Canadian Seniors will get $1250 Monthly OAS Payments: If you’re a Canadian senior, you’re probably curious about the Old Age Security (OAS) payments in November 2025 and want to get the facts straight on payment dates, amounts, and eligibility. This comprehensive guide will break it all down in plain language—with a friendly, conversational vibe—while providing expert insights for financial pros too. So, what’s happening with OAS payments this November? Let’s dive right in.

Table of Contents

Canadian Seniors will get $1250 Monthly OAS Payments

For Canadian seniors, Old Age Security payments are a cornerstone of retirement income, providing essential peace of mind amidst rising costs. While no hefty $1,250 monthly boost or fresh $2,400 lump sum is slated for November 2025, seniors will continue receiving inflation-adjusted payments of around $740 to $814 monthly, depending on age. Staying on top of your personal info, taxation, and eligibility can make your OAS experience smooth and hassle-free.

| Highlight | Details |

|---|---|

| Payment Date in November 2025 | November 20 or November 26, 2025 (check with Service Canada or your bank) |

| Monthly OAS Payment Amount | $740.09 (ages 65–74), $814.10 (ages 75+) (as of October 2025 adjustments) |

| One-time Boosts in 2025 | A $2,350 one-time payment was given to eligible seniors earlier in 2025; no $1,250/month increase expected |

| Eligibility | Must be 65 or older, Canadian citizen or permanent resident, and meet residency requirements |

| Application | Mostly automatic if tax returns and banking info are up to date |

| Official Info Source | Canada.ca – Old Age Security |

What Is Old Age Security (OAS)?

Old Age Security (OAS) is a monthly benefit paid to eligible Canadian seniors primarily based on age and residency, not employment history. It helps cover basic living expenses in retirement, providing a financial anchor faced with rising costs.

Unlike the Canada Pension Plan (CPP)—which is tied to your work contributions—OAS focuses on whether you’ve lived in Canada long enough and reached the age of 65.

The Evolution and History of Old Age Security in Canada

Understanding where OAS stands today means looking back at its roots. The program officially began in 1952, making it one of the oldest social security programs in Canada. It was created to address the worrying poverty rates among seniors at the time, offering a flat-rate pension paid to seniors aged 70 and above, irrespective of their income or employment history.

In the early days, OAS was groundbreaking because it was available to almost all seniors who met a residency rule, reflecting Canada’s commitment to social equity and support. Over the decades, this program gradually lowered the age qualification to 65 and adjusted payments to keep pace with inflation and the evolving economic landscape.

The program’s history is a tale of balancing fairness, sustainability, and dignity for seniors—principles that govern its operation to this day.

How Much Do Canadian Seniors Receive in 2025?

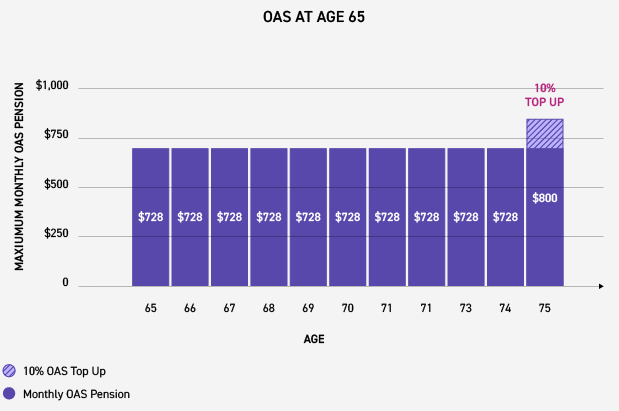

Thanks to annual inflation adjustments, monthly payments change regularly to keep pace with the cost of living. As of October 2025, here’s the scoop:

- $740.09/month for ages 65-74

- $814.10/month for ages 75 and up

These figures reflect a 0.7% increase from earlier in the year to help seniors cope with everyday price hikes.

What About One-Time Payments?

There were significant one-time payments in early 2025 to assist seniors with inflation pressures. This included a $2,350 lump sum for qualifying seniors, but there won’t be an additional monthly increase of $1,250 or similar lumpsums in November 2025.

