Americans Wish They Waited to Claim Their $300 Social Security: When it comes to Social Security, timing your claim is one of the biggest money decisions you’ll ever make. Across the U.S., millions of retirees are realizing that grabbing that first $300 Social Security check at age 62 might’ve been a mistake that’s costing them thousands every year.

It’s easy to understand why. The idea of finally getting a monthly check after decades of work sounds great—especially when bills, inflation, or medical costs are staring you down. But the truth is, claiming too early can permanently reduce your benefits for the rest of your life. And once you start, there’s usually no going back. Below, we’ll break down exactly why so many Americans regret claiming early, what the data shows, and how you can make a smarter, more strategic decision about your retirement benefits.

Table of Contents

Americans Wish They Waited to Claim Their $300 Social Security

Many Americans regret claiming their $300 Social Security check too early. This expert-backed guide explains why timing matters, how waiting boosts lifetime income, and what practical strategies can help you maximize benefits. With official data, real-life examples, and resources from SSA and AARP, this clear, conversational article helps you make smart, confident decisions about when to claim Social Security.

| Topic | Quick Insights |

|---|---|

| Average early benefit | $300–$1,800/month depending on lifetime earnings |

| Reduction for early claim | Up to 30% lower benefits if claimed before full retirement age |

| Reward for delaying | Around 8% increase per year after FRA, up to age 70 |

| Regret rate | Nearly 45% of retirees say they claimed too soon |

| Median full retirement age (FRA) | 66–67 years, depending on birth year |

| Official resources | Social Security Administration, AARP Retirement Tools |

The Backstory: Why Early Claims Became the “American Default”

When Social Security was created in 1935, the world looked very different. The average American man lived to about 62 years, and women only a few years longer. Retirement wasn’t meant to last decades—it was supposed to be a brief stage of life.

Back then, claiming early wasn’t really a problem because few people lived long enough to collect benefits for many years. Fast forward to today: the average lifespan in the U.S. is 77 years and rising. For women, it’s closer to 80–81.

That means if you retire at 62, you could easily live another 20 to 30 years. That’s a long time to rely on smaller checks. The system hasn’t changed much, but our lives have—and that’s why timing your claim matters more than ever.

Why Americans Wish They Waited to Claim Their $300 Social Security?

1. Fear of “Losing Out”

A big reason people rush to claim Social Security is fear. There’s a lot of talk about the program “running out of money.” While it’s true that the Social Security trust fund may be depleted around 2034, the system won’t go bankrupt.

According to the Social Security Trustees Report, even if Congress doesn’t act, payroll taxes will continue to fund about 77% of scheduled benefits. So while there might be adjustments in the future, benefits won’t vanish.

Many financial experts, including those at Morningstar and AARP, argue that this fear leads to billions in collective lost benefits each year because people grab what they can rather than planning for long-term security.

2. Financial Pressure and Debt

For millions of Americans, waiting simply doesn’t feel possible. Inflation, medical costs, housing, and credit card debt push people into early retirement. The National Institute on Retirement Security found that more than 40% of baby boomers have no retirement savings at all.

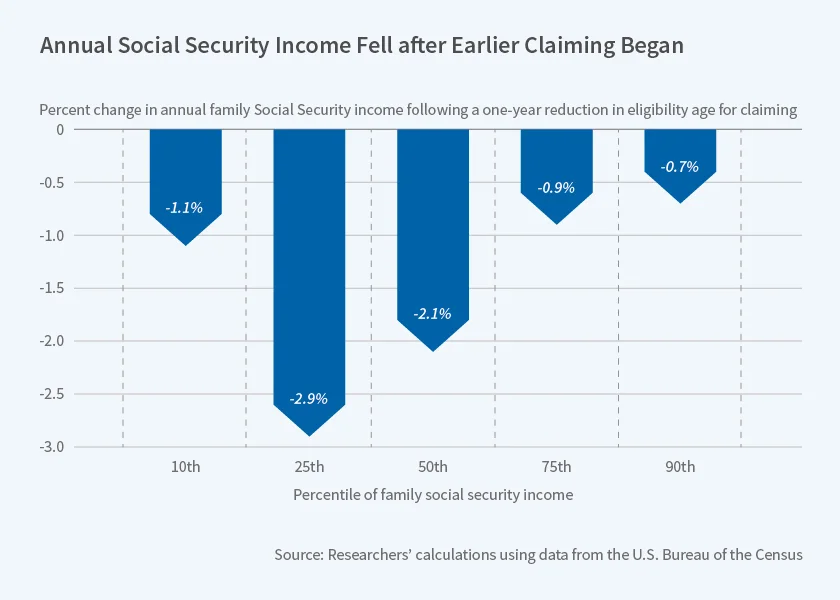

When faced with that, a guaranteed check—even a small one—feels like safety. But what many don’t realize is that claiming early can lock you into a smaller check forever, and that loss compounds over decades.

