Australia Centrelink Age Pension Rates: If you’ve been keeping an eye on Australia’s Centrelink Age Pension rates after October 2025, you’re not alone. With inflation, rising living costs, and shifting policy updates, many Aussies are asking, “How much will I get? When do the new rates start? And what does it mean for my retirement?” Let’s clear it all up in one place — no confusing jargon, no government-speak — just plain, practical info that helps you make sense of what’s happening with pension payments, eligibility, and how to plan ahead.

Australia Centrelink Age Pension Rates

The Australia Centrelink Age Pension rates after October 2025 bring higher payments, new deeming rates, and updated thresholds that better reflect today’s cost of living. If you’re approaching retirement, don’t wait. Check your eligibility, estimate your payments, and get your documents ready well before you apply. A bit of preparation can mean thousands more in support — and a smoother transition into retirement. Stay proactive, stay informed, and make sure you’re claiming every dollar you’ve earned after a lifetime of work.

| Topic | Key Data / Change | Why It Matters | Official Source |

|---|---|---|---|

| Full Pension Rate (Fortnightly) | Single: ~ AU $1,178.70; Couple (each): ~ AU $888.50 | Indicates maximum payment | |

| Assets Test Thresholds | Single homeowner: AU $714,500; Single non-homeowner: AU $972,500 | Determines eligibility | Services Australia |

| Deeming Rates | 0.75% (lower), 2.75% (upper) | Used to assess income from savings | DSS.gov.au |

| Payment Frequency | Fortnightly; some supplements monthly | Helps with budgeting | |

| Minimum Pension Age | 67 years (from July 1 2023 onward) | Key eligibility rule |

Understanding the Age Pension: How It Works

The Age Pension is the backbone of Australia’s retirement income system. It’s a fortnightly government payment managed through Centrelink, intended to support older Australians who’ve retired or reduced their work hours.

It isn’t a handout; it’s a safety net built from decades of taxation and contribution. It helps cover essentials like rent, food, and bills — especially as the cost of living keeps climbing.

To keep things fair and sustainable, the Age Pension is means-tested, meaning your income and assets determine how much you receive. If you’re under the thresholds, you’ll get the full pension. If you’re above, you might still qualify for a part pension.

Who Is Eligible for the Australia Centrelink Age Pension Rates?

Before worrying about numbers, check if you’re eligible. As of 2025, the following rules apply:

- Age Requirement: You must be 67 or older.

- Residency: You must have lived in Australia as a permanent resident for at least 10 years, including 5 years continuously.

- Means Tests: You must pass both the assets test and income test.

- Location: You must be living in Australia when you apply.

What’s Changing After October 2025?

The updates coming in September 2025 (effective through October and beyond) reflect indexation adjustments — periodic updates based on inflation and wage growth.

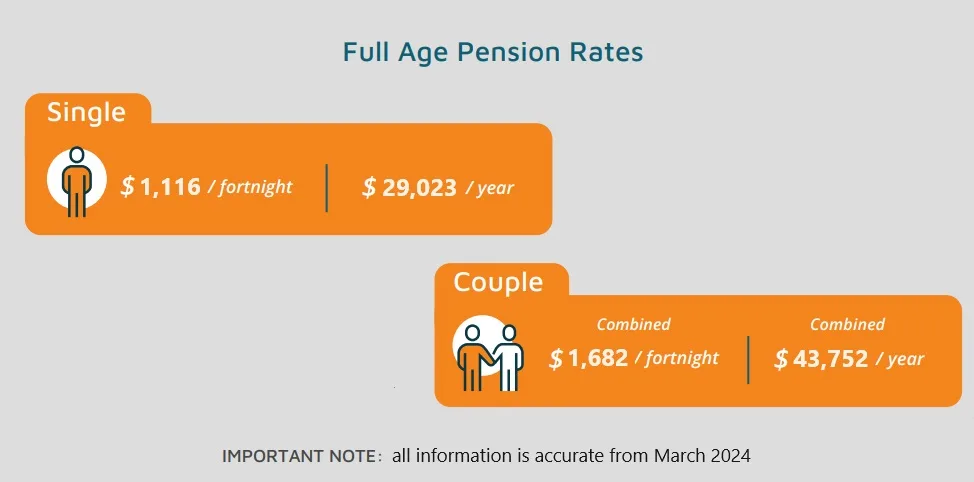

1. Increased Pension Rates

From 20 September 2025, payments rise again to help offset inflation:

- Single pensioners: AU $1,178.70 per fortnight

- Couples (each): AU $888.50, or AU $1,777 combined

That’s roughly $770 per week for singles, and $1,230 for couples, depending on supplements. These figures include the Energy Supplement and Pension Supplement.