Who Qualifies for $1250 Monthly OAS Payments?

You’re eligible if you:

- Are 65 years or older.

- Are a Canadian citizen or legal resident when approved.

- Have lived in Canada for at least 10 years after turning 18 (to receive OAS while residing in Canada).

- Can still qualify living outside Canada if you lived in Canada for 20 years or more between ages 18 and 65.

Most seniors don’t need to apply manually—the system activates automatically if your tax filings and personal data are up to date.

When Will November 2025 Payments Arrive?

Payments typically deposit about once a month. For November 2025, seniors can expect their OAS payments around:

- November 20 or November 26

Specific dates vary by how your payment is delivered (direct deposit or cheque).

How Does OAS Compare to Other Retirement Income?

It’s important to see OAS as one piece in your retirement puzzle alongside:

| Benefit Program | Description | Relation to OAS |

|---|---|---|

| Canada Pension Plan (CPP) | Work-based pension reflecting contributions | Complementary, usually larger impact |

| Registered Retirement Savings Plan (RRSP) | Personal retirement savings plan | Private savings, withdrawals flexible |

| Provincial Supplements | Some provinces offer extra supports (e.g., GIS) | Boosts low-income seniors |

OAS helps cover essential living expenses, but most retirees rely on multiple income streams for financial security.

Inflation and Cost of Living Impact on OAS

Every quarter, OAS payments are tweaked based on the Consumer Price Index (CPI) to protect seniors’ buying power. This means your $740 or $814 might increase slightly each quarter, helping combat rising prices for groceries, utilities, and medicines.

The government regularly reviews and adjusts OAS according to inflation trends, so it’s wise for seniors to factor this into long-term planning.

Tips for Financial Planning For Canadian Seniors will get $1250 Monthly OAS Payments

- Budget Smart: Treat OAS as your baseline income for essential expenses, then layer on other pensions or savings.

- Watch Income Thresholds: High income over $95,000 CAD annually triggers OAS clawbacks—meaning your payment will reduce.

- Apply for GIS: If your income is low, the Guaranteed Income Supplement adds extra monthly funds beyond OAS.

- Stay Mobile-Friendly: Use the My Service Canada Account portal on your phone or desktop to track payments and update info.

Understanding the Old Age Security Clawback and How It Affects Your Payments

One important aspect that every Canadian senior receiving OAS should know about is the Old Age Security clawback, also known as the OAS recovery tax. This isn’t some hidden penalty, but a rule where the government reduces your OAS payments if your annual income crosses a certain threshold. For 2025, if your net world income exceeds about $93,454 CAD, the government will claw back 15 cents from your OAS for every dollar earned above that amount. This means the more you make past this limit, the smaller your OAS check becomes.

If your income reaches around $151,668 (for ages 65–74) or $157,490 (for ages 75 and older), you could lose your entire OAS benefit for the year. It’s calculated based on your previous year’s income, so even financial moves like selling property or large RRIF withdrawals could trigger this clawback unexpectedly.

Knowing how the clawback works helps seniors plan smartly to minimize its impact and keep as much of their OAS benefits as possible.

Resources and Assistance for Seniors

Besides OAS, many other programs help Canadian seniors. Some resources to keep handy:

- Service Canada offers seniors’ support services.

- Provincial programs like the Senior’s Supplement in British Columbia provide extra help for low-income seniors.

- Non-profits and community centers often have free financial counseling and assistance with government benefits.

Common Mistakes to Avoid with OAS

- Ignoring Tax Returns: Not filing taxes on time can disrupt automatic OAS enrollment.

- Overlooking Residency Qualifications: Living abroad without meeting residency requirements might disqualify you.

- Failing to Report Income: Undeclared income could affect your OAS if it triggers clawbacks.

- Missing Application Deadlines: While many get OAS automatically, newcomers to Canada need to apply promptly.

$400 Increase In CPP/OAS Benefits in October 2025: Who will get this? Check Payment Date

$2100 Direct Deposit For Canadian Seniors 2025: Check Payment Date & Eligibility Criteria

Canada Retirement Age Change: OAS to Move to 67 – What Does This Mean for You?