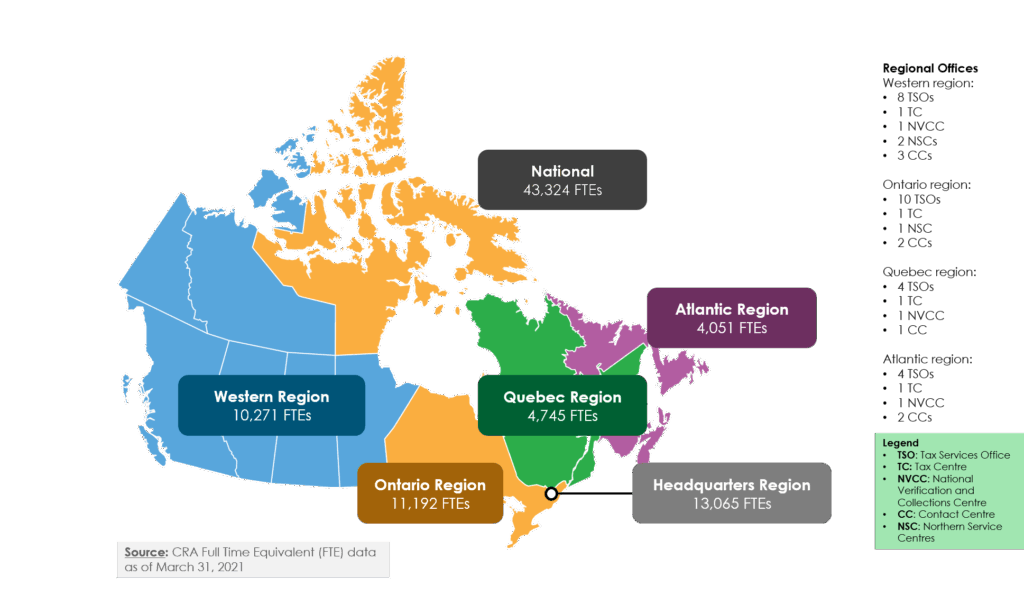

Canada Revenue Agency Dodges Key Question: If you’ve ever called the Canada Revenue Agency (CRA) and found yourself stuck on hold so long that you memorized the background music, you’re not alone. The CRA recently announced it’s hiring more call centre workers and rolling out AI-powered tools to make taxpayer service faster. Sounds good, right? Well, here’s the catch — nobody seems to know how many new workers are actually being hired. The CRA keeps dodging the question. And that’s causing frustration among taxpayers, union leaders, and even some members of Parliament who say it’s time for some transparency.

Table of Contents

Canada Revenue Agency Dodges Key Question

The Canada Revenue Agency’s refusal to share how many new call-centre workers it’s hiring isn’t just a bureaucratic oversight — it’s a matter of public trust. Canadians deserve honesty about how their tax dollars are used and how their calls are handled. If the CRA wants to rebuild credibility, it must start by being transparent, accountable, and human-centered. Otherwise, Canadians will keep hearing the same old line: “Your call is important to us… please continue to hold.”

| Category | Details |

|---|---|

| Topic | Canada Revenue Agency hiring mystery: undisclosed number of new call-centre workers |

| Main Issue | CRA promises better service and AI tools but won’t reveal hiring figures |

| Recent Cuts | Approximately 3,300 call-centre jobs cut since May 2024 |

| Temporary Extensions | About 850 worker contracts extended temporarily |

| Service Complaints | Long wait times, poor accessibility, and taxpayer frustration continue |

| Official Source | Government of Canada – CRA Official Site |

| AI Tools | CRA integrating chatbots and self-service features to reduce wait times |

| Keywords | Canada Revenue Agency hiring, CRA call centre jobs, CRA staffing update, CRA service delays |

The Backstory: CRA’s Customer Service Problem

The CRA isn’t exactly known for lightning-fast customer service. Over the years, Canadians have complained about dropped calls, endless hold times, and confusing responses from overworked agents.

A 2023 Auditor General report showed that only about one in three callers successfully reached a live agent during tax season. Some callers reported waiting over 90 minutes, only to have their call disconnected.

For a country that depends on the CRA for everything from tax refunds to child benefits, that kind of service gap isn’t just inconvenient — it’s unacceptable.

From Job Cuts to “Hiring Spree” – A Rollercoaster Ride

In May 2024, the CRA slashed roughly 3,300 call-centre positions as part of a federal cost-cutting measure. The move was justified as a “modernization effort,” with promises that automation would fill the gap.

But instead of smoother service, things got worse. Reports surfaced of average call wait times doubling, and taxpayers flooded social media with complaints.

Now, just a few months later, the CRA says it’s in “recovery mode” — launching a 100-day action plan to rebuild trust and restore service quality. The agency claims it’s hiring new call-centre agents and extending 850 temporary contracts, yet it refuses to reveal exactly how many new hires are coming.

That silence has many Canadians wondering whether this plan is genuine reform or just political PR.