Why the boost? Because the pension is tied to inflation (CPI) or Male Total Average Weekly Earnings (MTAWE) — whichever is higher. This ensures older Australians don’t fall behind as costs rise.

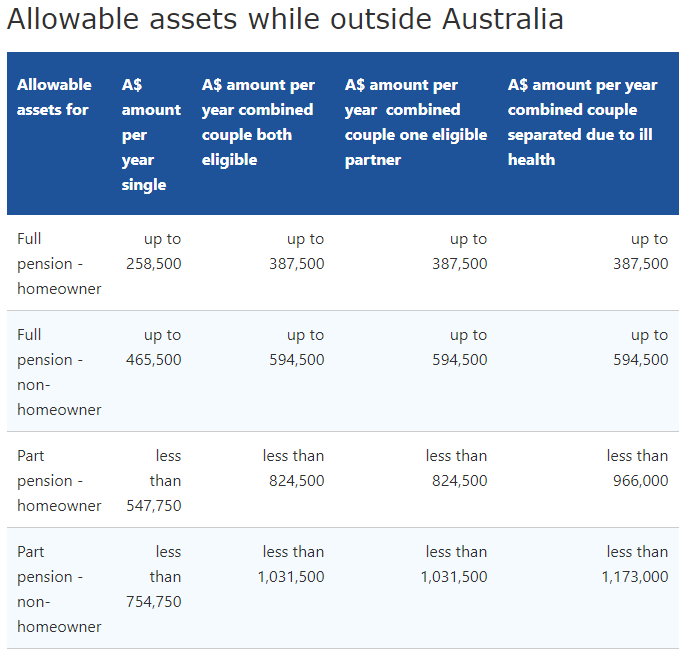

2. Assets Test Thresholds

The assets test determines whether you get the full or part pension based on what you own. Updated thresholds from 20 September 2025 are:

- Single homeowner: AU $714,500

- Single non-homeowner: AU $972,500

- Couple homeowners (combined): AU $1,074,000

- Couple non-homeowners (combined): AU $1,332,000

Assets beyond these limits reduce your pension by $3.00 per fortnight for every $1,000 over.

Example: If you’re a single homeowner with assets worth $720,000, you’re $5,500 over the threshold — reducing your pension by about $16.50 per fortnight.

3. Deeming Rates

The deeming system estimates how much income you “earn” from investments. It applies even if your bank or shares pay less.

From September 2025, deeming rates will be:

- 0.75% on the first $60,400 (single) or $100,200 (couple combined)

- 2.75% on the rest

These rates were frozen for years, so their adjustment will affect thousands of retirees with savings or investments.

4. Income Test

Under the income test, your pension reduces by 50 cents for each dollar above the free area:

- Single: Income up to $204/fortnight = full pension

- Couple (combined): Up to $360/fortnight = full pension

This encourages part-time work while protecting pensioners with modest incomes.

If you work casually, you can also benefit from the Work Bonus, allowing you to earn up to $11,800 per year without affecting your pension.

5. Payment Dates and Schedules

Pensions are paid every two weeks, usually on a Tuesday or Wednesday, depending on your banking institution.

If a public holiday lands on payday, payments may arrive early.

How to Apply for the Australia Centrelink Age Pension Rates (Step-by-Step)

Here’s how to get started — whether you’re new to the system or applying after a review.

Step 1: Check Your Eligibility

Use the Services Australia Pension Calculator to estimate your rate and confirm you meet age, residency, and income requirements.