3. Lack of Knowledge and Planning

Another issue is misunderstanding how the system works. The Full Retirement Age (FRA)—the age when you can claim 100% of your benefits—is between 66 and 67, depending on when you were born.

Claiming before that reduces your monthly payout permanently. For example, claiming at 62 instead of 67 means you’ll get only about 70% of your full benefit. That’s a 30% cut every single month for the rest of your life.

A Real-Life Example: Meet Mary from Ohio

Mary, a 62-year-old nurse from Toledo, retired early to help raise her grandkids. She started collecting $1,200 a month in Social Security benefits.

Had Mary waited until 70, her check would’ve been $2,064 a month. That’s an extra $864 every month—or more than $10,000 a year. If she lives 25 years into retirement, she’ll miss out on over $250,000.

Mary told her financial planner later, “I thought I was being smart. I didn’t realize I’d be short-changing myself for the rest of my life.”

Pros and Cons of Claiming Early

| Pros of Claiming Early | Cons of Claiming Early |

|---|---|

| Get immediate income at 62 | Permanent reduction in monthly payments |

| Good option for poor health | Lose up to 30% of lifetime benefits |

| Can use funds for emergencies | Lower survivor and spousal benefits |

| Sense of security | Miss out on annual cost-of-living increases applied to higher benefit |

The Math Behind It: How Social Security Really Works

Your Social Security payment is based on your highest 35 years of earnings. If you have fewer than 35 years, the missing ones count as zero, pulling your average down.

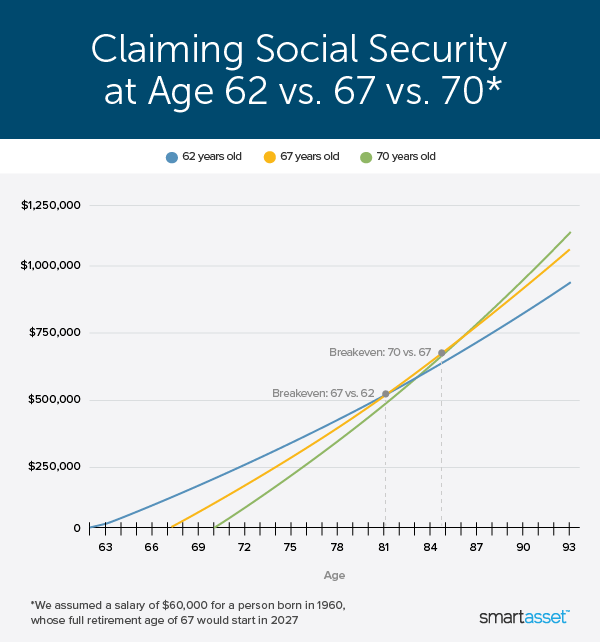

Each year you delay collecting after your FRA, your benefit grows by about 8%. That’s a guaranteed, risk-free return—something even the stock market can’t promise.

For example:

- If your FRA benefit is $1,500, claiming at 62 reduces it to about $1,050.

- Waiting until 70 increases it to $1,860.

Over 20 years, that difference equals more than $190,000 in additional lifetime income.

