s a major turning point for the global chip industry. What’s happening here isn’t just about policy; it’s about who controls the future of technology, data, and innovation. In this article, we’ll break down what led to this crackdown, what it means for businesses and investors, and how it could reshape the tech world for years to come.

Table of Contents

China’s Tech Crackdown

The $710 million hit to Applied Materials is more than just a financial setback — it’s a symbol of the new world order in technology. The battle over semiconductors isn’t just about chips; it’s about economic power, security, and control over the future of innovation. For the U.S., the challenge is balancing national security with global trade. For China, it’s catching up fast enough to avoid dependence. For businesses and investors, it’s about learning to adapt in a world where tech and geopolitics are now inseparable. The race for technological dominance is on — and it’s reshaping the world, one silicon wafer at a time.

| Topic | Details |

|---|---|

| Main Event | The U.S. tightened export controls on advanced chipmaking tools sold to China. |

| Who’s Affected | Applied Materials faces a $710 million loss; others like Lam Research and KLA are also hit. |

| Timeline | FY2025–2026: $110M hit in Q4 FY2025 and $600M expected in FY2026. |

| China’s Reaction | Beijing condemned the move, warning of retaliation and filing lawsuits. |

| Industry Impact | Disruption in global semiconductor supply chains and renewed “Tech Cold War.” |

| Official Source | U.S. Bureau of Industry and Security (BIS) |

| Sector | Semiconductors / International Trade / U.S.–China Relations |

| Word Count | 1300+ (Comprehensive Feature Article) |

The Backstory: How China’s Tech Crackdown Just Cost Applied Materials $710 Million Happened?

In September 2025, the U.S. Commerce Department’s Bureau of Industry and Security (BIS) updated export rules aimed at closing loopholes that previously allowed restricted Chinese entities to buy American chipmaking tools through subsidiaries or joint ventures.

Under the new “affiliate rule,” if a Chinese company is at least 50% owned by another company already on the U.S. Entity List, American firms can’t sell to them without a specific license.