The Agency’s Defense: AI Will Save the Day

According to a CRA spokesperson, the agency’s new strategy involves blending human agents with artificial intelligence to “streamline taxpayer communication.”

Translation: bots will handle simple questions — like password resets or payment status — while humans will deal with more complicated tax issues.

That’s not a bad idea on paper. The U.S. Internal Revenue Service (IRS) tried a similar approach in 2023, and it worked. The IRS added 5,000 new phone agents, improved its callback system, and used AI to answer routine questions. Within a year, it cut average hold times from 28 minutes to under four.

If the CRA can mirror that success, Canadians could see real improvement. But the big difference is transparency: the IRS publicly shared its staffing data, hiring goals, and performance metrics. The CRA hasn’t.

Why the CRA Won’t Give a Number?

There are a few likely reasons the CRA won’t say how many people it’s hiring:

- The number is still being finalized. Bureaucracy moves slowly, and hiring hundreds of government employees takes time.

- The figure might look too small. If only a few hundred are being hired, that won’t offset the 3,300 job losses.

- Public image management. By keeping the number vague, the CRA can claim “progress” without committing to measurable targets.

Labour groups aren’t buying it. The Public Service Alliance of Canada (PSAC) has repeatedly warned that “you can’t fix a human service problem with automation alone.”

Marc Brière, national president of the Professional Institute of the Public Service of Canada (PIPSC), told reporters that “staffing transparency is key to rebuilding trust. Canadians have a right to know how their tax dollars are being used.”

He’s right. If the CRA is truly rebuilding, showing its math would be the first step.

What the Numbers Tell Us (Even Without CRA’s Help)

Let’s do some quick math:

- Job cuts: ~3,300 call-centre positions gone since 2024.

- Contract extensions: ~850 workers staying on temporarily.

- Unknown hires: Possibly in the hundreds, but no official data.

Even if CRA rehired 1,000 agents, that’s still a net loss of over 2,000 workers. And that’s before considering the fact that call volumes spike every year during tax season.

So while the CRA talks about improvement, the math suggests Canadians might still be waiting — both for answers and for service.

Canadians Are Losing Patience

A quick scroll through Reddit’s r/Canada or Twitter (now X) shows what taxpayers really think. One user wrote:

“I spent 2 hours on hold with CRA, got disconnected, called again, and waited another hour. Still no answer. Unreal.”

Another said:

“Their new chatbot told me to call an agent… the same agent I couldn’t reach. Thanks for nothing, CRA.”

For many Canadians, these stories aren’t funny anymore. They’re a reminder that the system is broken.

And that frustration isn’t limited to individuals — small businesses, accountants, and financial advisors all rely on CRA’s call centres for quick issue resolution. When the phones don’t work, the entire financial ecosystem slows down.

How Canada Revenue Agency Dodges Key Question Affects You (Even If You Never Call the CRA)

Even if you’ve never called the CRA directly, these staffing issues still matter. Why? Because every taxpayer, family, and business interacts with the agency in some way.

Here’s what’s at stake:

- Tax Refunds: Delays in call centres can mean slower issue resolution and delayed refunds.

- Benefit Payments: Families relying on Canada Child Benefit or GST/HST credits may face payment delays if account issues go unresolved.

- Audit Responses: Fewer agents means longer processing times for audits and appeals.

So when the CRA says it’s “improving services” but won’t say how many people it’s actually hiring, it’s fair to ask whether those promises are realistic.

What You Can Do If You Can’t Reach Canada Revenue Agency?

Until the CRA gets its staffing sorted, here’s what you can do to help yourself:

1. Call Early or Late

Phone lines open around 8:00 a.m. local time. Calling right when they open or just before they close can reduce wait times.

2. Use CRA’s Online Services

Create or log in to your CRA My Account or My Business Account to handle most routine tasks like checking refund status or updating personal info.

3. Chatbots and AI Tools

CRA’s digital assistants can help answer basic questions. They’re not perfect, but they’re improving.

4. Seek Help from a Tax Professional

Accountants and certified tax preparers often have insider contacts or escalation channels for urgent issues.

5. Contact Your Member of Parliament

MPs have direct lines to CRA liaison offices. If you’re stuck in a bureaucratic loop, your MP can sometimes expedite help.

Lessons from the U.S. IRS: Transparency Pays Off

The IRS went through a public relations nightmare similar to CRA’s a few years ago. But it made one big change: it started sharing data.

The IRS publishes quarterly service reports, showing how many calls it answers, average wait times, and how much it’s spending on improvements. That transparency helped rebuild trust — and pressure itself to perform better.

If the CRA followed the same model, Canadians would be able to see real progress instead of relying on vague promises.

After all, taxpayers aren’t just customers — they’re shareholders in the system.

Building Back Trust: What CRA Needs to Do

To truly fix its image and service, the CRA should focus on three big things:

- Be Transparent: Publish actual hiring numbers, service benchmarks, and performance data.

- Invest in People: AI is helpful, but only humans can provide empathy and judgment.

- Report Progress: Give the public quarterly updates — even if progress is slow.

Transparency isn’t just a buzzword; it’s how trust gets rebuilt.