Centrelink Pension Payments of $250 and $750: The rumors about Centrelink Pension Payments of $250 and $750 in October 2025 have been making waves across social media, online forums, and even in local community conversations. You might have seen posts claiming that “every pensioner will receive a $750 bonus this October” or that “Centrelink is giving $250 to low-income Aussies.” But before you start counting the money, it’s important to separate fact from fiction. This detailed, professional, and easy-to-follow guide will help you understand what’s really happening, who’s eligible for any extra support, and how to make sure you don’t fall for scams. We’ll also talk about how pension adjustments actually work, why these rumors appear, and how to make the most of your Centrelink benefits.

Table of Contents

Centrelink Pension Payments of $250 and $750

Right now, there is no official $250 or $750 Centrelink payment in October 2025. What’s real are the inflation-based adjustments made in September, which slightly increased pensions for millions of Australians. If a payment is genuine, it will be clearly announced by the government—never through viral social media posts. For pensioners and low-income Australians, focusing on regular entitlements, applying for concessions, and using financial assistance programs remains the best way to stay ahead in tough times.

| Topic | What It Means |

|---|---|

| Age Pension (as of September 2025) | Max for singles: $1,178.70/fortnight; couples (each): $888.50/fortnight |

| Eligibility Age | You must be 67 years or older (born on or after 1 January 1957) |

| Advance Payment Option | Pensioners can apply for a lump-sum advance of their pension to handle big expenses |

| No Official $750 Bonus | No confirmed government announcement of a universal $750 bonus in October 2025 |

| Recent Adjustments | Pensions rose in September 2025 due to inflation and cost-of-living pressures |

| Official Source | Services Australia |

Why People Are Talking About Centrelink Pension Payments of $250 and $750?

Lately, several online posts have gone viral claiming that Centrelink will pay an extra $250 or $750 to pensioners in October 2025. These posts often include fake screenshots of “official announcements” or links to websites that look like government pages but aren’t.

As of mid-October 2025, no official government announcement or legislative update confirms these lump-sum payments. The Department of Social Services (DSS) and Services Australia—the agencies that manage social welfare and pensions—have made it clear that there are no one-off payments of those amounts currently scheduled for this month.

However, it’s easy to see why people get confused. The government does issue real, legitimate lump-sum payments from time to time—such as the COVID-19 stimulus payments or the 2022 Cost of Living payment. Plus, regular pension rate increases happen every March and September through a process called indexation. This is what many are noticing in their bank accounts now.

The Real Reason Behind Centrelink Pension Payments of $250 and $750 Rumours

Rumors about “bonus payments” often spread right after indexation updates or budget announcements. In 2025, inflation and the rising cost of essentials like groceries, rent, and fuel have put a financial strain on many Australians, especially seniors on fixed incomes.

When pensioners noticed slightly higher payments after the September 2025 indexation, many assumed it was a special one-off bonus. Others saw posts on Facebook or TikTok claiming that everyone was getting $250 or $750 “this month only.” Unfortunately, scammers often exploit these moments by setting up fake websites to harvest personal information such as myGov credentials or bank details.

The Australian Competition and Consumer Commission (ACCC), via Scamwatch, has warned that fake “Centrelink bonus” messages are among the most common scams targeting retirees.

How Centrelink Pension Payments Actually Work?

1. Eligibility

To receive the Age Pension, you must meet three key tests:

- Age test: You must be at least 67 years old (for those born after 1 January 1957).

- Residency test: You must be an Australian resident and have lived in the country for at least 10 years, with some exceptions.

- Means tests: Both an income test and an assets test are applied. The payment you receive is based on whichever test gives you the lower amount.

For example, a single homeowner can own up to $321,500 in assets to receive the full pension. A couple who owns their home can have up to $482,500 in combined assets.

