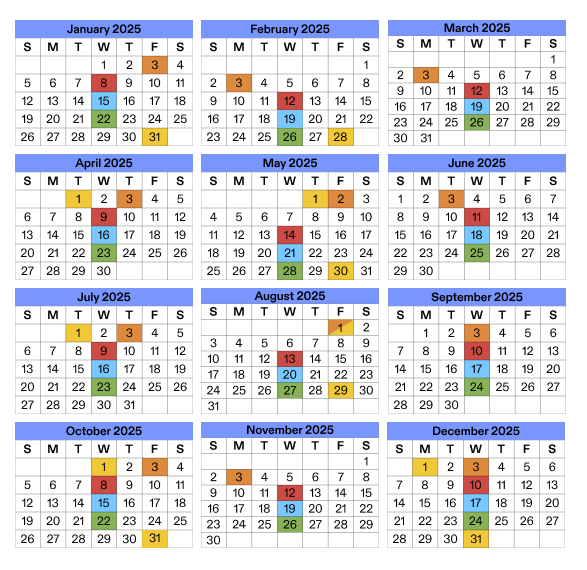

The November 2025 Social Security Payments schedule has been released by the Social Security Administration (SSA), outlining when more than 70 million Americans will receive their monthly benefits. The payments—vital to retirees, disabled workers, and survivors—will be distributed between October 31 and November 26, 2025, depending on birthdate and benefit type.

Table of Contents

Social Security Payments in November 2025

| Key Fact | Detail / Statistic |

|---|---|

| First SSI Payment | October 31, 2025 (since Nov 1 is a Saturday) |

| Early Social Security Beneficiaries (pre-May 1997) | November 3, 2025 |

| Birthdays 1–10 | November 12, 2025 |

| Birthdays 11–20 | November 19, 2025 |

| Birthdays 21–31 | November 26, 2025 |

| Average Retired Worker Benefit (2025) | $2,008.31 |

| Max SSI Benefit (Individual) | $967 |

| Official Website | SSA.gov |

November 2025 Social Security Payment Schedule

Each month, the SSA issues payments according to a structured schedule that helps manage one of the largest recurring financial distributions in the U.S. government.

Recipients whose birthdays fall between:

- 1st and 10th receive payment on Wednesday, November 12

- 11th and 20th on Wednesday, November 19

- 21st and 31st on Wednesday, November 26

Those who began receiving benefits before May 1997, or who collect both Social Security and Supplemental Security Income (SSI), will be paid on Monday, November 3.

SSI-only beneficiaries—typically those with limited income or disabilities—will receive their checks early, on Friday, October 31, because November 1 falls on a weekend.

How Benefit Amounts Are Determined?

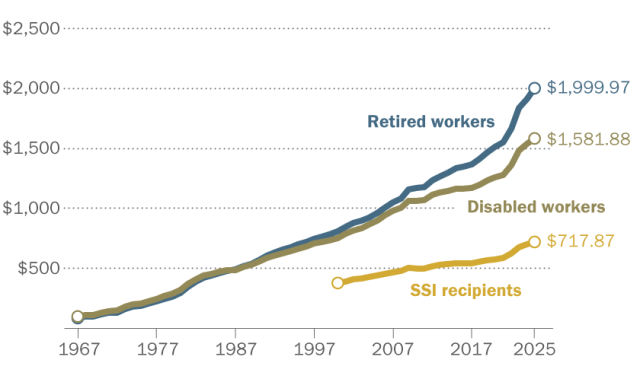

Benefit amounts vary widely depending on lifetime earnings, work history, and the age at which benefits were first claimed.

According to the SSA’s 2025 data, the average retired worker benefit stands at $2,008.31 per month. For Supplemental Security Income (SSI) recipients, the federal maximum is $967 for an individual and $1,450 for a couple. States may add small supplements to these federal rates.

The SSA calculates benefits using a formula that replaces a higher proportion of earnings for low-income workers, ensuring greater support for those most dependent on Social Security. Individuals can view their personalized estimates through the SSA’s online portal.

Why Payment Dates Vary?

The staggered schedule was introduced in 1997 to spread payments across the month and prevent processing delays. Before this change, all beneficiaries were paid on the same day, leading to heavy strain on the Treasury’s systems and banking networks.

“Distributing payments throughout the month helps ensure reliability and avoids system overload,” said an SSA representative. “This approach also gives beneficiaries predictable and consistent timing tied to their birthdays.”

Today, more than 99 percent of payments are made electronically through direct deposit or Direct Express debit cards, a shift that has significantly reduced fraud and postal delays.