Step 2: Gather Your Documents

You’ll need:

- Proof of age and citizenship

- Bank account details and balances

- Property valuations

- Superannuation or investment statements

- Tax returns or payslips

Step 3: Apply Online or In Person

You can apply:

- Online through myGov (linked to Centrelink)

- At a Service Centre

- Via mail if digital access is limited

Apply 13 weeks before your eligibility date to avoid payment gaps.

Step 4: Track and Update

Once lodged, track your claim in myGov.

If your situation changes — like selling a property, starting work, or inheriting money — you must update Centrelink immediately.

Common Mistakes Pensioners Make (and How to Avoid Them)

- Forgetting to update assets:

Selling property, winning money, or getting a new car? Report it right away. Centrelink can backdate debts. - Not reviewing your super:

Your super income streams may count differently depending on structure. Check with your provider. - Assuming you’re too wealthy:

Even partial pensions include perks like concession cards and energy rebates. Don’t self-disqualify. - Overlooking supplements:

You may qualify for Rent Assistance, Energy Supplement, or Pensioner Concession Card — worth hundreds yearly.

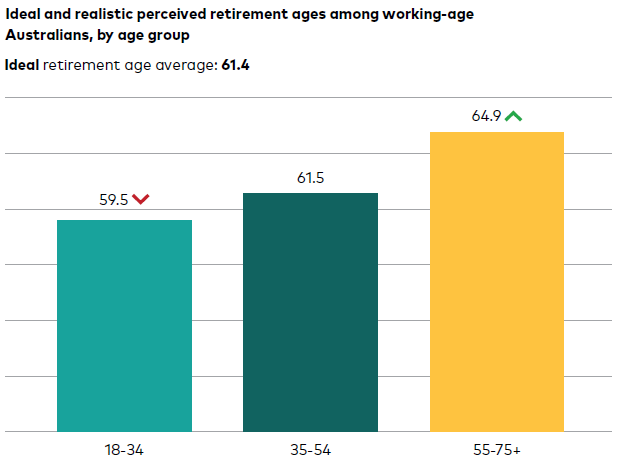

Economic Context: Why These 2025 Changes Matter

Australia’s pension system is one of the world’s most sustainable, but it evolves with the economy.

The 2025 rate increase reflects broader cost-of-living pressures: energy bills, housing, and groceries have all climbed sharply.

According to the Australian Bureau of Statistics (ABS), seniors face inflation rates roughly 1–1.5 percentage points above the national average because essentials make up a larger share of their spending.

Raising pension rates and deeming thresholds helps maintain purchasing power and reduce poverty among retirees. It also supports local economies, since most pension income is spent domestically.

Tax, Supplements, and Related Benefits

Taxation

Most Age Pension income is tax-free, especially when combined with offsets like:

- Seniors and Pensioners Tax Offset (SAPTO)

- Low Income Tax Offset (LITO)

Additional Benefits

Pensioners may qualify for:

- Rent Assistance (up to $188.20/fortnight single, $177.20 each for couples)

- Energy Supplement

- Pharmaceutical Benefits Scheme (PBS) discounts

- Concession Cards for travel and utilities

Combined, these can raise real pension value by 5–10%.

Real-Life Examples

Example 1: Single Homeowner

Lynette, age 68, owns her home and has $320,000 in savings.

Under 2025 rates, her assets are well below the $714,500 threshold. She’s eligible for nearly the full pension — around $1,160/fortnight, plus supplements.

Example 2: Couple Non-Homeowners

Raj and Priya rent and hold $1.2 million in investments.

That’s below the $1,332,000 limit, meaning they’ll get a part pension of roughly $800 each/fortnight.

Example 3: Working Pensioner

David, age 70, earns $300/week from part-time driving.

Thanks to the Work Bonus, much of that income doesn’t affect his pension — he keeps both income streams.

Professional Tips

- Plan ahead: Review your finances yearly; thresholds change every March and September.

- Stay informed: Subscribe to updates on Services Australia.

- Consult experts: Free advice is available from Financial Information Service (FIS) Officers.

- Use official calculators: Avoid third-party sites with outdated data.

- Keep digital records: Upload documents to myGov for faster processing.

Home Loan Shake-Up: Major Bank Adjusts Rates Following RBA Hold – What It Means for Borrowers