2. Payment Adjustments (Indexation)

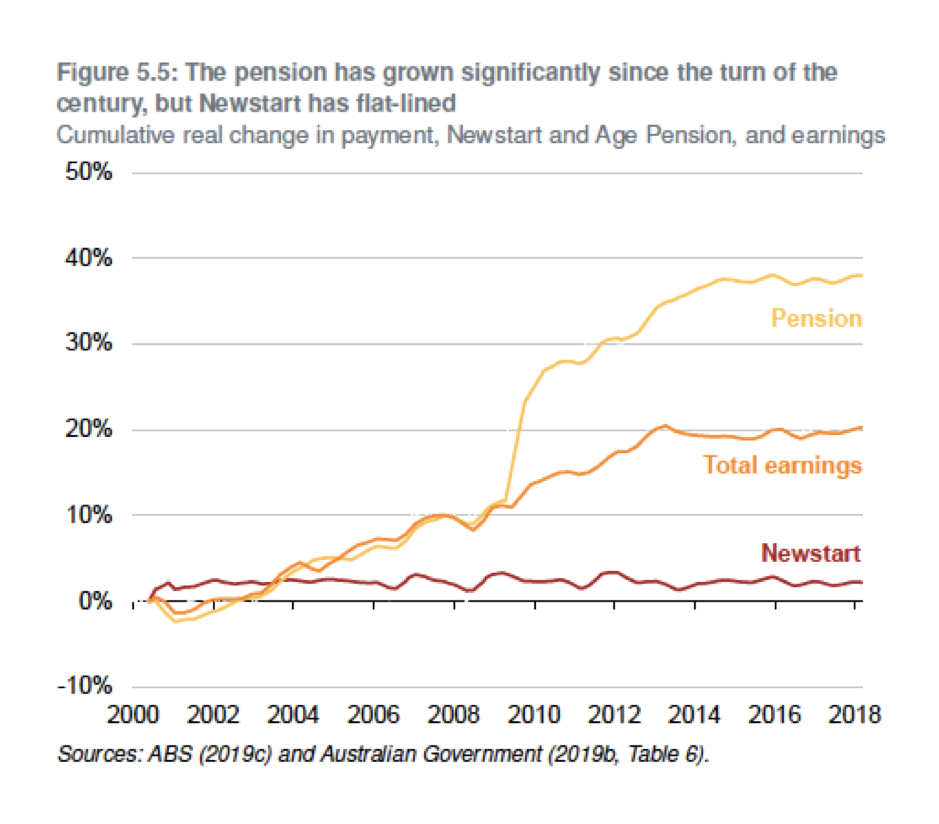

Centrelink adjusts pensions twice a year—March and September—to ensure they keep up with inflation and wage growth. The September 2025 increase added about $32 per fortnight for singles and $48 for couples combined.

This indexation is automatic and applies to:

- Age Pension

- Disability Support Pension

- Carer Payment

These are not extra bonuses—they’re ongoing adjustments built into the system.

3. Advance Payments

Some people confuse the advance payment option with a government bonus. An advance payment means you can ask Centrelink to pay you a portion of your future pension upfront. You then repay it through smaller deductions from future payments.

This system helps pensioners handle big expenses, like car repairs or dental work, without going into debt. But it’s not free money—it’s an early draw on your entitlement.

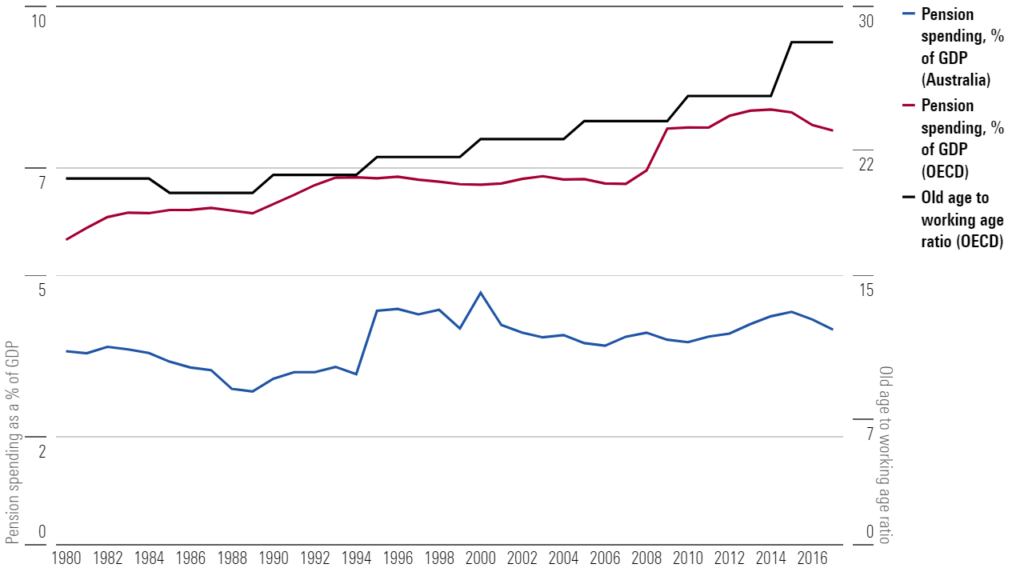

Cost of Living and Economic Context

The high cost of living in 2025 is a major driver behind the surge in interest about potential bonuses. According to the Australian Bureau of Statistics (ABS), consumer prices have risen more than 3.5% year-on-year.