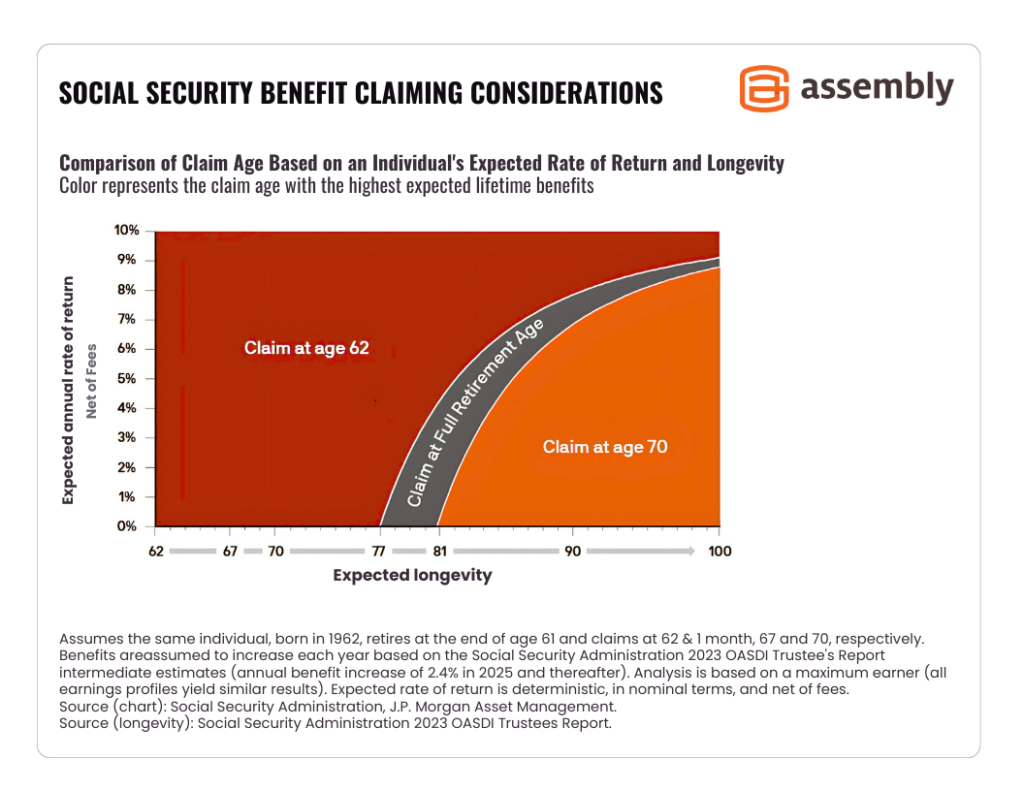

How Your Health, Family, and Career Affect Timing

Everyone’s situation is different. Here’s what financial advisors suggest:

- Good health and long-lived family? Wait until 70 if possible.

- Poor health or shorter life expectancy? Claim earlier to maximize total received.

- Married couples: It’s often wise for the higher earner to wait until 70 so the surviving spouse gets the larger benefit later.

- Still working? Claiming early while earning income can temporarily reduce your benefits until you reach FRA.

Expert Opinions and Data

According to Morningstar’s 2024 Retirement Report, waiting until 70 increases total lifetime income for the average retiree by $182,000 compared to claiming at 62.

A Boston College Center for Retirement Research study found that only 10% of Americans wait until age 70, even though the majority would benefit financially by doing so.

Financial expert Jean Chatzky often notes that Social Security is “one of the few guaranteed sources of income that increases with inflation.” Delaying it can act like buying a personal pension that pays more every year you wait.

The Emotional Side: Why It’s Hard to Wait

Money isn’t just math—it’s emotional. Many Americans start Social Security early because they’re tired, stressed, or simply want to enjoy life after decades of hard work. That’s fair.

But financial advisors caution that you might be trading short-term comfort for long-term hardship. If you live into your 80s or 90s, smaller checks can make it harder to keep up with rising costs.

AARP calls this “the longevity trap”: most people underestimate how long they’ll live, and overestimate how much they’ll have later.

Strategies to Delay Without Strain

If waiting sounds impossible, here are practical strategies to buy yourself a few more years:

- Work part-time – Even a few years of light work can bridge the gap.

- Use other savings first – Tap your IRA or 401(k) strategically before claiming.

- Spousal strategy – One spouse claims early for income; the other delays for maximum payout.

- Cut expenses – Downsizing or reducing debt can help you postpone claiming.

- Health check – If you expect to live long, waiting is a sound financial move.

These small steps can increase your lifetime benefit dramatically.

Tools & Resources for Smart Planning

Use these trusted resources to help you make data-driven decisions:

- Social Security Administration – Official calculators and benefit estimators.

- AARP Social Security Resource Center – Planning guides and tools.

- Investopedia: Social Security Basics – Detailed explanations and examples.

- Consumer Financial Protection Bureau – Retirement and benefit planning resources.

Greystar’s $50M Deal in RealPage Case Could Disrupt the Entire U.S. Rental Market

Trump Just Reinstated $187 Million for NYPD; Here’s Why It’s Sparking Major Controversy

Senator Reveals Trump’s Secret Plan to Slash Tariffs for U.S. Vehicle Production