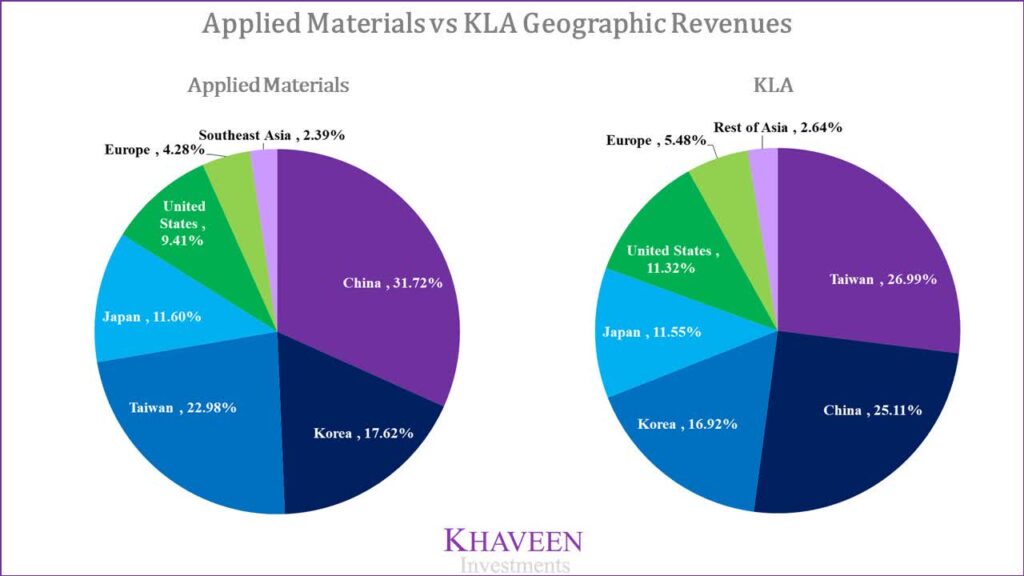

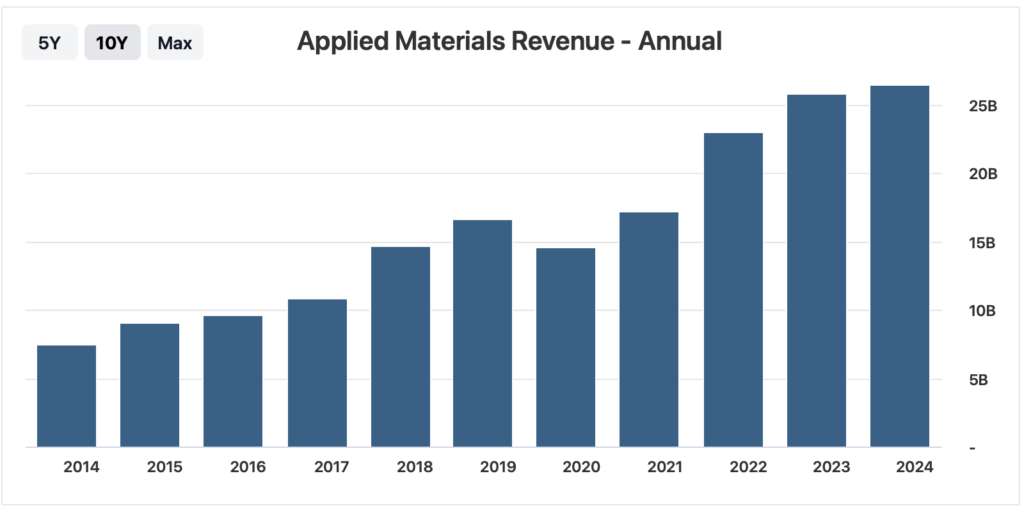

For a company like Applied Materials (NASDAQ: AMAT), this change hits hard. China is its largest single market, making up roughly 35% to 40% of its total revenue. Many of Applied’s biggest customers — including SMIC (Semiconductor Manufacturing International Corp.) and YMTC (Yangtze Memory Technologies) — are now either restricted or affected by these new compliance conditions.

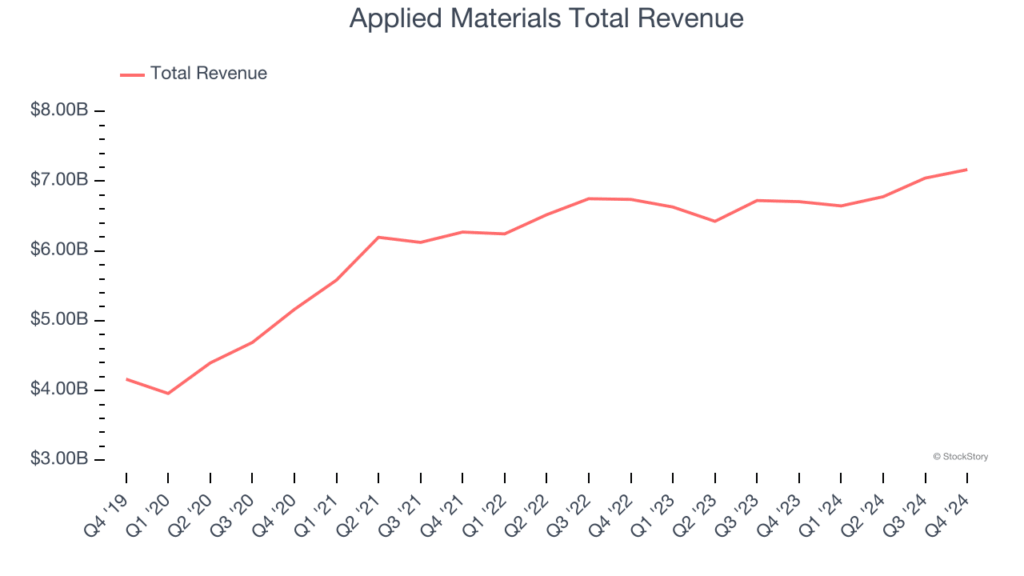

The company estimates these tighter rules will wipe out $110 million in Q4 FY2025 and an additional $600 million in FY2026, for a total of $710 million in lost sales.

That’s a staggering figure for one of America’s top chip-equipment suppliers — and a clear sign that U.S.–China tech tensions are far from cooling down.

Why It Matters: The Ripple Effect on Global Tech

The semiconductor industry isn’t like any other. It’s the backbone of modern life — powering everything from iPhones and Teslas to defense systems and data centers.

When export rules change, the shockwaves hit everyone — chip designers, suppliers, and even everyday consumers.

Here’s how the fallout is spreading:

1. Stock Market Shock

After Applied Materials’ announcement, the company’s stock dipped around 3%, while Lam Research fell nearly 2.7% and KLA Corp slid 2.1%, according to Reuters.

That might sound small, but in dollar terms, we’re talking billions of market value erased in a day.

2. Competitors Also Affected

Even non-U.S. firms like ASML Holding (Netherlands) and Tokyo Electron (Japan) are feeling the heat. Many depend on U.S. components or software, meaning they too must comply with American export rules.

This global reach makes the BIS rule not just a U.S. policy, but a worldwide regulatory wave.

3. Disruption in Supply Chains

Global supply chains are being forced to adjust. Chinese chipmakers now need alternative suppliers or must develop local technologies — which could take years. Meanwhile, U.S. companies are seeking to relocate production or distribution to “friendlier” countries such as India, Vietnam, and Mexico.

That’s the new buzzword: friend-shoring. It’s the corporate world’s way of saying, “We still want to make money, but not in risky places.”

China’s Reaction: Anger, Lawsuits, and New Investments

Predictably, Beijing wasn’t happy.