Essential categories that have hit pensioners the hardest include:

- Food and non-alcoholic beverages: up 4.2%

- Electricity and gas: up 8.1%

- Rents: up 6.5% nationally

- Medical services and insurance: up 5.3%

While the government’s regular indexation helps cushion these pressures, many households still struggle. That’s why the idea of a $750 bonus spreads so easily—it feels like the kind of help people truly need.

However, in Australia, these types of extra payments usually come from federal budget initiatives. For example, during the COVID-19 pandemic and early inflation surges, the government issued specific one-off bonuses to help vulnerable groups.

Comparison with Past Bonus Payments

It’s worth remembering that real one-off payments have occurred before:

- March and July 2020: Two $750 stimulus payments for welfare recipients during the COVID-19 crisis.

- April 2022: A $250 Cost of Living Payment went to more than 6 million Australians, including Age Pensioners, to offset inflation.

- 2023–2024: Energy bill rebates were provided through joint state-federal programs, but not as cash bonuses.

These examples show that when the government introduces such payments, it does so through official budget announcements, media releases, and legislation—not unverified online posts.

Expert Commentary: Understanding the Misinformation Loop

According to Dr. Sarah Liu, a senior policy analyst at the University of New South Wales, misinformation about government payments tends to spread faster when cost-of-living stress peaks.

“People are looking for hope. When they hear about a potential $750 boost, they share it before verifying. The government has increased transparency over time, but scam operators often mimic official sites perfectly. The rule is simple: if it doesn’t end in

.gov.au, don’t click it.”

This advice aligns with warnings from Services Australia and Scamwatch, both of which recommend checking your myGov account or calling Centrelink directly before acting on any payment-related news.

Practical Budget Tips for Pensioners

Even though there’s no new $750 payment this month, there are legitimate ways to make your pension stretch further.

- Apply for the Pensioner Concession Card – It offers discounts on medicines, utility bills, and transport.

- Access Rent Assistance – If you pay private rent, you might qualify for extra fortnightly payments.

- Use State Energy Rebates – Each state offers seasonal rebates; check your local government website.

- Review Advance Payments – If you need funds urgently, you can request an advance through your Centrelink account.

- Avoid scams – Never share your myGov login or bank details with unverified websites.

- Check for Financial Counseling – Services like the National Debt Helpline (1800 007 007) offer free, confidential advice.

How to Verify Any Centrelink Payment Announcement?

Follow these steps to ensure you’re getting information from legitimate sources:

- Visit the official site: Go to servicesaustralia.gov.au.

- Check the News section: Look for official press releases.

- Use MyGov: Log in to your linked Centrelink account to see verified messages.

- Watch the Federal Budget: Major payments are announced during the annual budget or mid-year economic updates.

- Never click links in emails or texts that claim “You’re eligible for $750 now.” These are phishing scams.

What Professionals and Financial Advisors Recommend?

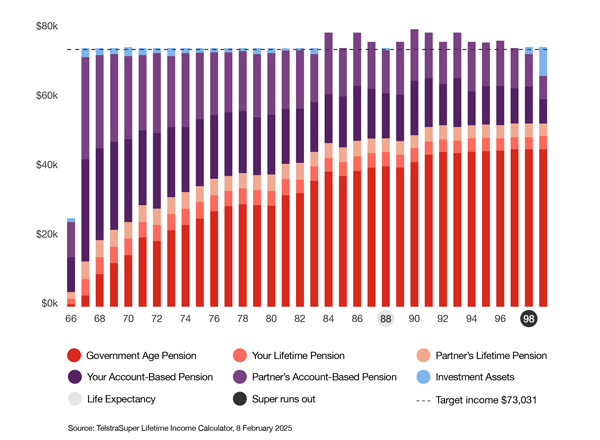

Many financial planners emphasize that pensioners should focus on long-term stability, not short-term rumors.

Financial advisor Mark Reynolds, who specializes in retirement planning, advises:

“Always treat windfall payment rumors with caution. Focus on ensuring your eligibility for ongoing benefits like Rent Assistance, the Energy Supplement, and Concession Cards. These provide real, reliable savings every year.”

He adds that many seniors overlook legitimate entitlements simply because they’re not well-publicized. Staying informed via Services Australia’s newsletter or by calling Centrelink directly can make a big difference.

Australia Centrelink Age Pension Rates After October 2025: Check Revised Rate, Payment Date