Cost-of-Living Adjustment (COLA) and Inflation

In 2025, benefits rose by 3.2 percent following the annual Cost-of-Living Adjustment (COLA). The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), measured by the U.S. Bureau of Labor Statistics.

This year’s increase reflects persistent inflation pressures in housing, healthcare, and food.

“COLA is a lifeline for retirees on fixed incomes,” said Nancy Altman, president of Social Security Works, an advocacy organization. “Without it, inflation would erode their purchasing power every year.”

Economists agree that while a 3.2 percent increase offers relief, it still lags behind real-world cost increases in many essential categories.

The Economic Role of Social Security

Social Security remains the largest source of retirement income in the United States. According to the Center on Budget and Policy Priorities, nearly two-thirds of seniors rely on it for more than half of their monthly income.

The program not only provides economic stability for individuals but also contributes to the broader economy by supporting consumer spending. Economists estimate that Social Security benefits inject more than $1.5 trillion annually into the U.S. economy.

In rural areas, where private pensions are less common, the effect is particularly strong. “In some counties, Social Security payments represent the single biggest source of monthly income,” noted Dr. Kathleen Romig, a senior researcher at the CBPP.

How to Check or Report a Missing Payment?

If a payment doesn’t arrive as scheduled, the SSA advises recipients to:

- Wait three business days after the expected date.

- Check bank or Direct Express accounts for pending deposits.

- Contact the SSA by calling 1-800-772-1213 or visiting a local office.

Recipients can also log into their My Social Security account to verify payment status.

For lost or stolen payments, the U.S. Department of the Treasury investigates and issues replacements, though this process may take several weeks.

Protecting Against Scams and Fraud

The SSA continues to warn against impersonation scams, where callers or emails claim to represent the agency. These schemes often request personal details or payment to “fix” alleged issues with a person’s account.

The SSA emphasizes that it never contacts people by phone or text to demand payment or threaten legal action. Suspicious messages can be reported through the official SSA Office of the Inspector General website.

“Scammers have become more sophisticated, but the rule remains simple: if someone asks for money or personal information, it’s not us,” said Gale Stallworth Stone, the SSA’s acting inspector general.

Digital Access and Modernization

The SSA has expanded its digital services to handle the growing number of beneficiaries. Through My Social Security, users can track payments, request benefit verification letters, and estimate future benefits.

In 2024, the agency rolled out enhanced mobile access, allowing beneficiaries to receive payment notifications and updates through secure online accounts.

These efforts aim to modernize the 88-year-old program as it faces an aging population and increasing administrative demands.

Historical Context: From 1935 to Today

The Social Security Act, signed by President Franklin D. Roosevelt in 1935, was designed to provide financial protection for older Americans during the Great Depression. Payments began in 1940, reaching about 222,000 retirees.

Today, more than 70 million Americans receive benefits each month, including retirees, people with disabilities, and survivors of deceased workers. The total monthly distribution now exceeds $100 billion.

Policy Outlook: Debates About the Program’s Future

Looking beyond 2025, policymakers are debating how to sustain the Social Security Trust Fund, which faces projected shortfalls by the mid-2030s.

According to the Congressional Budget Office (CBO), without reform, the trust fund reserves could be depleted by 2034, reducing benefits by roughly 20 percent.

Lawmakers have proposed various solutions, from raising payroll tax caps to adjusting benefit formulas. However, consensus remains elusive.

“Social Security is not in crisis yet,” said Andrew Biggs, a senior fellow at the American Enterprise Institute. “But every year Congress delays action, the options become more painful.”

Trump’s $1,000 Baby Stimulus: How It Could Grow to $93,000 for Your Child

Get Your $1390 IRS Relief Payment—Check Eligibility and Timing for Direct Deposit

Social Security 2026 COLA Forecast: How Much Will Your Benefits Increase?

What to Expect in the Coming Months

With inflation moderating and federal budget negotiations ongoing, experts say beneficiaries should expect smaller COLA increases in 2026. Nonetheless, payments are expected to continue without disruption, supported by ongoing Treasury operations and payroll tax revenues.

Recipients are encouraged to keep their contact and banking details up to date and use SSA’s online tools for any changes or inquiries.

Looking Ahead

The November 2025 Social Security Payments schedule reflects the system’s reliability amid economic uncertainty. For millions of Americans, these payments represent not just financial support but long-term stability and security.

As policymakers debate the future of the program, the SSA continues to emphasize its core mission: to ensure that every qualified beneficiary receives their payment—accurately and on time.