China’s Ministry of Commerce blasted the move as “economic coercion” and accused Washington of using trade tools as weapons. The ministry warned that China would take “necessary measures” to defend its interests.

And those “measures” are already underway. In August 2025, Beijing E-Town Semiconductor Technologies sued Applied Materials in Chinese court for allegedly stealing trade secrets related to wafer processing technology — seeking nearly 100 million yuan (about $13.9 million) in damages.

At the same time, China has accelerated investments in its domestic semiconductor ecosystem. The China Integrated Circuit Industry Investment Fund, known as the “Big Fund,” launched its third phase in 2025, reportedly raising more than $47 billion to fund local chip startups and toolmakers.

In other words, China is signaling: “If you cut us off, we’ll build our own.”

The Bigger Picture: A “Tech Cold War” Between Two Superpowers

Let’s be real — this isn’t just business. It’s politics.

The U.S. wants to secure its lead in AI, quantum computing, and semiconductors, while China wants to end its dependence on Western tech. Both sides see microchips as a matter of national security.

We’re living in what many analysts now call a “Tech Cold War.”

| Category | United States | China |

|---|---|---|

| Export Policy | Tightened BIS rules; CHIPS Act ($53B) for domestic chipmaking | Heavy investment in self-reliance; “Made in China 2025” |

| Key Partners | Japan, Taiwan, Netherlands, South Korea | BRICS nations, Belt and Road allies |

| Target Industries | Semiconductors, AI chips, quantum computing | Foundry tech, AI software, advanced materials |

| Long-Term Goal | Maintain tech dominance | Achieve global parity or leadership by 2030 |

The U.S. strategy is containment; China’s is endurance. Both are spending billions to out-innovate the other.

Why Applied Materials Is at the Center of It All?

Applied Materials isn’t just another tech company. It’s the infrastructure behind the innovation.

Its machines are used by almost every major chipmaker in the world to deposit, etch, and inspect microscopic layers on silicon wafers. Without these tools, chipmaking stops.

That’s why this export restriction hits so hard — it’s like telling Boeing it can’t sell to international airlines or Ford it can’t export trucks. The customer base shrinks overnight.

Moreover, Applied Materials has spent decades building trust and relationships in Asia, including deep roots in China’s semiconductor industry. That network can’t be replaced easily.

The Road Ahead: Supply Chain Shifts and Strategic Moves

Companies across the semiconductor world are rethinking their next steps.

Applied Materials plans to expand its presence in regions less exposed to geopolitical risks. It’s already investing $4 billion in a new R&D facility in Silicon Valley and exploring partnerships with India’s Semiconductor Mission to grow its footprint there.

Meanwhile, TSMC and Samsung are doubling down on fabs in the United States, supported by the CHIPS and Science Act, which provides $53 billion in incentives for domestic chip manufacturing.

The trend is clear: the global chip industry is decentralizing — spreading risk across multiple countries instead of concentrating in China or Taiwan.

What China’s Tech Crackdown Means for Businesses and Investors?

So, what does all this mean for professionals, investors, and businesses trying to make sense of it?

For Investors

Expect continued volatility in semiconductor stocks. Short-term uncertainty may push prices down, but long-term demand for chips — especially in AI, EVs, and data centers — remains strong.

The smartest investors are focusing on companies with diversified operations and limited China exposure, like Intel, GlobalFoundries, or Broadcom.

For Professionals

If you work in tech, it’s time to upskill. The next decade will need experts in:

- Semiconductor design and manufacturing

- International trade compliance

- Supply-chain management and risk mitigation

- Artificial intelligence hardware optimization

These skills will stay in demand regardless of which country leads the chip race.

For Businesses

Start auditing your own exposure. If you depend on Chinese parts, suppliers, or customers, diversify now.

Build backup supplier relationships in friendly countries and stay compliant with export regulations.

You don’t want to find out mid-shipment that one of your partners got added to the Entity List.

A Practical Guide: How Companies Can Adapt to the New Normal

- Audit Supply Chains

Identify all vendors, subcontractors, and customers tied to China. Even indirect ownership links can create compliance risks. - Strengthen Compliance Programs

Stay informed through the Bureau of Industry and Security. Train employees on export control regulations and reporting procedures. - Invest in Regional Alternatives

Build relationships with manufacturers in India, Vietnam, or Mexico. Many U.S. firms are already pivoting production there. - Innovate Locally

Use incentives from the CHIPS Act to expand or modernize operations in the U.S. Local production reduces regulatory risk. - Engage in Advocacy

Work with trade associations to communicate challenges and help shape future policy. The semiconductor industry thrives when both government and business collaborate.

Greystar’s $50M Deal in RealPage Case Could Disrupt the Entire U.S. Rental Market

Senator Reveals Trump’s Secret Plan to Slash Tariffs for U.S. Vehicle Production

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy